Technology

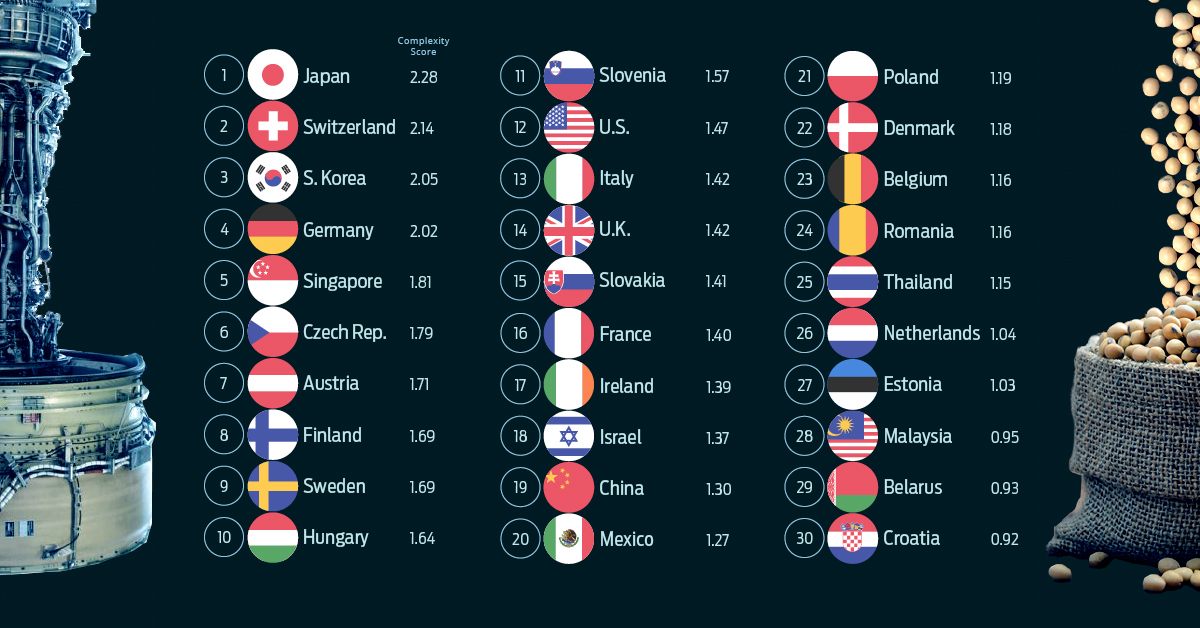

Countries Ranked by Their Economic Complexity

Countries Ranked by Their Economic Complexity

In the past, the trade between nations was a much simpler matter to grasp. Commodities and a few finished goods moved between a handful of countries in a straightforward way.

Today, around 6,000 officially classified products pass through the world’s ports, and digital products and services zip across country lines creating an extra layer of difficulty in measuring economic activity.

To try to understand this enormous level of economic complexity, the team at Harvard’s Growth Lab have created the Country Complexity Ranking. Here’s a look at the top 50 countries in the ranking:

| Rank | Country | Score | Top Export(s) |

|---|---|---|---|

| 1 | Japan | 2.28 | Cars, ICT (tech) |

| 2 | Switzerland | 2.14 | ICT, gold, packaged medicaments |

| 3 | South Korea | 2.05 | ICT, cars |

| 4 | Germany | 2.02 | Integrated circuits, ICT, cars |

| 5 | Singapore | 1.81 | ICT, cars |

| 6 | Czech Rep. | 1.79 | Cars, vehicle parts |

| 7 | Austria | 1.71 | ICT, tourism |

| 8 | Finland | 1.69 | ICT |

| 9 | Sweden | 1.67 | ICT |

| 10 | Hungary | 1.64 | ICT, cars |

| 11 | Slovenia | 1.57 | Cars, ICT |

| 12 | United States | 1.47 | ICT, tourism |

| 13 | Italy | 1.42 | ICT, tourism |

| 14 | United Kingdom | 1.42 | ICT, finance |

| 15 | Slovakia | 1.41 | Cars |

| 16 | France | 1.40 | ICT, tourism |

| 17 | Ireland | 1.39 | ICT |

| 18 | Israel | 1.37 | ICT, diamonds |

| 19 | China | 1.30 | Electronic equipment |

| 20 | Mexico | 1.27 | Cars |

| 21 | Poland | 1.19 | ICT |

| 22 | Denmark | 1.18 | Transport, ICT |

| 23 | Belgium | 1.16 | ICT |

| 24 | Romania | 1.16 | ICT, vehicle parts |

| 25 | Thailand | 1.15 | Tourism |

| 26 | Netherlands | 1.04 | ICT |

| 27 | Estonia | 1.03 | ICT, transport |

| 28 | Malaysia | 0.95 | Integrated circuits |

| 29 | Belarus | 0.93 | Refined oils, ICT |

| 30 | Croatia | 0.92 | Tourism, ICT |

| 31 | Lithuania | 0.85 | Transport, refined oils |

| 32 | Spain | 0.85 | Tourism, ICT |

| 33 | Philippines | 0.75 | Integrated circuits, ICT |

| 34 | Portugal | 0.72 | Tourism, ICT |

| 35 | Canada | 0.69 | Crude oil, cars, ICT |

| 36 | Bosnia and Herz. | 0.65 | Tourism, ICT |

| 37 | Serbia | 0.65 | ICT |

| 38 | Turkey | 0.65 | Tourism, transport |

| 39 | Latvia | 0.64 | Transport, ICT |

| 40 | Bulgaria | 0.62 | Tourism, ICT |

| 41 | Norway | 0.56 | Crude oil, petrol. gases |

| 42 | Ukraine | 0.42 | ICT, transport |

| 43 | Cyprus | 0.38 | Tourism, transport |

| 44 | Tunisia | 0.34 | Electrical wire, tourism |

| 45 | India | 0.32 | ICT |

| 46 | Costa Rica | 0.30 | ICT, tourism |

| 47 | Uruguay | 0.29 | Tourism, wood pulp |

| 48 | Brazil | 0.24 | Soya beans, iron ore |

| 49 | Russia | 0.24 | Crude oil, refined oils |

| 50 | Lebanon | 0.24 | Tourism, ICT |

Japan, Switzerland, and South Korea sit at the top of the ranking.

Czech Republic – which was recently ranked as the most attractive manufacturing destination in Europe – has a strong showing, ranking 6th in the world. The United States slipped out of the top 10 into 12th position.

The Power of Productive Knowledge

Highly ranked countries tend to have the following attributes:

-

• A high diversity of exported products

• Sophisticated and unique exported products (i.e. few other countries produce similar products)

In short, the ranking hinges on the concept of “productive knowledge” – or the tacit ability to produce a product.

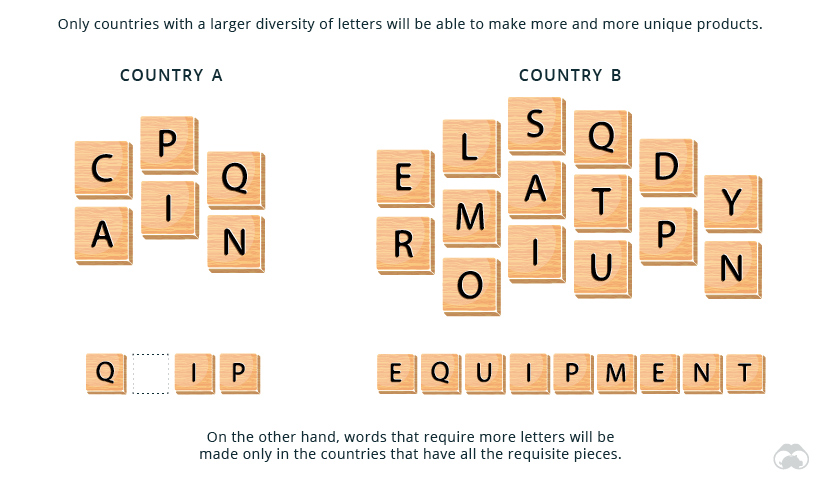

Muhammed Yildirim, of Harvard University, has thought up a useful analogy for thinking about the role of productive knowledge in the complexity of an economy:

“Suppose that each type of productive knowledge is a letter and each product is a word composed of these letters. Like the game of Scrabble, each country holds a set of letters with plenty of copies of each letter and tries to make words out of these letters. For instance, with letters like A, C and T, one can construct words like CAT or ACT. Then our problem of measuring economic complexity resembles interpreting how many different letters there are in each country’s portfolio. Some letters, like A and E, go in many words, whereas other letters, like X and Q, are used in very few. Extending this analogy to the countries and products, only those with a larger diversity of letters will be able to make more and more unique products. On the other hand, words that require more letters will be made only in the countries that have all the requisite pieces.”

