Globalization

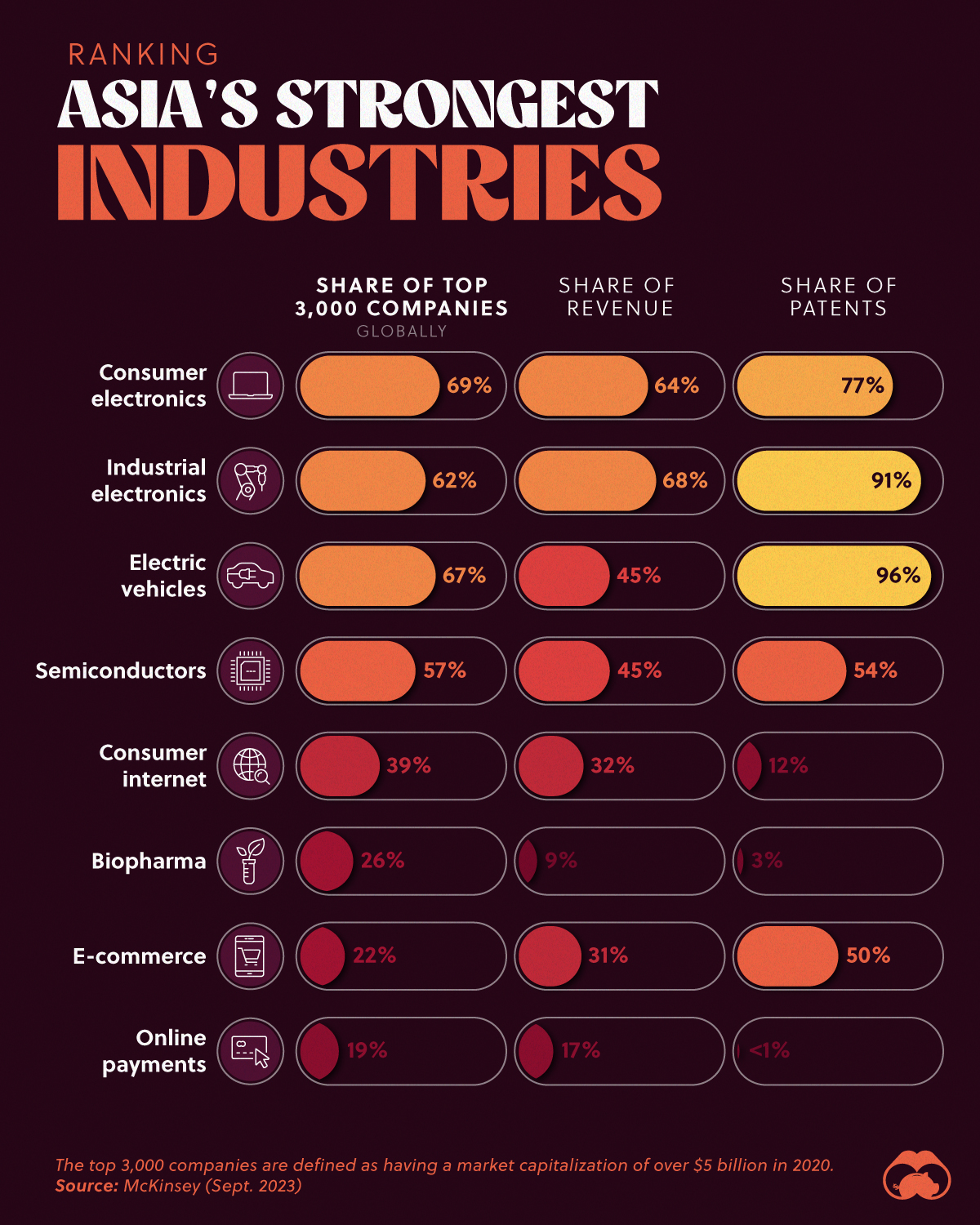

Charted: The Industries Where Asian Companies are the Strongest

The Industries Where Asian Companies are the Strongest

The last 30 years of globalization have benefited Asia greatly.

As a result of deepening trade relations and access to other markets, Asian companies have grown in output and prominence. But which sectors do they excel in?

Using data from McKinsey Global Institute we visualize Asian companies’ share of the top 3,000 global companies, broken down by industry, revenue, and patent share.

A top 3,000 company was defined as having a market capitalization of over $5 billion in 2020.

Ranking Asia’s Strongest Industries

Unsurprisingly, among the top 3,000 companies globally, Asian companies are most prevalent in the manufacturing sector. Specifically, the region’s strength is in industries like consumer electronics, industrial electronics, electric vehicles, and semiconductors.

For many Asian countries, manufacturing is the bulwark of the economy. In Asia’s largest economy, China, the manufacturing sector accounts for nearly one-third of economic output. In Asia’s 13th largest economy, Vietnam, it accounts for almost one-fourth of gross domestic product.

However, manufacturing isn’t all what Asia is known for anymore. Here’s a full list of the top Asian companies’ share in various industries.

| Industry | Asian Share of Top 3,000 Companies | Revenue Share (%) | Patent Share (%) |

|---|---|---|---|

| Consumer electronics | 69% | 64% | 77% |

| Industrial electronics | 62% | 68% | 91% |

| Electric vehicles | 67% | 45% | 96% |

| Semiconductors | 57% | 45% | 54% |

| Consumer internet | 39% | 32% | 12% |

| Biopharma | 26% | 9% | 3% |

| E-commerce | 22% | 31% | 50% |

| Online payments | 19% | 17% | <1% |

Note: The top 3,000 companies list is industry agnostic; companies are classified by sector according to their main business.

Another fast-growing industry where Asian companies are thriving is in the consumer internet services space. Asia is home to half of the world’s internet users, which is driving innovation within the region’s online services industry.

And even though Asia is home to “only” 22% of e-commerce companies within the top 3,000, these firms accounted for 50% of patents granted.

Five Distinct “Asias”

Asia is of course a vast place, and for this reason McKinsey divides the Asia-Pacific region into five distinct “Asias” to get a more granular view. For the most part, they use UN country groupings here, though McKinsey notes it excludes parts of Western Asia (i.e. the Middle East) due to dissimilarities with other Asia-Pacific economies:

- Advanced Asia: High per-capita GDP, urbanization, and connectivity. Includes Australia, New Zealand, Japan, South Korea, and Singapore.

- China: 18% of global GDP and population.

- Emerging Asia: Southeast Asia, strong regional connections and trade. Includes Indonesia, Vietnam, Thailand, and others.

- India: 18% of global population but only 3% of global GDP.

- Frontier Asia: Limited integration, large populations and potential. Includes Pakistan, Bangladesh, Sri Lanka, and others.

McKinsey noted that the region is economically integrated—without formal political governance and despite sometimes being at odds with each territorially—with 59% of Asian trade done with other Asian countries.

