Business

Visualizing the Revenue of the Big Four Accounting Firms

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Visualizing the Revenue of the Big Four Accounting Firms

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

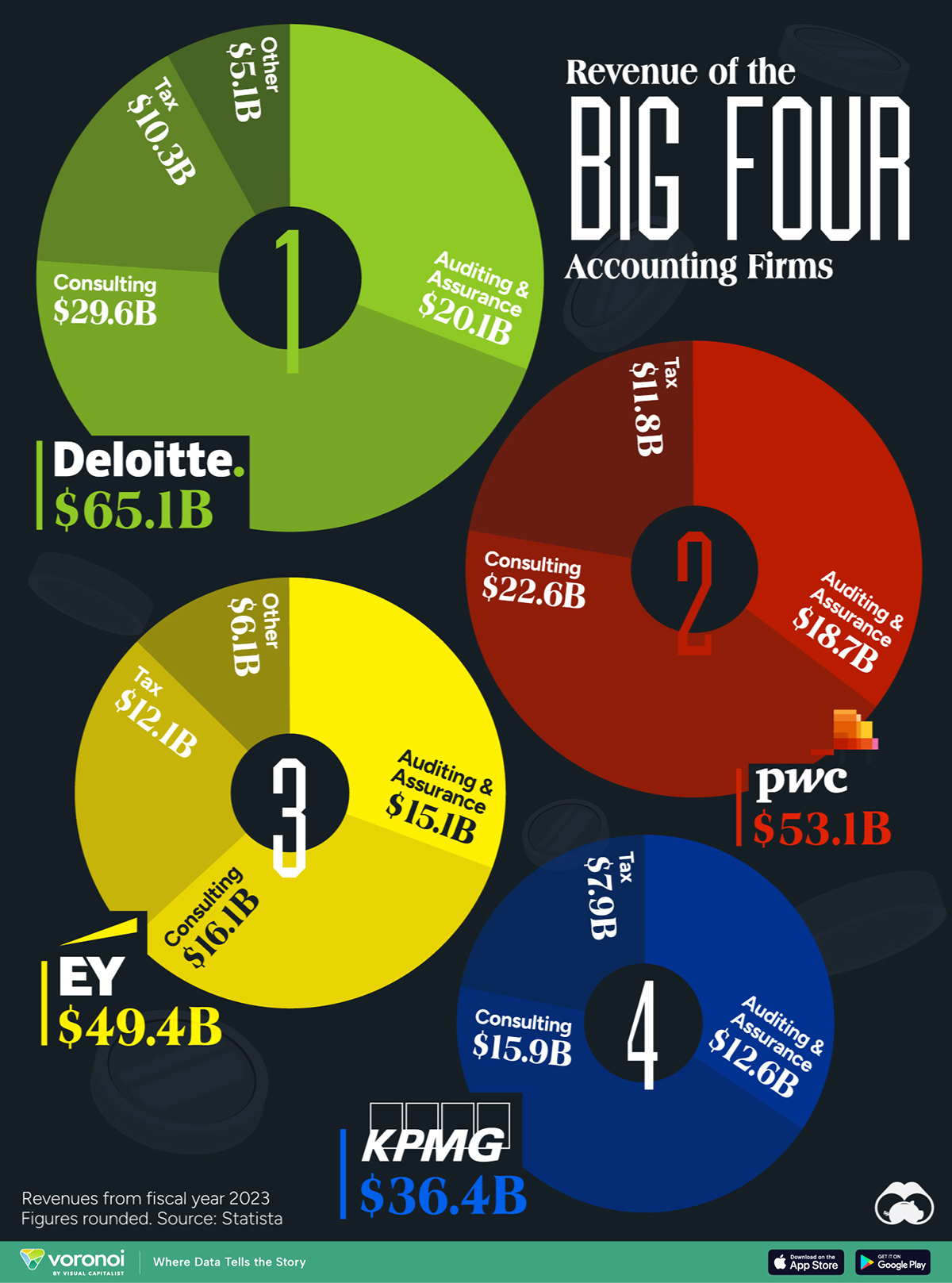

The Big Four accounting firms – Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and KPMG – have solidified their positions as global industry leaders, boasting a combined revenue exceeding $200 billion in 2023.

Together, these firms audit the majority of publicly traded companies worldwide.

This infographic details the revenues of the “Big Four” accounting firms for the fiscal year 2023, based on data from Statista.

Deloitte Leads the Big Four in 2023 Revenues

Offering diverse services, the Big Four specialize in auditing and assurance, ensuring financial transparency, and regulatory compliance for their clients. Additionally, they provide strategic consulting services. All four are legally headquartered in the UK and command a dominant global market share.

| Company | Auditing & Assurance | Consulting | Tax | Other | Total ($ billions) |

|---|---|---|---|---|---|

| Deloitte | $20.1 | $29.6 | $10.3 | $5.1 | $65.1 |

| PwC | $18.7 | $22.6 | $11.8 | $53.1 | |

| EY | $15.1 | $16.1 | $12.1 | $6.1 | $49.4 |

| KPMG | $12.6 | $15.9 | $7.9 | $36.4 |

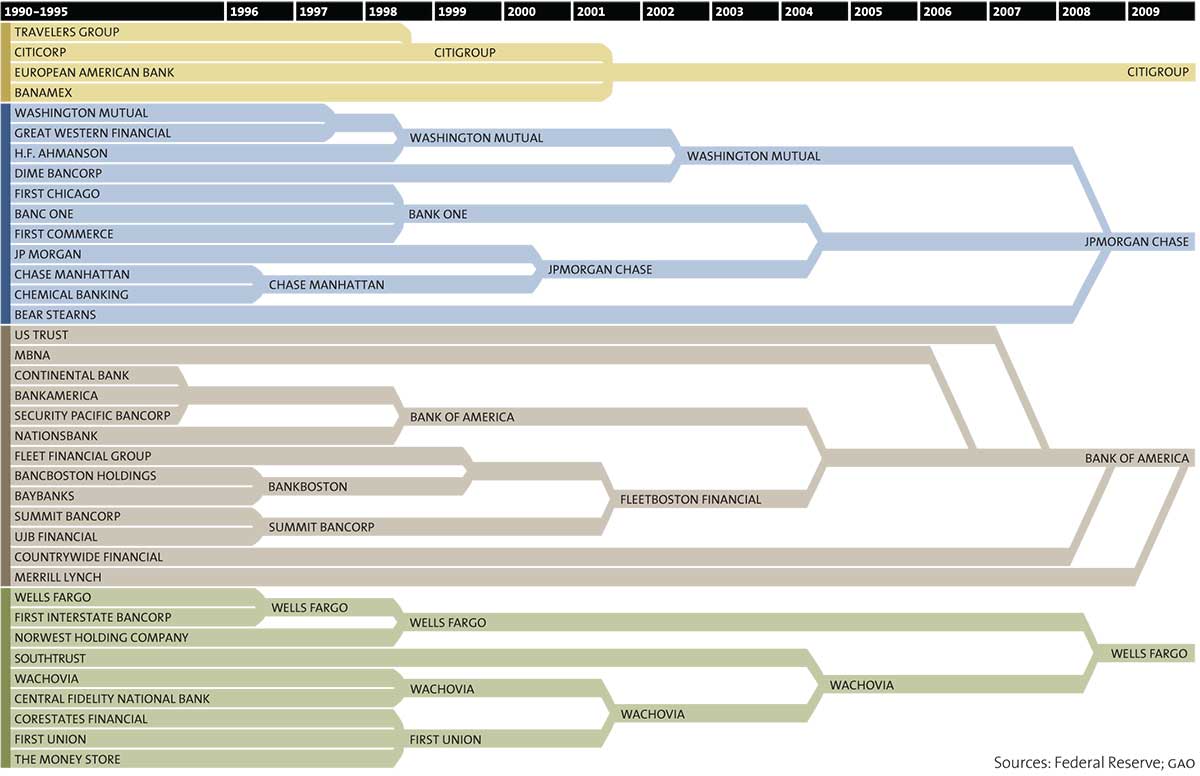

Interestingly, the largest accounting firms were formerly known as the “Big Eight,” but mergers and closures starting in the late 1980s have reduced their number to four.

The original group consisted of Arthur Andersen, Arthur Young, Coopers & Lybrand, Deloitte Haskin & Sells, Ernst & Whinney, Peat Marwick Mitchell, Price Waterhouse, and Touche Ross, all headquartered in the U.S. or UK.

Arthur Young merged with Ernst & Whinney, and Deloitte Haskin & Sells combined with Touche Ross. Subsequently, Price Waterhouse and Coopers & Lybrand merged their practices, reducing the count to five. However, following the collapse of Arthur Andersen due to its involvement in the Enron scandal, the “Big Five” became the present-day four.

The Scale of the Big Four

Deloitte is the largest in terms of headcount, with over 456,000 employees as of FY2023, followed by Ernst & Young with more than 395,000 workers, and PwC with 364,000. Despite being the smallest among the four, KPMG still has 298,356 employees.

Business

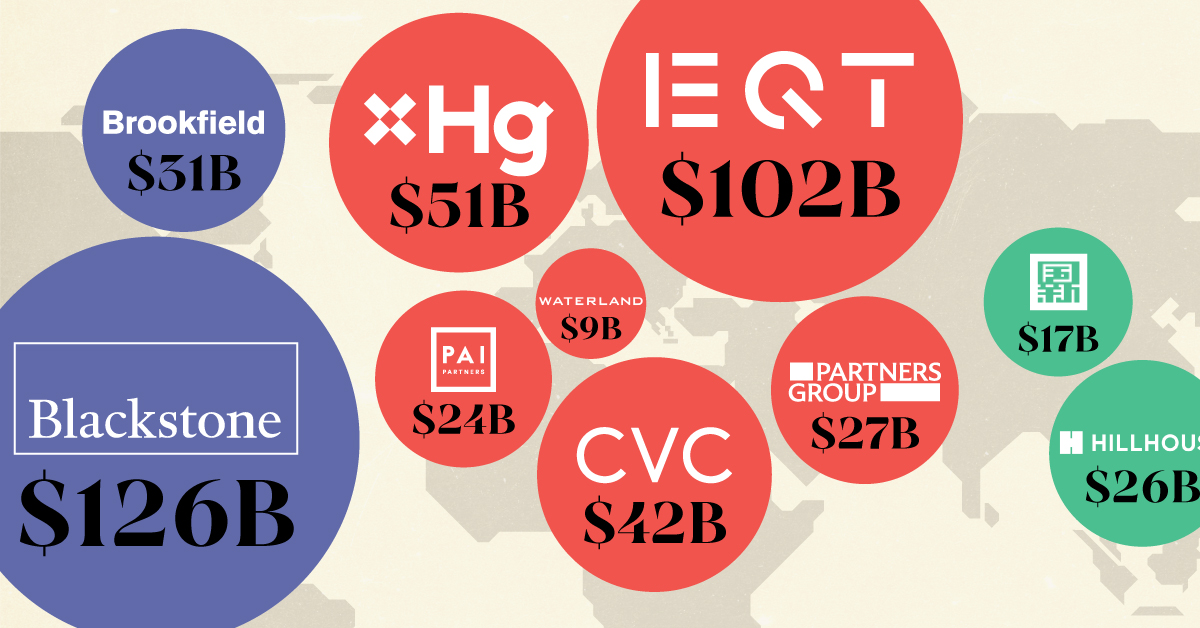

The Top Private Equity Firms by Country

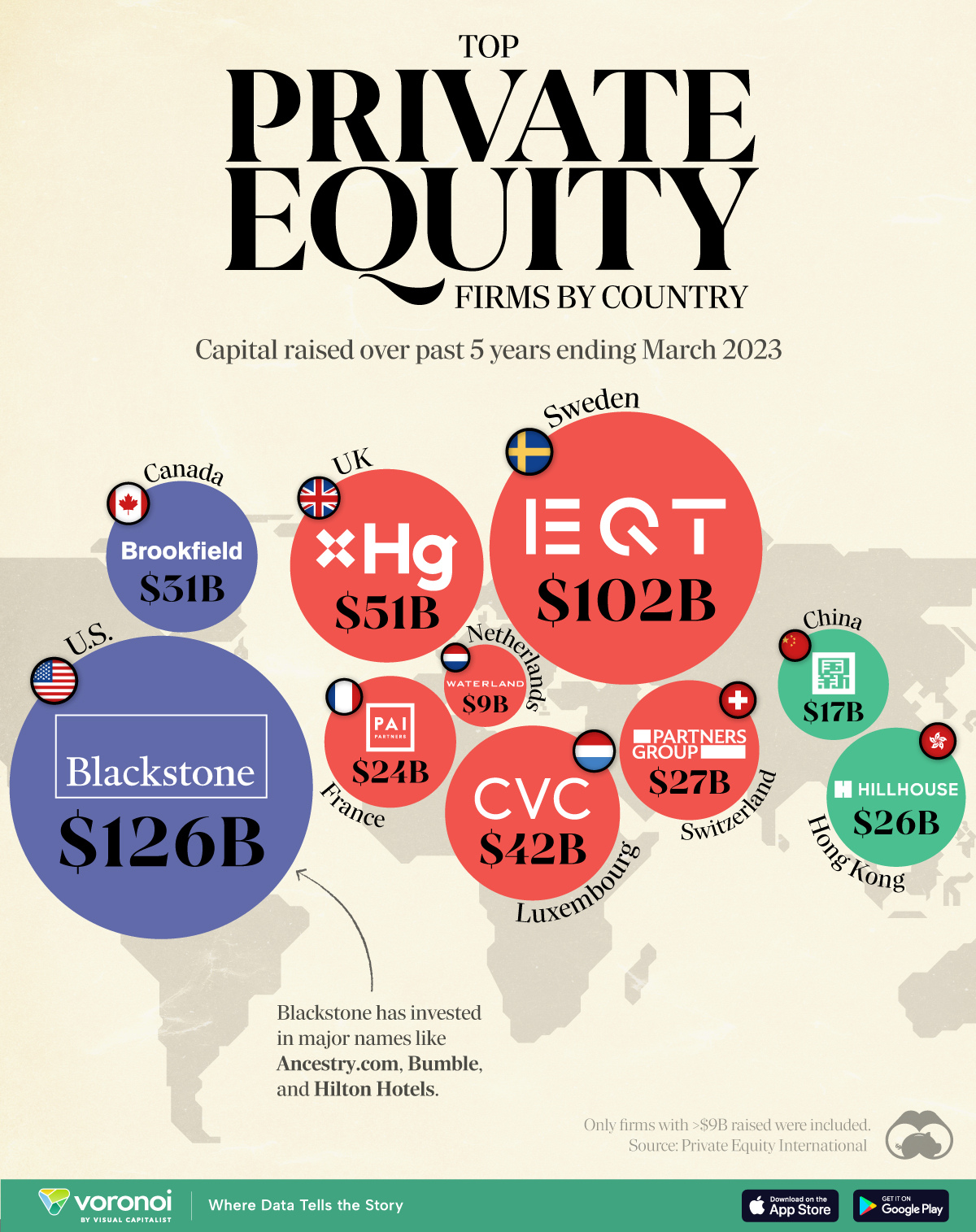

This map visualizes the leading private equity firms of major countries, ranked by capital raised over the past five years.

The Top Private Equity Firms by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Private equity firms are investment management companies that pool investor capital to acquire stakes in private companies. Through strategic management, they aim to enhance the value of these companies, then profit from a future sale or public offering.

To gain insight into this industry, we’ve visualized the top private equity firms in various countries, ranked by the amount of capital they raised over the past five years ending March 2023.

The cutoff for inclusion in this graphic was $9 billion raised. All figures come from Private Equity International’s PEI 300 ranking.

Data and Highlights

The data we used to create this graphic is included in the table below.

| Country | Firm | Amount raised |

|---|---|---|

| 🇺🇸 US | Blackstone | $126B |

| 🇸🇪 Sweden | EQT | $102B |

| 🇬🇧 UK | Hg | $51B |

| 🇱🇺 Luxembourg | CVC Capital Partners | $42B |

| 🇨🇦 Canada | Brookfield Asset Management | $31B |

| 🇨🇭 Switzerland | Partners Group | $27B |

| 🇭🇰 Hong Kong | Hillhouse Capital Group | $26B |

| 🇫🇷 France | PAI Partners | $24B |

| 🇨🇳 China | China Reform Fund Management Corp | $17B |

| 🇳🇱 Netherlands | Waterland Private Equity | $9B |

U.S.-based Blackstone is the world’s largest private equity firm, with operations in additional areas like credit, infrastructure, and insurance.

While not shown in this graphic, the U.S. largely dominates the private equity landscape. If we were to rank the top 10 private equity firms by the same metric (capital raised over past five years), U.S. firms would account for eight of them.

More About Blackstone

Blackstone was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman, both former Lehman Brothers employees.

Notably investments that Blackstone has made include Ancestry.com, where it acquired a majority stake for nearly $5 billion in 2020.

In 2007, it also acquired Hilton Worldwide (one of the world’s biggest hotel operators) for roughly $26 billion.

Sweden’s EQT

EQT is Sweden’s largest private equity firm, and third largest globally. It is just one of three firms that have raised over $100B in capital over the past five years alongside Blackstone and KKR (also American).

EQT made news earlier this year when it raised $24B in two years for its EQT X private equity fund, which invests in the healthcare, technology and tech-enabled service sectors.

If you found this post interesting, check out this graphic that visualizes the most common types of investments that financial advisors use with their clients.

-

Demographics6 days ago

Demographics6 days agoThe Countries That Have Become Sadder Since 2010

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000