Markets

Charted: Big Four Market Share by S&P 500 Audits

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Charted: Big Four Market Share by S&P 500 Audits

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

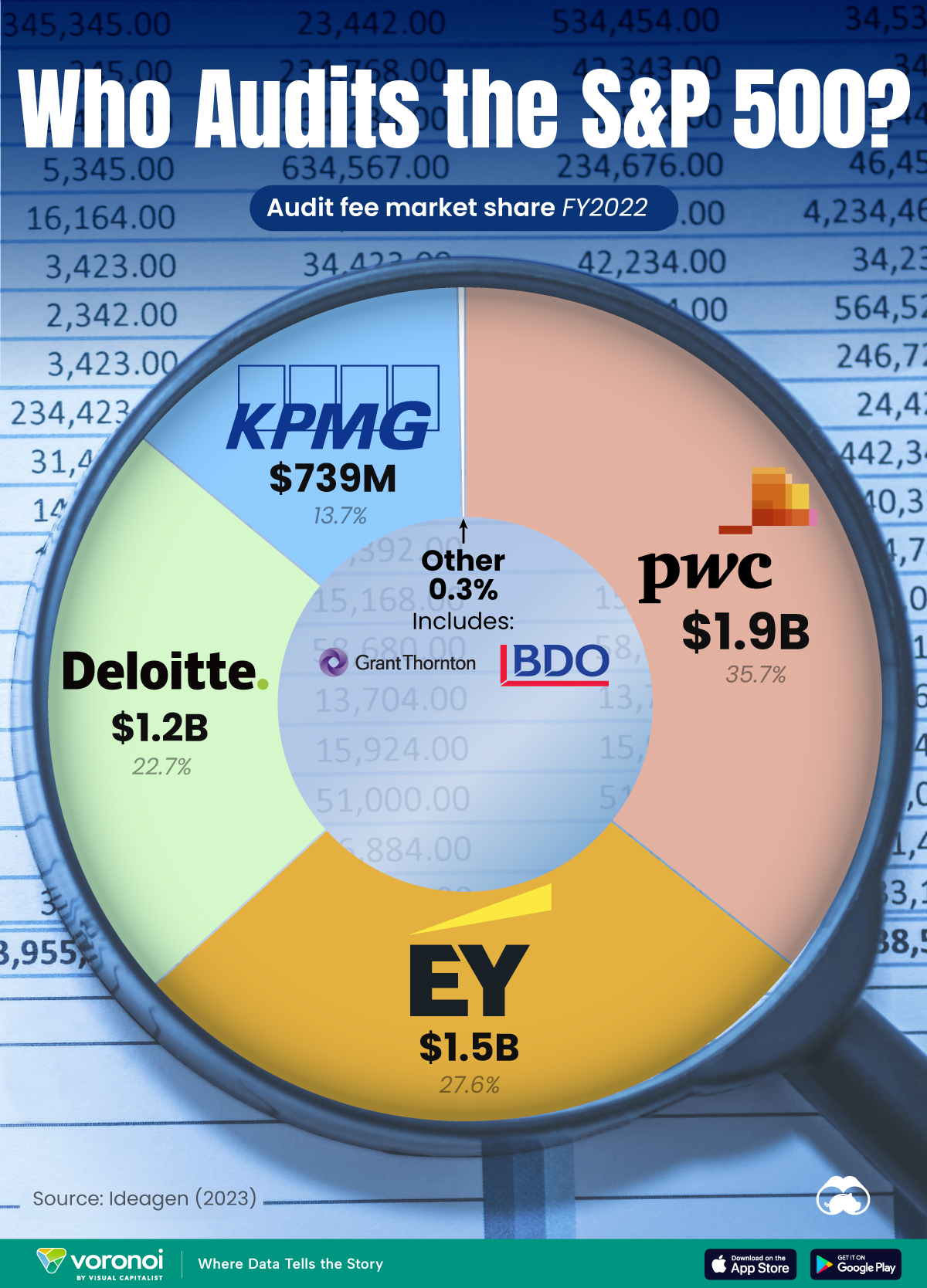

The companies on the S&P 500 together paid $5.3 billion in audit fees in fiscal year (FY) 2022. But which accounting firm took home the lion’s share of that windfall?

To find out, we visualized the Big Four’s market share of S&P 500 audits using data published by Ideagen in August 2023.

Who Audits the S&P 500?

PricewaterhouseCoopers claims the largest share of S&P 500 companies’ audit fees, at a massive $1.9 billion. Given the firm’s 152 clients among the index, this translates to roughly $12.6 million in revenue per relationship.

| Rank | Company | Audit Fees from S&P 500 | Market Share |

|---|---|---|---|

| 1 | PwC | $1.9B | 35.7% |

| 2 | EY | $1.5B | 27.6% |

| 3 | Deloitte | $1.2B | 22.7% |

| 4 | KPMG | $739M | 13.7% |

| N/A | Other | $15M | 0.3% |

Ernst & Young ($1.5 billion) and Deloitte ($1.2 billion) rank second and third, with KPMG a distant fourth at $739 million.

KPMG is generally considered the laggard of the Big Four accounting firms, and has faced more challenging times in the last few years. For instance, it was the auditor of the three U.S. banks that failed in 2023.

And in 2020, the firm had the worst report card of the Big Four, with only 61% of its sampled audits meeting industry standards.

Nevertheless the Big Four still maintain an ironclad grip on the general auditing business. Grant Thornton and BDO USA, the two other firms that audited the index, together only managed about $15 million in fees.

Which S&P 500 Companies Pay the Most Audit Fees?

Ideagen found that Manufacturing and Finance sectors paid the most audit fees, comprising nearly 69% of the $5.3 billion total paid by the index.

| Rank | S&P 500 Sector | Market Share | Audit Fees (FY22) |

|---|---|---|---|

| 1 | 🏭 Manufacturing | 43.4% | $2.2B |

| 2 | 💼 Finance | 25.2% | $1.4B |

| 3 | 📞 Services | 11.8% | $635M |

| 4 | 🚚 Transport & Communication | 11.0% | $592M |

| 5 | 🛒 Retail Trade | 4.0% | $215M |

| 6 | 📦 Wholesale Trade | 2.3% | $124M |

| 7 | ⛏️ Mining | 1.6% | $86M |

| 8 | 🔨 Construction | 0.5% | $27M |

| 9 | 🌾 Agriculture | 0.2% | $11M |

General Electric led the manufacturing sector, disbursing $57.6 million for audit services during FY22. Meanwhile, Goldman Sachs topped the finance sector, spending $78.1 million on audit fees.

Markets

The Best U.S. Companies to Work for According to LinkedIn

We visualized the results of a LinkedIn study on the best U.S. companies to work for in 2024.

The Best U.S. Companies to Work for According to LinkedIn

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we list the 15 best U.S. companies to work for in 2024, according to LinkedIn data.

LinkedIn ranked companies based on eight pillars: ability to advance, skills growth, company stability, external opportunity, company affinity, gender diversity, educational background, and employee presence in the country.

To be eligible, companies must have had 5,000 or more global employees, with at least 500 in the country as of December 31, 2023.

Data and Highlights

Financial institutions dominate the ranking of the best U.S. companies to work for in 2024, with JP Morgan Chase & Co. ranking first.

| Rank | Company | Industry |

|---|---|---|

| 1 | JP Morgan Chase & Co. | Financial Services |

| 2 | Amazon | E-commerce |

| 3 | Wells Fargo | Financial Services |

| 4 | Deloitte | Professional Services |

| 5 | PwC | Professional Services |

| 6 | UnitedHealth Group | Healthcare |

| 7 | AT&T | Telecommunications |

| 8 | Verizon | Telecommunications |

| 9 | Moderna | Pharmaceuticals |

| 10 | Alphabet Inc. | Technology |

| 11 | General Motors | Automotive |

| 12 | Bank of America | Financial Services |

| 13 | Mastercard | Financial Services |

| 14 | Capital One | Financial Services |

| 15 | Northrop Grumman | Aerospace & Defense |

J.P. Morgan has a program that offers opportunities for candidates without a university degree. In fact, in 2022, 75% of job descriptions at the bank for experienced hires did not require a college degree.

Meanwhile, Deloitte and Amazon offer a variety of free training courses, including in AI.

Moderna includes in its employee package benefits to help avoid employee burnout — from subsidized commuter expenses and pop-up daycare centers, to wellness coaches.

Mastercard offers flexible work availability, with 11.5% remote and 89% hybrid options.

It’s also interesting to note that only Amazon and Alphabet made the cut from the ‘Magnificent Seven’ companies (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla).

See more about the best companies to work for in this infographic, which covers a separate ranking from Glassdoor.

-

Demographics6 days ago

Demographics6 days agoThe Countries That Have Become Sadder Since 2010

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000