Technology

An Investing Megatrend: How Technological Breakthroughs are Shaping the Future

Since Apple released the first iPhone in 2007, few industries have been left unaffected.

This transformational device is a prototypical example of a technological breakthrough. It was a tipping point in turning entire business models upside-down, while also impacting our everyday lives at a more fundamental level.

New growth opportunities emerged from the ensuing disruption, while many status quo solutions were rendered obsolete.

Technological Game-Changers

Today’s infographic from BlackRock highlights the pervasive and positive impact that technological breakthroughs can have on the global economy.

Fueling the Flames of Innovation

According to recent data from Accenture, it’s estimated that 71% of businesses are on the brink of being disrupted.

In fact, disruptive innovation most often emerges in two scenarios:

- New solutions to existing problems or challenges that have proven difficult to solve

- New competitors in highly profitable sectors with historically high returns

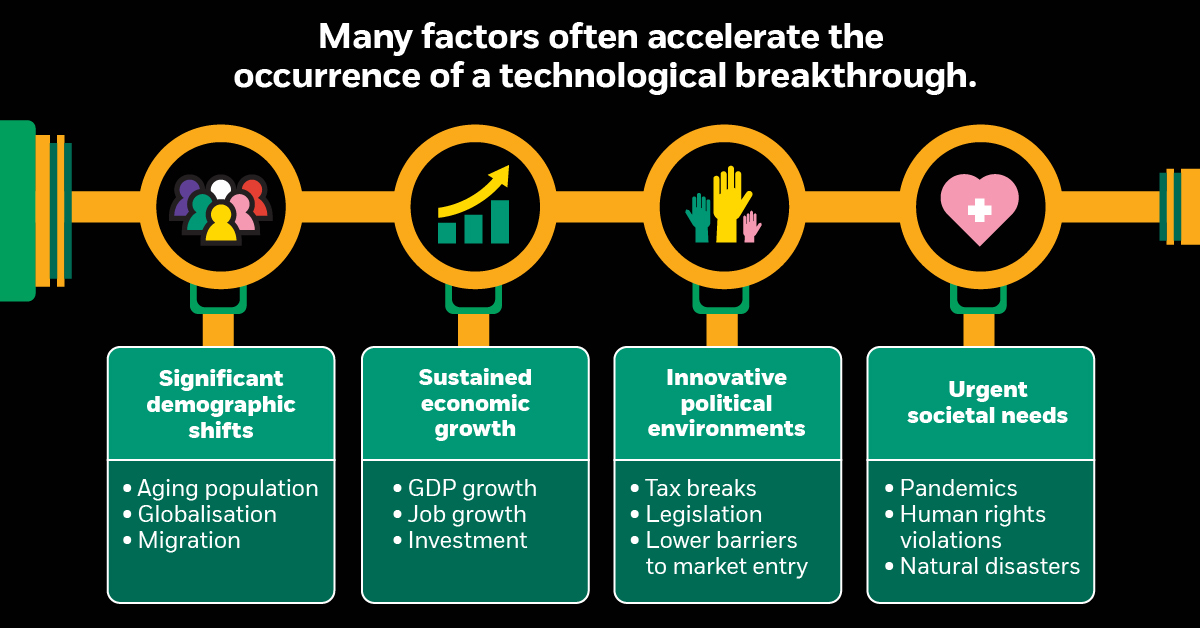

The occurrence of technological breakthroughs can also be accelerated through several factors, including significant demographic shifts, sustained economic growth, innovative political environments, and urgent societal needs.

Technological Adoption is Speeding Up

Breakthrough inventions have always sent ripple effects throughout society, but today those ripples are travelling faster than ever.

Moore’s Law – the assertion that number of components in a dense integrated circuit (i.e., transistors, resistors, diodes, or capacitors) will double every year, while still getting cheaper – is one factor. Similar examples of staggering increases in utility for less cost can be found in a number of other instances, from DNA sequencing to data storage.

The rate of technological adoption is also speeding up. For example, consider the mobile phone─due to the price point and ease of use, the number of U.S. adults with a cell phone jumped from 10% in 1994 to over 96% in 2019. This is also evident in new technologies such as smart speakers, where the adoption rate in the U.S. is expected to double to 55% in less than 3 years.

Breakthrough Investment Opportunities

Where innovation leads, investment usually follows. However, predicting which technological innovations will have a lasting impact on society has often proved difficult.

Instead, investors can track the wider trends that often spark technological disruption, in order to unlock potential opportunities:

- Research and Development Funding:

The number of investments in emerging technologies is growing. Tech company acquisitions also totalled US$278 billion by Q2 2018—a 50% increase from the year before. - The Future Workforce:

Historically, productivity gains have increased the demand for more skilled labour. Technical and soft skills are top priorities for employers for their future teams, and it it’s projected that the amount of hours that workers spend using technological skills will increase by 55% from 2016 to 2030. - Shifts in Consumer Demand:

Companies aware of these factors should seek to incorporate innovations into their platforms for a more customer-centric experience. - Societal Needs:

Persistent global social issues such as access to better healthcare are drivers of innovative solutions that offer a better quality of life. Symphony Post-Acute Network harnessed artificial intelligence (AI) and machine learning (ML) to be able to offer personalised healthcare for over 80,000 patients─cutting costs by more than US$13,000 per patient.

Future Impact of Technological Innovation

Technological change will likely continue to accelerate, and investors should tailor their portfolios accordingly.

At the same time, traditional barriers to entry for new competitors are consistently being eroded by these breakthroughs, sending industries into flux and creating potential new opportunities.

Humanity’s co-evolution with technology will continue to profoundly impact the economy, while improving life on Earth in unimaginable ways.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees