Technology

How the STEM Crisis is Threatening the Future of Work

<img src="https://www.visualcapitalist.com/wp-content/uploads/2020/01/STEM-1200.jpg" alt="STEM education infographic"

How the STEM Crisis Threatens the Future of Work

As the world’s leading economy, the U.S. is under pressure to produce the best minds to solve the greatest challenges facing mankind.

The problem is, the United States is falling behind in some of the most important areas of education to help solve the problems of today and tomorrow. The crisis in STEM fields—which cover science, technology, engineering and mathematics—is threatening the growing workforce and in turn, the country’s position in the global economy.

Today’s infographic from Early Childhood Education Degrees explores the importance of STEM education and how an emphasis on these four areas could successfully lead the world into an uncertain future.

The Rise of STEM

STEM is a relatively new term, coined less than two decades ago—although the grouping of subjects was sometimes referred to as SMET in previous years.

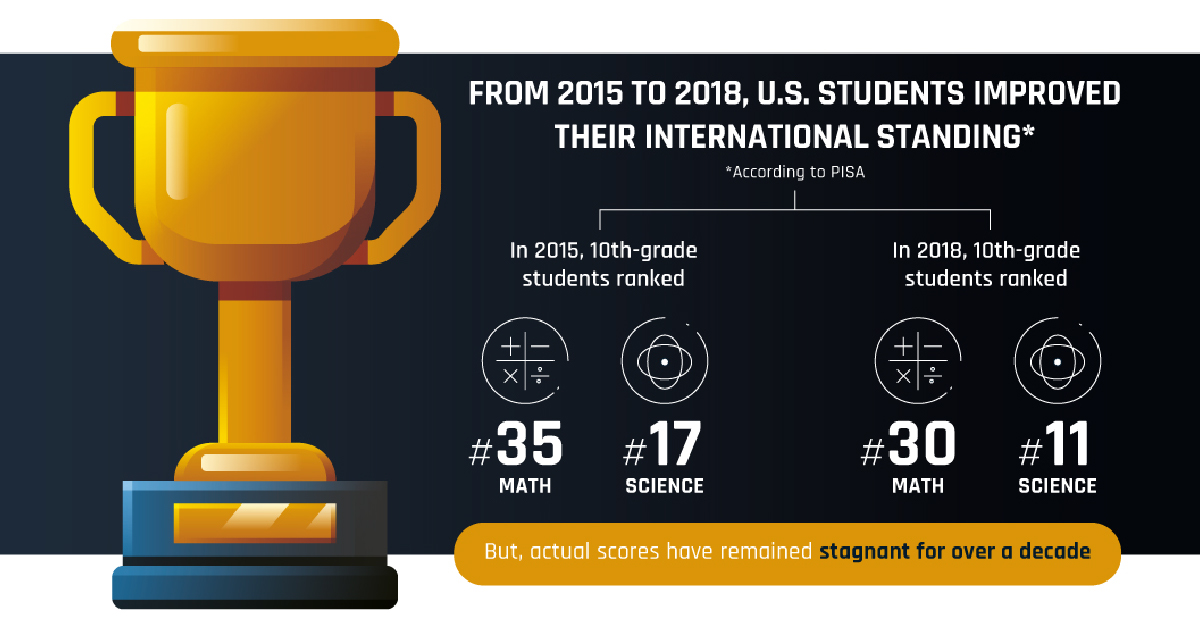

While 86% of Americans believe that increasing the number of workers in STEM areas is vital for maintaining their position in the global economy, a 2005 report sounded the alarm that U.S. students were lagging behind academically.

To combat this issue, STEM education and subsequent research programs were injected with more funding. New legislation also helped prioritize these subjects in the curriculum for kindergarten through high school.

The Skills Shift

According to Emsi, a modeler of economic data, undergraduates in STEM education increased by 43% between 2010 and 2016. However, despite the promising growth, 2.4 million STEM jobs went unfilled in 2018.

One possible reason for this? Advancing technologies such as artificial intelligence, quantum computing, and robotics require entirely new skill sets. Success in STEM jobs also relies on adapting to new situations and developing soft skills such as:

- Creativity and innovation

- Problem-solving and critical thinking

- Collaboration and leadership

As these technologies continue to evolve, having skills in STEM will be non-negotiable for employees and leaders the world over.

Threatening U.S. Economic Leadership

Statistics show that the U.S. is providing more opportunities for other countries to take the lead in STEM fields. For example, 62% of all international students in tertiary education in the U.S. are in science and engineering fields, with almost 70% of those students coming from India and China.

What’s more, over half of all U.S. patents go to foreign nationals and companies instead of Americans at home.

If America’s STEM proficiency continues to decline, not only will the skills gap be detrimental to the workforce, but it will also erode its potential future for economic and scientific leadership.

The Global STEM Leaders

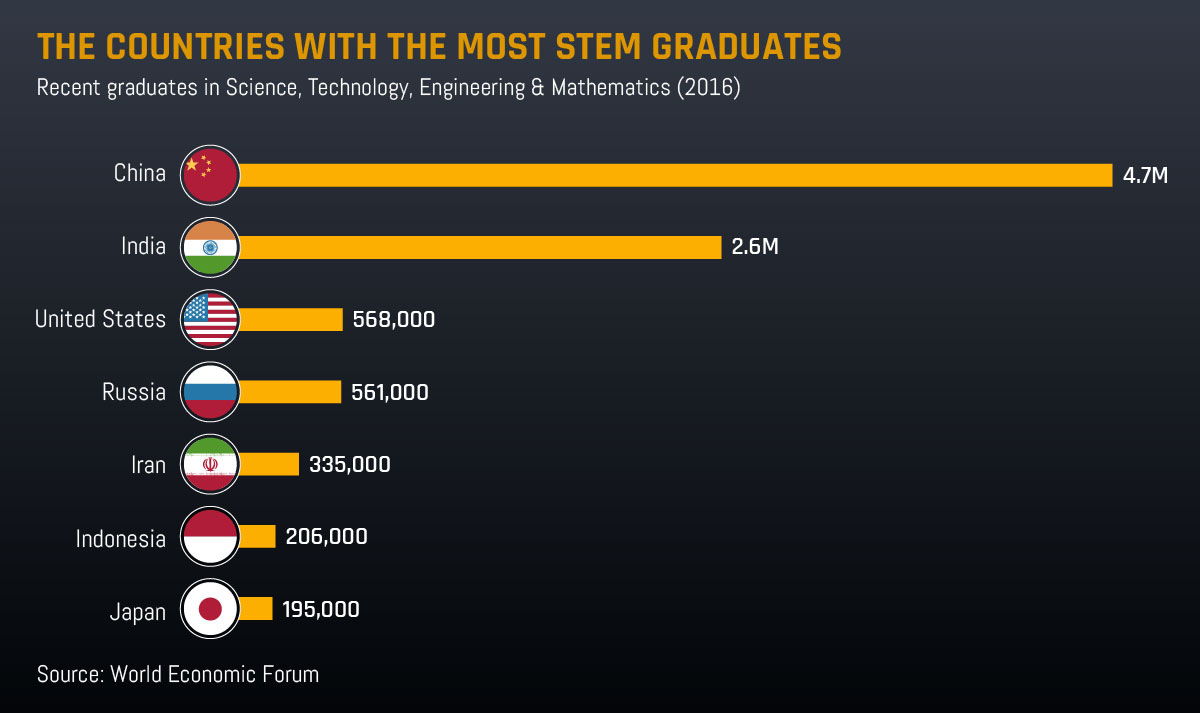

According to the World Economic Forum, China is a major player in STEM education, boasting 4.7 million graduates as of 2016.

The country’s swift uptake of STEM initiatives is driven by new government policy, school participation, and parents’ increasing awareness of the benefits that will future proof the careers of their children.

The U.S. sits in third place with 568,000 STEM graduates, but compares closely with India on STEM graduates per population—1 to 52 in India and 1 to 57 in the United States. However, they’re still no match for China’s 1 to 29 ratio.

Narrowing the Skills Gap

If the U.S. is to become a global leader in STEM literacy, innovation, and employment, the Department of Education suggests that a STEM reform is needed, with the increase of diversity and inclusion being a top priority.

A significant opportunity for growth lies in making STEM more accessible for women—but while there has been a steady rise in women pursuing STEM careers, there are still systemic barriers in place that prohibit women from entering.

Experts also suggest that the introduction of STEM at an earlier age and educating students on the diversity of STEM careers are crucial elements in preparing a more capable workforce.

Given the recent demand for reform, it is clear that STEM education is key to thriving in the new technology-based economy and cultivating solutions to real world problems.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue