Misc

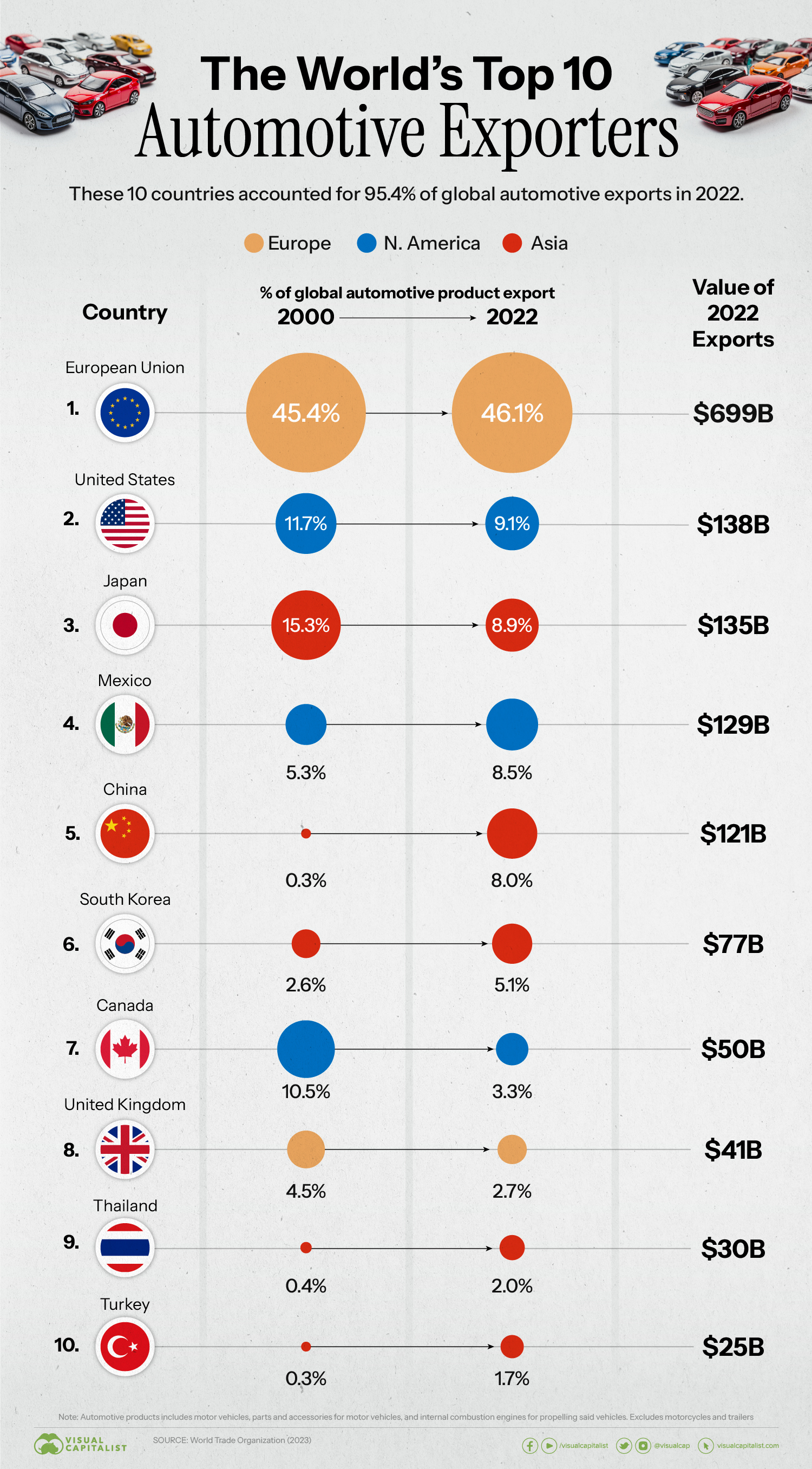

Ranked: The World’s Top 10 Automotive Exporters (2000-2022)

Ranked: The World’s Top 10 Automotive Exporters

According to the European Automobile Manufacturers’ Association, over 85 million motor vehicles were built around the world in 2022.

In this graphic, we add context to this massive figure by ranking the world’s 10 largest automotive exporters. The list is based on data from the World Trade Organization (WTO) and includes countries from nearly every corner of the world, highlighting the global nature of the industry.

Top 10 Exporting Countries

The data we used to create this graphic is included in the table below. It represents each country’s share of the total export value of global automotive products in both 2000 and 2022.

“Automotive products” are defined by the WTO as motor vehicles, parts and accessories for motor vehicles, and internal combustion engines for propelling said vehicles. This grouping excludes motorcycles and trailers.

| Exporter | 2000 (% of world exports) | 2022 (% of world exports) | Change (pp) |

|---|---|---|---|

| 🇪🇺 EU | 45.4% | 46.1% | +0.7 |

| 🇺🇸 U.S. | 11.7% | 9.1% | -2.6 |

| 🇯🇵 Japan | 15.3% | 8.9% | -6.4 |

| 🇲🇽 Mexico | 5.3% | 8.5% | +3.2 |

| 🇨🇳 China | 0.3% | 8.0% | +7.7 |

| 🇰🇷 South Korea | 2.6% | 5.1% | +2.5 |

| 🇨🇦 Canada | 10.5% | 3.3% | -7.2 |

| 🇬🇧 UK | 4.5% | 2.7% | -1.8 |

| 🇹🇭 Thailand | 0.4% | 2.0% | +1.6 |

| 🇹🇷 Türkiye | 0.3% | 1.7% | +1.4 |

| Total | 96.3% | 95.4% | -- |

From this list we can identify which countries have experienced the most growth or decline over the past 22 years.

Countries With the Most Growth Since 2000

The automotive exporters that grew their share of global value the most since 2000 are China (+7.7 pp), Mexico (+3.2 pp), and South Korea (+2.5 pp).

There are clear drivers behind each of these growth stories.

For example, China became the world’s largest car market back in 2009, which accelerated the growth of its domestic automakers. China is also home to some of the world’s biggest automotive suppliers, including Weichai (diesel engines), Hasco Automotive (drivetrain and air conditioning systems), and CATL (EV batteries).

Mexico, on the other hand, has grown its auto industry by enticing global brands to construct their factories there. The country’s competitive edge includes cheaper labor and a land border to the United States.

Finally there’s South Korea, whose growth is largely attributed to Hyundai Motor Company. The Seoul-based automaker recently became the third largest on a global basis, trailing only Toyota and Volkswagen.

Countries With the Biggest Decline Since 2000

The automotive exporters that declined the most since 2000 are Canada (-7.2 pp), Japan (-6.4 pp), and the U.S. (-2.6 pp).

Canada’s auto industry has experienced a steady decline in recent years, though new EV-related investments could turn things around. In March 2022, Stellantis and LG Energy Solutions announced the construction of a $3.5 billion EV battery plant in Windsor, Ontario.

Canada’s automotive industry is largely concentrated in the province of Ontario, which neighbors Michigan, the top state for U.S. car production.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001