Datastream

Tesla Bears: A Short Short Story

The Briefing

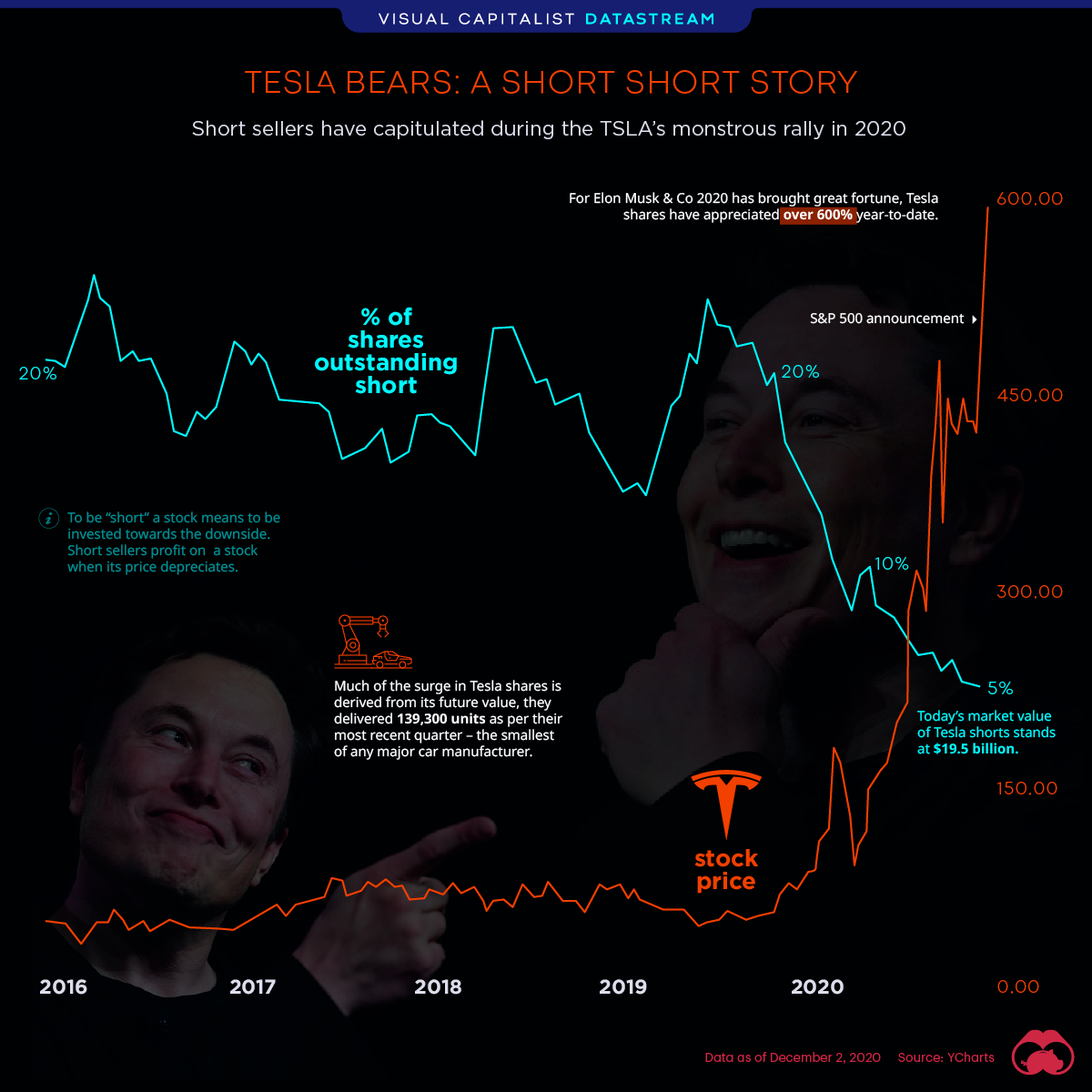

- Tesla, Inc has gained infamy for the sheer depth of short seller activity on its stock. At its peak in 2019, over 200 million shares were short

- However, short sellers have recently capitulated, thanks to Tesla’s monster year

- TSLA shares are up roughly 600% YTD

Tesla Bears: A Short Short Story

Short selling is often said to be the Wild West of financial markets. Where there’s a short seller, there can be whipsawing asset prices just around the corner. Tesla is no exception.

In some cases billions of dollars pour behind these short ideas—conducted by some of the world’s most sophisticated investors.

The efficient market hypothesis suggests short selling is a necessary evil that helps the market reflect on all the information of a given security and obtain its true market value. Yet most market participants are anything but receptive to short sellers.

The market—which tends to be long, often panics when a short seller enters the arena and takes the opposite stance. What typically follows is an avalanche of legal and regulatory action from corporate lawyers to the SEC.

In the case of Tesla, short sellers couldn’t have gotten it more wrong – at least for now. Some market commentators call it the most unprofitable short witnessed. The data shows that approximately 20% of Tesla shares have been held short since 2016. This year a reported $27 billion has been lost betting against Tesla.

| Date | Shares Sold Short | Dollar Volume Sold Short |

|---|---|---|

| October 30th, 2020 | 47,800,000 | $19 billion |

| October 15th, 2020 | 52,960,000 | $22 billion |

| September 30th, 2020 | 57,130,000 | $25 billion |

| September 15th, 2020 | 59,040,000 | $24 billion |

| August 31st, 2020 | 54,890,000 | $20 billion |

| August 14th, 2020 | 12,310,000 | $5 billion |

Tesla’s short thesis is often anchored around a few compelling narratives. The first is that Tesla’s present day fundamentals are poor—a $530 billion company delivered 139,300 vehicles in Q3’20 and turned a $331 million profit. That’s after government subsidy programs.

The second, the electric vehicle market is expected to be competitive with many players, and short sellers make the point Tesla is currently priced as the sole-winner in this space.

We don’t know how the future EV market will transpire, but with Tesla shares up 600% year-to-date, and with the company set to join the S&P 500, some bears look to be calling it quits.

Where does this data come from?

Source:Ycharts

Notes: Financial data is as of December 2nd, 2020

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001