Inequality

Visualizing the Footprint of Highways in American Cities

Visualizing the Footprint of Highways in American Cities

Driving on the open road is a defining feature of the American experience, made possible by coast-to-coast highways. It defined a generation of life and ingrained the automobile into the urban fabric of American cities, for better and worse.

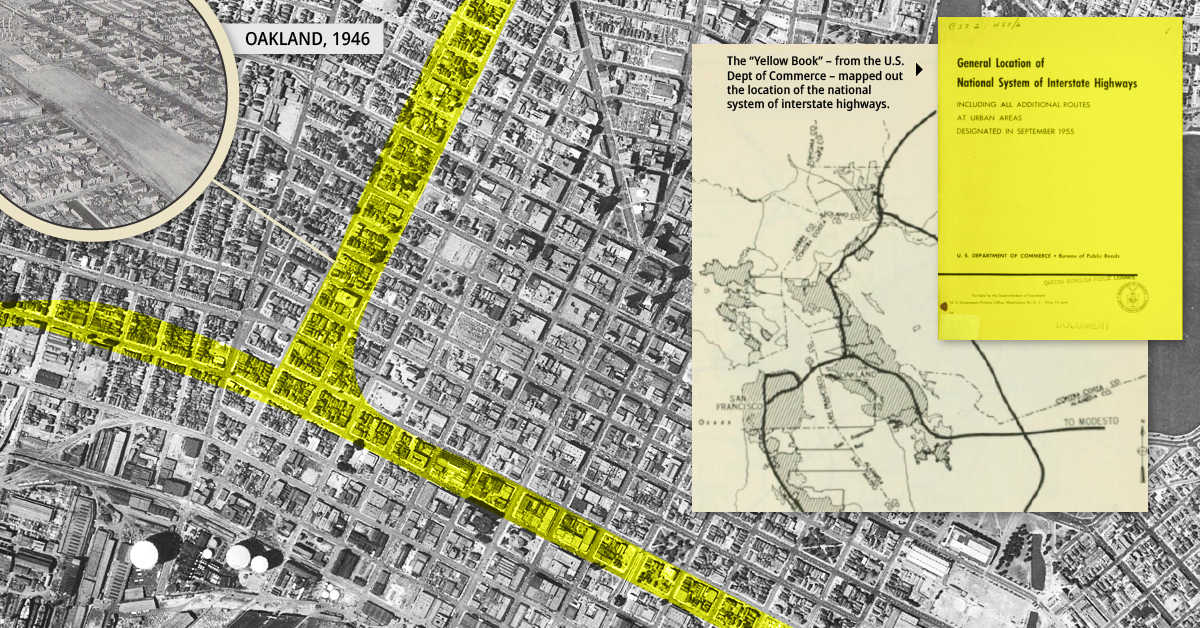

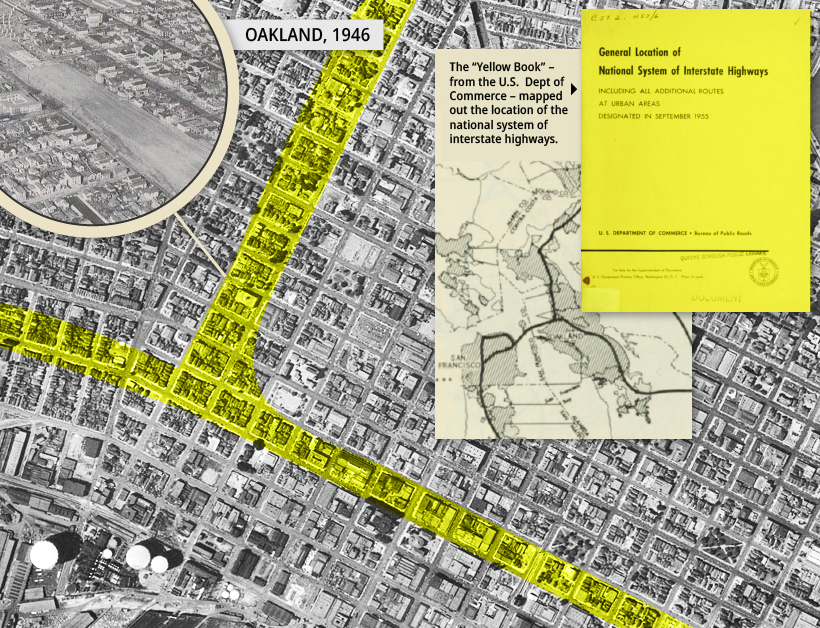

Today’s animations show how highways reshaped the downtown cores of six American cities and created new patterns of urban life. But first, some background information on the creation of the interstate system.

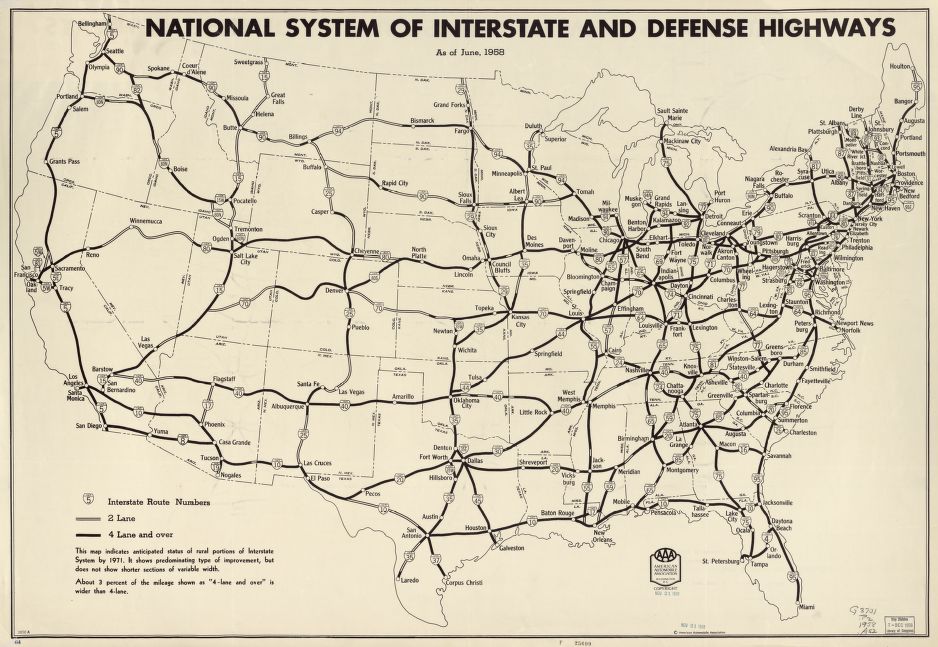

The Interstate Highway System

The U.S. Interstate System was created on June 29, 1956, when Dwight Eisenhower signed the Federal-Aid Highway Act. It would eventually run 46,876 miles, cost $521 billion and take 36 years to complete.

From San Diego to Bangor, the interstate highway system connected Americans and opened up the country to commerce and geographic mobility like never before, but for all its benefits, this new transportation network ripped through established patterns of urban and town life, creating a new era of urban development.

The Legacy of Highways: The Suburbs and Inner Cities

The vast geography of continental America helped to entrench personal mobility and freedom into American society. Highways and automobiles accelerated this lifestyle and even changed the shape of entire cities.

According to Prof. Nathaniel Baum-Snow of the University of Toronto, between 1950 and 1990, the population of central cities in the U.S. declined by 17% despite a population growth of 72% in larger metropolitan areas during the same period. Baum-Snow posits that, had the interstate highway system not been built, central cities’ populations would have increased 8%.

Firms followed the workers to the suburbs, but the highways system also created additional benefits for these firms. Cross-country road access freed manufacturing from ports and downtown rail hubs, while allowing economies to operate across larger distances, altering the dynamics of typical urban economies.

Faced with this new reality, inner cities struggled in years to come.

Inner Cities

The introduction of highways created an increase in the supply of land for development through faster commutes to outlying areas. In 1950, half of all jobs were located in central cities. By 1990, less than one-third of urban jobs were located in the core of American cities.

“Not TV or illegal drugs but the automobile has been the chief destroyer of American communities.” Jane Jacobs, Author The Death and Life of Great American Cities

Benefits of new development accrued to the outer areas while the construction of the highways in inner cities displaced largely low-income communities, segregated neighborhoods, increased the amount of air and noise pollution, devalued surrounding properties, and removed access to jobs for those without a car, further concentrating poverty.

Before and After: Six American Cities

A bird’s eye view of six American cities reveals what was and what is now. By overlaying existing highways over the neighborhoods they replaced, it becomes clear how much interstate construction drastically altered America’s urban landscape.

Public opposition to the construction of I-980 was so strong that developers abandoned the project in 1971, only to complete it over a decade later.

The I-95 carved through Miami’s largely black Overtown neighborhood. The construction of a single highway cloverleaf resulted in 20 square blocks being demolished, displacing over 10,000 people in that community.

