Technology

The Top Celebrity Investors, and What We Can Learn From Them

Image courtesy of: CB Insights

The Top Celebrity Investors, and What We Can Learn From Them

Celebrities – they’re just like us! Except that they’re famous, and usually quite wealthy, too. So it’s perhaps not surprising that they would choose to expand their investment portfolios beyond luxury yachts and Hollywood Hills mansions.

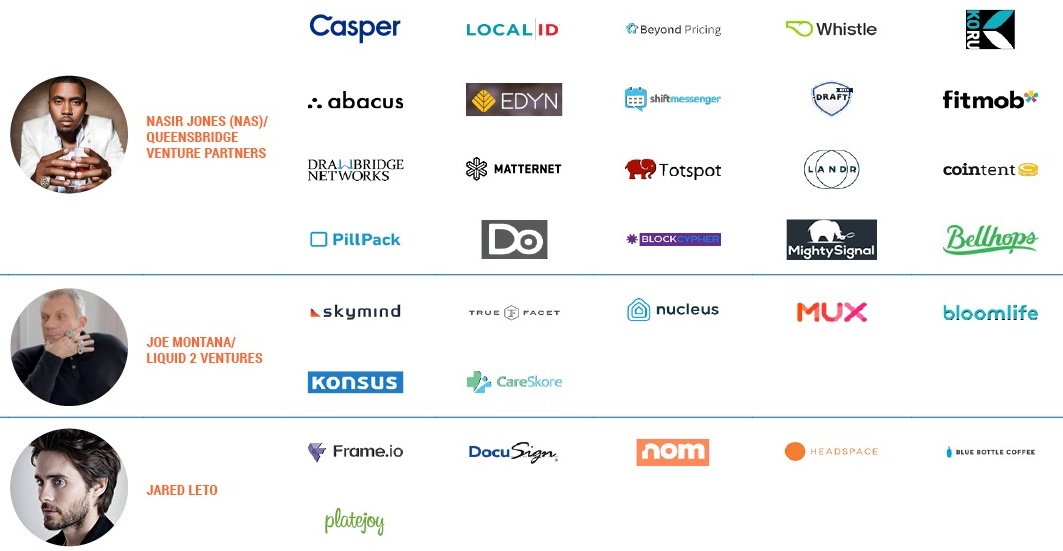

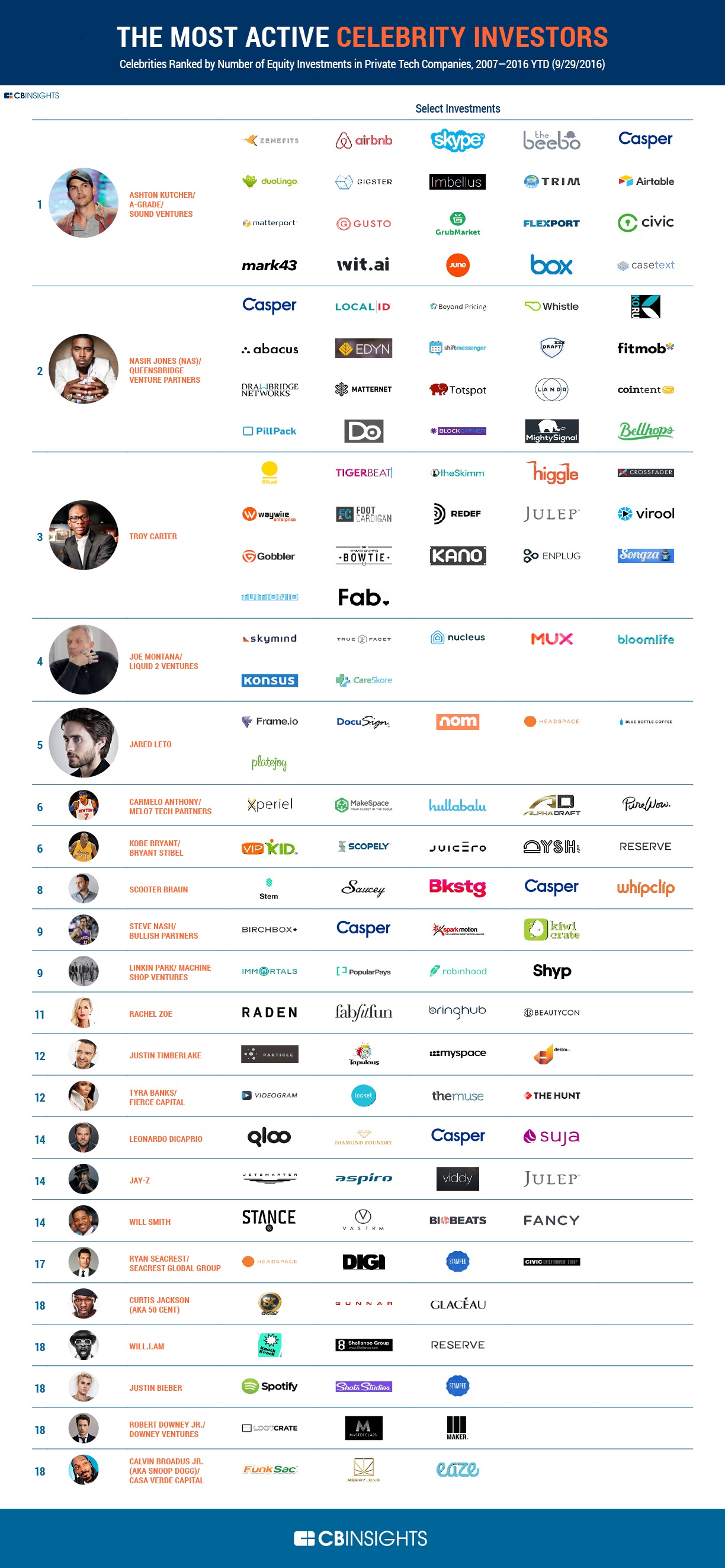

Yet, you might be surprised to learn that celebrities have quietly been funding some of today’s fastest-growing startups. Today’s infographic from CB Insights ranks celebrity investors based on the number of private tech companies they’ve invested in over the last decade.

After delving a little deeper into the investment activities of these tech-savvy celebs, we came up with a few key takeaways.

Diversity is Key

Holding down the top spot on the list is Ashton Kutcher. The former model turned actor, once known for playing lovable stoners on screen (That 70s Show; Dude, Where’s My Car?) has since proven he’s a skilled entrepreneur and investor.

Kutcher co-founded venture fund A-Grade Investments along with Ron Burkle and Guy Oseary in 2010, building a diverse portfolio that includes Spotify, Skype, Airbnb, Foursquare, and Uber, to name a few companies.

According to Forbes, the fund has grown from $30 million to $250 million over the last six years, representing a nearly 8.5x investment multiple, and making the actor somewhat of a legend among Silicon Valley VCs. Kutcher also co-founded A Plus, a viral media site that has reportedly amassed nearly 50 million global monthly unique visitors since its soft launch in 2014, and was acquired by Chicken Soup for the Soul in September 2016.

Coming in at a close second on the list is hip-hop recording artist Nas, AKA Nasir Jones, with a total of 42 investments into 36 companies. Nas co-founded Queensbridge Venture Partners along with manager and business partner Anthony Saleh in 2014. The VC firm has made 128 investments into 118 companies spanning media, health care, retail, Bitcoin, and cyber security, with a portfolio that includes heavyweights such as Lyft and Dropbox.

Find Opportunities Within Your Network

Casper, the NYC-based online manufacturer of foldable memory foam beds, appears on this list a total of five times, having received funding from Ashton Kutcher, Nas, Scooter Braun, Steve Nash, and Leonardo DiCaprio. The startup famously generated $1 million in sales within its first 28 days of business.

The company is backed by other celebrities off the above list as well, showing that Casper has tapped into somewhat of a celebrity network effect. Tobey Maguire and Adam Levine joined the party, putting money into the Series B round for $55 million.

Casper recently surpassed $100 million in cumulative sales, has launched a line of sheets and pillows, and forayed into dog beds. The company, which is planning to expand internationally, has reportedly raised a total of $72 million, with a total valuation of $550 million.

Invest in Your Passions

Calvin Broadus Jr, the pot-loving multi-platinum hip-hop recording artist also known as Snoop Dogg, founded Casa Verde Capital in 2015. The marijuana-centric investment firm’s repertoire of weed-based ventures includes Merry Jane, an online media channel dedicated to cannabis culture; Funksac, a manufacturer of recyclable packaging for medical and recreational marijuana; and Eaze, an online medical marijuana delivery service.

Recently he partnered with Canadian medical marijuana producer Tweed, and launched his own cannabis line called Leafs by Snoop. However, the rapper is clearly diversifying his portfolio; he’s also invested in online media company Reddit along with Jared Leto, and zero-commission stock trading app Robinhood along with Leto and Nas.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees