Money

The Richest People in the World in 2023

The Richest People in the World in 2023

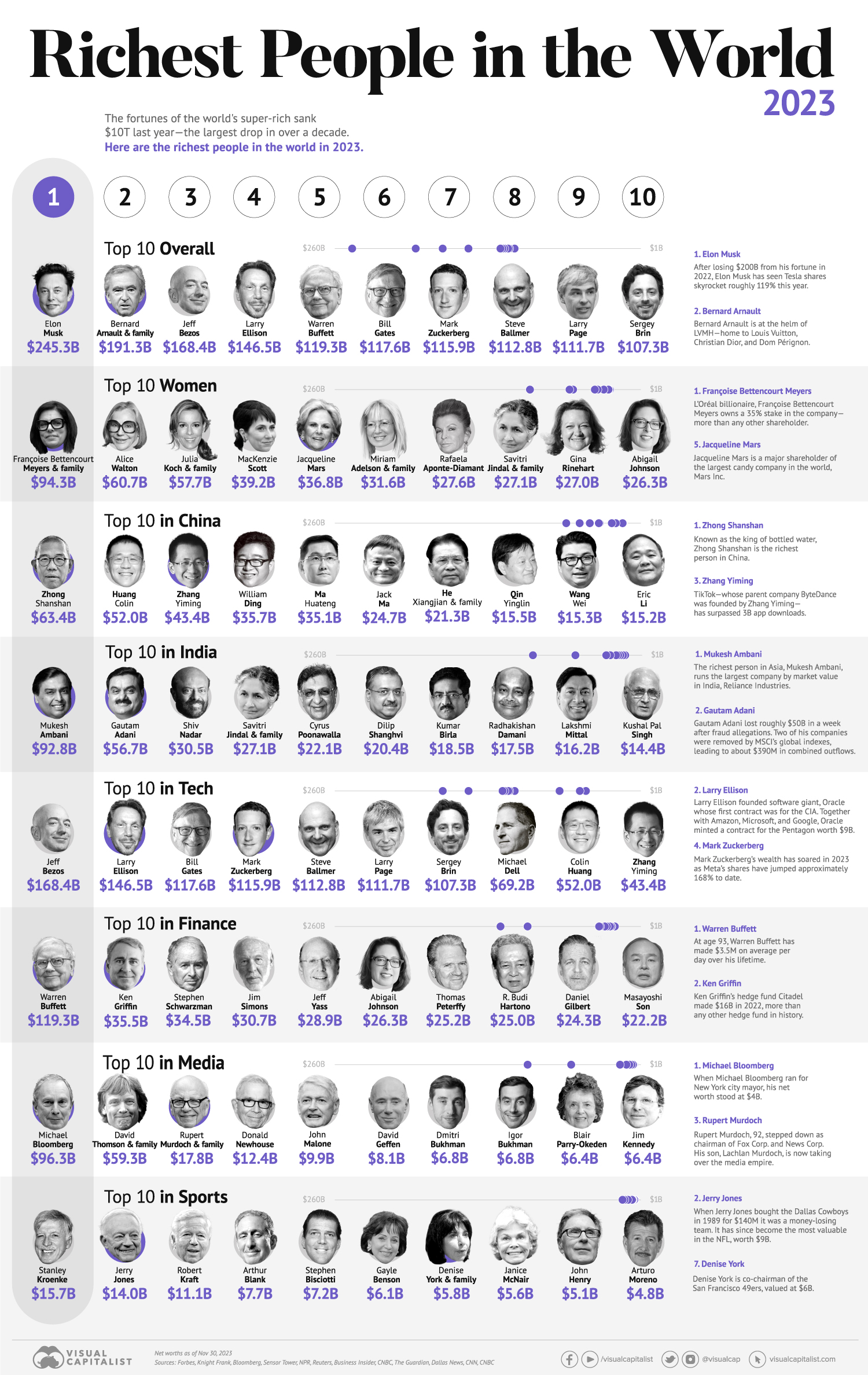

After witnessing record gains in wealth, ultra-high net worth individuals (UHNWIs) lost a combined $10 trillion last year.

A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But in 2023, some of the world’s billionaires have flourished, posting sky-high revenues in spite of inflationary pressures.

With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Elon Musk at the Top

Elon Musk, CEO of Tesla and the company’s largest shareholder, is the wealthiest person in the world. Musk’s net worth stands at over $245 billion.

In November, Tesla launched its Cybertruck, its first new passenger vehicle in three years. Musk called it the company’s “best product ever.” The event drew mixed responses, with some complaining that cheaper models had jumped $20,000 from previous price targets.

