Money

Ranked: The U.S. Banks With the Most Uninsured Deposits

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

The U.S. Top Banks by Uninsured Deposits

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

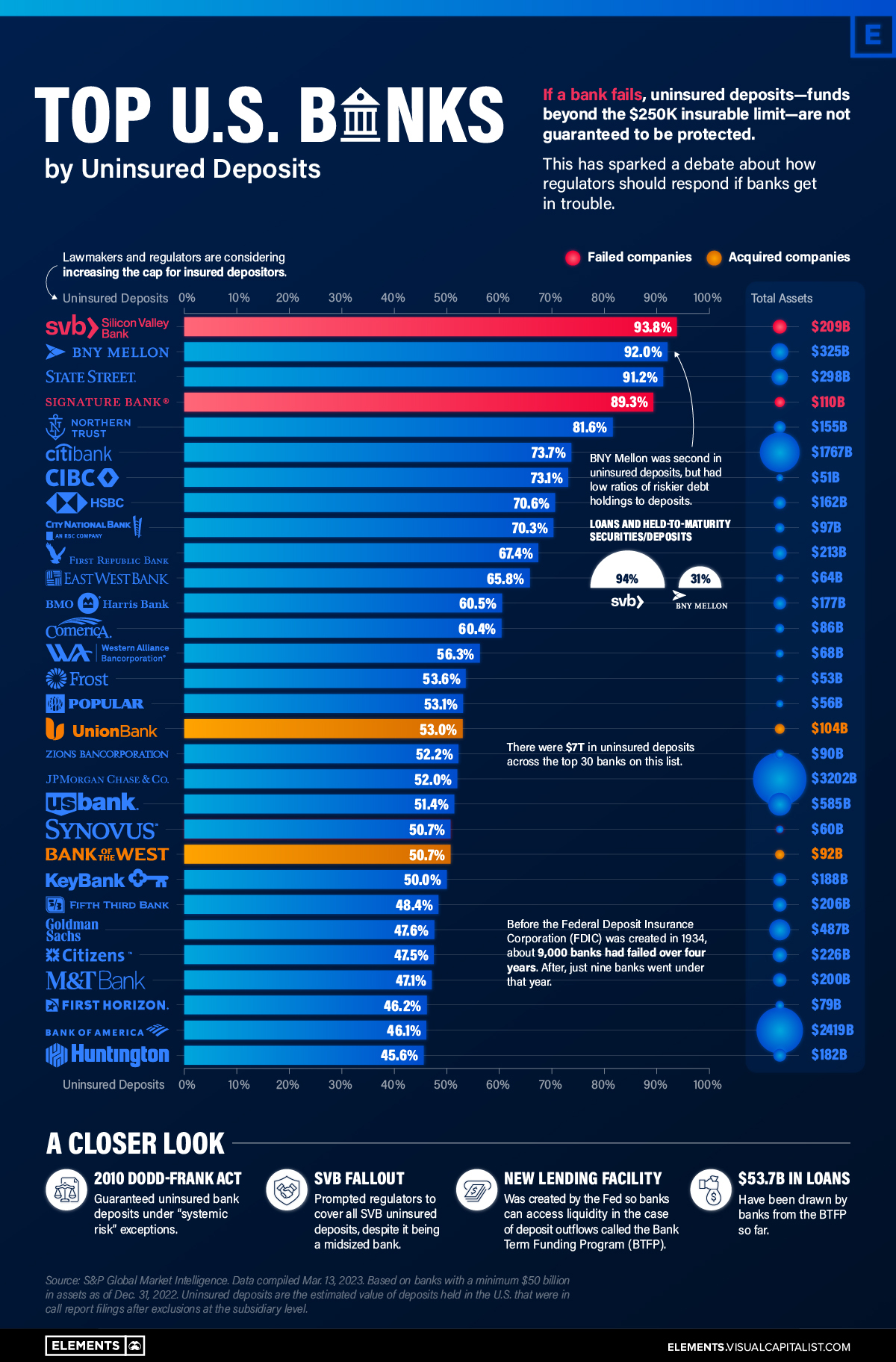

Today, there is at least $7 trillion in uninsured bank deposits in America.

This dollar value is roughly three times that of Apple’s market capitalization, or about equal to 30% of U.S. GDP. Uninsured deposits are ones that exceed the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC), which was actually increased from $100,000 after the Global Financial Crisis. They account for roughly 40% of all bank deposits.

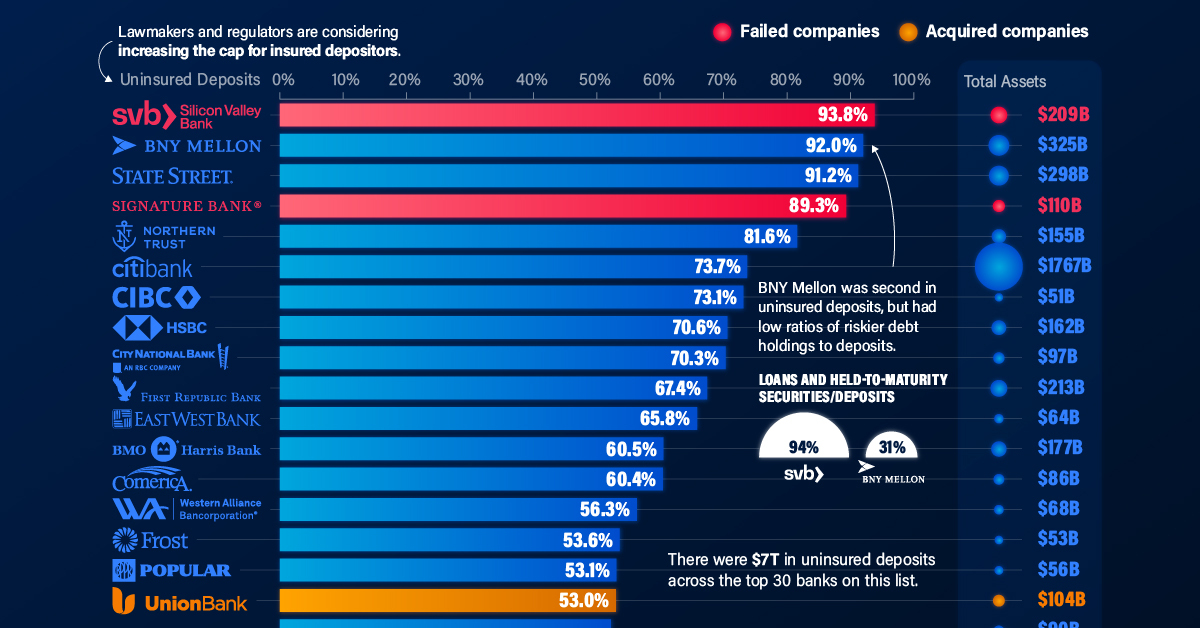

In the wake of the Silicon Valley Bank (SVB) fallout, we look at the 30 U.S. banks with the highest percentage of uninsured deposits, using data from S&P Global.

Which Banks Have the Most Uninsured Deposits?

Over the last month, SVB and Signature Bank went under at lightning speed.

Below, we show how their level of uninsured deposits compare to other banks. The dataset includes U.S. banks with at least $50 billion in assets at the end of 2022.

| Top 30 Rank | Bank | Uninsured Deposits (%) | Total Assets (B) |

|---|---|---|---|

| 1 | Silicon Valley Bank* | 93.8 | $209 |

| 2 | Bank of New York Mellon | 92.0 | $325 |

| 3 | State Street Bank and Trust Co. | 91.2 | $298 |

| 4 | Signature Bank* | 89.3 | $110 |

| 5 | Northern Trust Co. | 81.6 | $155 |

| 6 | Citibank NA | 73.7 | $1,767 |

| 7 | CIBC Bank USA | 73.1 | $51 |

| 8 | HSBC Bank USA NA | 70.6 | $162 |

| 9 | City National Bank | 70.3 | $97 |

| 10 | First Republic Bank | 67.4 | $213 |

| 11 | East West Bank | 65.8 | $64 |

| 12 | BMO Harris Bank NA | 60.5 | $177 |

| 13 | Comerica Bank | 60.4 | $86 |

| 14 | Western Alliance Bank | 56.3 | $68 |

| 15 | Frost Bank | 53.6 | $53 |

| 16 | Banco Popular de Puerto Rico | 53.1 | $56 |

| 17 | MUFG Union Bank NA** | 53.0 | $104 |

| 18 | Zions Bancorp. NA | 52.2 | $90 |

| 19 | JPMorgan Chase Bank NA | 52 | $3,202 |

| 20 | U.S. Bank NA | 51.4 | $585 |

| 21 | Synovus Bank | 50.7 | $60 |

| 22 | Bank of the West** | 50.7 | $92 |

| 23 | KeyBank NA | 50.0 | $188 |

| 24 | Fifth Third Bank NA | 48.4 | $206 |

| 25 | Goldman Sachs Bank USA | 47.6 | $487 |

| 26 | Citizens Bank NA | 47.5 | $226 |

| 27 | Manufacturers and Traders Trust Co. | 47.1 | $200 |

| 28 | First Horizon Bank | 46.2 | $79 |

| 29 | Bank of America NA | 46.1 | $2,419 |

| 30 | Huntington National Bank | 45.6 | $182 |

*Failed banks. **Acquired banks.

Bank of New York (BNY) Mellon and State Street Bank are the active banks with the highest levels of uninsured deposits. They are the two largest custodian banks in the U.S., followed by JP Morgan. Custodian banks provide critical infrastructure in the financial system, holding assets for safe-keeping for investment managers and transferring assets, among other duties.

Both BNY Mellon and State Street are considered “systemically important” banks.

Where these banks differ from SVB is that their loans and held-to-maturity securities as a percentage of total deposits are much lower. While these loans made up over 94% of SVB’s deposits, they made up 31% of BNY Mellon’s and 40% of State Street Bank’s deposits, respectively.

Held-to-maturity securities pose a greater risk to banks. Many of these holdings have lost value since interest rates have risen at a sharp clip. This presents interest-rate risks to banks. Consider how the value of long-term U.S. Treasurys declined about 30% in 2022. In this way, if a bank sells these assets before they mature, they take on a steep loss.

Overall, 11 banks on this list have loans and held-to-maturity assets that are over 90% of their total value of deposits.

Backstop Measures

To prevent wider ramifications, regulators implemented emergency actions. This was done by protecting all deposits of SVB and Signature Bank days after they announced failure.

The Fed also set up an emergency lending facility for banks. This Bank Term Funding Program (BTFP) was created to provide additional funding for banks if depositors pulled their money. It was also set up to prevent banks from interest-rate risk.

So far, more than $50 billion in loans have been withdrawn from the BTFP, up from $11.9 billion in its first week. (The Federal Reserve updates these numbers on a weekly basis.) This has led the Fed’s balance sheet to once again tick higher after slowly declining with the introduction of quantitative tightening in 2022.

Between a Rock and a Hard Place

What does this mean for the U.S. banking system, and what are the implications for depositors and the broader financial system?

On the one hand, the Fed may have had no other option than to save the banks.

“The way the world is, the government had no alternative but to back all deposits. Or we would have had the biggest goddamn bunch of bank runs you ever saw.”

-Charles Munger

The bigger problem is that it introduces new risk into the system. If market participants expect the Fed to always come to the rescue, they will likely make less prudent decisions. Beyond this, the ultra-low interest rate environment not only made banks more sensitive to interest-rate risk as rates went up, but it also lowered the cost of risk-taking.

Now, the Fed has said that they could take necessary actions to protect uninsured deposits. How quickly BTFP loans increase in the next few months will be anyone’s guess as clients from smaller banks withdraw funds and send to larger ones or invest in money market funds.

Editor’s note: Not all types of uninsured deposits are created equal. For custodian banks, retail deposits can make up a smaller portion of total deposits while operational deposits comprise a larger share. These types of deposits hold large amounts of funds for other banks for the purposes of custody or clearing and cash management, among other functions. For this reason, they are often considered more stable forms of deposits.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001