Not All Exports are Created Equal

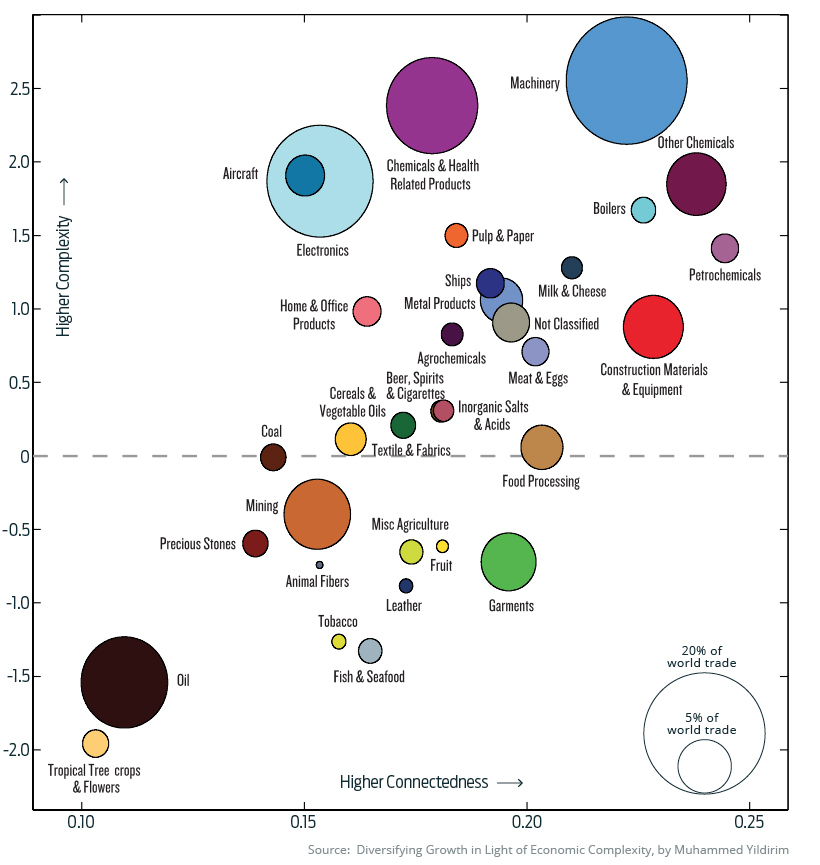

Much like the rack of letters in a Scrabble game, the elements of every export-driven economy can be broken down and quantified. The resulting categories encompass everything from rendered pig fat to integrated circuits, each contributing to the country’s overall score.

Agricultural and extractive industries tend to score lower on the complexity scale. Machinery can be highly complex to produce and is connected to many facets of the global economy.

Visualizing this overall mix of categories can provide a unique perspective beyond big picture numbers like GDP. Below are a few real world examples of export markets on both ends of the complexity spectrum.

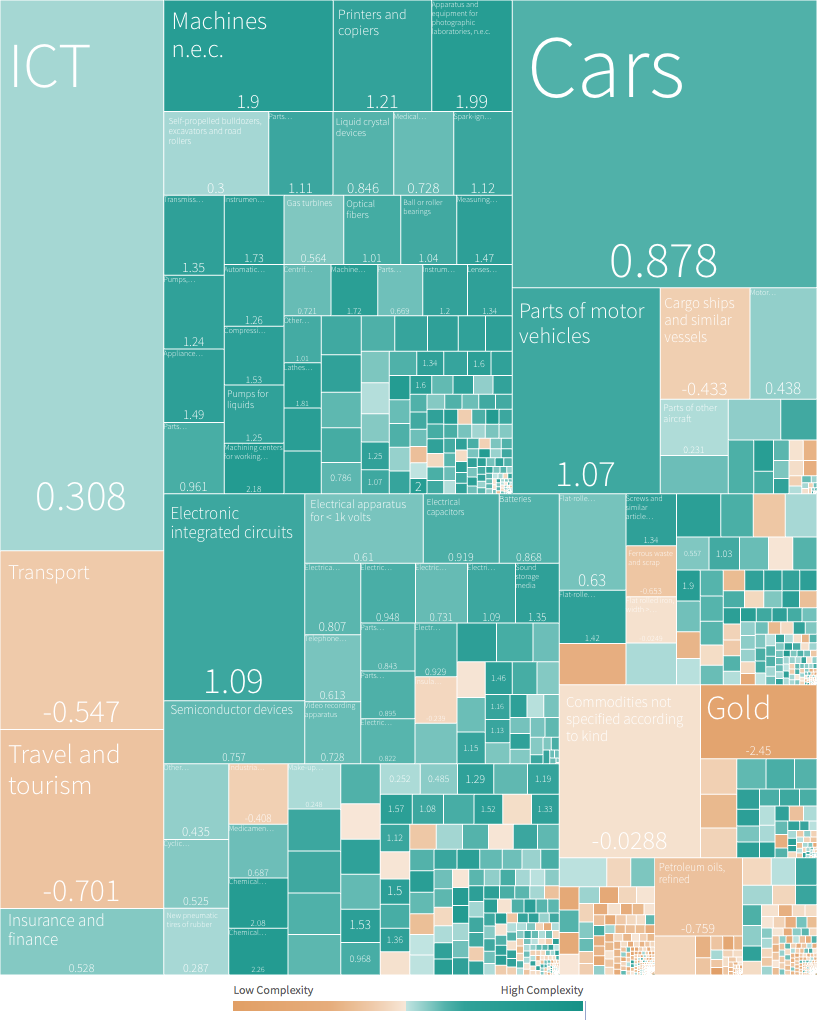

Japan

Since this ranking began in the mid-1990s, Japan has never been bumped from the top spot.

Due to a restricted land mass and some ingenuity, Japan has become the prototypical example of a low-ubiquity, high-sophistication export economy.

Cars and electronics are obvious standouts, but there numerous other high-value product categories in the mix as well. The country also has a wide variety of high value exports and trading partners, lowering the risk of a trade war or industry downturn crippling the country’s economy.

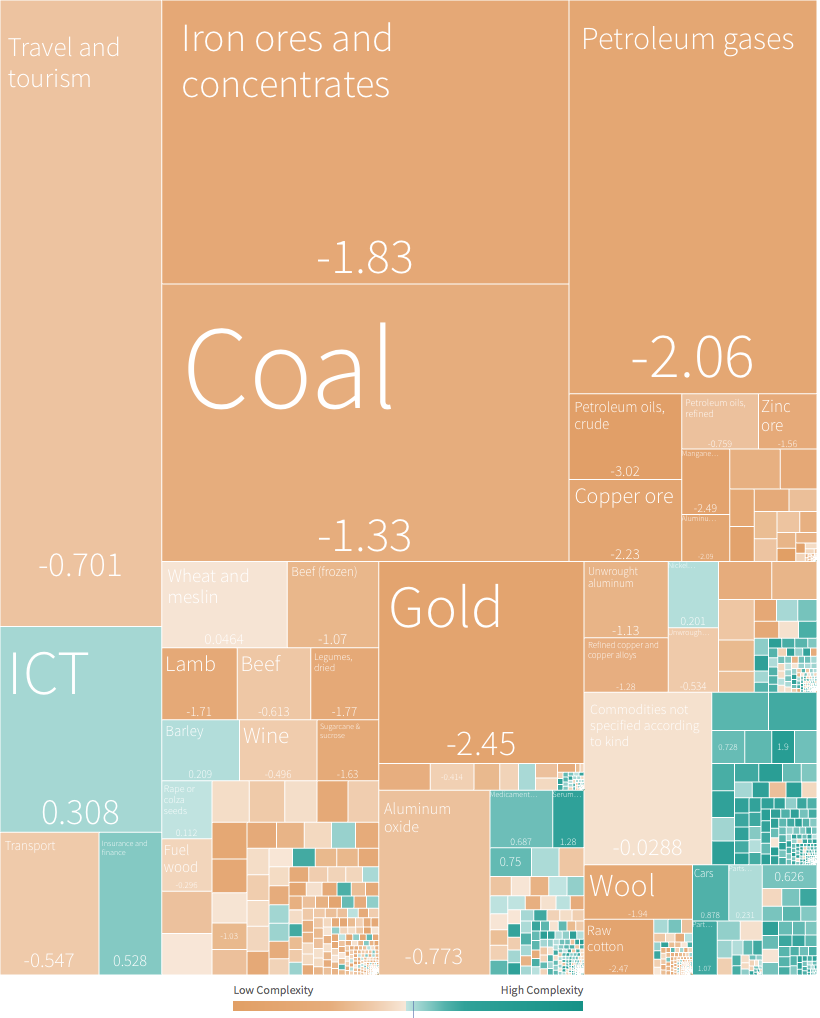

Australia

Many will be surprised to learn that Australia sits in the lower third of this complexity ranking.

Although Australia’s global ranking is high in a myriad of categories – household wealth per person, for example – its economic complexity score is -0.60, much lower than expected for its income level. Looking at the breakdown below, there are clues as to why this might be the case.

Australia’s largest exports are in low complexity categories, such as minerals and agriculture. To compound matters, the country’s economy is heavily linked to China’s. To underscore this point, a recent study found that a 5% drop in China’s GDP would result in a 2.5% dip in Australia’s.

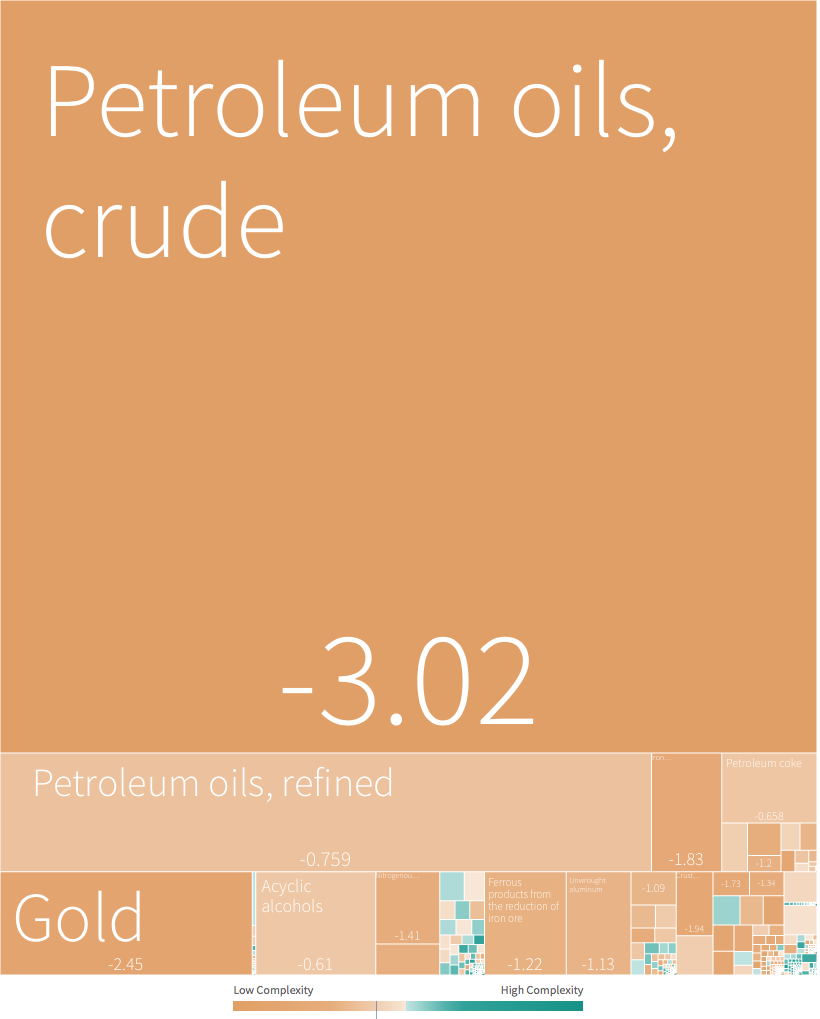

Venezuela

It’s no secret that Venezuela has seen some tough times in recent years. The chart below shows just how reliant Venezuela was on oil exports to sustain its economy.

An over-reliance on a single export can leave a country extremely vulnerable in the event of price volatility or geopolitical events. In the case of Venezuela, three quarters of their export economy was comprised of crude oil – one of the lowest scoring product categories in the ranking.

The Rush to Diversify

A low level of economic complexity isn’t necessarily a problem. Many countries with middle-to-low scores in the ranking have great standards of living and a high level of wealth. Countries like Canada, Norway, and Australia were all well down the list.

On the other hand, some countries have made diversification a priority. SoftBank’s $100 billion Vision Fund is partially the result of Saudi Arabia’s push to develop a diversified, knowledge-based economy. Other oil-rich nations, such as Kazakhstan, are also pushing to diversify in the face of the world’s evolving energy mix.

As world economies evolve and the shift from fossil fuels continues, we will likely see economic complexity increase across the board.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees