Technology

The Industrial Internet of Things (IIoT): Are Companies Ready For It?

Are Companies Ready For the Industrial Internet of Things?

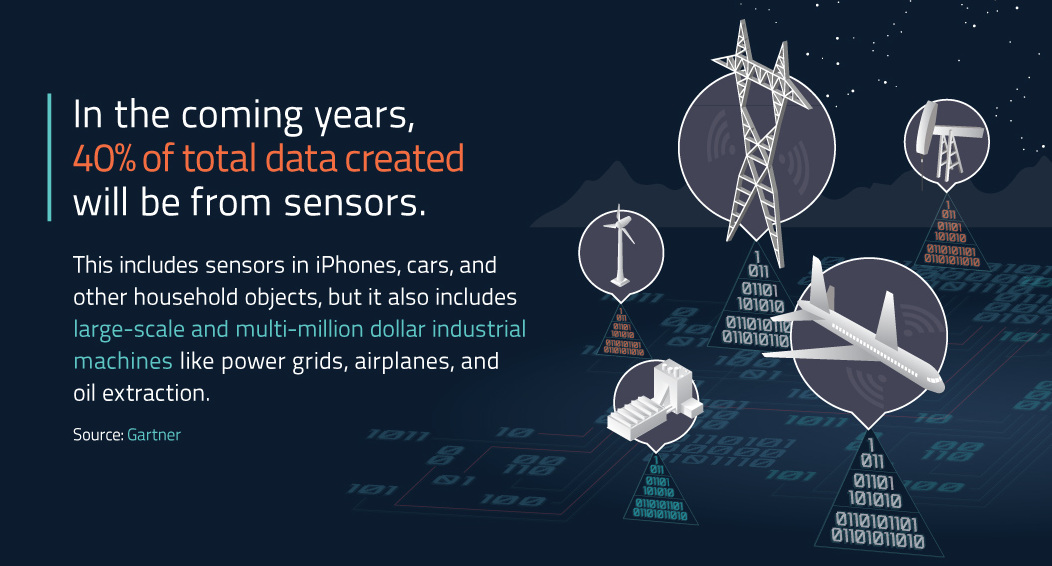

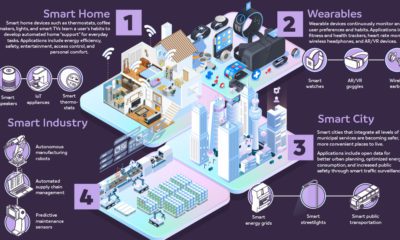

We’ve all heard about how the consumer version of the internet of things (IoT) will impact our lives. Smart devices in our homes, cars, and cities are already beginning to send and receive data to each other, allowing for unprecedented integration with consumer technologies.

But the implications of this revolution of connectivity extend way behind just smartphones and your home. In fact, it’s about to be applied on an industrial scale to everything from aerospace to mining in ways that people can hardly imagine.

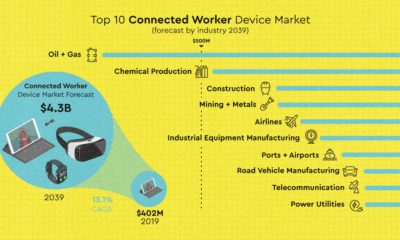

The Industrial Internet of Things (IIoT) will pull data from millions of tiny sensors on every piece of industrial equipment fathomable. Companies will harness this data in real-time to create insights and efficiencies on a crazy scale: GE estimates it will help to generate a $10-$15 trillion increase in global GDP over the next 20 years.

But can companies handle the IIoT?

While this all sounds great in theory, the reality is that the transition to a useful IIoT is going to be an ongoing challenge. Very different types of data need to be captured and integrated, and companies will need to find ways to turn huge amounts of data into focused insights.

Bit Stew, from GE Digital, recently commissioned a survey of top IT execs to see if their respective companies were ready for the IIoT.

The survey found that only 30% of companies are currently early adopters of the IIoT, while the other 70% are still in the planning phase. Perhaps more importantly, top IT execs identified the potential barriers to their companies adopting the IIoT, as well as the opportunities that the IIoT can unlock for their operations:

Opportunities

- 80% of senior IT executives view improving operating efficiency and uptime as the top benefits that IIoT will bring.

- Other benefits identified: improved operating costs, better uptime, improved asset performance management, and knowledge transfer in the workplace.

- Larger organizations (1,000+ employees) found improving uptime to be a more compelling benefit than smaller organizations.

- 70% say that having proven capabilities for data modeling and mapping were more important for a IIoT platform than any other feature.

Barriers to Adoption

- 64% of senior IT executives said that integrating data from disparate sources and formats, and extracting business value from that data, is the biggest challenge the IIoT presents.

- Meanwhile, 36% say limited access to the right skills and expertise is the problem.

- Larger organizations (1,000+ employees) were more likely to struggle with traditional database management and analytics tools (34% vs 12%).

- 87% say that the overwhelming volume and veracity of data will result in losing valuable business insights.

- 33% say that businesses without a data management strategy will become marginalized, obsolete, or disappear.

Why is industrial data so complicated?

Industrial data comes from a variety of source types and is often messy. Combine this with its complexity, and that it comes in massive volumes and varied frequencies, and the situation is quite a quagmire for any aspiring adopter.

To enter a truly connected world where data about everything is analyzed instantaneously on an industrial scale, we must first solve these issues around data. It’s only then that the IIoT will show its true potential for business.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science7 days ago

Science7 days agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023