Road to Decarbonization: U.S. Coal Plant Closures

Road to Decarbonization: U.S. Coal Plant Closures

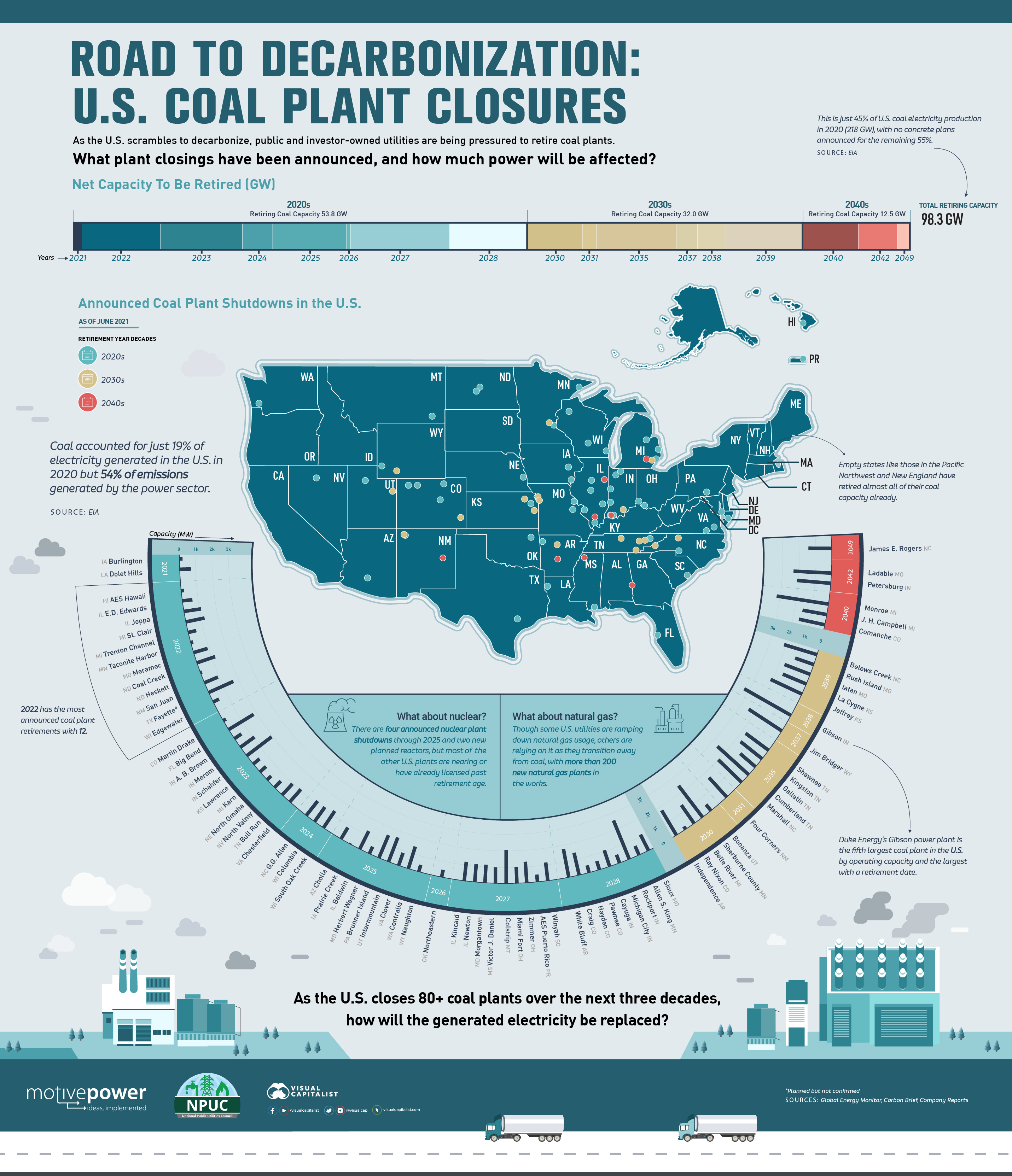

As the push to decarbonize starts to kick into gear in the U.S., how do coal plant closures factor into the equation?

With a target of net-zero emissions by 2050, the U.S. is examining all aspects of its economy to see where action is needed. In the automotive industry, for example, the Biden administration is aiming for half of new vehicles to be electric by 2030, following in the footsteps of automakers that have made similar commitments.

But in the power sector that supplies electricity for much of the country, fossil fuels continue to be large emission sources. Coal, which accounted for just 19% of electricity generated in the U.S. in 2020, created 54% of the power sector’s emissions.

That’s leading to U.S. utilities feeling the pressure to retire coal plants and look for alternatives. This infographic from the National Public Utilities Council visualizes the coal plant closures that have been announced, and how much power will be affected as a result.

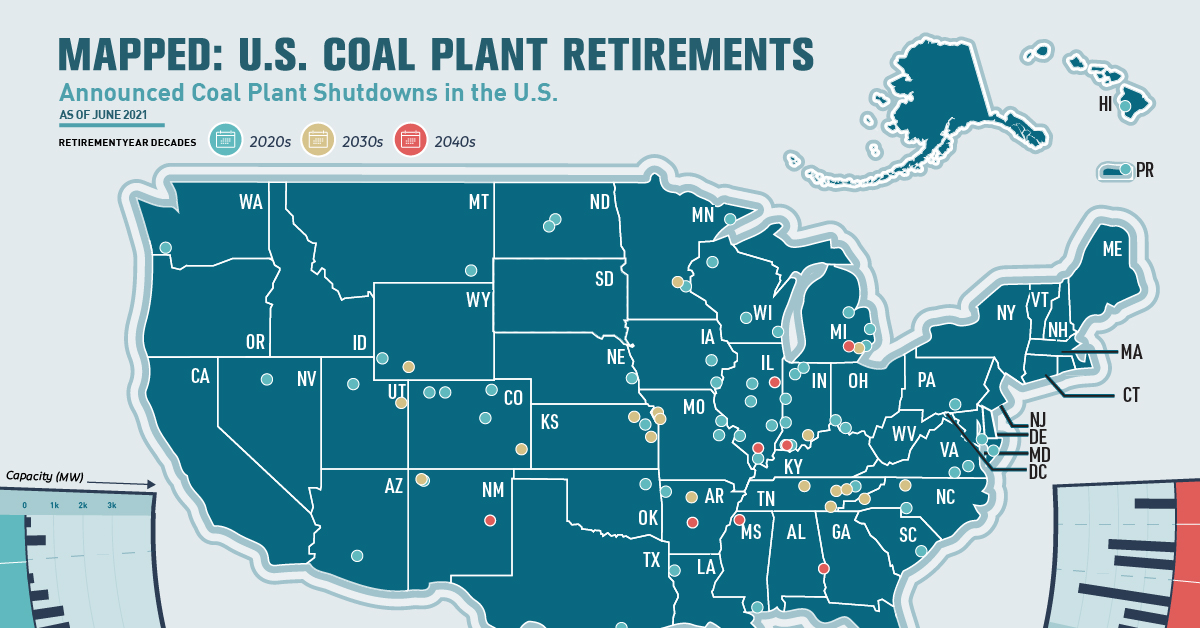

Where Are U.S. Coal Plant Closures Happening?

Accurately tracking coal plant closures currently means turning to non-profits and parsing through company reports. To assemble this list, we leveraged the Global Energy Monitor and Carbon Brief and cross-referenced against company sustainability reports and news releases.

The result? 80 coal plants with a total capacity of 98.3 GW publicly scheduled for full retirement over the next three decades.

| Plant | State | Retirement Date | Capacity (MW) |

|---|---|---|---|

| Burlington | IA | 2021 | 212 |

| Dolet Hills | LA | 2021 | 721 |

| AES Hawaii | HI | 2022 | 204 |

| Coal Creek | ND | 2022 | 1,210 |

| E.D. Edwards | IL | 2022 | 645 |

| Edgewater | WI | 2022 | 414 |

| Fayette* (announced not confirmed) | TX | 2022 | 1,690 |

| Heskett | ND | 2022 | 115 |

| Joppa | IL | 2022 | 1,100 |

| Meramec | MO | 2022 | 924 |

| San Juan | NM | 2022 | 924 |

| St. Clair | MI | 2022 | 1,210 |

| Taconite Harbor | MN | 2022 | 168 |

| Trenton Channel | MI | 2022 | 536 |

| A.B. Brown | IN | 2023 | 530 |

| Big Bend | FL | 2023 | 1,824 |

| Bull Run | TN | 2023 | 950 |

| Chesterfield | VA | 2023 | 1,053 |

| Karn | MI | 2023 | 516 |

| Lawrence | KS | 2023 | 517 |

| Martin Drake | CO | 2023 | 207 |

| Merom | IN | 2023 | 1,080 |

| North Omaha | NE | 2023 | 354 |

| North Valmy | NV | 2023 | 567 |

| Schahfer | IN | 2023 | 1,944 |

| Columbia | WI | 2024 | 1,112 |

| G.G. Allen | NC | 2024 | 1,155 |

| South Oak Creek | WI | 2024 | 1,240 |

| Baldwin | IL | 2025 | 1,260 |

| Brunner Island | PA | 2025 | 1,558 |

| Centralia | WA | 2025 | 1,460 |

| Cholla | AZ | 2025 | 840 |

| Clover | VA | 2025 | 848 |

| Herbert Wagner | MD | 2025 | 495 |

| Intermountain | UT | 2025 | 1,640 |

| Nauhgton | WY | 2025 | 448 |

| Prairie Creek | IA | 2025 | 50 |

| Northeastern | OK | 2026 | 473 |

| AES Puerto Rico | PR | 2027 | 510 |

| Colstrip | MT | 2027 | 2,272 |

| Kincaid | IL | 2027 | 1,319 |

| Miami Fort | OH | 2027 | 1,115 |

| Morgantown | MD | 2027 | 1,252 |

| Newton | IL | 2027 | 1,235 |

| Victor J. Daniel | MS | 2027 | 1,097 |

| Winyah | SC | 2027 | 1,260 |

| Zimmer | OH | 2027 | 1,426 |

| Allen S. King | MN | 2028 | 598 |

| Cayuga | IN | 2028 | 1,062 |

| Craig | CO | 2028 | 1,427 |

| Hayden | CO | 2028 | 466 |

| Michigan City | IN | 2028 | 540 |

| Pawnee | CO | 2028 | 552 |

| Rockport | IN | 2028 | 2,600 |

| Sioux | MO | 2028 | 1,099 |

| White Bluff | AR | 2028 | 1,800 |

| Belle River | MI | 2030 | 1,396 |

| Bonanza | UT | 2030 | 500 |

| Independence | AR | 2030 | 1,800 |

| Ray Nixon | CO | 2030 | 207 |

| Sherburne County | MN | 2030 | 2,469 |

| Four Corners | NM | 2031 | 1,636 |

| Cumberland | TN | 2035 | 2,600 |

| Gallatin | TN | 2035 | 1,255 |

| Kingston | TN | 2035 | 1,700 |

| Marshall | NC | 2035 | 1,996 |

| Shawnee | TN | 2035 | 1,750 |

| Jim Bridger | WY | 2037 | 2,441 |

| Gibson | IN | 2038 | 3,340 |

| Belews Creek | NC | 2039 | 2,160 |

| Iatan | MO | 2039 | 1,725 |

| Jeffrey | KS | 2039 | 2,160 |

| La Cygne | KS | 2039 | 1,599 |

| Rush Island | MO | 2039 | 1,242 |

| Comanche | CO | 2040 | 1,636 |

| J. H. Campbell | MI | 2040 | 1,540 |

| Monroe | MI | 2040 | 3,280 |

| Ladabie | MO | 2042 | 2,389 |

| Petersburg | IN | 2042 | 2,147 |

| James E. Rogers | NC | 2049 | 1,481 |

Noticeably, most of the coal plant closures are targeted in the Midwest (which uses the most coal for power). And most of the retirements are coming early, with the 2020s seeing more than half of announced closures and retired capacity (53.6 GW).

But the largest coal plants with announced retirement dates are currently scheduled for the 2030s and 2040s. That includes Duke Energy’s Gibson power plant in Indiana, the fifth largest coal plant in the U.S. and the largest with a retirement date.

What’s Next for U.S. Decarbonization?

Though it seems like the U.S. has a lot of coal plant closures announced, there’s a lot left to go.

The 98.3 GW of tracked coal plant closures is just 45% of U.S. coal electricity production in 2020. Though many utilities have talked about eventually assessing and planning retirements for some of the remaining 55%, no concrete plans have been announced yet.

“In our industry, deciding to exit coal-fired power is not taken lightly,” said Omaya Ahmad, Sustainability Policy Consultant at Arizona Public Service. “Our coal plants are often the oldest in our fleet and are largely the reason our service territories have grown and flourished into what they are today. However, the pressures presented by climate change and the economic demands tied to coal have required a commitment to transition to clean energy.”

Coal Plant Closures Are Part of a Larger Equation

But as Ahmad explains, turning off coal plants is not such a quick-and-easy fix.

“Such a transition will be a lofty undertaking and will not come without its own challenges,” said Ahmad. “Recognizing the regional transition landscape and timeline depicted on a map like this one will help utilities adequately prepare for and support their coal communities as we all take steps to reach a clean energy economy.”

And coal plants are just one part of the decarbonization equation. Some utilities are opting to transform coal power plants into natural gas plants, which are more cost-efficient and emit less than coal. Even though many utilities and consumers are turning away from carbon emitting fuel sources entirely, there are more than 200 new natural gas plants planned in the U.S.

But the big question is how the generated electricity from coal will be replaced. Communities that rely on coal for power (and economic strength) will have to turn to natural gas or work on renewables capacity, while others have already started the transition.

National Public Utilities Council is the go-to resource for all things decarbonization in the utilities industry. Learn more.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology…

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.