Technology

The Fight for Smart Speaker Market Share

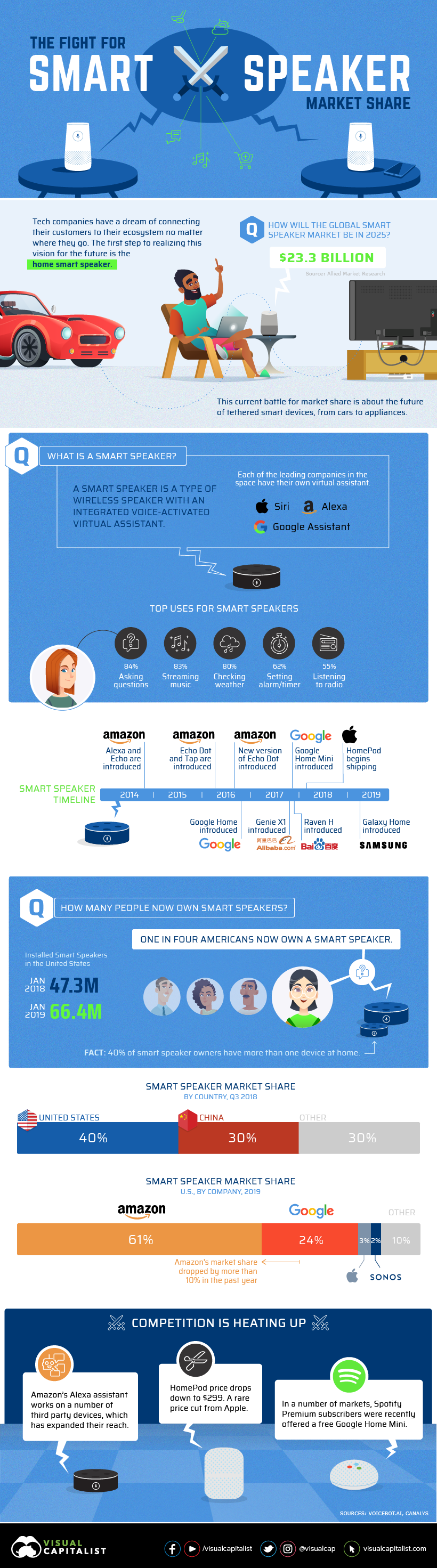

Tech companies are betting that the future of personal computing will be driven by the sound of your voice.

If they’re right, this early stage of smart speaker adoption will have a massive impact on future profits. Switching smartphone brands is relatively straightforward, but switching an entire voice assistant ecosystem? That’s not quite as easy.

Voice Assistants like Siri and Alexa will transform behavior inside the home. At the center of that behavior is a smart speaker, serving as the hub of a connected lifestyle.

– Andy Chambers, Vice President of Connected Home, Assurant

Today’s infographic is an overview of the rapidly expanding smart speaker market, and how the major players in the space are competing for critical early market share.

Moving towards Majority

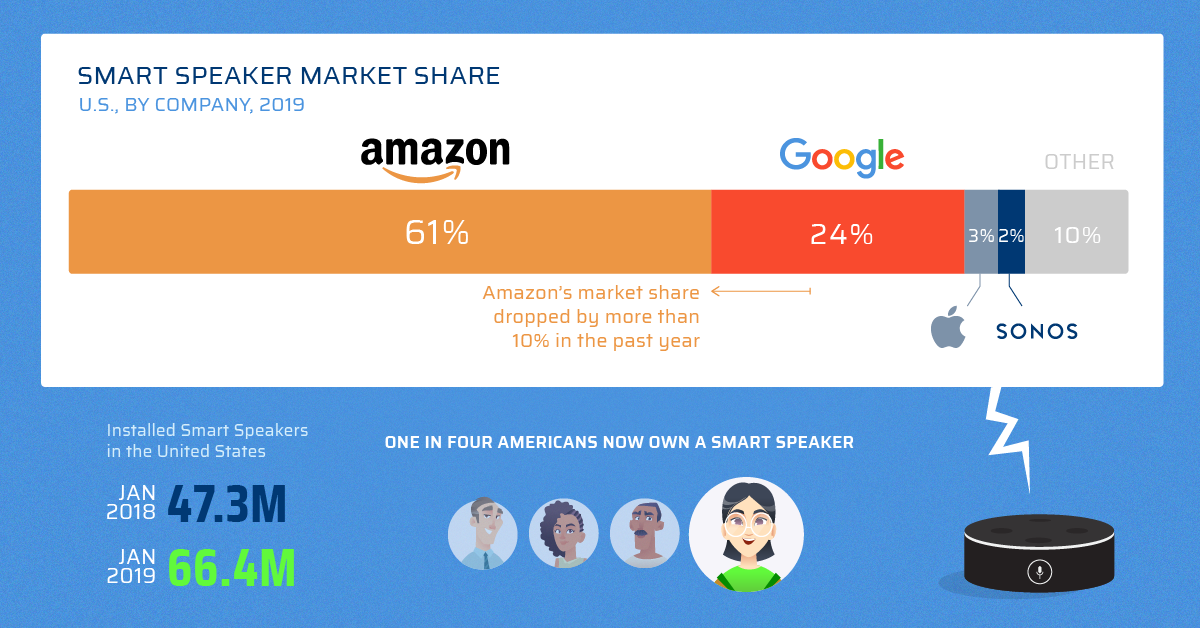

Adoption of smart speakers really began to gain traction with consumers in 2018, when the percentage of American adults with such a device passed the 20% mark. Today, the U.S. adoption rate sits at about 25%, and by 2022, it’s expected to more than double to 55%.

In just one year, China’s global share of the smart speaker market went from almost zero to 30%, and the country’s smart home market was valued at over $7 billion. Companies like Baidu and Alibaba are fighting their own battle for domestic market share.

Amazon’s Head Start

It has now been almost five years since Amazon announced Alexa and the Echo to the world, kicking off the age of the smart speaker.

The sting of Amazon’s failed foray into the smartphone market was still fresh, and the initial reaction to a device listening inside the home was mixed. That said, Amazon’s huge built-in customer base and two-year head start was enough to bag a hefty portion of the smart speaker market. Now, other brands are playing catch-up.

Here’s a look at U.S. smart speaker market share by device:

| Company | Device | Voice Assistant | Market Share |

|---|---|---|---|

| Amazon | Echo Dot | Alexa | 31.4% |

| Amazon | Echo or Plus | Alexa | 23.2% |

| Home | Google Assistant | 11.2% | |

| Home Mini | Google Assistant | 11.2% | |

| Amazon | Echo Spot | Alexa | 3.5% |

| Amazon | Echo Show | Alexa | 3.0% |

| Apple | HomePod | Siri | 2.7% |

| Sonos | One | Alexa | 2.2% |

| Home Hub | Google Assistant | 1.2% | |

| Home Max | Google Assistant | 0.2% |

The Fight is Heating Up

Companies are responding to Amazon’s market dominance in different ways.

Apple recently dropped the price of its HomePod smart speaker to $299, a rare price cut for a company that is used to people lining up to buy its products. Unlike its competitors, Apple can’t go all-in on using the device as a “loss leader” to support advertising or e-commerce. HomePod is positioned as a more premium product, but price will be a sticking point for many.

Google, on the other hand, is taking a drastically different approach. The company released the Google Home Mini as a cost effective entry point for consumers looking to try out a voice-directed device.

As well, Google partnered with Spotify to offer Home Minis as a free promotion for Spotify Premium customers. Spotify’s premium userbase is nearly 90 million, so if even a fraction of users take the free offer, a massive influx of Google smart speakers will enter the market.

Over the last year, Amazon saw over 10% of its market share chipped away by competitors, and Google accounted for about half of that loss.

What’s Next? It’s Hard to Say

With the promise of future connected home profits on the line, it’s hard to say what lengths companies will go to outmanoeuver each other. One thing is clear though, the overall smart speaker market is still in the midst of a major growth cycle, and we’re just seeing the beginning of what’s possible with voice-directed devices.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023