Economy

Animated Chart: The S&P 500 in 2023 So Far

The S&P 500’s Performance in 2023 Q1

With one quarter of 2023 in the books, how has the S&P 500 performed so far?

The index had a tumultuous 2022, ending the year down 18%, its worst performance since 2008. But so far, despite dealing with tight monetary conditions and an unexpected banking crisis, the S&P 500 has promptly started to rebound.

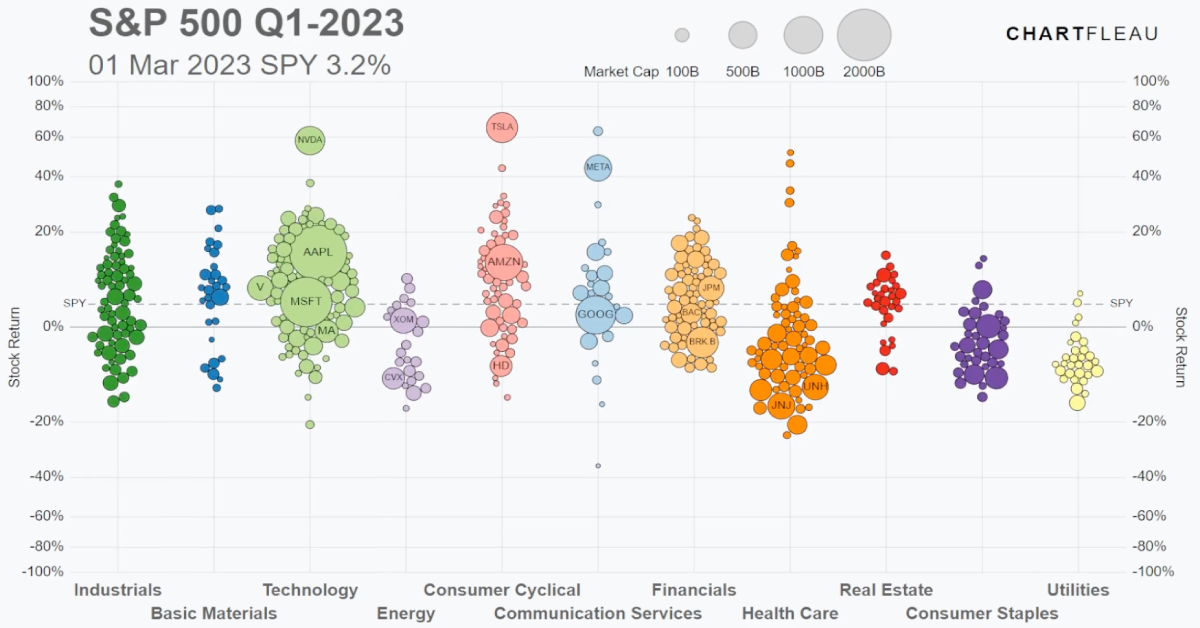

The above animation from Jan Varsava shows the stock performance of each company on the S&P 500, categorized by sector.

Biggest Gainers on the S&P 500

The S&P 500 increased 7.5% during the first quarter of 2023. Though it was led by a few big outperformers, more than half of the stocks on the index closed above their end-of-December prices.

Here are the top 30 biggest gainers on the index from January 1 to March 31, 2023.

| Rank | Company | 3-Month Return |

|---|---|---|

| 1 | Nvidia | 90.1% |

| 2 | Meta (Facebook) | 76.1% |

| 3 | Tesla | 68.4% |

| 4 | Warner Bros. Discovery | 59.3% |

| 5 | Align Technology | 58.4% |

| 6 | AMD | 51.3% |

| 7 | Salesforce | 50.7% |

| 8 | West Pharmaceuticals | 47.3% |

| 9 | General Electric | 46.3% |

| 10 | Catalent | 46.0% |

| 11 | First Solar | 45.2% |

| 12 | Monolithic Power Systems | 41.8% |

| 13 | MarketAxess Holdings | 40.6% |

| 14 | GE Healthcare Tech | 40.5% |

| 15 | Arista Networks | 38.3% |

| 16 | ANSYS Inc. | 37.8% |

| 17 | Fortinet Inc. | 35.9% |

| 18 | Wynn Resorts | 35.7% |

| 19 | Paramount Global | 33.8% |

| 20 | FedEx Corp | 32.7% |

| 21 | MGM Resorts | 32.5% |

| 22 | Royal Caribbean Group | 32.1% |

| 23 | ON Semiconductor Corp | 32.0% |

| 24 | Booking Holdings | 31.6% |

| 25 | Cadence Design Systems | 30.8% |

| 26 | Skyworks Solutions | 30.2% |

| 27 | Pulte Group | 28.4% |

| 28 | Seagate Technology | 27.1% |

| 29 | Apple | 27.1% |

| 30 | Lam Research | 26.6% |

Nvidia shares gained the most of all the companies on the S&P 500 in Q1 2023, posting a staggering 90% return over three months.

As the world’s largest chipmaker by market cap, Nvidia gained from both strong earnings and semiconductor industry performance. It also benefited from the rising prevalence of artificial intelligence (AI) through software like ChatGPT.

Meanwhile, other tech giants Apple and Microsoft gained 27% and 21% respectively over the same time period.

Tech Leads Returns by Sector

The technology sector as a whole was the best performing sectoral index thanks to these big moves, up 21.7% at the end of March.

| Sector | 3-Month Return |

|---|---|

| Technology | 21.65% |

| Consumer Services | 21.27% |

| Consumer Discretionary | 16.60% |

| Materials | 4.29% |

| Industrials | 3.47% |

| Real Estate | 1.95% |

| Consumer Staples | 0.72% |

| Utilities | -3.24% |

| Health Care | -4.31% |

| Energy | -4.37% |

| Financials | -5.56% |

| S&P 500 | 7.5% |

Shares of other tech-adjacent companies like Meta (formerly Facebook) and Tesla—listed on the S&P 500 under the categories of communication services and consumer discretionary—also had a strong start to the year and lifted their respective sectors.

Meta in particular is up 76% in Q1 2023, continuing its rebound after falling to an eight-year low in November 2022 on the back of better-than-expected fourth quarter results and share buybacks.

Biggest Losers on the S&P 500

On the other side of the S&P 500, the financial sector was rocked by sudden collapses.

Signature Bank and Silicon Valley Financial Group shares lost the most ground in the first quarter, after both banks collapsed, shedding nearly all of their value in a matter of 30 days.

In fact, seven of the 10 worst performers on the index to start 2023 are banks or financial companies. The visualization shows the ripple effect on the market after the collapse of regional banks in March, and the ensuing rout driving the entire sector down 5.6% year-to-date.

Here are the top 30 biggest losers on the index from January 1 to March 31, 2023.

| Rank | Company | 3-Month Return |

|---|---|---|

| 1 | Signature Bank | -99.8% |

| 2 | Silicon Valley Financial Group | -99.6% |

| 3 | First Republic Bank | -88.5% |

| 4 | Lumen Technologies | -49.2% |

| 5 | Zions Bancorporation | -38.6% |

| 6 | Charles Schwab Corp | -36.9% |

| 7 | Comerica Incorporated | -33.9% |

| 8 | DISH Network | -33.5% |

| 9 | KeyCorp | -27.3% |

| 10 | Lincoln National Corp | -25.8% |

| 11 | Centene Corporation | -22.9% |

| 12 | Cigna Group | -22.5% |

| 13 | APA Corporation | -22.3% |

| 14 | Citizens Financial Group | -22.1% |

| 15 | Enphase Energy Inc. | -20.6% |

| 16 | Baxter International Inc. | -19.9% |

| 17 | Truist Financial Corporation | -19.9% |

| 18 | American International Group | -19.8% |

| 19 | CVS Health Corporation | -19.7% |

| 20 | Pfizer | -19.6% |

| 21 | Gen Digital | -19.5% |

| 22 | MetLife | -19.4% |

| 23 | Huntington Bancshares | -19.4% |

| 24 | Fidelity National | -19.3% |

| 25 | Halliburton Company | -19.2% |

| 26 | Molina Healthcare | -19.0% |

| 27 | PNC Financial Services | -18.8% |

| 28 | Boston Properties | -18.4% |

| 29 | Fifth Third Bancorp | -17.8% |

| 30 | Allstate Corporation | -17.7% |

Despite the tight monetary landscape, traditionally defensive sectors like energy, consumer staples, and healthcare also underperformed the broader index. This is a reversal from market trends seen in 2022.

Investment Trends to Watch for in 2023

Experts predict a pause in U.S. interest rate hikes “sometime in 2023” but it’s unclear when (or at what level) the pause will take place given persistent inflation in the economy.

However, if interest rates level off in 2023, it could be a key momentum maker for the S&P 500. As Barron’s points out, the index tends to rise after hikes are paused.

Meanwhile, the current tumult in the financial sector is fanning the flames of recessionary fears. How effectively regulators manage the crisis might be the story of the year.

Finally, as we have seen in 2023 so far, investor interest in AI has sent tech stocks soaring. Is this a quick fad, or an overarching trend for the year?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024