Jobs

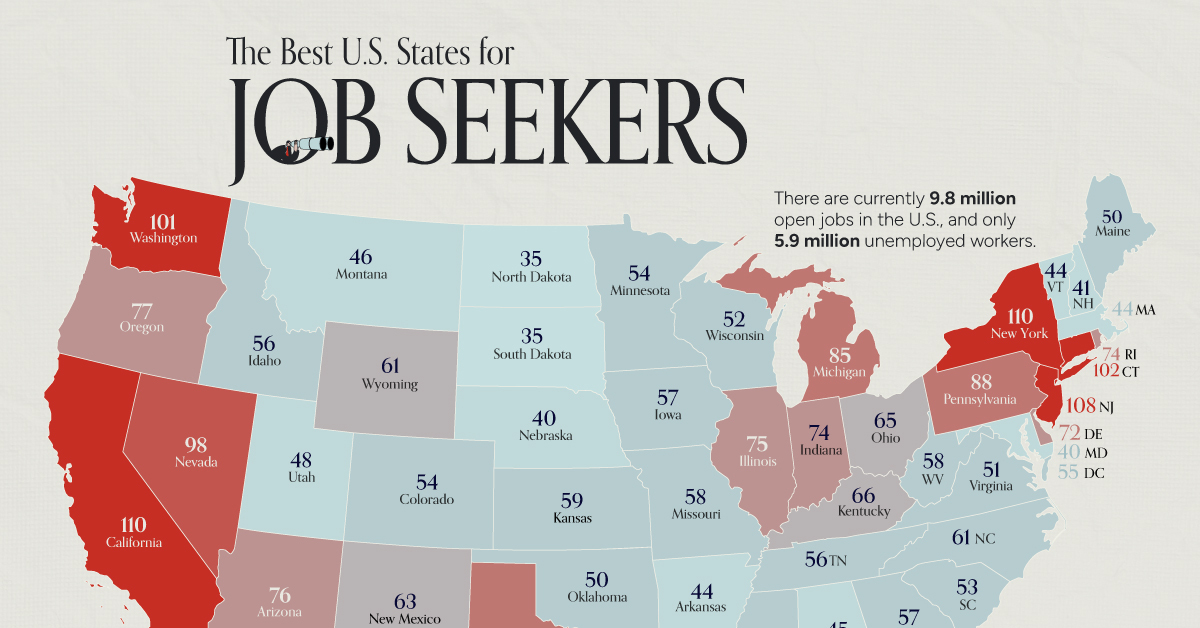

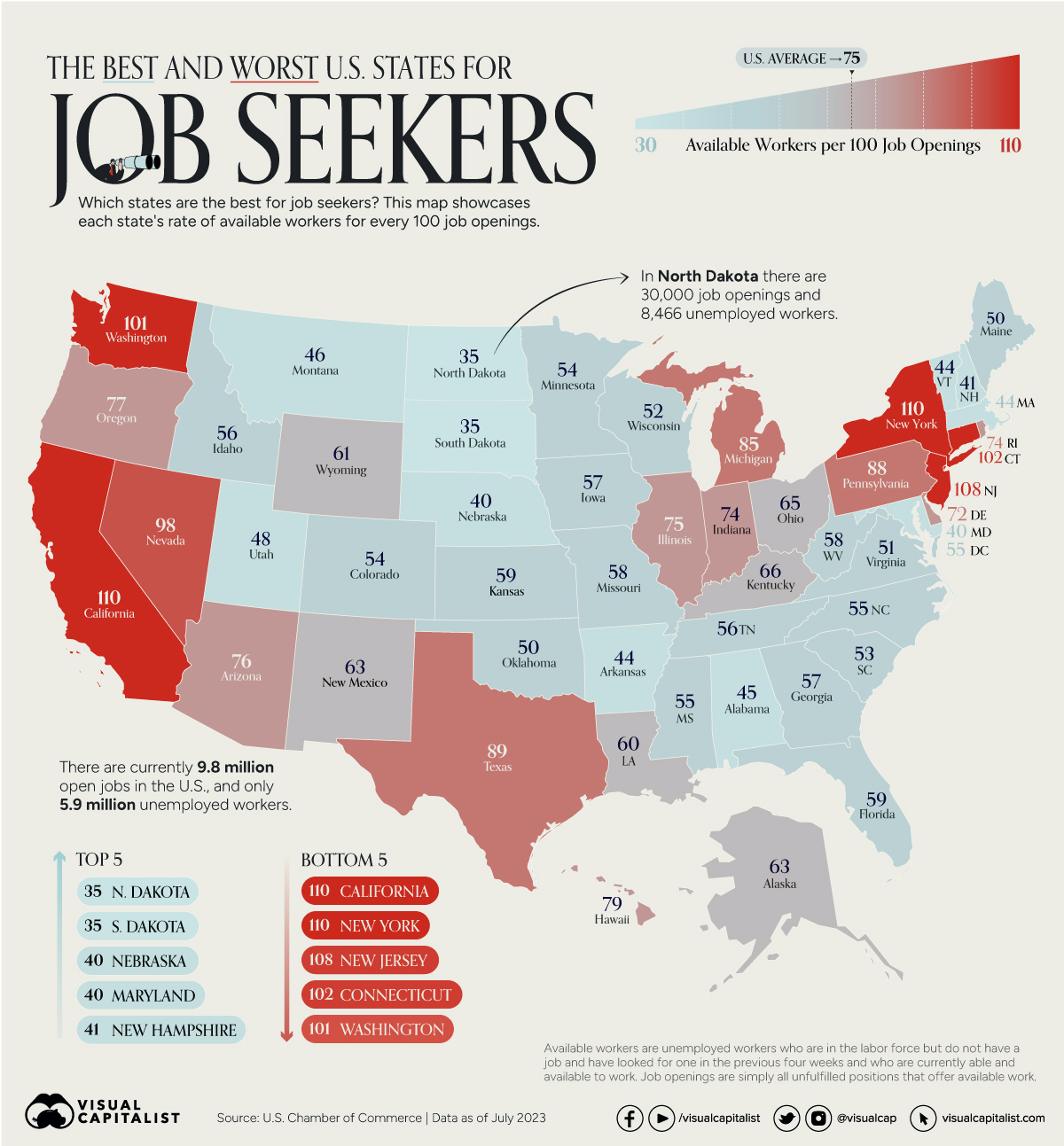

Mapped: Unemployed Workers vs. Job Openings, by U.S. State

Mapped: Unemployed Workers vs. Job Openings, by U.S. State

In the United States, there were about 75 workers available for every 100 job openings as of July 2023. This means there is a significant gap between labor and jobs available, but also many opportunities present in some states for potential job seekers.

This map, using data from the U.S. Chamber of Commerce, showcases the number of available workers per 100 job openings in each U.S. state.

Note: Available workers are unemployed workers who are in the labor force but do not have a job, have looked for one in the previous four weeks, and are currently able and available to work. Job openings are simply all unfulfilled positions that offer available work.

Workers and Job Openings by State

The below table lists out the number of unemployed workers per 100 jobs in every state.

Higher ratios, such as 110 workers per 100 job openings, mean there is more competition for each job opening in that state. Lower ratios suggest that it is harder to find workers in a given state.

| Rank | State | Available Workers per 100 Job Openings |

|---|---|---|

| #T1 | California | 110.0 |

| #T1 | New York | 110.0 |

| #3 | New Jersey | 108.0 |

| #4 | Connecticut | 102.0 |

| #5 | Washington | 101.0 |

| #6 | Nevada | 98.0 |

| #7 | Texas | 89.0 |

| #8 | Pennsylvania | 88.0 |

| #9 | Michigan | 85.0 |

| #10 | Hawaii | 79.0 |

| #11 | Oregon | 77.0 |

| #12 | Arizona | 76.0 |

| #13 | Illinois | 75.0 |

| #T14 | Indiana | 74.0 |

| #T14 | Rhode Island | 74.0 |

| #16 | Delaware | 72.0 |

| #17 | Kentucky | 66.0 |

| #18 | Ohio | 65.0 |

| #T19 | Alaska | 63.0 |

| #T19 | New Mexico | 63.0 |

| #21 | Wyoming | 61.0 |

| #22 | Louisiana | 60.0 |

| #T23 | Florida | 59.0 |

| #T23 | Kansas | 59.0 |

| #T25 | Missouri | 58.0 |

| #T25 | West Virginia | 58.0 |

| #T27 | Georgia | 57.0 |

| #T27 | Iowa | 57.0 |

| #T29 | Idaho | 56.0 |

| #T29 | Tennessee | 56.0 |

| #T31 | District of Columbia | 55.0 |

| #T31 | Mississippi | 55.0 |

| #T31 | North Carolina | 55.0 |

| #T34 | Colorado | 54.0 |

| #T34 | Minnesota | 54.0 |

| #36 | South Carolina | 53.0 |

| #37 | Wisconsin | 52.0 |

| #38 | Virginia | 51.0 |

| #T39 | Maine | 50.0 |

| #T39 | Oklahoma | 50.0 |

| #41 | Utah | 48.0 |

| #42 | Montana | 46.0 |

| #43 | Alabama | 45.0 |

| #T44 | Arkansas | 44.0 |

| #T44 | Massachusetts | 44.0 |

| #T44 | Vermont | 44.0 |

| #47 | New Hampshire | 41.0 |

| #48 | Maryland | 40.0 |

| #49 | Nebraska | 40.0 |

| #50 | North Dakota | 35.0 |

| #51 | South Dakota | 35.0 |

| U.S. Total | 75.0 |

While states like New Jersey and California have more workers that they know what to do with, states like North Dakota have a 0.35 ratio of people to jobs, potentially tipping the balance of power to job seekers.

Over the last three years, job openings have increased the most in the state of Georgia, where there were only 0.57 people available for every open role in July. But despite growth in open positions, unemployment has hardly changed over the last year, wavering around 3%.

The Reason for the Gap

“If every unemployed person in the country found a job, we would still have 4 million open jobs.”– U.S. Chamber of Commerce

According to the U.S. Chamber of Commerce, the main driver of the current labor shortage was the COVID-19 pandemic, forcing more than 100,000 businesses to close temporarily and resulting in millions losing their jobs.

Subsequent government support for those who lost work and other subsidies made it easier for people to stay home and out of the workforce. A Chamber of Commerce survey found that 1-in-5 people have changed their work style since the pandemic, with 17% having retired, 19% having transitioned to a homemaker role, and another 14% working only part time.

The industries with the highest unemployment rates are also those that have added the most jobs, with leisure and hospitality experiencing the highest rates (5.1%) just ahead of wholesale and retail trade (4.4%).

Overall, though the job marker has started to cool somewhat, hiring is still outpacing quit rates. The national quit rate in July 2023 was 3.8%, compared to a hiring rate of 4%. And with 9.8 million job openings in the U.S., there should be ample opportunities for job seekers.

Where does this data come from?

Source: U.S. Chamber of Commerce

Notes/Definitions: Hire rates are calculated by dividing the number of hires by employment and multiplying that quotient by 100. Quit rates are calculated by estimating the number of quits for a reference period, then dividing quits by employment and multiplying by 100. The labor force participation rate is the share of the population that is either working or actively looking for work. Unemployment rates are calculated as the share of the labor force that is unemployed.

Economy

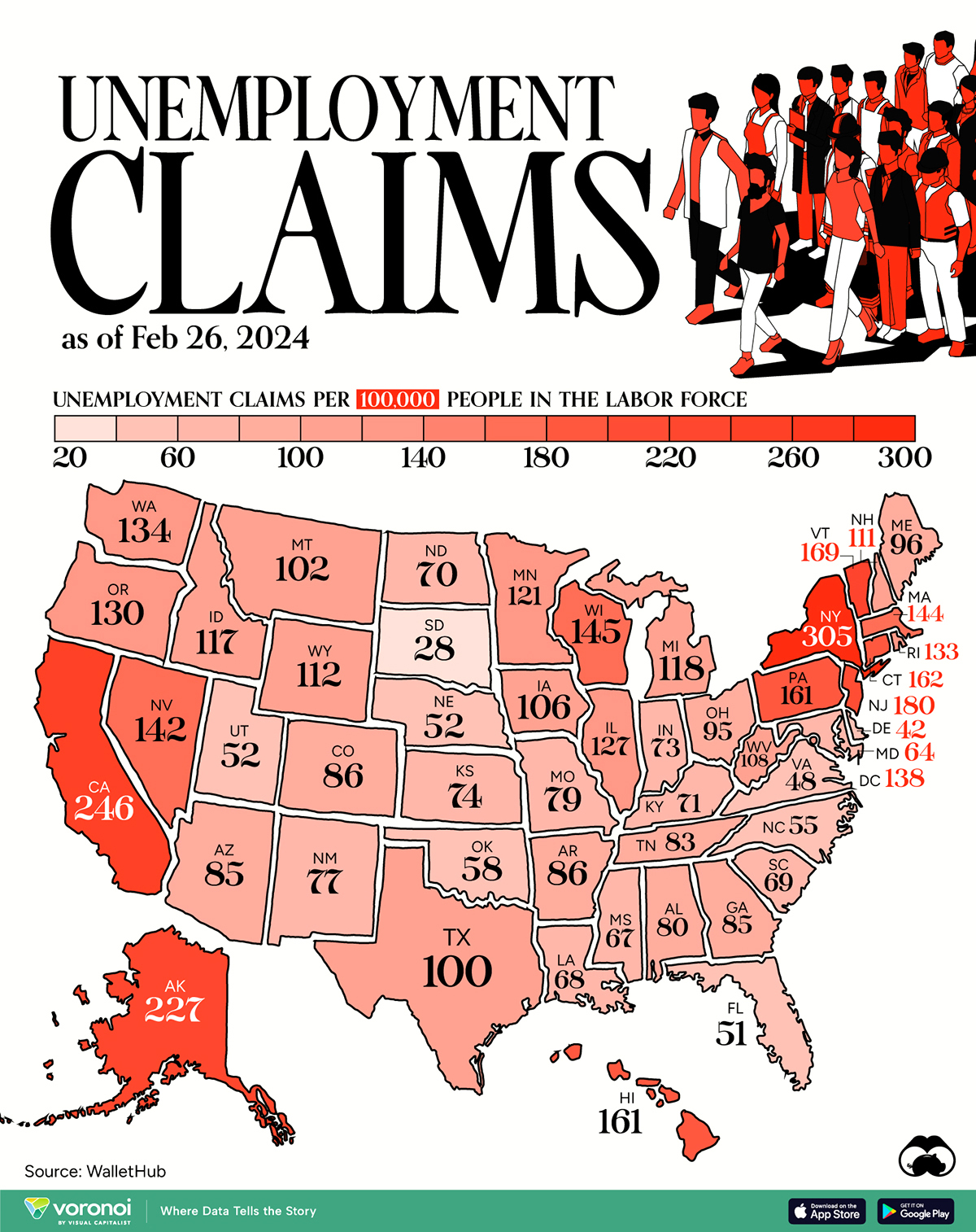

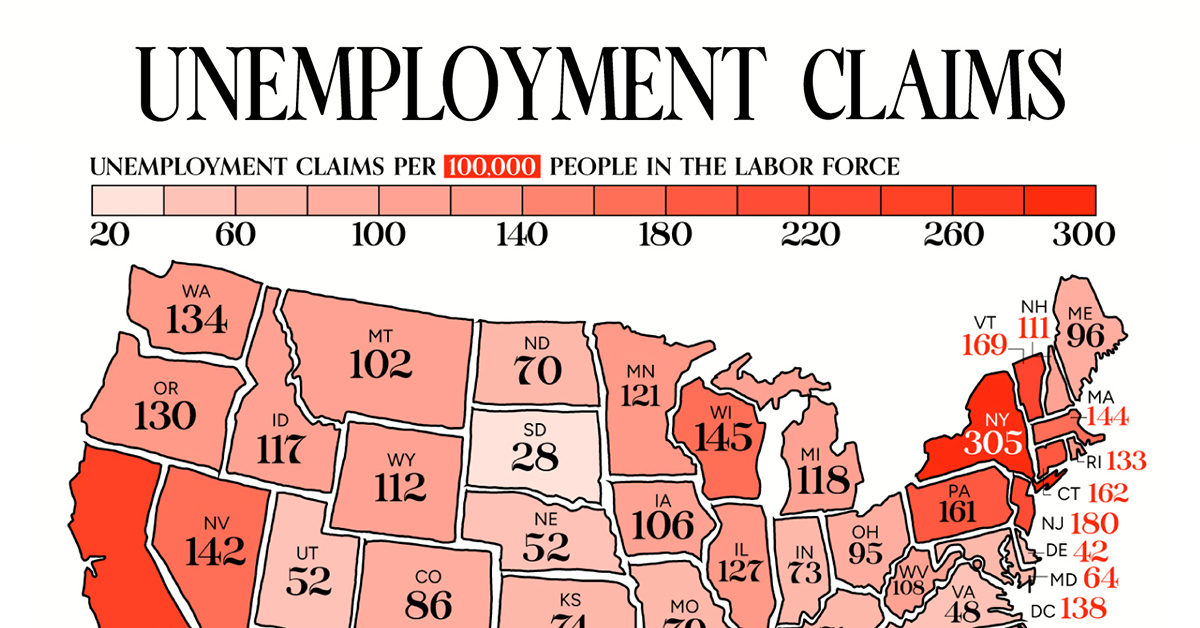

Mapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

Mapped: Weekly Unemployment Claims by State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Unemployment claims per 100,000 people is a handy metric for gauging the health of the job market. Generally speaking, a higher number of claims suggests that more people are unemployed, which may highlight issues with the economy.

In this graphic, we’ve visualized the number of weekly initial unemployment claims per 100,000 people in the labor force across the U.S., using data from WalletHub. All figures are for the week ending Feb 26, 2024, with data being released in early March.

| State | Unemployment Claims per 100,000 People in the Labor Force |

|---|---|

| New York | 305 |

| California | 246 |

| Alaska | 227 |

| New Jersey | 180 |

| Vermont | 169 |

| Connecticut | 162 |

| Pennsylvania | 161 |

| Hawaii | 161 |

| Wisconsin | 145 |

| Massachusetts | 144 |

| Nevada | 142 |

| DC | 138 |

| Washington | 134 |

| Rhode Island | 133 |

| Oregon | 130 |

| Illinois | 127 |

| Minnesota | 121 |

| Michigan | 118 |

| Idaho | 117 |

| Wyoming | 112 |

| New Hampshire | 111 |

| West Virginia | 108 |

| Iowa | 106 |

| Montana | 102 |

| Texas | 100 |

| Maine | 96 |

| Ohio | 95 |

| Colorado | 86 |

| Arkansas | 86 |

| Arizona | 85 |

| Georgia | 85 |

| Tennessee | 83 |

| Alabama | 80 |

| Missouri | 79 |

| New Mexico | 77 |

| Kansas | 74 |

| Indiana | 73 |

| Kentucky | 71 |

| North Dakota | 70 |

| South Carolina | 69 |

| Louisiana | 68 |

| Mississippi | 67 |

| Maryland | 64 |

| Oklahoma | 58 |

| North Carolina | 55 |

| Nebraska | 52 |

| Utah | 52 |

| Florida | 51 |

| Virginia | 48 |

| Delaware | 42 |

| South Dakota | 28 |

Across the country, there are 6.1 million Americans unemployed as of end of February, resulting in a national unemployment rate of around 3.9%. Notably, this is the highest figure seen since January 2022.

States With the Largest Increases

For further context, we can examine the change in unemployment claims by state for the period of Jan 1- Feb 26, in 2024 and 2023.

States that saw the biggest rise over this period were New York, New Jersey, and Nevada. A top 10 list can be found below.

| State | Change in Unemployment Claims (Jan-Feb, 2023 vs 2024) |

|---|---|

| New York | 2,725% |

| New Jersey | 2,132% |

| Nevada | 505% |

| Arizona | 51% |

| Iowa | 45% |

| Maryland | 35% |

| North Carolina | 34% |

| Virginia | 31% |

| Montana | 25% |

| Oklahoma | 24% |

From a broader perspective, weekly initial claims for unemployment insurance across the U.S. have hovered around the low 200,000s in 2024. This is generally in line with figures seen prior to the COVID-19 pandemic.

In the week of April 4, 2020, unemployment claims spiked to 6.137 million due to COVID-related lockdowns and business closures.

Learn More About the U.S Job Market

Before you go, be sure to check out Visualizing the American Workforce as 100 People to gain a unique perspective on the U.S. economy.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023