Misc

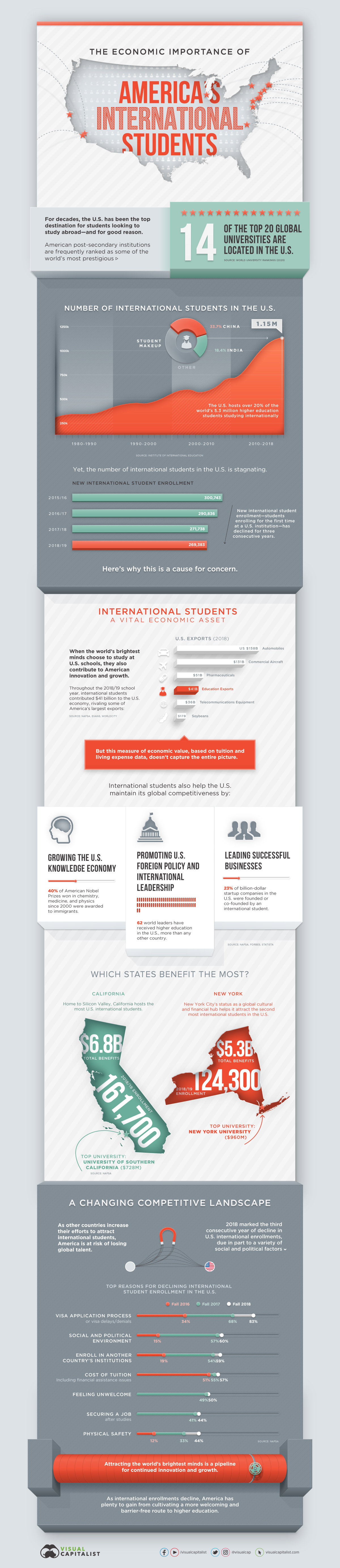

The Impact of International Students on the U.S. Economy

The Economic Impact of America’s International Students

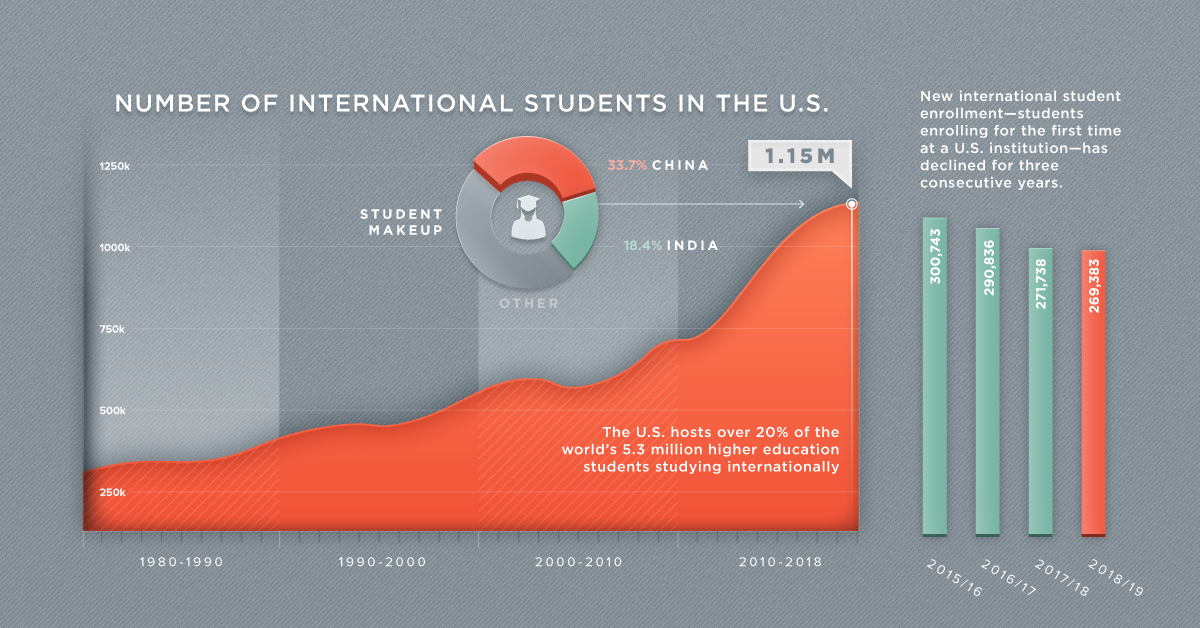

For decades, the U.S. has been the top destination for students looking to study abroad.

It’s easy to see why. Not only does the country provide access to world-class economic hubs like Silicon Valley, but the U.S. is also home to 14 of the top 20 universities in the world, many of which are famed for their research and alumni networks.

Yet, there is cause for concern.

International enrollments in the U.S. have slowed, while other countries are attracting a larger share of the global talent pool. To help us understand what’s at stake if enrollments continue to decline, today’s infographic shows the impact of international students on the U.S. economy.

Driving American Innovation and Growth

International students and scholars are a vital economic asset, and America’s ability to attract them puts the country in an enviable position.

First, there are the direct economic benefits which result from tuition fees and living expenses. Throughout the 2018/2019 school year, these benefits totaled $41 billion, a comparable value to many other American exports:

| Export | Value (2018) |

|---|---|

| Automobiles | $158B |

| Commercial Aircraft | $131B |

| Pharmaceuticals | $51B |

| Education Exports | $41B |

| Telecommunications Equipment | $36B |

| Soybeans | $17B |

Source: NAFSA, Evans, WorldCity

Even after graduation, however, international students and scholars continue to make significant contributions to the U.S. economy.

For example, attracting the world’s brightest minds helps to grow the knowledge economy in the United States, and 40% of American Nobel Prizes won in chemistry, medicine, and physics since 2000 have been awarded to immigrants. Furthermore, students who return home often do so with a network of connections and an appreciation for American culture, thus promoting U.S. international leadership.

Finally, these individuals can also go on to become successful entrepreneurs and business leaders in the U.S. economy. The list is long, but here are two noteworthy examples:

- Elon Musk, known for founding Paypal, Tesla, and SpaceX, was born in South Africa. He received two Bachelor’s degrees from the University of Pennsylvania before founding his first business.

- Satya Nadella, CEO of Microsoft, was an international student from India. He received an M.S. from the University of Wisconsin and an MBA from the University of Chicago before helping Microsoft develop its cloud computing capabilities.

Cause for Concern

In recent years, however, the number of new international students enrolling at U.S. institutions has been on the decline:

| School Year | New International Student Enrollments in the U.S. | Percent Change |

|---|---|---|

| 2013/14 | 270,128 | -- |

| 2014/15 | 293,766 | 8.8% |

| 2015/16 | 300,743 | 2.4% |

| 2016/17 | 290,836 | -3.3% |

| 2017/18 | 271,738 | -6.6% |

| 2018/19 | 269,383 | -0.9% |

Source: Institute of International Education

With so many opportunities and success stories, why have international enrollments slowed? A survey of 509 higher education institutions in the U.S. revealed the top reasons for declining international enrollments:

| Cited Reason for Decline in Enrollment | % of Institutions (Fall 2016) | % of Institutions (Fall 2017) | % of Institutions (Fall 2018) |

|---|---|---|---|

| Visa Application Process (delays/denials) | 34% | 68% | 83% |

| Social and Political Environment | 15% | 57% | 60% |

| Enroll in Another Country’s Institutions | 19% | 54% | 59% |

| Cost of Tuition | 51% | 55% | 57% |

| Feeling Unwelcome | - | 49% | 50% |

| Securing a Job | - | 41% | 44% |

| Physical Safety | 12% | 33% | 44% |

Source: NAFSA

Critically, the two most common reasons for declining enrollment—visa applications and the social and political environment—suggest that the quality of an American education is not the issue. Rather, it would appear that students are being discouraged from coming to the United States.

When we discourage or turn away international students, we lose much more than the students themselves… We lose their inventions and innovation, their collaborative input and their contributions to our communities.

– Dr. Martha E. Pollack, President, Cornell University

At the same time, other countries are taking proactive measures to attract global talent.

Australia

Australia allows its international students to work for up to 18 months after graduation. This limit can increase to 4 years for graduates of high-demand occupations. In 2018, the country saw a 15% increase in international enrollments.

Canada

Canada, a country distinguished for its multiculturalism, is quickly becoming an attractive destination for international students. The country offers expedited visa processing for qualified individuals, as well as a 3-year work visa for graduates. In 2017, international enrollments in Canada grew by an impressive 20%.

Potential Consequences

The world’s brightest minds are an important asset for continued innovation and growth, and today, there is a mass of countries welcoming them with open arms.

While the U.S. is still the preferred destination for international students and scholars, the country’s leadership in this space is at risk. In fact, since 2001, the share of international students in America has fallen from 28% to 21%.

Will the U.S be able to maintain global competitiveness if the number of new international students enrolling continues to fall? Can the country work to cultivate a more welcoming and barrier-free route to higher education?

These are potent questions that will need to be answered, especially with a sizable economic impact on the line.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024