Uranium: Powering the Cleanest Source of Energy

The following content is sponsored by the Sprott Physical Uranium Trust

Uranium: Powering the Cleanest Source of Energy

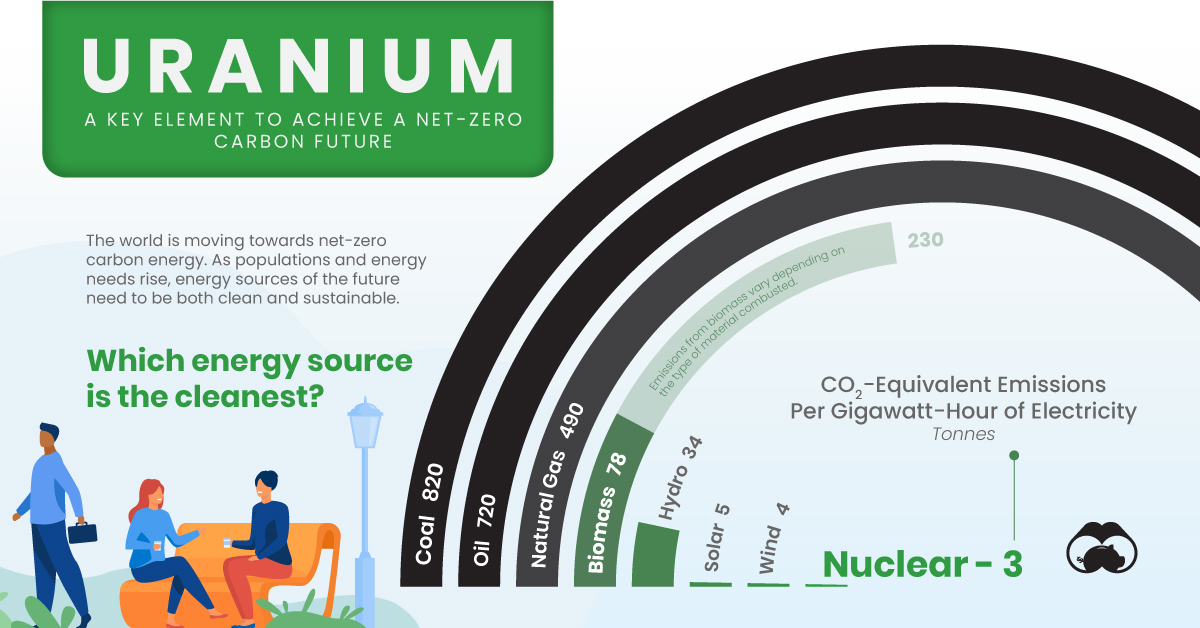

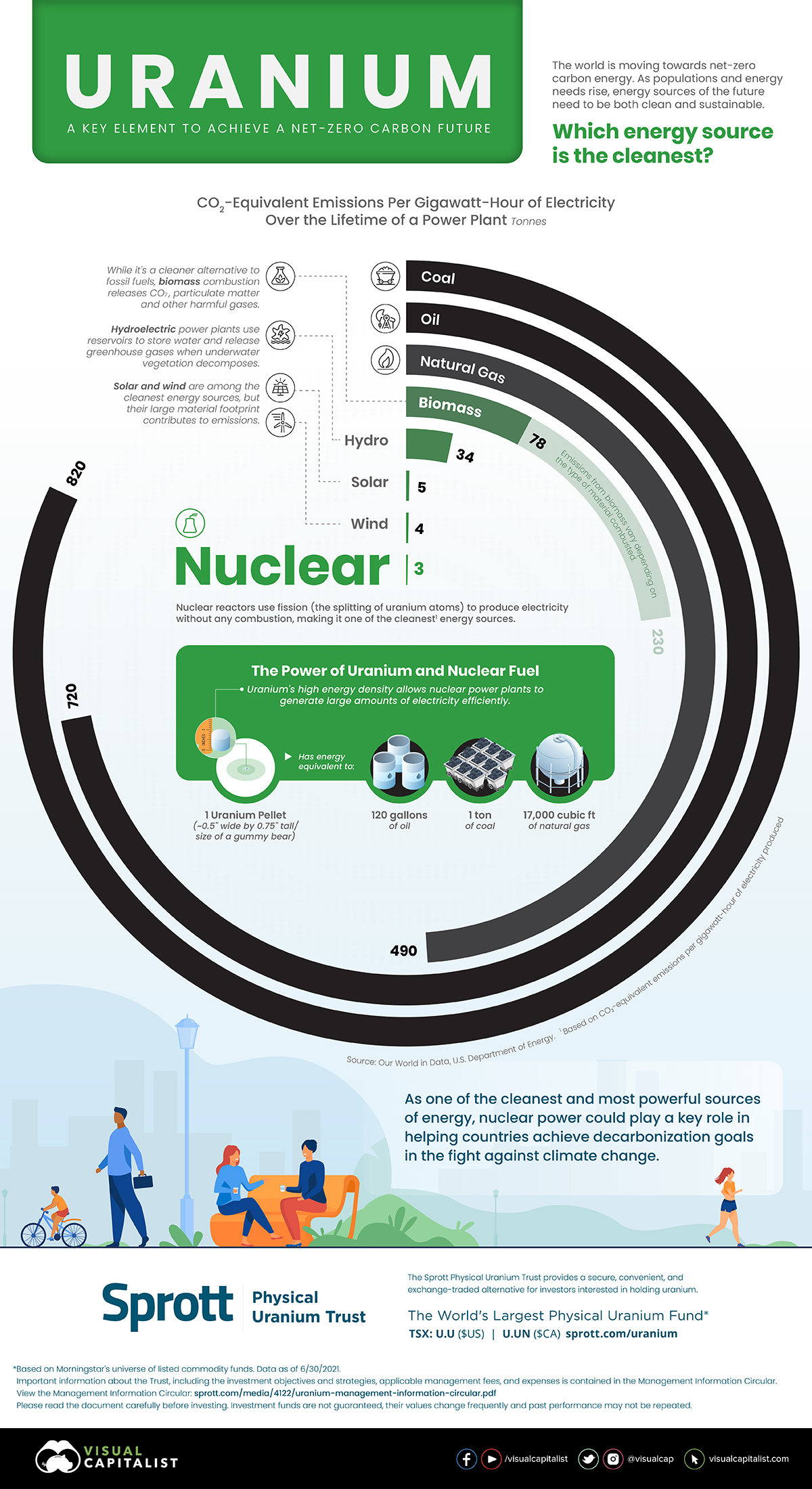

The world’s energy needs are growing with its population. However, achieving a net-zero carbon economy while meeting our growing energy needs requires a larger role for clean, sustainable, and reliable sources. Nuclear is one such energy source.

The above graphic from the Sprott Physical Uranium Trust highlights how uranium is powering one of the cleanest and most reliable sources of energy in nuclear power.

The Cleanest Energy Sources

Although all energy sources have tradeoffs, some are better for the environment than others.

To find the cleanest sources of energy, Our World in Data calculated CO2-equivalent emissions per gigawatt-hour (GWh) of electricity generated over the lifecycle of power plants for different energy sources. This includes the footprint of raw materials, transport, and construction of power plants.

| Energy Source | CO2-equivalent Emissions Per GWh (tonnes) | Type |

|---|---|---|

| Coal | 820 | Fossil fuel |

| Oil | 720 | Fossil fuel |

| Natural Gas | 490 | Fossil fuel |

| Biomass | 78-230* | Non-renewable |

| Hydro | 34 | Renewable |

| Solar | 5 | Renewable |

| Wind | 4 | Renewable |

| Nuclear | 3 | Non-renewable |

*Emissions from biomass vary depending on the type of fuel combusted.

It’s not surprising that coal, oil, and natural gas plants emit much more greenhouse gases than their renewable and non-renewable counterparts. In fact, emissions per GWh from coal power plants are roughly 273 times higher than nuclear power plants.

Hydropower offers a cleaner and renewable alternative to fossil fuels, however, the concrete and materials used in dam construction contribute to emissions. Furthermore, the decomposition of underwater vegetation in reservoirs also releases methane and carbon dioxide into the environment. Still, emissions per GWh from hydropower are around 24 times lower than coal.

Solar and wind are often the most mentioned energy sources when it comes to the clean energy transition. However, their energy densities are lower than fossil fuels and as a result, they often require more units to generate the same amount of power. For example, generating one GWh of electricity can take more than three million photovoltaic panels, or 412 utility-scale wind turbines. Constructing these massive solar and wind farms adds up to a relatively large material footprint and consequently, GHG emissions.

This is where nuclear power comes in.

Why is Nuclear the Cleanest Source of Energy?

Nuclear power plants use fission to generate electricity without any combustion, avoiding emissions from the process of electricity generation. What’s more, on average, it only takes one typical nuclear reactor to generate one GWh of electricity. The power generation capacity of nuclear reactors is largely due to the high energy density of uranium and nuclear fuel.

According to the U.S. Department of Energy, a single, eraser-sized uranium pellet contains the same amount of energy as 120 gallons of oil or 17,000 cubic feet of natural gas. This allows nuclear power plants to generate large amounts of electricity efficiently, making them one of the cleanest energy sources per GWh of electricity produced.

Nuclear’s Role in the Clean Energy Transition

Nuclear power offers several advantages in the transition to clean energy.

Besides being carbon-free and sustainable, nuclear power is also one of the most reliable and safest sources of energy. In fact, nuclear plants in the United States have a capacity factor of 92.5%, which means that they run at maximum capacity for almost 93% of the time during a year.

As one of the cleanest, most powerful, and reliable sources of energy, nuclear power could play a key role in helping countries achieve decarbonization goals in the fight against climate change.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.