In the table below, we show the world’s 10 richest people with data as of November 30, 2023:

| Rank | Name | Source | Net Worth Dec 2023 |

|---|---|---|---|

| 1 | Elon Musk | Tesla, SpaceX | $245B |

| 2 | Bernard Arnault & family | LVMH | $191B |

| 3 | Jeff Bezos | Amazon | $168B |

| 4 | Larry Ellison | Oracle | $147B |

| 5 | Warren Buffett | Berkshire Hathaway | $119B |

| 6 | Bill Gates | Microsoft | $118B |

| 7 | Mark Zuckerberg | Meta (Facebook) | $116B |

| 8 | Steve Ballmer | Microsoft | $113B |

| 9 | Larry Page | $112B | |

| 10 | Sergey Brin | $107B |

The second-richest person in the world is France’s Bernard Arnault, chairman and CEO of LVMH. With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany.

Third on the list is Jeff Bezos, followed by Oracle founder Larry Ellison. Oracle, a multi-billion dollar cloud provider, is partnering with Nvidia in its artificial intelligence (AI) supercomputing platform designed for enterprises across multiple industries.

Fifth on the list is Warren Buffett. In his 2022 annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

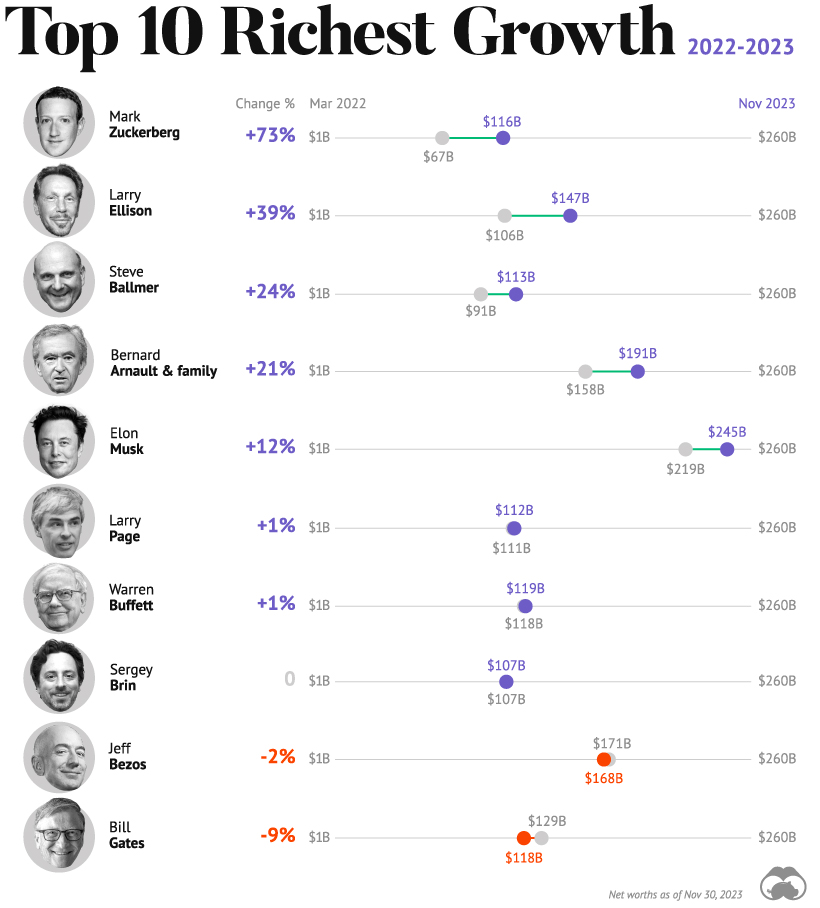

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Zuckerberg’s wealth has soared the fastest, at 57%, followed by Ellison at 43%.

In its “year of efficiency,” Meta has laid off over 10,000 employees this year on top of 11,000 in November of 2022. Meanwhile, online advertising has bounced back in 2023, and the company posted better-than-expected revenues in the third quarter.

Bill Gates has seen his wealth decline 9%, or $11 billion, the most across the top 10 richest.

So far this year, AI market euphoria has led fortunes in big tech to rebound, although not all have fully recovered. In 2022, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Taylor Swift Reaches Billionaire Status

Thanks to the stunning success of the Eras Tour, Taylor Swift became one of the newest members of the Forbes list in October, with a $1.1 billion net worth.

The tour has added an estimated $4.3 billion to U.S. GDP.

Swift’s music sales have generated the majority of her fortune, at $400 million since 2019. This is followed by ticket sales and merchandise ($370 million), streaming earnings ($120 million), and the value of her five personal properties ($110 million).

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)