Business

The Habits of Highly Effective Leaders

How Strong Leadership Impacts the Bottom Line

Organizations of all shapes and sizes are under immense pressure to retain good talent.

High employee turnover can directly impact a company’s bottom line—with many studies suggesting poor leadership is one of the main causes.

Today’s infographic from Online PhD Degrees explores what it takes to be an strong leader, and the behaviors of poor leaders that should be avoided at all costs.

In today’s rapidly changing world, how can the qualities of a strong leader positively shape a company’s future?

The Benefits of Investing in Leadership

Effective leadership is worth its weight in gold, with 58% of employees claiming they would choose having a great boss over a higher salary.

Not only that, 94% of employees with great bosses feel passionate about their jobーnearly twice as many as those working for a bad boss. A strong leader increases employee loyalty, creating a conducive environment for reaching a company’s goals.

In fact, research shows that companies with strong leaders are crucial when it comes to outperforming industry competitors and are three times more prepared to react to the speed of change. Moreover, a company with a strong leader is almost five times more likely to have higher customer engagement and retention rates.

How to Lead Effectively

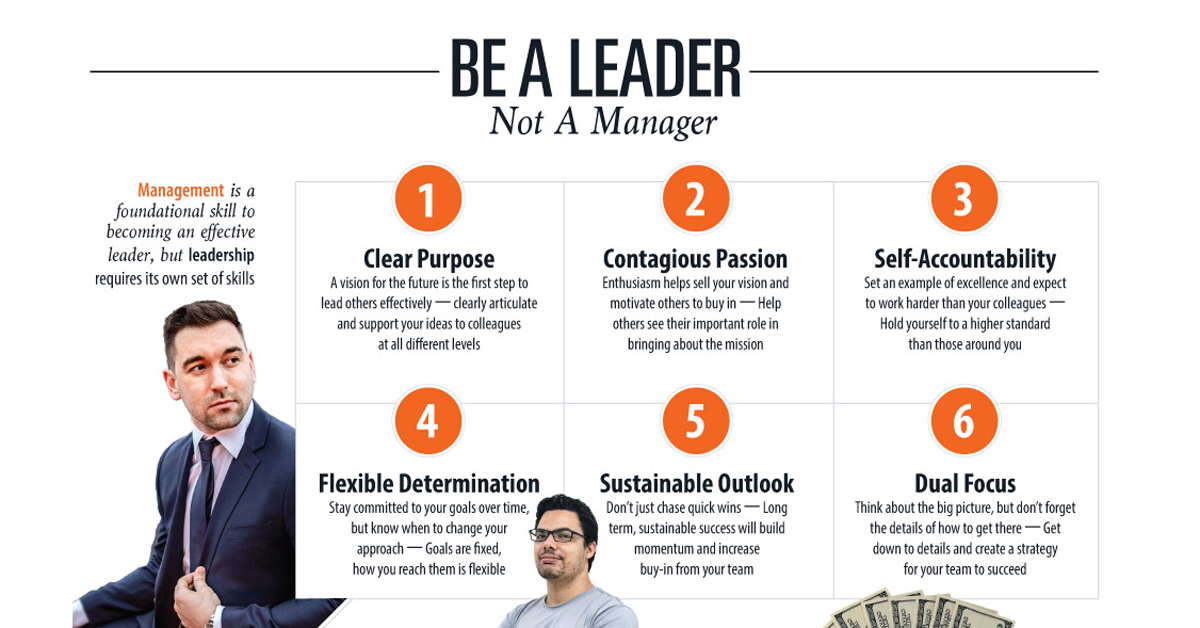

While each company has its own processes and demands different skill sets, there are core behaviors that separate leaders from managers:

- Clear Purpose: Clearly articulating the company’s future vision to all levels of staff in a clear and concise way.

- Contagious Passion: While managers light fires under people to motivate them, leaders light fires in people.

- Self-Accountability: The expectation to work harder than employees and set a standard of excellence.

- Flexible Determination: Leaders are agile and open to change.

- Sustainable Outlook: Focusing on long-term goals proves to a team that a leader is invested in the long-haul.

- Dual Focus: Beyond thinking big picture, leaders provide employees with a clear and actionable strategy for success.

Effective leaders are born from this combination of behaviors. However, one of them has the farthest-reaching impact, both on employees and a company’s bottom line: purpose.

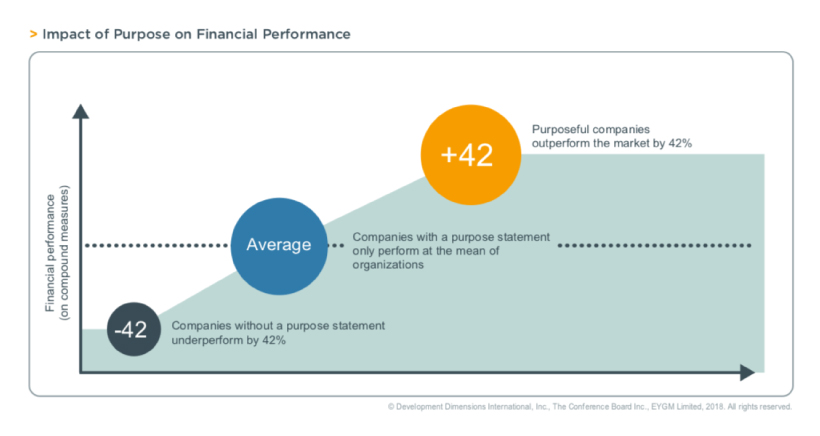

Purpose and Performance

The Global Leadership Forecast finds that a strong and well-executed purpose can build organizational resilience and improve long-term financial performance.

Leaders who amplify an organization’s purpose create a culture of optimism where employees feel safe in proposing new ideas that will shape the trajectory of a company.

The Future of Leadership

To stay competitive, continuous learning and re-skilling should be at the heart of every organization’s leadership strategy. Leaders of the future should possess the ability to redesign jobs in a more fluid way and lean in to the changing nature of work.

“If we don’t disrupt our business, somebody else is going to do it for us.”

—McKinsey Analysts

While management is a foundational skill, organizations need to invest in their leaders to ensure constant growth. Embracing the traits of an effective leader can not only provide improved returns—it also empowers organizations to thrive in an uncertain future.

Markets

Ranked: The Largest U.S. Corporations by Number of Employees

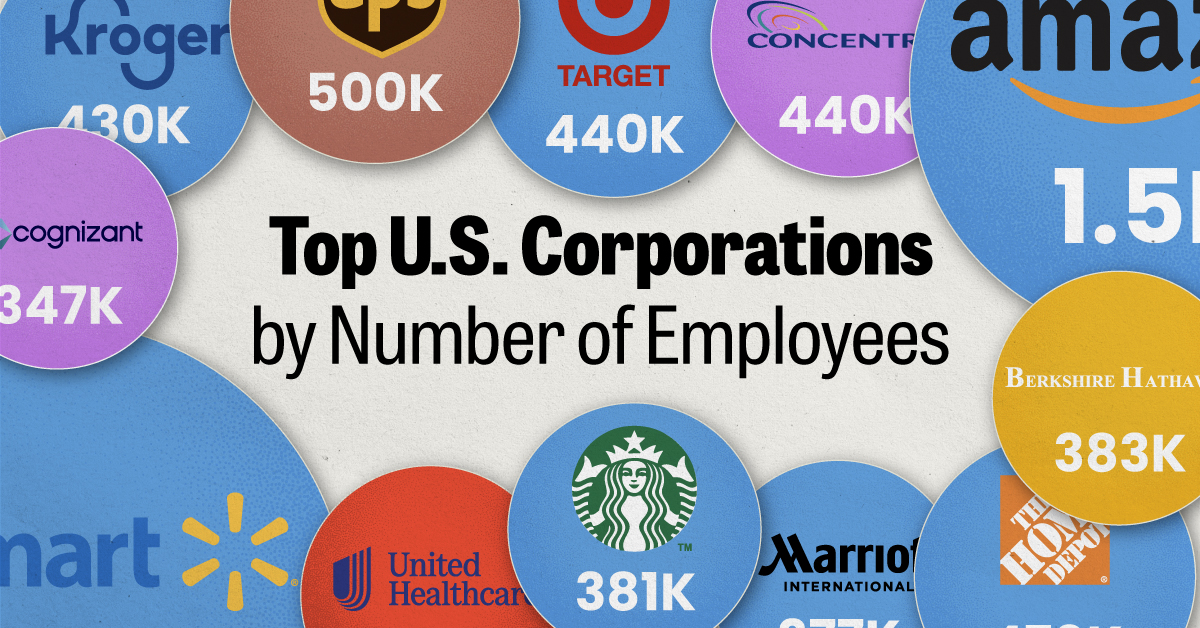

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?