Wealth

Ranked: The World’s 25 Richest Millennial Billionaires

Ranked: The World’s 25 Richest Millennial Billionaires

There are 2,755 billionaires globally—and combined, they are worth over $13 trillion.

Of these ultra wealthy individuals, just over 100 are millennials, born between the years 1981 and 1996. This young generation represents around 3.8% of all billionaires on a global basis with a combined net worth of $573.1 billion.

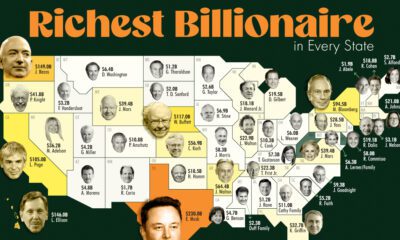

This visualization, using data from Forbes, ranks the richest 25 millennial billionaires and details their source of wealth, total net worth, nationality, and age.

Note: Forbes categorized billionaires by current age (2021). For those slightly over or under the age range of Millennials, meaning those who are currently 24 or 40 years old (i.e. they could have been born in either 1996/1997 or 1980/1981), if their birth year could not be accurately determined, they were left out of this ranking.

Who are the Millennial Billionaires?

The oldest millennials will be turning 40 in 2021, while the youngest are just turning 25. This means that millennial billionaires are generally the youngest billionaires in the world, save two Gen Zers: Wang Zelong of China, 24, and Kevin David Lehmann of Germany, 18.

| Name | Age | Net Worth | Country | Industry |

|---|---|---|---|---|

| Mark Zuckerberg | 36 | $97.0 B | U.S. | Tech |

| Zhang Yiming | 37 | $35.6 B | China | Tech |

| Yang Huiyan & family | 39 | $29.6 B | China | Real Estate |

| Dustin Moskovitz | 36 | $17.8 B | U.S. | Tech |

| Su Hua | 39 | $17.8 B | China | Media & Entertainment |

| Pavel Durov | 36 | $17.2 B | Russia | Tech |

| Lukas Walton | 34 | $15.6 B | U.S. | Fashion & Retail |

| Eduardo Saverin | 39 | $14.6 B | Brazil | Tech |

| Cheng Yixiao | 37 | $14.1 B | China | Media & Entertainment |

| Brian Chesky | 39 | $13.7 B | U.S. | Tech |

| Nathan Blecharczyk | 37 | $12.4 B | U.S. | Tech |

| Joe Gebbia | 39 | $12.4 B | U.S. | Tech |

| Bobby Murphy | 32 | $11.9 B | U.S. | Tech |

| Evan Spiegel | 30 | $11.1 B | U.S. | Tech |

| Guillaume Pousaz | 39 | $9.0 B | Switzerland | Finance & Investments |

| Sam Bankman-Fried | 29 | $8.7 B | U.S. | Finance & Investments |

| Agnete Kirk Thinggaard | 37 | $8.7 B | Denmark | Manufacturing |

| Dmitry Bukhman | 35 | $7.9 B | Russia | Media & Entertainment |

| Igor Bukhman | 39 | $7.9 B | Russia | Media & Entertainment |

| Ernest Garcia, III. | 38 | $7.4 B | U.S. | Automotive |

| Brian Armstrong | 38 | $6.5 B | U.S. | Finance & Investments |

| Wang Ning & family | 34 | $6.3 B | China | Media & Entertainment |

| Scott Duncan | 38 | $6.0 B | U.S. | Energy |

| David Velez | 39 | $5.2 B | Colombia | Finance & Investments |

| Kate Wang | 39 | $5.0 B | China | Manufacturing |

| Daniel Ek | 38 | $4.6 B | Sweden | Technology |

| Gustav Magnar Witzoe | 27 | $4.4 B | Norway | Food & Beverage |

| Steven Meng Yang & family | 38 | $4.2 B | China | Technology |

| Li Xiang | 39 | $4.0 B | China | Automotive |

| Ben Silbermann | 38 | $3.9 B | U.S. | Technology |

| Lynsi Snyder | 38 | $3.6 B | U.S. | Food & Beverage |

| Apoorva Mehta | 34 | $3.5 B | Canada | Technology |

| Franco Bittar Garcia | 37 | $3.5 B | Brazil | Fashion & Retail |

| Xu Yi | 31 | $3.4 B | China | Media & Entertainment |

| RJ Scaringe | 38 | $3.4 B | U.S. | Automotive |

| Patrick Collison | 32 | $3.2 B | Ireland | Technology |

| John Collison | 30 | $3.2 B | Ireland | Technology |

| Pedro de Godoy Bueno | 30 | $3.0 B | Brazil | Healthcare |

| Geoffrey Kwok | 35 | $3.0 B | Hong Kong | Real Estate |

| Yin Xin | 36 | $3.0 B | China | Media & Entertainment |

| Huang Jinfeng | 38 | $3.0 B | China | Fashion & Retail |

| Cameron Winklevoss | 39 | $3.0 B | U.S. | Finance & Investments |

| Tyler Winklevoss | 39 | $3.0 B | U.S. | Finance & Investments |

| Paul Sciarra | 40 | $2.9 B | U.S. | Technology |

| Chen Tianshi | 36 | $2.8 B | China | Technology |

| Tony Xu | 36 | $2.8 B | U.S. | Technology |

| Victor Jacobsson | 39 | $2.7 B | Sweden | Fiannce & Investments |

| Caroline Hagen Kjos | 37 | $2.6 B | Norway | Diversified |

| Adam Kwok | 38 | $2.6 B | Hong Kong | Real Estate |

| André Street | 36 | $2.5 B | Brazil | Finance & Investments |

| Chang Jing | 38 | $2.5 B | China | Technology |

| Byju Raveendran and Divya Gokulnath | 39 | $2.5 B | India | Technology |

| Austin Russell | 26 | $2.4 B | U.S. | Automotive |

| Jonathan Kwok | 29 | $2.4 B | Hong Kong | Real Estate |

| David Chen | 40 | $2.4 B | Singapore | Media & Entertainment |

| Tom Persson | 36 | $2.3 B | Sweden | Fashion & Retail |

| Jared Isaacman | 38 | $2.3 B | U.S. | Technology |

| Andrew Paradise | 38 | $2.3 B | U.S. | Media & Entertainment |

| Sebastian Siemiatkowski | 39 | $2.2 B | Sweden | Finance & Investments |

| Timur Turlov | 33 | $2.1 B | Russia | Finance & Investments |

| Gong Yingying | 36 | $2.1 B | China | Healthcare |

| Katarina Martinson | 39 | $2.1 B | Sweden | Diversified |

| Andy Fang | 28 | $2.0 B | U.S. | Technology |

| Stanley Tang | 28 | $2.0 B | U.S. | Technology |

| Christopher Kwok | 35 | $1.9 B | Hong Kong | Real Estate |

| Ipek Kirac | 36 | $1.9 B | Turkey | Diversified |

| Kevin Systrom | 37 | $1.9 B | U.S. | Technology |

| Fred Ehrsam | 32 | $1.9 B | U.S. | Finance & Investments |

| Nick Molnar | 30 | $1.8 B | Australia | Finance & Investments |

| Joachim Ante | 38 | $1.8 B | Germany | Technology |

| Drew Houston | 38 | $1.8 B | U.S. | Technology |

| Said Gutseriev | 32 | $1.7 B | Russia | Energy |

| Ginia Rinehart | 34 | $1.7 B | Australia | Metals & Mining |

| Hope Welker | 35 | $1.7 B | Australia | Metals & Mining |

| Bill Liu | 38 | $1.7 B | China | Technology |

| Peter Szulczewski | 39 | $1.7 B | Canada | Technology |

| Lisa Draexlmaier | 30 | $1.6 B | Germany | Automotive |

| Eva Maria Braun-Luedicke | 34 | $1.6 B | Germany | Healthcare |

| Heikki Herlin | 34 | $1.6 B | Finland | Manufacturing |

| Ryan Cohen | 35 | $1.6 B | Canada | Fiannce & Investments |

| Friederike Braun-Luedicke | 37 | $1.6 B | Germany | Healthcare |

| Wen Yilong | 32 | $1.5 B | China | Manufacturing |

| Zeng Chaolin | 38 | $1.5 B | China | Metals & Mining |

| Alexandra Andresen | 24 | $1.4 B | Norway | Diversified |

| Katharina Andresen | 25 | $1.4 B | Norway | Diversified |

| Karl Friedrich Braun | 38 | $1.4 B | Germany | Healthcare |

| Trevor Milton | 39 | $1.4 B | U.S. | Automotive |

| Ludwig Theodor Braun | 31 | $1.3 B | Germany | Healthcare |

| Anna Kasprzak | 31 | $1.3 B | Denmark | Fashion & Retail |

| Whitney Wolfe Herd | 31 | $1.3 B | U.S. | Technology |

| André Kasprzak | 34 | $1.3 B | Denmark | Fashion & Retail |

| Hakan Koc | 36 | $1.2 B | Germany | Automotive |

| Nik Storonsky | 36 | $1.2 B | UK | Technology |

| Christian Bertermann | 37 | $1.2 B | Germany | Automotive |

| Ryan Graves | 37 | $1.2 B | U.S. | Technology |

| Cheng Wei | 38 | $1.2 B | China | Service |

| Lu Zhilin | 38 | $1.2 B | China | Manufacturing |

| Sachin Bansal | 39 | $1.2 B | India | Fashion & Retail |

| Huang Yimeng | 39 | $1.2 B | China | Media & Entertainment |

| Wang Han | 33 | $1.1 B | China | Diversified |

| Anne Werninghaus | 35 | $1.1 B | Brazil | Manufacturing |

| Binny Bansal | 38 | $1.1 B | India | Technology |

| Sanjit Biswas | 39 | $1.1 B | U.S. | Technology |

| Vlad Tenev | 34 | $1.0 B | U.S. | Fiannce & Investments |

| Baiju Bhatt | 36 | $1.0 B | U.S. | Finance & Investments |

| Hou Jianbin | 39 | $1.0 B | China | Service |

The U.S. is home to the most millennial billionaires at 33 total, with China coming in second at 23—most other countries fall far behind.

In the U.S., millennial billionaires are often associated with notable tech companies like Snapchat, Airbnb, and Facebook. Others are heirs of massive family fortunes like Lukas Walton—grandson of Sam Walton, the founder of Walmart and the original head of America’s richest family.

In China, some millennial billionaires really stand out, like Relx founder, Kate Wang. The 39-year-old started her e-cigarette and vape company only three years ago, at age 36, and is expected to soon be vying for the title of richest woman in China.

Billionaire Growth

Overall, billionaires were up $8 trillion in combined net worth compared to 2020 with around 493 new people added to the list in 2021.

In fact, 86% of all billionaires are richer than a year ago. But let’s look at how wealth changed for the millennials in the billionaires club. Here’s a look at the difference in net worth from 2020 to 2021 for the top five richest millennials:

- Mark Zuckerberg: +$35 Billion

- Zhang Yiming: +$19.4 Billion

- Yang Huiyan: +$9.3 Billion

- Dustin Moskovitz: +$8.5 Billion

- Su Hua: +$14.9 Billion

For each of the top 25 millennial billionaires, net worth either increased or was unchanged (or they were new to the title of billionaire). This is true for all except one person—Lukas Walton, whose net worth decreased by almost $3 billion from 2020 to 2021.

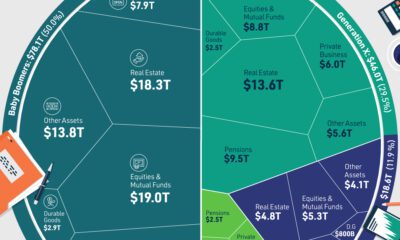

The Average Millennial

While there are around 106 millennial billionaires worldwide, their combined net worth is only a fraction of total billionaire wealth. So how much economic power and influence does this generation really hold?

When looking at the average American millennial’s wealth, the Generational Power Index has determined that this young generation only holds 9.6% of economic power in the U.S. Here’s a quick look at millennial wealth metrics in the U.S.:

- Millennials only make up 7% of American business leaders

- They own $73 billion in equities and mutual fund shares

- They represent 13% of small business leaders

- They make up 7% of American billionaire wealth

Globally, there are an estimated 1.8 billion millennials. Among that cohort, there are just over 100 people worth billions—and given that many are still in the early part of their careers, there is likely to be many millennial billionaires yet to come.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees