Investor Education

Structured Notes: The Secret to Improving Your Risk/Return Profile?

Structured Notes: The Secret to Improving Your Risk/Return Profile?

Structured notes are gaining momentum in the market, with a whopping $2 trillion in assets under management (AUM) globally.

So why haven’t more investors heard of them?

Traditionally, structured notes had a $1 million minimum investment. They were only available to high-net-worth or institutional investors—but they are now becoming more accessible.

Today’s infographic from Halo Investing explains what structured notes are, outlines the two main types, and demonstrates how to implement them in a portfolio.

What is a Structured Note?

A structured note is a hybrid security, where approximately 80% is a bond component and 20% is an embedded derivative.

Structured notes are issued by major financial institutions. Since they are the liability of the issuer, it is critical that the investor is comfortable with the issuer—as with any bond purchase.

Almost all structured notes have four simple parameters.

- Maturity – The term typically falls within 3 to 5 years.

- Payoff – The amount the investor receives at maturity.

- Underlying asset – The note’s performance is linked to the price return (excluding dividends) of an asset, such as stocks, ETFs, or foreign currencies.

- Protection – The level of protection the investor receives if the underlying asset loses value.

As long as the underlying asset does not fall lower than the protection amount at maturity, the investor will receive their initial investment back in full.

This is the primary draw of structured notes: they provide a level of downside protection, while still allowing investors to participate in market upswings.

Types of Structured Notes

There are a variety of structured notes, providing investors with diverse options and a range of risk/return profiles. Structured notes generally fall into one of two broad categories: growth notes and income notes.

Growth Notes

Investors receive a percentage—referred to as the participation rate—of the underlying asset’s price appreciation.

For example, a growth note has the following terms:

- Maturity: 5 years

- Participation rate: 117%

- Underlying asset: S&P 500 index

- Principal protection: 30%

Here’s what the payoff would look like in 4 different scenarios:

| S&P 500 return | Growth Note Return |

|---|---|

| 50% | 58.5% |

| 10% | 11.7% |

| -10% | 0% |

| -50% | -20% |

The S&P 500 can return a loss of up to 30%, the principal protection level in this example, before the note starts to lose value.

Income Notes

Over an income note’s life, investors receive a fixed payment known as a coupon. Income notes do not participate in the upside returns the way a growth note does—but they may generate a higher income stream than a standard debt security or dividend-paying stock.

This is because protection is offered for both the principal and the coupon payments. For example, say a note’s underlying asset is the S&P 500, and it pays an 8% coupon with 30% principal protection. If the S&P 500 trades sideways all year—sometimes slightly negative or positive—the note will still pay its 8% coupon due to the protection.

Income notes have another big advantage: their yields can spike in tumultuous markets, as was demonstrated during the market volatility near the end of 2018.

Why did this spike occur? Banks construct the derivative piece of an income note by selling options*, which are more expensive in volatile markets. Banks then collect these higher premiums, creating larger coupons inside the structured note.

Investors can diversify their return profile by using a combination of growth and income notes.

*Option contracts offer the buyer the opportunity to either buy or sell the underlying asset at a stated price within a specific timeframe. Unlike futures, the buyer is not forced to exercise the contract if they choose not to.

Portfolio Applications

Structured notes are powerful tools that can accomplish almost any investment goal, and investors commonly use them as a core portfolio component.

- Step 1: Select a portfolio asset class where downside protection is desired.

- Step 2: Reallocate a portion of the asset class to a structured note

- Step 3: Improve risk/reward performance.

The asset class will demonstrate an enhanced return profile, with less downside risk.

A Global Market

While relatively small in the Americas, the structured notes market is growing on a global scale:

| Region | AUM (2019 Q2) |

|---|---|

| Americas | $434B |

| Europe | $526B |

| Asia Pacific | $1,066B |

In the first half of 2019, assets under management in the Americas was up by 4%. It’s clear the asset class presents enormous untapped potential—and investors are taking notice.

Lowering Barriers Through Technology

Technology is becoming more ingrained in wealth management—empowering investors to access structured notes more easily through efficient trading.

The market is already becoming more accessible. By 31 October 2019, the average transaction size had decreased by almost $500,000 over the year prior.

Technology also offers other benefits for investors:

- Improved analytics

- Investment education

- Risk information

- Increased competition = lower fees

- Improved secondary liquidity

As more investors take advantage of this asset class, they may be able to improve their return potential while limiting their risk.

Investor Education

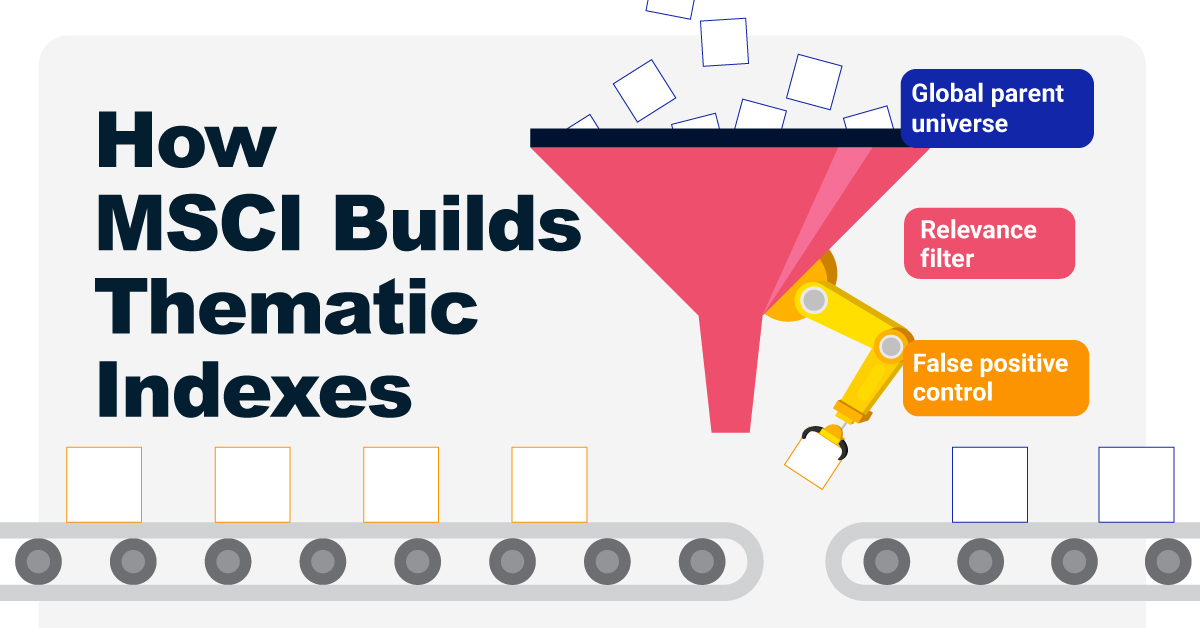

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

From developing an index objective to choosing relevant stocks, this graphic breaks down how MSCI builds thematic indexes using examples.

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

Have you ever wondered how MSCI builds its thematic indexes?

To capture long-term, structural trends that could drive business performance in the future, the company follows a systematic approach. This graphic from MSCI breaks down each step in the process used to create its thematic indexes.

Step 1: Develop an Index Objective

MSCI first builds a broad statement of what the theme aims to capture based on extensive research and insights from industry experts.

Steps 2 and 3: List Sub-Themes, Generate Keyword List

Together with experts, MSCI creates a list of sub-themes or “seedwords” to identify aligned business activities.

The team then assembles a collection of suitable documents describing the theme. Natural language processing efficiently analyzes word frequency and relevance to generate a more detailed set of keywords contextually similar to the seedwords.

Step 4: Find Relevant Companies

By analyzing financial reports, MSCI picks companies relevant to the theme using two methods:

- Direct approach: Revenue from a company’s business segment is considered 100% relevant if the segment name matches a theme keyword. Standard Industrial Classification (SIC) codes from these directly-matched segments make up the eligible SIC code list used in the indirect approach.

- Indirect approach: If a segment name doesn’t match theme keywords, MSCI will:

- Analyze the density of theme keywords mentioned in the company’s description. A minimum of two unique keywords is required.

- The keyword density determines a “discount factor” to reflect lower certainty in theme alignment.

- Revenue from business segments with an eligible SIC code, regardless of how they are named, is scaled down by the discount factor.

The total percentage of revenue applicable to the theme from both approaches determines a company’s relevance score.

Step 5: Select the Stocks

Finally, MSCI narrows down the stocks that will be included:

- Global parent universe: The ACWI Investable Market Index (IMI) is the starting point for standard thematic indexes.

- Relevance filter: The universe is filtered for companies with a relevance score of at least 25%.

- False positive control: Eligible companies that are mapped to un-related GICS sub-industries are removed.

Companies with higher relevance scores and market caps have a higher weighting in the index, with the maximum weighting for any one issuer capped at 5%. The final selected stocks span various sectors.

MSCI Thematic Indexes: Regularly Updated and Rules-Based

Once an index is built, it is reviewed semi-annually and updated based on:

- Changes to the parent index

- Changes at individual companies

- Theme developments based on expert input

Theme keywords are reviewed yearly in May. Overall, MSCI’s thematic index construction process is objective, scalable, and flexible. The process can be customized based on the theme(s) you want to capture.

Learn more about MSCI’s thematic indexes.

-

Investor Education6 months ago

Investor Education6 months agoThe 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Stocks10 months ago

Stocks10 months agoVisualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education11 months ago

Investor Education11 months ago10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education1 year ago

Investor Education1 year agoVisualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Debt2 years ago

Debt2 years agoCountries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

Markets2 years agoThe Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue