China

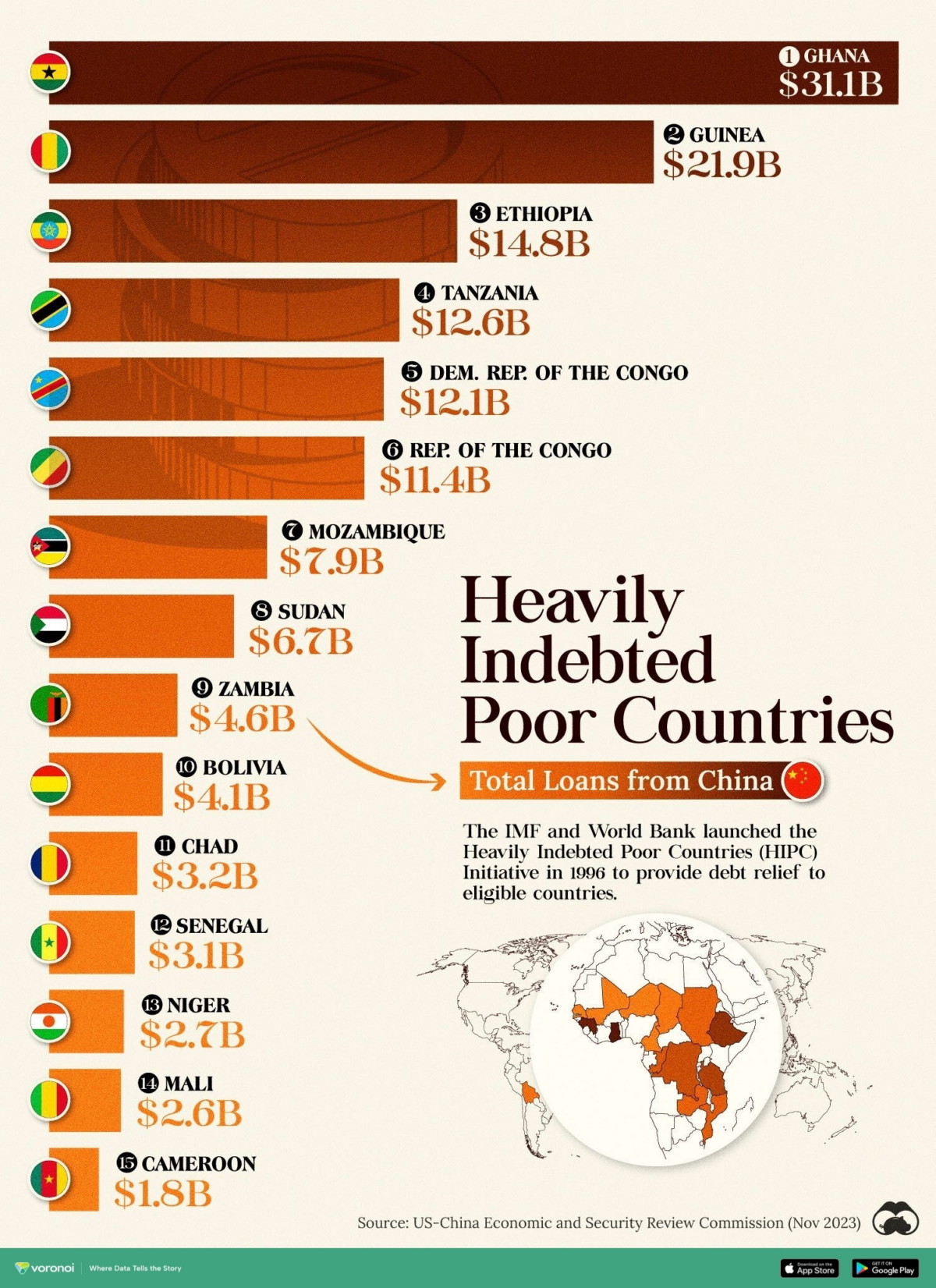

Developing Countries Receiving the Most Loans from China

Which Developed Countries Receive the Most Loans from China?

According to the IMF, the most indebted poor countries in the world all have taken big loans from China.

Critics refer to this as “debt-trap diplomacy,” in which China deliberately provides loans to countries it knows are unable to pay, with the hope of gaining political leverage.

In this infographic we use data from the US-China Economic and Security Review Commission to list heavily indebted countries by their total loans from China.

China’s Massive Belt and Road Initiative

Much of China’s loans are part of the country’s wider investments in global infrastructure: the Belt and Road Initiative (BRI).

Launched in 2013 and also referred to as the New Silk Road, the BRI stands as one of the most ambitious infrastructure projects ever conceived. Its goal is to create a vast network of railways, energy pipelines, highways, and streamlined border crossings.

In the process, Chinese state-owned creditors rapidly scaled up the provision of foreign currency-denominated loans to resource-rich countries, specially in Africa.

| Country | Loans from China | Region |

|---|---|---|

| 🇬🇭 Ghana | $31.1B | 🌍 Sub-Saharan Africa |

| 🇬🇳 Guinea | $21.9B | 🌍 Sub-Saharan Africa |

| 🇪🇹 Ethiopia | $14.8B | 🌍 Sub-Saharan Africa |

| 🇹🇿 Tanzania | $12.6B | 🌍 Sub-Saharan Africa |

| 🇨🇩 Democratic Republic of the Congo | $12.1B | 🌍 Sub-Saharan Africa |

| 🇨🇬 Republic of the Congo | $11.4B | 🌍 Sub-Saharan Africa |

| 🇲🇿 Mozambique | $7.9B | 🌍 Sub-Saharan Africa |

| 🇸🇩 Sudan | $6.7B | 🌍 Sub-Saharan Africa |

| 🇿🇲 Zambia | $4.6B | 🌍 Sub-Saharan Africa |

| 🇧🇴 Bolivia | $4.1B | 🌎Latin America and the Caribbean |

| 🇹🇩 Chad | $3.2B | 🌍 Sub-Saharan Africa |

| 🇸🇳 Senegal | $3.1B | 🌍 Sub-Saharan Africa |

| 🇳🇪 Niger | $2.7B | 🌍 Sub-Saharan Africa |

| 🇲🇱 Mali | $2.6B | 🌍 Sub-Saharan Africa |

| 🇨🇲 Cameroon | $1.8B | 🌍 Sub-Saharan Africa |

Among the heavily indebted countries, 14 of 15 are African nations, many of the poorest in the world, like Sudan, Niger, Mozambique, Chad, and the Democratic Republic of Congo. The sole non-African country on the list, Bolivia, is also one of the poorest nations in South America.

According to the US-China Economic and Security Review Commission, 60% of China’s debtor nations were in financial distress in 2022, up from 5% in 2010.

In addition to gaining preferential infrastructure accesses, China is gaining political allies. Many countries on this list, like the Republic of the Congo, have publicly supported China’s positions in Hong Kong and in the South China Sea.

Markets

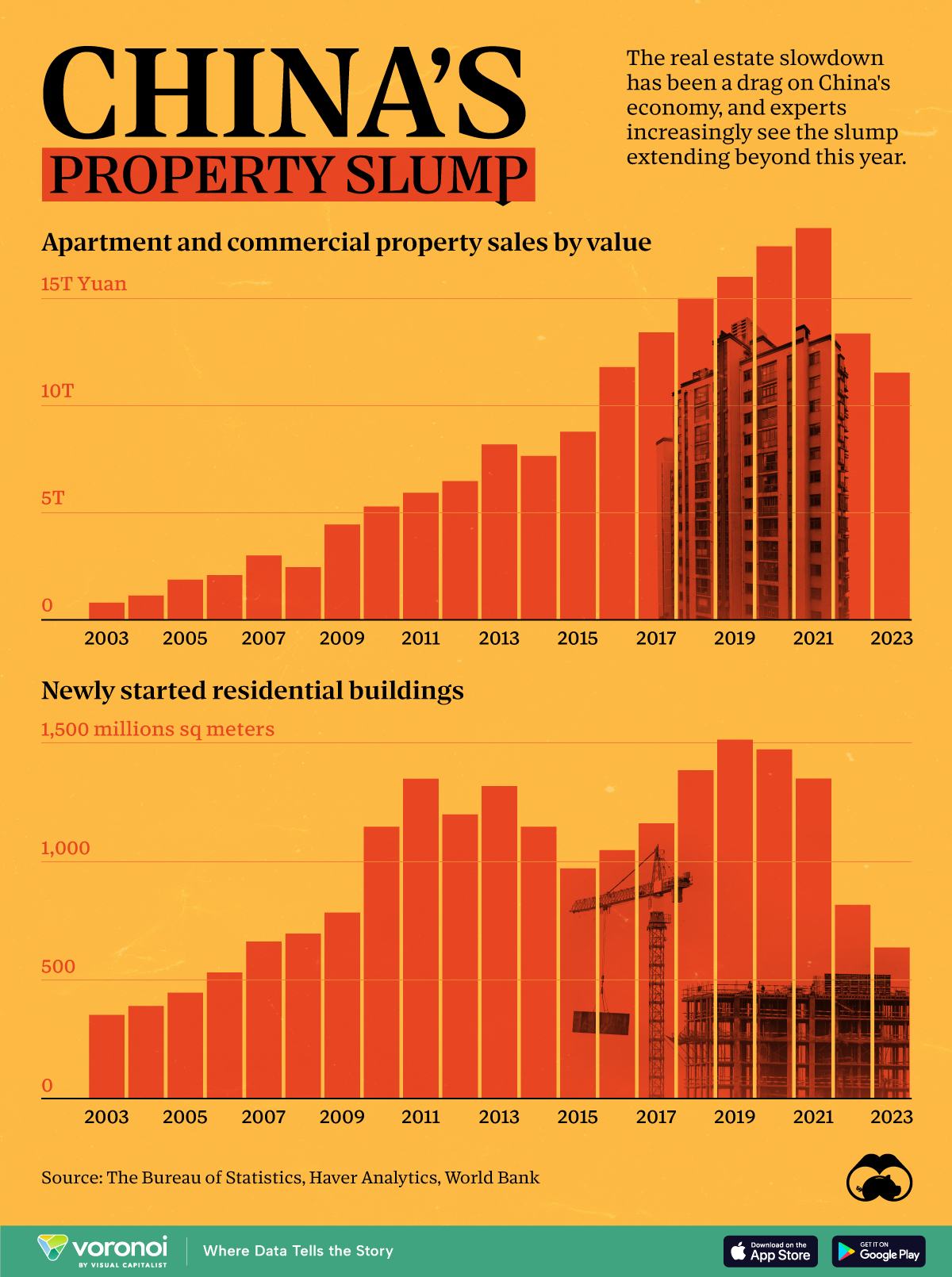

China’s Real Estate Crisis, Shown in Two Charts

These charts show China’s real estate boom in the 21st century and the subsequent slowdown since 2022.

Visualizing China’s Real Estate Boom and Crisis

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Evergrande—once China’s largest real estate developer—was forced to liquidate on January 28th. It was yet another strike against the country’s now fledgling real estate market, adding to a growing list of China’s economic worries.

In the charts above we show two annual metrics related to China’s real estate crisis from 2003 to 2023. The first looks at apartment and commercial property sales using Burreau of Statistics data from Bloomberg, and the second examines new housing starts using data from the World Bank.

Things to Know About China’s Property Slump

Property sales by value in China climbed pretty steadily from less than ¥1 trillion RMB in 2003 to over ¥15 trillion in 2021, but have since dropped to under ¥12 trillion in 2023.

This was the case across both residential and commercial sales. In China’s residential market specifically, new home sales dropped 6% in 2023, with secondhand home prices declining in major cities.

And on the development side, new residential developments have fallen 58% from 1,515 million m² in 2019 to 637 million m² in 2023.

| Year | New Residential Building Developments (million sq meters) |

|---|---|

| 2023 | 637.4 |

| 2022 | 817.3 |

| 2021 | 1,350.2 |

| 2020 | 1,473.4 |

| 2019 | 1,514.5 |

| 2018 | 1,385.4 |

| 2017 | 1,160.9 |

| 2016 | 1,047.8 |

| 2015 | 970.8 |

| 2014 | 1,146.4 |

| 2013 | 1,318.5 |

| 2012 | 1,199.1 |

| 2011 | 1,349.4 |

| 2010 | 1,147.2 |

| 2009 | 784.9 |

| 2008 | 695.4 |

| 2007 | 662.3 |

| 2006 | 531.8 |

| 2005 | 446.5 |

| 2004 | 390.0 |

| 2003 | 352.4 |

| 2002 | 276.5 |

Here are a few more things to know about the ongoing real estate crisis in China:

- Developer Defaults: Real estate firms faced $125 billion in bond defaults between 2020 and 2023.

- Economic Impact: The property sector’s slump has dragged down China’s economy, leading to layoffs and financial instability.

- Getting Creative: Municipalities, many of which rely on land sales as a key source of income, have been introducing “old-for-new” support measures meant to stimulate new home purchases.

Experts predict a prolonged downturn, with many people souring on Chinese investments, but exactly how things will develop after Evergrande’s collapse is unclear.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)