Technology

See How the Internet of Things Will Change Your Life

See How the Internet of Things Will Change Your Life

The dawn of the Internet of Things (IoT) era is already upon us, but for many people there is a chance that the future impact of the IoT is still pretty unclear.

What is the scale of this technological shift, and how exactly will our day-to-day lives be changed by more everyday devices being connected to the web?

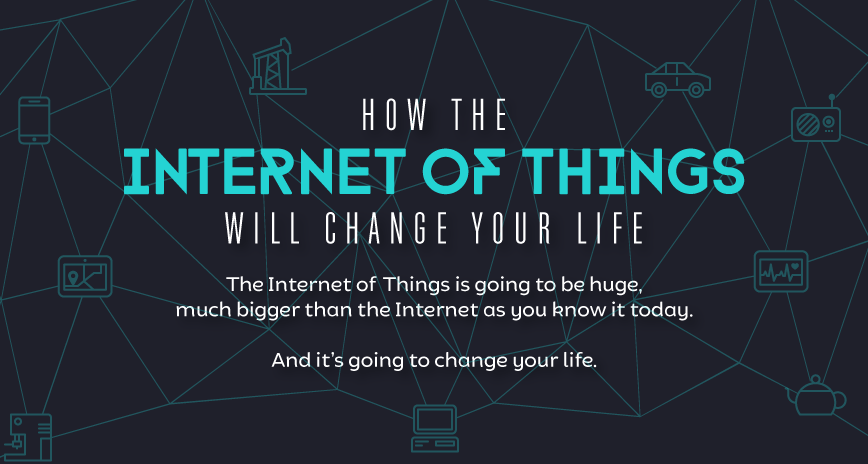

Today’s infographic puts the scale of the IoT into a dazzling sense of perspective. Here’s the dramatic shift in devices connected to the web from 1990 until today:

- In 1990, there were over 300,000 desktop computers connected to the internet.

- In 2000, there were over 300 million desktops connected to the internet.

- In 2016, there are now over 2 billion mobile phones connected to the internet.

And here’s what to expect after just a few more years! By 2020…

- There will be 13 billion kettles, fridges, TVs, thermostats, security cameras, lights, smoke detectors and other things in your home connected to the internet.

- There will be 3.5 billion navigation systems, in-car entertainment systems, and other things in vehicles connected to the internet.

- There will be 411 million wrist bands, shoes, glasses, watches, sports socks, clothing, and other wearable things connected to the internet.

- There will be 646 million heart rate monitors, body implants, pill bottles, blood pressure monitors, skin patches, and other things in the hospital connected to the internet.

- There will be 9.7 buildings, street lights, traffic lights, water pipes, parking meters, pollution monitors, and other things in the city connected to the internet.

What does this mean?

It means that in just a few years, it is likely true that: your house’s heating will turn when you start to head home, traffic lights will adjust to the flow of traffic, empty parking spaces will communicate with your car, your kettle can be ready as you walk in the door, your fridge will order milk for you when you are running low, and your pill bottle may message you when a dose is accidentally missed.

Original graphic by: RS Components

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024