Politics

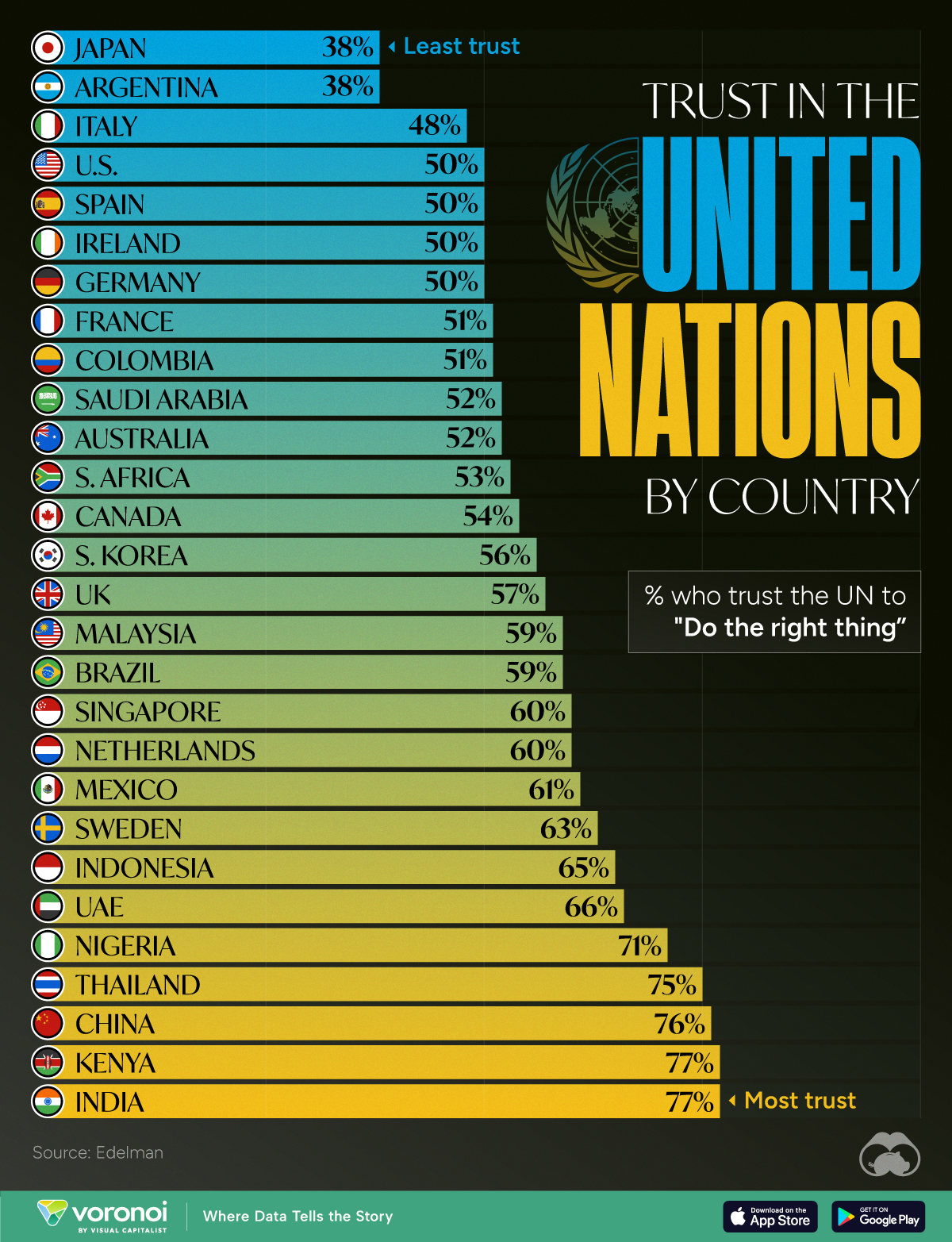

Charted: How Much Do Countries Trust the United Nations?

Which countries trust the United Nations to do the right thing the most, and the least?

How Much Do Countries Trust the United Nations?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Do you trust the United Nations (UN) in carrying out its objectives of maintaining peace and security, protecting human rights, and upholding international law?

Survey results from Edelman’s 2024 Trust Barometer Global Report show that some countries’ citizens believe strongly in the UN to “do the right thing,” while others are less trusting.

Ranked: 28 Countries Trust Levels in the United Nations in 2024

To gauge trust in the United Nations, Edelman surveyed more than 32,000 respondents between 28 countries in November 2023. Each country sample of 1,150 people is statistically significant and representative.

According to the results, respondents from Japan and Argentina had the least amount of trust in the UN when it came to “doing the right thing.”

| Country | % who trust the UN to "Do the right thing" |

|---|---|

| 🇯🇵 Japan | 38% |

| 🇦🇷 Argentina | 38% |

| 🇮🇹 Italy | 48% |

| 🇺🇸 U.S. | 50% |

| 🇪🇸 Spain | 50% |

| 🇮🇪 Ireland | 50% |

| 🇩🇪 Germany | 50% |

| 🇫🇷 France | 51% |

| 🇨🇴 Colombia | 51% |

| 🇸🇦 Saudi Arabia | 52% |

| 🇦🇺 Australia | 52% |

| 🇿🇦 South Africa | 53% |

| 🇨🇦 Canada | 54% |

| 🇰🇷 South Korea | 56% |

| 🇬🇧 UK | 57% |

| 🇲🇾 Malaysia | 59% |

| 🇧🇷 Brazil | 59% |

| 🇸🇬 Singapore | 60% |

| 🇳🇱 Netherlands | 60% |

| 🇲🇽 Mexico | 61% |

| 🇸🇪 Sweden | 63% |

| 🇮🇩 Indonesia | 65% |

| 🇦🇪 UAE | 66% |

| 🇳🇬 Nigeria | 71% |

| 🇹🇭 Thailand | 75% |

| 🇨🇳 China | 76% |

| 🇰🇪 Kenya | 77% |

| 🇮🇳 India | 77% |

Just 38% of Japanese and Argentinian people had faith in the UN, by far the lowest levels of trust. Only one other country was below the 50% trust mark: Italy at 48%.

Many major economies and G7 countries had trust levels hovering between 50–60%, including the U.S. and Germany at 50% and the UK at 57%.

Meanwhile, India and Kenya had the highest levels of trust in the UN at 77%, with China right behind at 76%. In general, African and Asian nations tended to have higher levels of trust in the UN, though there were exceptions like South Africa (53%) and South Korea (56%)

It’s also worth noting that views within countries can differ significantly. Separate data on this topic from Pew Research shows that public opinion of the UN is split along ideological lines. In the U.S., there’s a 45 percentage point difference, with more conservative respondents having significantly lower trust in the UN.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees