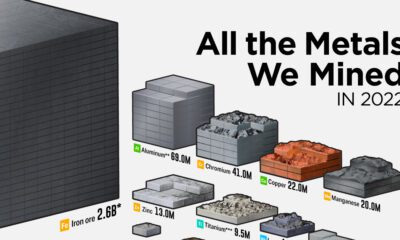

Mining

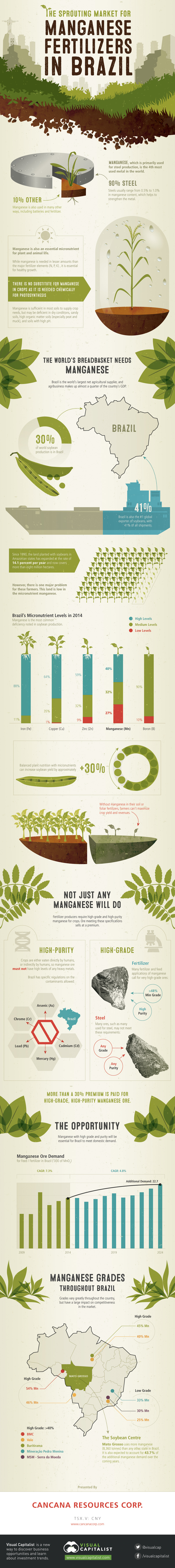

The Sprouting Market for Manganese Fertilizers in Brazil

The Sprouting Market for Manganese Fertilizers in Brazil

Manganese fertilizer infographic presented by: Cancana

Manganese is primarily known for its uses in steel production, which makes up about 90% of the metal’s demand. However, it is less known for its important uses in batteries and particularly fertilizers.

Manganese is an essential micronutrient that is needed for plant and animal life. While it is needed in lesser amounts than the major fertilizer elements (N, P, K), the metal is essential for healthy growth of plants. There is no substitute for manganese in crops as it is needed chemically for photosynthesis.

Manganese is sufficient in most soils to supply crop needs, but may be deficient in dry conditions, sandy soils, high organic matter soils (especially peat and muck), and soils with high pH.

As the world’s largest net agricultural supplier, Brazil is the world’s breadbasket and agribusiness makes up almost a quarter of the country’s GDP.

Brazil, The World’s Breadbasket

Brazil produces 30% of the world’s soybeans and is also the crop’s #1 exporter with 41% of all shipments. Growth in soybean production is not stopping, and it continues to expand by 14.1% per year in Amazonian states, covering over eight million hectares.

However, there is a major problem for these farmers. This soil tends to be low in manganese micronutrients. Balanced plant nutrition with micronutrients can increase soybean yield by approximately 30%, yet manganese is the most common deficiency noted in soybean production in Brazil. Without it, farmers cannot maximize crop yield or revenues.

Purity and Grade

Not just any type of manganese will do. It has to be both high-purity and high-grade. Crops are eaten directly or indirectly by humans, so manganese must not have significant levels of heavy metals such as arsenic, cadmium, mercury, lead, or chromium. Brazil has specific regulations on the level of contaminants allowed, and therefore high-purity manganese is needed.

Manganese also has to be high-grade. Many fertilizer and feed applications call for high-grade ores with a minimum grade of 48%. As a result, more than a 30% premium is paid for high-grade, high-purity manganese ore.

Mato Grosso

Of particular interest is Mato Grosso, which uses more manganese than any other state in Brazil. This state is expected to account for 43.7% of the additional fertilizer and feed demand of manganese over the coming years, and high-grade sources of ore in this area will be particularly strategic.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

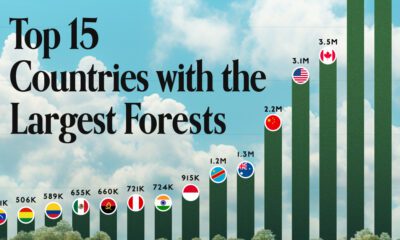

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)