The I-95 comprised unconnected segments between 1957 and 1965 through the densest urban areas in a deliberate effort to prevent premature suburbanization and to revitalize the downtown core.

The I-71 cuts downtown Cincinnati off from its waterfront and a massive freeway interchange forced the destruction of dozens of blocks west of downtown.

Freeway construction transformed Detroit between 1951 and 2010. Previously, its downtown had been surrounded by a high-density street grid. Today, it’s totally encircled by freeways.

Rochester is one of many cities opting to undertake freeway removal projects.

As the dotted line above shows, the “moat” surrounding downtown is slowly being removed. The city used reclaimed land from the Inner Loop freeway to construct three mixed-use developments that include below-market-rate units.

The Future of Urban Living: Do Highways Matter?

A new era of living is reconsidering the impacts of these highways on urban centers. As property values rise and existing housing stock is pressured, there are growing concerns over the environmental impacts of suburban life. As a result, urban planners and residents are looking to revitalize city cores and re-purpose land occupied by burdensome slabs of highway concrete.

Since 1987, there have been more than 20 urban highway segments removed from downtown cores, neighborhoods and waterfronts, mostly in North America. The pace of removals has picked up significantly and an additional 10 highways are now planned for removal in the United States.

During the COVID-19 pandemic, American cities have seen their traffic plummet. Rush-hour trips into cities are taking nearly half the time while some are not even commuting at all.

While this situation is likely temporary, it is offering a moment for reflection of how cities operate and whether the car should be at the center of urban planning.

*Hat tip to Shane Hampton, whose 60 Years of Urban Change compilation served as inspiration for this article. Visit that page for many more examples of highway impact on cities.

Money

Visualizing the World’s Growing Millionaire Population (2012-2022)

The world’s millionaire population has more than doubled in the last decade between 2012 and 2022. We visualize these numbers here.

Visualizing the World’s Growing Millionaire Population

Reaping the rewards of tech revolutions, market booms, and more, the last decade has seen a remarkable increase in the global number of millionaires.

In 2022, 1.1% of all of the world’s adults were millionaires, up from 0.6% in 2012.

In today’s visualization, we dive into the world’s growing millionaire population using data from this year’s Global Wealth Report by Credit Suisse.

The Global Millionaire Population, Then and Now

In 2022, total millionaire wealth stood at $208.3 trillion, accounting for 45.8% of global wealth. That represents a 138% increase from 2011, when millionaires held $87.5 trillion in wealth.

While the rise can be attributed to a number of factors, financial assets have accounted for most of the increase in total wealth since the 2008 Financial Crisis, according to Credit Suisse.

Here’s a look at the explosive growth in the number of millionaires from 2012 to 2022:

| Wealth range | Number of adults (2012) | Number of adults (2022) |

|---|---|---|

| $1-5M | 25.6 million | 51.5 million |

| $5-10M | 1.9 million | 5.1 million |

| >$10M | 1.0 million | 2.8 million |

At the very apex of these pyramids, the number of ultra-high-net-worth individuals (all holding $50 million or more in wealth) has nearly tripled over the last decade.

Where are the world’s millionaires mostly found?

- 42%: North America

- 27%: Europe

- 16%: Asia-Pacific (ex. China and India)

- 10%: China

- 5%: Rest of the World

In total, the world’s millionaire population amounted to 59.4 million adults in 2022.

Despite inflation, interest rates, and current market conditions hampering wealth creation for many in 2022 and 2023, Credit Suisse forecasts that the number of millionaires will still grow to 86 million by 2027, a 45% increase from 2022.

The Outlook for Wealth Inequality

Although wealth inequality fell slightly in 2022, a significant chunk of overall global wealth still belongs to the wealthiest parts of the population.

In stark contrast to millionaires, 52.5% of the world’s adults had less than $10,000 in wealth, and combined for just 1.2% of global wealth.

From a big picture perspective, however, worldwide wealth inequality has trended downward over the last two decades. That is, before the 2020–2021 period when the wealth gap was exacerbated due to the pandemic and the subsequent boom in share and house prices.

Looking ahead to 2027, Credit Suisse forecasts that the share of adults with less than $10,000 in wealth will fall, with more adults moving into the middle and upper income levels. It’ll be interesting to see if global wealth inequality continues its long-term downward trajectory.

Where does this data come from?

Source: Credit Suisse Global Wealth Report (2022 and 2012 versions)

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees