Energy

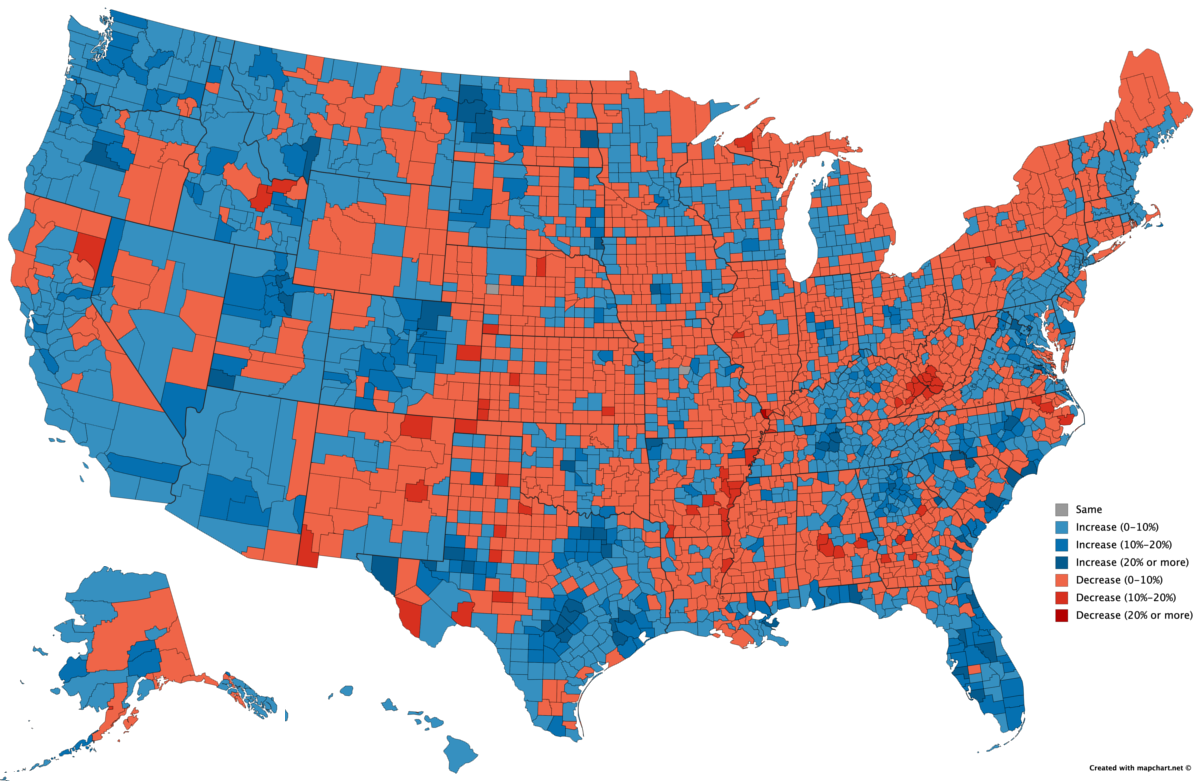

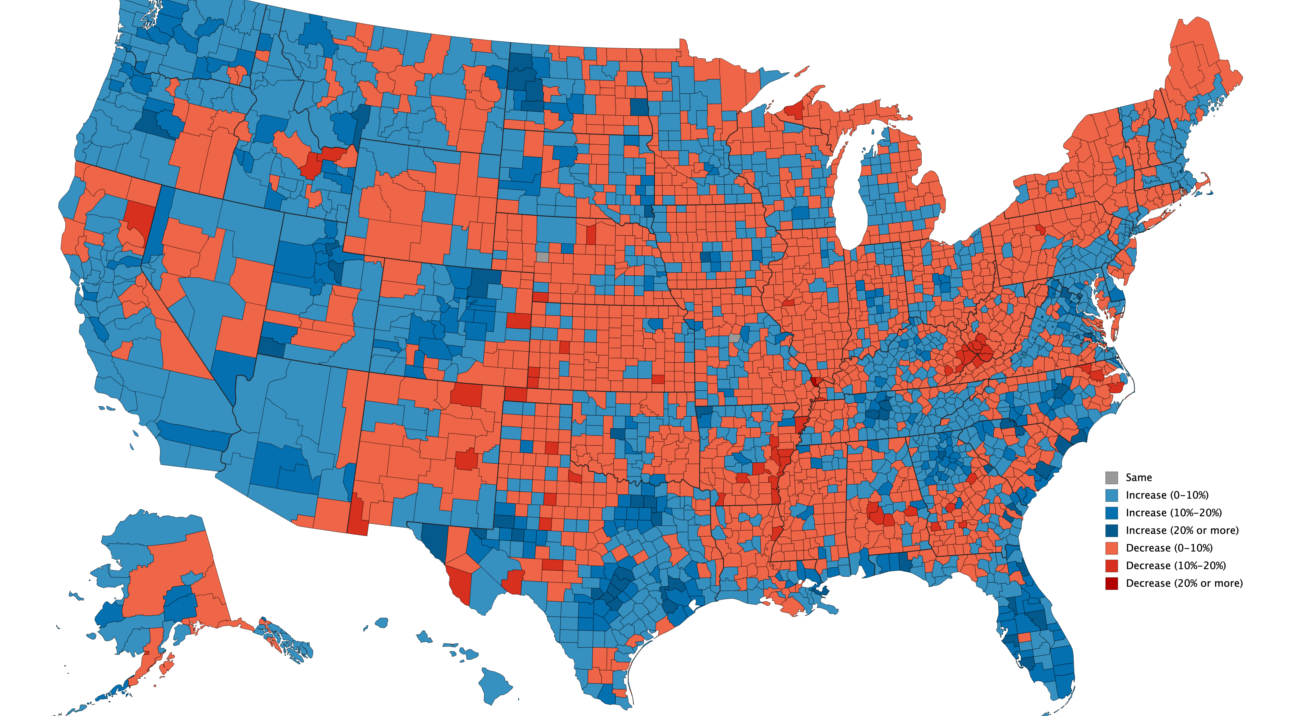

Growth and Decline: Visualizing U.S. Population Change by County

View a bigger sized version of this same map.

Visualizing U.S. Population Change by County (2010-2018)

The American Heartland continues to feed the growth of urban centers — not only with its agricultural products and natural resources, but with its people as well.

Across the nation, coastal urban centers are adding new citizens, while rural counties are seeing their populations decline. Outside of this general trend, fracking has created some rare pockets of growth in rural areas, while coal mine closures have had the opposite effect.

Today’s map comes to us from Reddit user jinkinson, and it maps U.S. population change by county from 2010 to 2018, using data from the U.S. Census Bureau.

Uneven Growth

From 2010 to 2018, the total United States population increased by 6% from 308,745,538 to 327,167,434. However, it’s clear that not all counties participated in this uptrend.

There are 3,142 counties counted as part of this map (Puerto Rico and U.S. territories excluded). Of these, 1,489 experienced positive growth, while 1,653 saw a decline.

Which Counties are Growing the Fastest?

America’s economy has grown for over a decade, but that growth increasingly concentrates in 1% of the nation’s counties.

In fact, just 31 counties were responsible for 32.3% of the U.S. gross domestic product (GDP) in 2018, according to data from the Bureau of Economic Analysis.

Although economic concentration tells part of the story, a view of changing population patterns can help us see where physical growth is happening across the country.

Top 20 Counties for U.S. Population Growth

| Rank | State | County Name | 2010 Population | 2018 Population | % Change |

|---|---|---|---|---|---|

| #1 | North Dakota | McKenzie County | 6,360 | 13,632 | 114% |

| #2 | Texas | Loving County | 82 | 152 | 85% |

| #3 | North Dakota | Williams County | 22,398 | 35,350 | 58% |

| #4 | Texas | Hays County | 157,107 | 222,631 | 42% |

| #5 | Utah | Wasatch County | 23,530 | 33,240 | 41% |

| #6 | Tennessee | Trousdale County | 7,870 | 11,012 | 40% |

| #7 | Texas | Hudspeth County | 3,476 | 4,795 | 38% |

| #8 | Florida | Sumter County | 93,420 | 128,754 | 38% |

| #9 | Florida | Osceola County | 268,685 | 367,990 | 37% |

| #10 | Texas | Comal County | 108,472 | 148,373 | 37% |

| #11 | Texas | Kendall County | 33,410 | 45,641 | 37% |

| #12 | Iowa | Dallas County | 66,135 | 90,180 | 36% |

| #13 | Georgia | Forsyth County | 175,511 | 236,612 | 35% |

| #14 | Texas | Fort Bend County | 585,375 | 787,858 | 34% |

| #15 | Texas | Williamson County | 422,679 | 566,719 | 34% |

| #16 | Florida | St. Johns County | 190,039 | 254,261 | 34% |

| #17 | North Dakota | Mountrail County | 7,673 | 10,218 | 33% |

| #18 | Georgia | Long County | 14,464 | 18,998 | 31% |

| #19 | South Dakota | Lincoln County | 44,828 | 58,807 | 31% |

| #2 | Virginia | Loudoun County | 312,311 | 406,850 | 30% |

At the top of the list is McKenzie County, North Dakota, which experienced a growth of 114% in its population from 2010 to 2018. This is due to the shale gas industry that flourished in the area. Interestingly, all of North Dakota’s active oil and gas rigs are in just four counties: McKenzie, Dunn, Williams, and Mountrail, three of which make the top 20 list above.

The fracking boom also fueled growth in Texas, where six counties made the list.

However, immediate economic success built on fracking sands and sensitive commodity prices may not be sustainable over the longer term. In fact, counties from a previous energy era are already seeing what happens when demand dries up.

Which Counties are Declining the Fastest?

If you look at a map of coal operations in the U.S. and compare it to the list of declining counties below, a stark pattern appears.

Half of country’s coal miners work in just 25 counties, and as mines close there are fewer economic opportunities available in those areas.

Top 20 Counties for U.S. Population Decline

| Rank | State | County Name | 2010 Population | 2018 Population | % Change |

|---|---|---|---|---|---|

| #1 | Illinois | Alexander County | 8,238 | 6,060 | -26% |

| #2 | Oklahoma | Blaine County | 11,943 | 9,485 | -21% |

| #3 | West Virginia | McDowell County | 22,113 | 18,223 | -18% |

| #4 | Kansas | Morton County | 3,233 | 2,667 | -18% |

| #5 | Arkansas | Phillips County | 21,757 | 18,029 | -17% |

| #6 | Texas | Terrell County | 984 | 823 | -16% |

| #7 | Texas | Schleicher County | 3,461 | 2,895 | -16% |

| #8 | Alaska | Petersburg Borough | 3,815 | 3,221 | -16% |

| #9 | Arkansas | Monroe County | 8,149 | 6,900 | -15% |

| #10 | Louisiana | Tensas Parish | 5,252 | 4,462 | -15% |

| #11 | South Carolina | Allendale County | 10,419 | 8,903 | -15% |

| #12 | Michigan | Ontonagon County | 6,780, | 5,795 | -15% |

| #13 | Mississippi | Quitman County | 8,223 | 7,051 | -14% |

| #14 | Alabama | Macon County | 21,452 | 18,439 | -14% |

| #15 | Arkansas | Lee County | 10,424 | 8,985 | -14% |

| #16 | Alabama | Perry County | 10,591 | 9,140 | -14% |

| #17 | Virginia | Emporia city | 5,927 | 5,121 | -14% |

| #18 | Mississippi | Coahoma County | 26,151 | 22,628 | -13% |

| #19 | Colorado | Kit Carson County | 8,270 | 7,163 | -13% |

| #20 | Texas | Mitchell County | 9,403 | 8,145 | -13% |

While coal counties have grim figures due to the changing domestic energy story, it’s Alexander County in Illinois that tops the list with a 26% decline in population over the time period.

In fact, the harsh reality is that 93% of Illinois’ counties have seen a decrease in population between 2010-2018.

State by State: Winners and Losers

The number of declining counties within a state reveals a larger picture. Visual Capitalist aggregated county level data to reveal the patterns of U.S. states.

| State | # Counties with Negative Growth | # Counties with Positive Growth | % of Counties with Negative Growth |

|---|---|---|---|

| Illinois | 93 | 9 | 91% |

| Connecticut | 7 | 1 | 88% |

| Kansas | 90 | 15 | 86% |

| West Virginia | 46 | 9 | 84% |

| Mississippi | 62 | 20 | 76% |

| New York | 46 | 16 | 74% |

| Nebraska | 66 | 27 | 71% |

| Pennsylvania | 47 | 20 | 70% |

| New Mexico | 23 | 10 | 70% |

| Missouri | 79 | 36 | 69% |

| Iowa | 68 | 31 | 69% |

| Ohio | 58 | 30 | 66% |

| Alabama | 43 | 24 | 64% |

| Indiana | 59 | 33 | 64% |

| Arkansas | 48 | 27 | 64% |

| Michigan | 53 | 30 | 64% |

| Louisiana | 39 | 25 | 61% |

| Oklahoma | 44 | 33 | 57% |

| Vermont | 8 | 6 | 57% |

| Maine | 7 | 6 | 54% |

| Kentucky | 63 | 57 | 53% |

| Wyoming | 12 | 11 | 52% |

| North Dakota | 27 | 26 | 51% |

| Minnesota | 44 | 43 | 51% |

| Rhode Island | 4 | 4 | 50% |

| New Jersey | 10 | 11 | 48% |

| Wisconsin | 34 | 38 | 47% |

| Georgia | 73 | 86 | 46% |

| South Carolina | 21 | 25 | 46% |

| Virginia | 60 | 73 | 45% |

| North Carolina | 43 | 57 | 43% |

| South Dakota | 26 | 40 | 39% |

| Alaska | 11 | 18 | 38% |

| Texas | 96 | 158 | 38% |

| Nevada | 6 | 11 | 35% |

| Tennessee | 32 | 63 | 34% |

| Montana | 18 | 38 | 32% |

| New Hampshire | 3 | 7 | 30% |

| Maryland | 7 | 17 | 29% |

| California | 15 | 43 | 26% |

| Colorado | 16 | 48 | 25% |

| Utah | 7 | 22 | 24% |

| Florida | 15 | 52 | 22% |

| Massachusetts | 3 | 11 | 21% |

| Idaho | 9 | 35 | 20% |

| Hawaii | 1 | 4 | 20% |

| Oregon | 7 | 29 | 19% |

| Arizona | 2 | 13 | 13% |

| Washington | 2 | 37 | 5% |

| Delaware | 0 | 3 | 0% |

| District of Columbia | 0 | 1 | 0% |

Illinois tops the list with the most people leaving its counties, while areas such as the District of Columbia and Delaware experienced no declines.

What happens to a state where the majority of its counties are losing residents?

The Big Picture

Americans are seeking out opportunity where it resides: in the cities. The pursuit of fracking oil and gas created opportunities in regions beyond the coast or traditional urban centers.

However, the long term trend of concentration of people on coasts and in major urban centers will continue to impact infrastructure spending, labor mobility, and economic activity. America no longer derives the majority of its economic success from rural counties and industries.

It is unclear how rural counties will fare as their denizens continue to dwindle. What is clear is that the few that rely on natural resources for success will continue to experience the ups and downs of volatile commodity markets.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

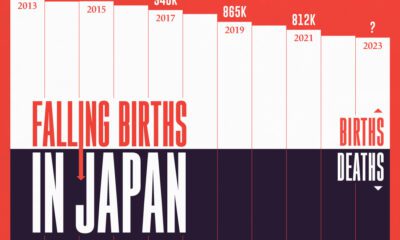

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Science7 days ago

Science7 days agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023