How to Reach Financial Happiness

Many Americans believe that you need $1.2 million to reach financial happiness.

So, it follows that 71% of Americans feel more money would solve their problems. This leaves us to wonder: how happy are Americans with their finances?

To answer this question, Empower explored how to stay on the road to financial happiness.

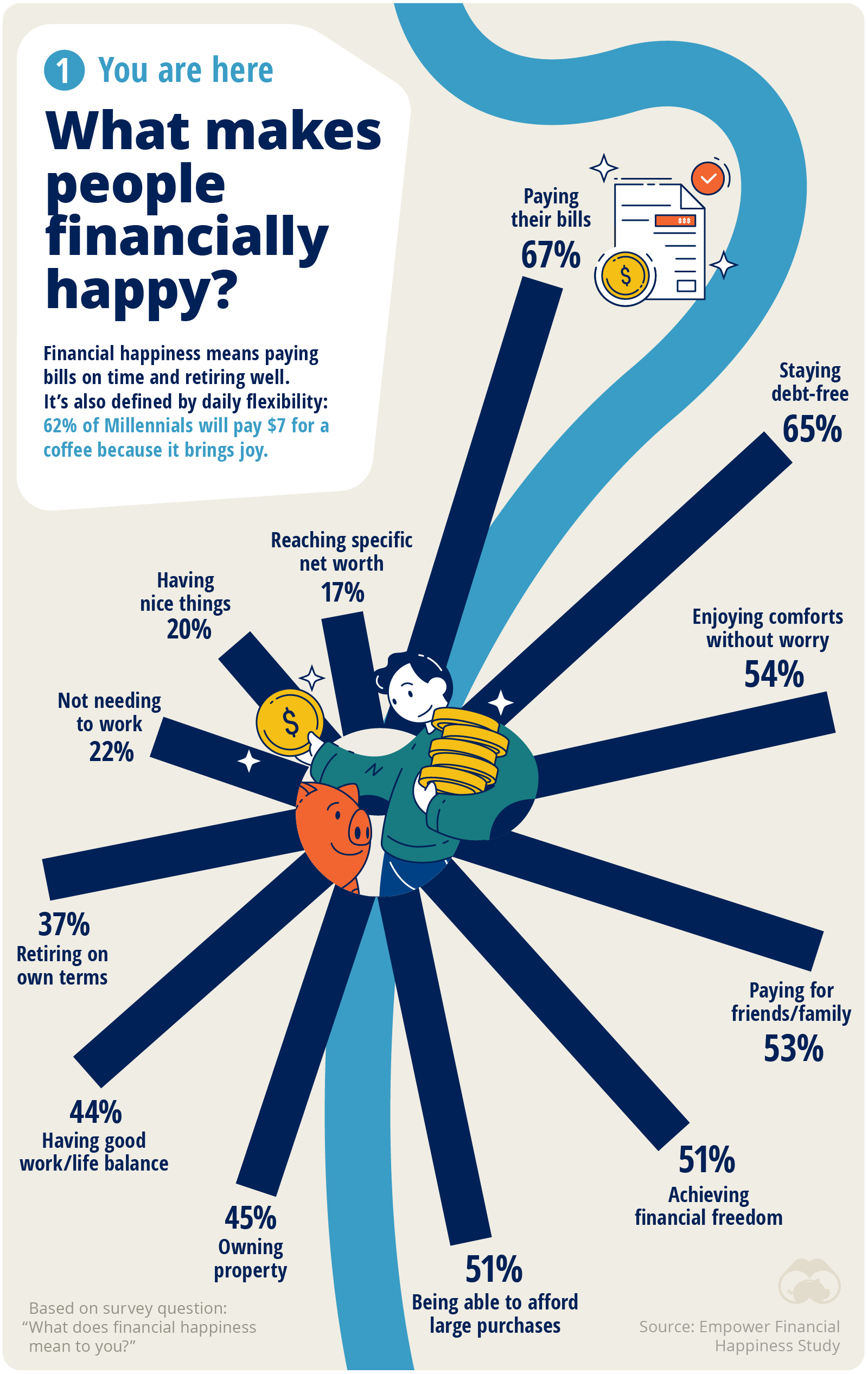

What makes people financially happy?

Despite the seven-figure price tag, only 17% of Americans believe financial happiness is tied to a specific net worth. Instead, when looking at the data, we see that Americans prioritize the freedom of incremental goals. Most of those surveyed agreed that paying bills on time and avoiding debt were the best ways to achieve financial happiness, 70% and 65%, respectively.

But in today’s world, avoiding debt and successfully managing money can be challenging. Budgets are stretched in a way that 42% report that a one-off payment of $25,000 would only keep them happy for six months.

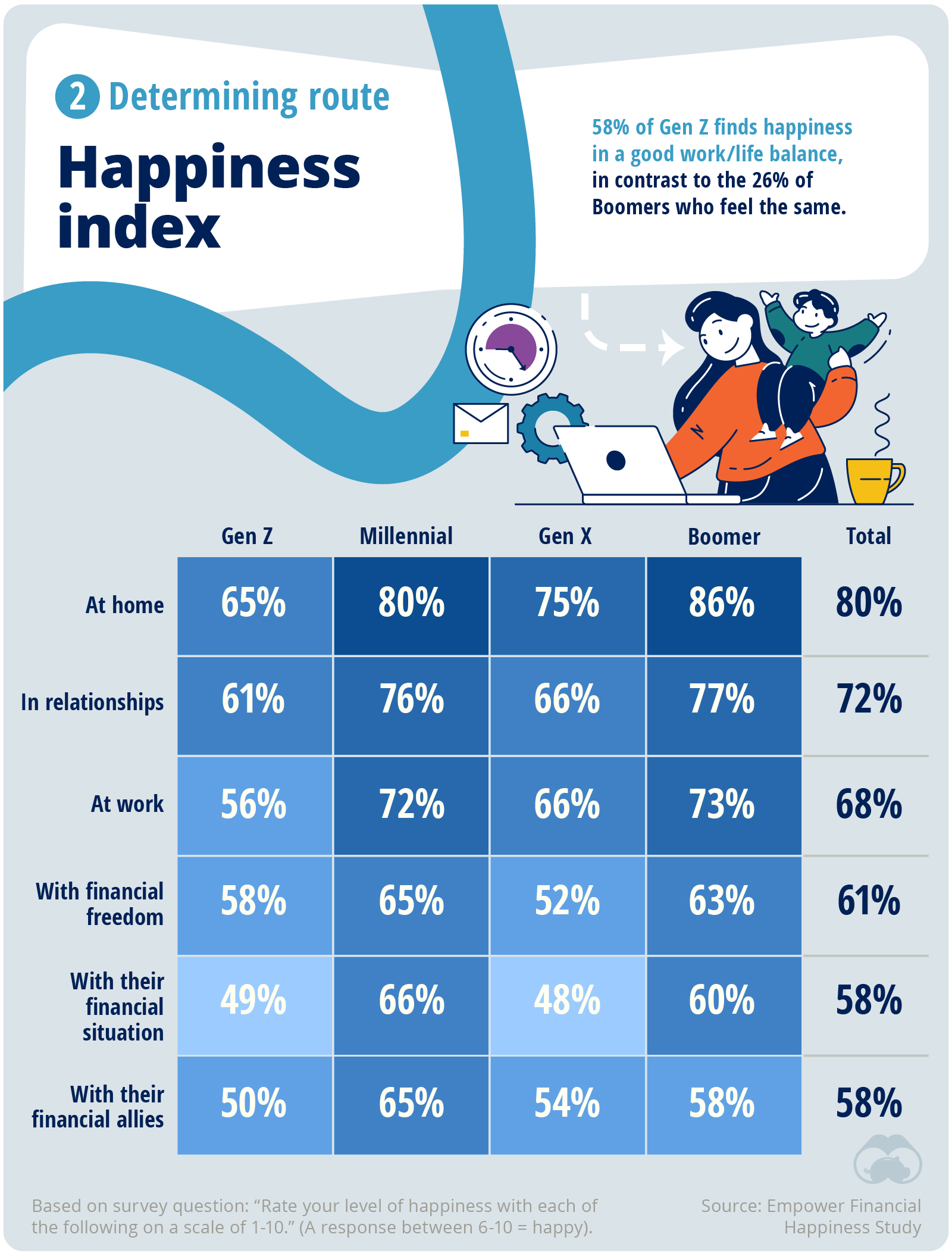

The happiness index

Across generations, Americans are tending to find happiness in areas other than their finances. The financial situation is especially challenging for Gen Z and X; less than half report being satisfied with their finances.

How, then, can someone stay on the road to financial happiness?

We must first understand the roadblocks in people’s way

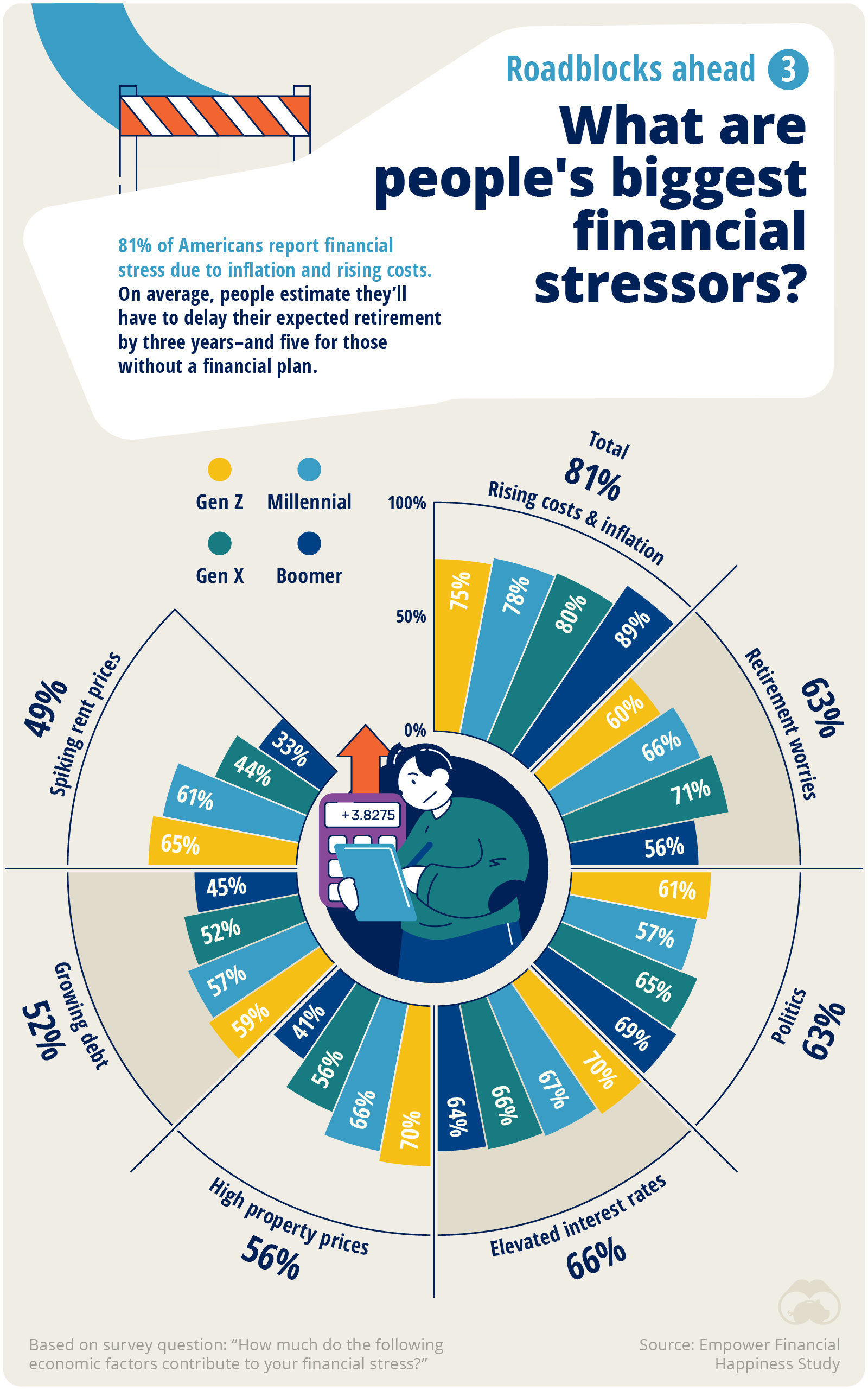

What are people’s biggest financial stressors?

The route to financial happiness isn’t the same for everyone, though 73% of Americans agree that inflation and the rising cost of goods generate the most stress. But different trends emerge when we compare the generations.

Aside from inflation and the rising cost of goods, the financial happiness of older generations is most impacted by politics and retirement worries. Job layoffs and elevated property prices cause significant stress for Millennials and Gen Z but not so for the older generations.

Younger generations would benefit from guidance on their journey toward financial happiness, as many report a lack of financial education and poor financial advice:

- 80% say a financial plan would help them reach their goals in life.

- 65% wish they had received financial advice sooner.

- 56% say they haven’t received the financial advice they need.

Financial stress is such a challenge that many plan to retire three years later than planned. As a result, many would go to great lengths to reach financial happiness.

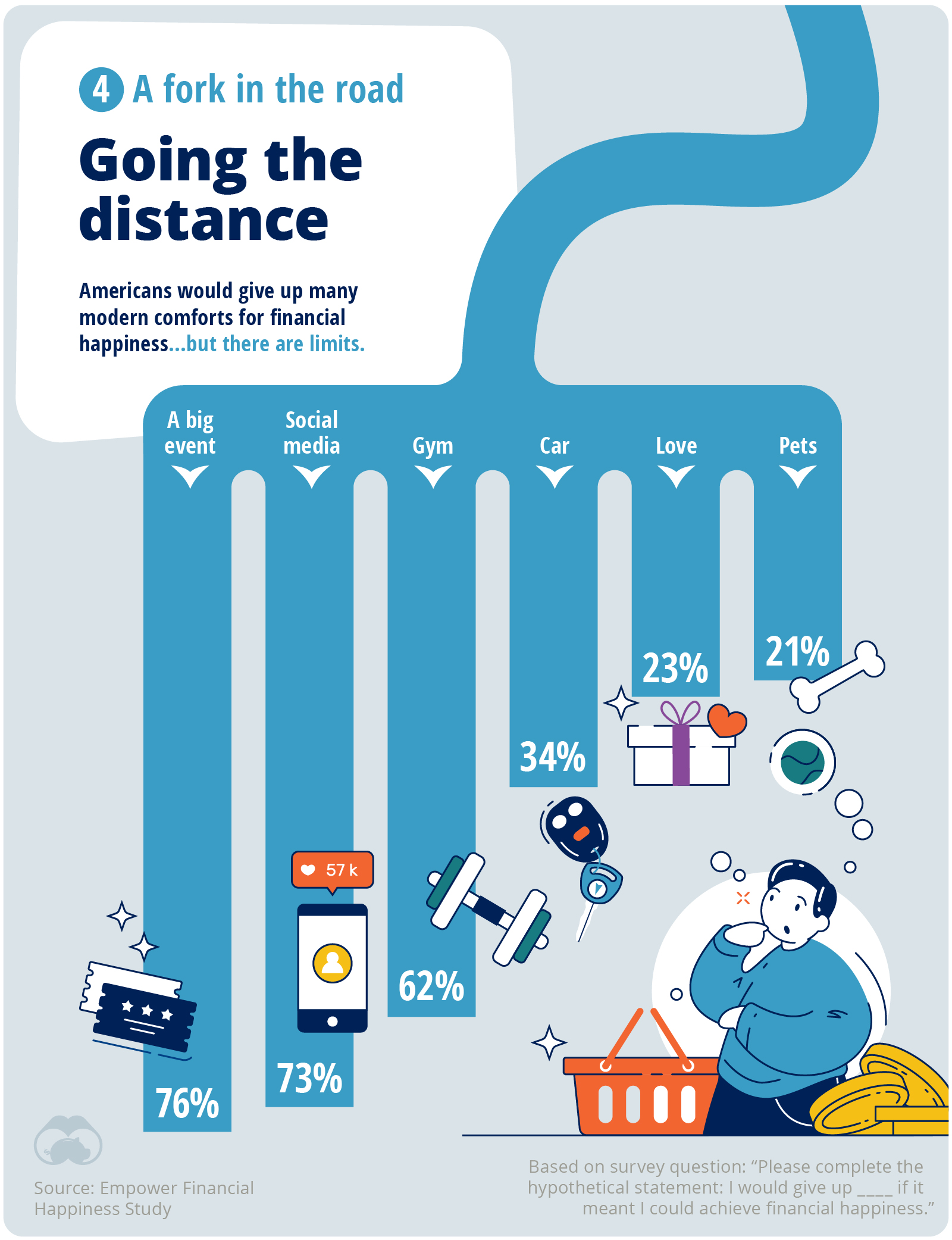

Getting a plan and going the distance

Given stress levels, it’s not surprising that many would go to great lengths for happiness.

In fact, financial happiness is so valued that nearly three-quarters of those surveyed say they would give up social media, and almost 25% say they would give up on love.

The data indicates a solution that doesn’t involve giving up their car, partner, or pets: an in-depth financial plan.

Americans with a more detailed financial plan are three times more likely than those with a less detailed plan to report greater economic freedom and better financial health. They are also three times more likely to be happy with their ability to achieve their financial goals.

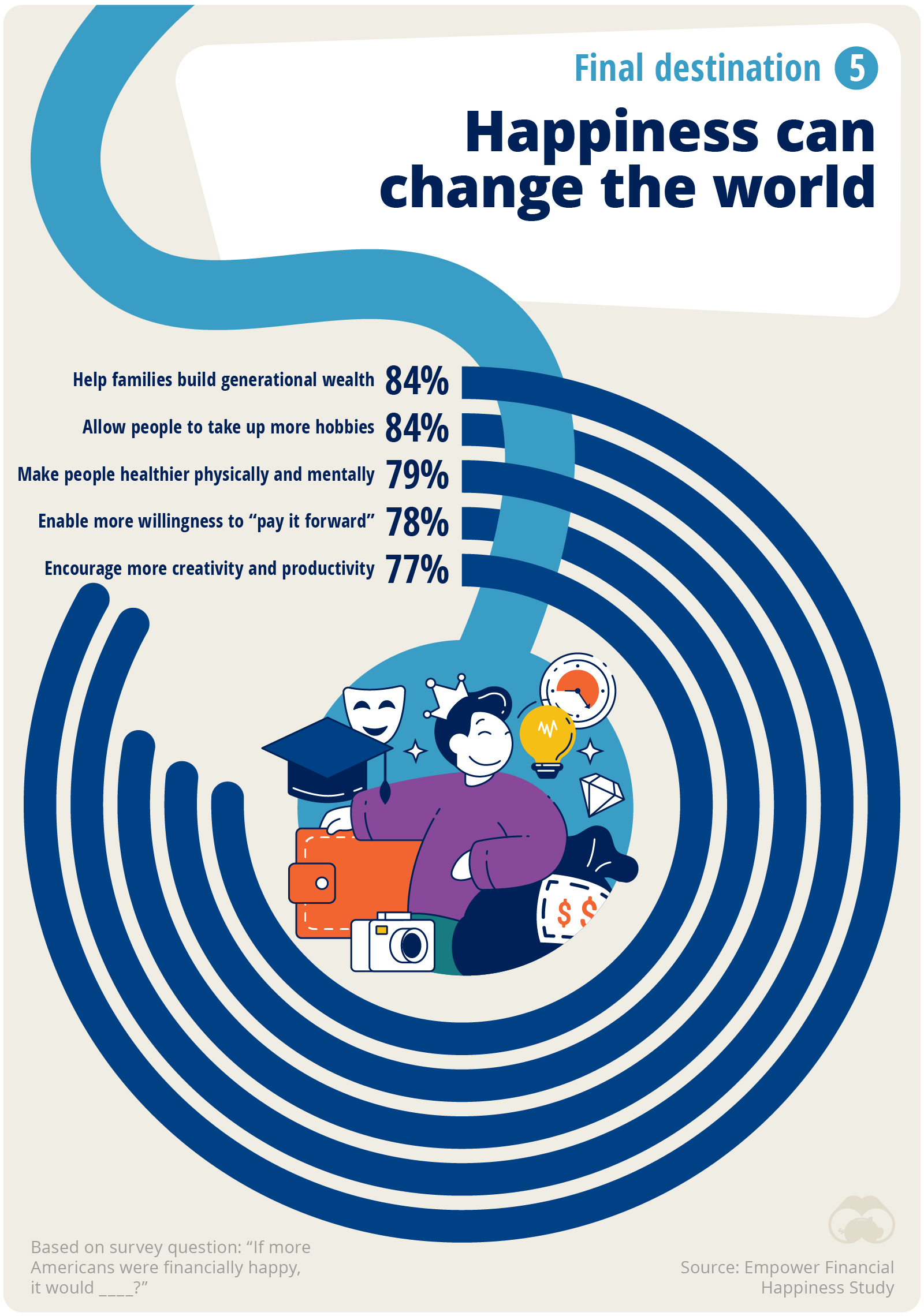

Happiness can change the world

So what results from more widespread financial happiness?

It turns out that it can change the world.

Financial happiness enables people to build wealth for those who come after them, lead a more creative life, and be more willing to “pay it forward.” So, while the journey can be challenging, financial happiness is worth the trip.

Navigating the roadblocks to financial happiness, from debt payoff to inflation, requires focus, planning, and support. But financial happiness is a destination within reach, given a clear plan and the right copilot.

That’s where Empower can help.

-

Personal Finance1 month ago

Personal Finance1 month agoChart: The Declining Value of the U.S. Federal Minimum Wage

This graphic compares the nominal vs. inflation-adjusted value of the U.S. minimum wage, from 1940 to 2023.

-

Personal Finance3 months ago

Personal Finance3 months agoRanked: The Top 25 Countries for Retirement

Of the 44 nations analyzed for retirement welfare, these 25 score well on health, financial, and social support for their aging populations.

-

Personal Finance4 months ago

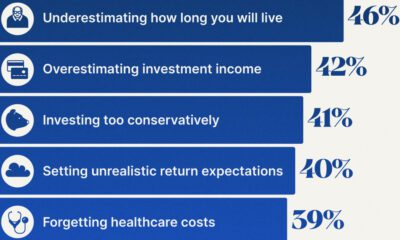

Personal Finance4 months agoCharted: Top 10 Retirement Planning Mistakes

What are the top retirement planning mistakes people make? Here are the top 10 common mistakes to avoid as seen by financial professionals.

-

Personal Finance4 months ago

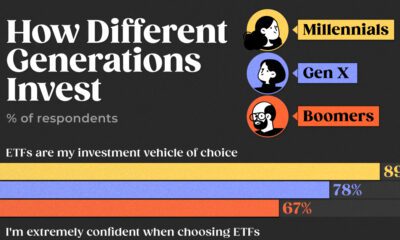

Personal Finance4 months agoCharted: Investment Preferences by Generation in the U.S.

How personal are your investments? We chart investment preferences by generation in the U.S. based on a survey of 2,200 investors in 2023.

-

Personal Finance6 months ago

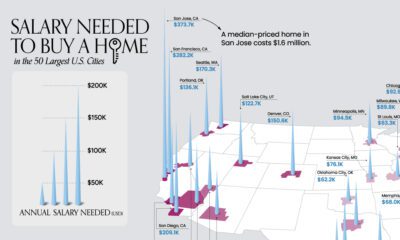

Personal Finance6 months agoMapped: What You Need to Earn to Own a Home in 50 American Cities

What does it take to own a home in the U.S. in 2023? Here’s a look at the salary needed for home ownership in the top…

-

Personal Finance7 months ago

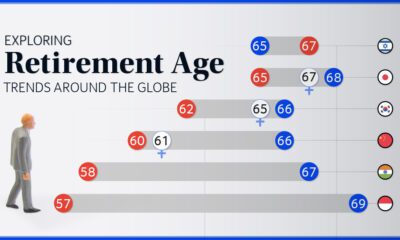

Personal Finance7 months agoCharted: Retirement Age by Country

We chart current and effective retirement ages for 45 countries, revealing some stark regional differences.