Energy

A Cost Comparison: Lithium Brine vs. Hard Rock Exploration

A Cost Comparison: Lithium Brine vs. Hard Rock Exploration

Lithium brine exploration infographic presented by: Dajin Resources

Capital is limited in the current mining exploration environment, so investors are increasingly looking for companies that have lower costs of doing business. Over the last four years, we’ve seen large-scale, low-grade projects go out of favour and investor preferences resting with low-CAPEX, high-return projects.

However, it is not only the construction costs and scale of a mine with which companies can save money. It can also be in initial prospecting, exploration, and the development of a project. The key here is for a company to be doing this work in a location setting that is easy to work in from logistical and cost perspectives. If a project is in a remote area in mountainous wilderness that requires setup of a camp and bush planes in and out, the payoff has to be that much higher.

This is where lithium brine deposits come in. Typically, they are located in salars (salt flats) which are flat, arid, and barren areas. This makes the logistics of setting up shop for exploration relatively straightforward, and also removes most topographical challenges of exploration.

Further, there are some other major benefits of lithium brine exploration from a cost perspective that makes it favourable to many hard rock projects. Lithium brine deposits are considered placer deposits and are easier to permit. Brine is also a liquid which means that drilling to find it is more akin to drilling for water, and once it is found the continuity is more straightforward. It’s also typically not located relatively close to surface, which limits the amount of meters drilled.

Once a deposit is discovered, advanced exploration and development can also be at a discount. Drilling wells and testing recovery are more like shallow oil wells or drilling for water. Finally, permitting for construction and production is faster because of the placer classification.

Lithium brine exploration has benefits from the angle of cost that make it less expensive than most comparable hard rock projects. However, their potential also depends on the price of lithium – we cover all of the elements of supply and demand for the light metal in this infographic.

Energy

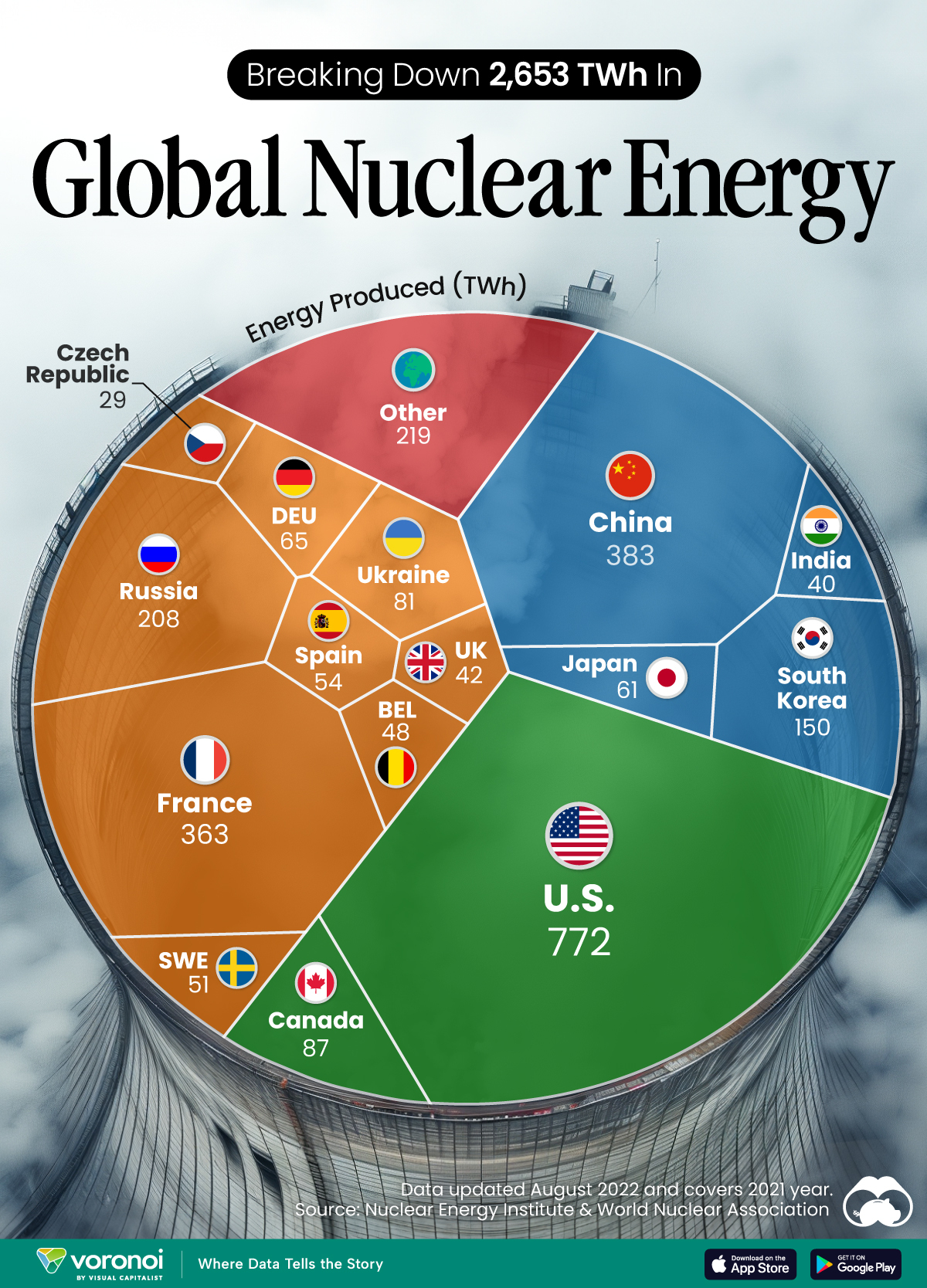

The World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

The World’s Biggest Nuclear Energy Producers

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Scientists in South Korea recently broke a record in a nuclear fusion experiment. For 48 seconds, they sustained a temperature seven times that of the sun’s core.

But generating commercially viable energy from nuclear fusion still remains more science fiction than reality. Meanwhile, its more reliable sibling, nuclear fission, has been powering our world for many decades.

In this graphic, we visualized the top producers of nuclear energy by their share of the global total, measured in terawatt hours (TWh). Data for this was sourced from the Nuclear Energy Institute, last updated in August 2022.

Which Country Generates the Most Nuclear Energy?

Nuclear energy production in the U.S. is more than twice the amount produced by China (ranked second) and France (ranked third) put together. In total, the U.S. accounts for nearly 30% of global nuclear energy output.

However, nuclear power only accounts for one-fifth of America’s electricity supply. This is in contrast to France, which generates 60% of its electricity from nuclear plants.

| Rank | Country | Nuclear Energy Produced (TWh) | % of Total |

|---|---|---|---|

| 1 | 🇺🇸 U.S. | 772 | 29% |

| 2 | 🇨🇳 China | 383 | 14% |

| 3 | 🇫🇷 France | 363 | 14% |

| 4 | 🇷🇺 Russia | 208 | 8% |

| 5 | 🇰🇷 South Korea | 150 | 6% |

| 6 | 🇨🇦 Canada | 87 | 3% |

| 7 | 🇺🇦 Ukraine | 81 | 3% |

| 8 | 🇩🇪 Germany | 65 | 2% |

| 9 | 🇯🇵 Japan | 61 | 2% |

| 10 | 🇪🇸 Spain | 54 | 2% |

| 11 | 🇸🇪 Sweden | 51 | 2% |

| 12 | 🇧🇪 Belgium | 48 | 2% |

| 13 | 🇬🇧 UK | 42 | 2% |

| 14 | 🇮🇳 India | 40 | 2% |

| 15 | 🇨🇿 Czech Republic | 29 | 1% |

| N/A | 🌐 Other | 219 | 8% |

| N/A | 🌍 Total | 2,653 | 100% |

Another highlight is how China has rapidly grown its nuclear energy capabilities in the last decade. Between 2016 and 2021, for example, it increased its share of global nuclear energy output from less than 10% to more than 14%, overtaking France for second place.

On the opposite end, the UK’s share has slipped to 2% over the same time period.

Meanwhile, Ukraine has heavily relied on nuclear energy to power its grid. In March 2022, it lost access to its key Zaporizhzhia Nuclear Power Station after Russian forces wrested control of the facility. With six 1,000 MW reactors, the plant is one of the largest in Europe. It is currently not producing any power, and has been the site of recent drone attacks.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?