Technology

Cents and Sounds: How Music Streaming Makes Money

How Music Streaming Makes Money

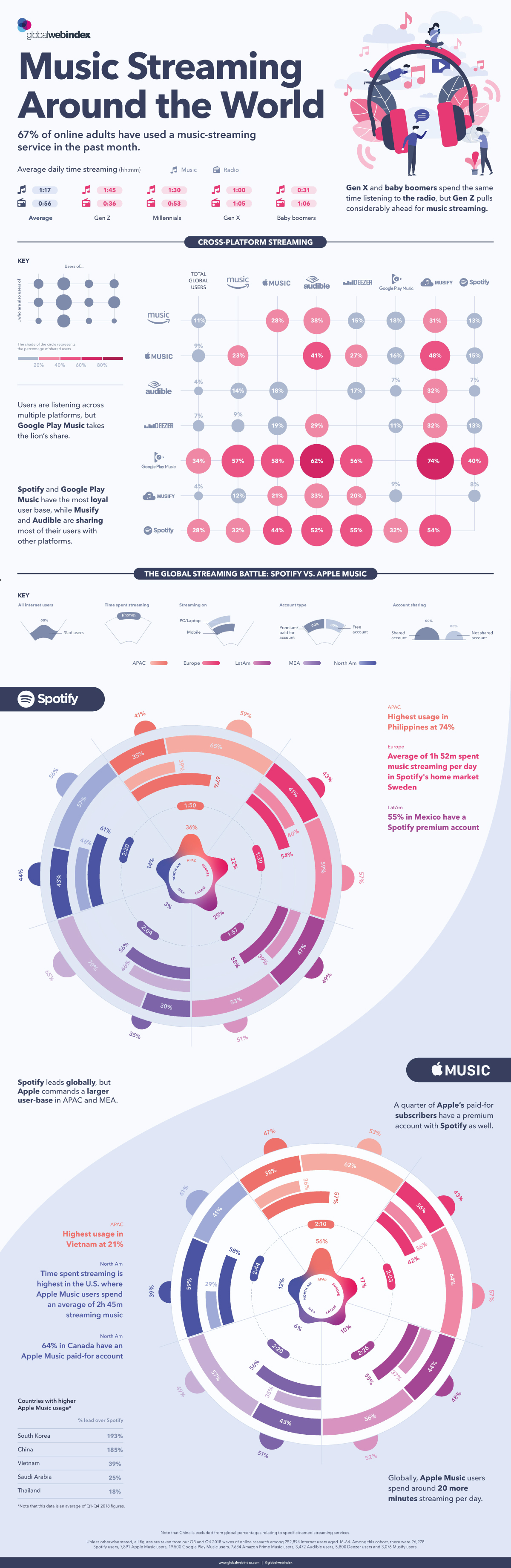

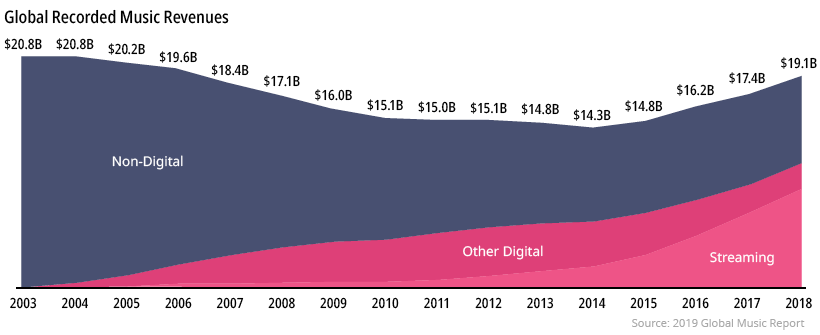

The global music market experienced its fourth consecutive year of growth in 2018, generating over $19 billion in revenue. Music streaming now accounts for almost half of that revenue, with 255 million paid users worldwide.

Today’s infographic from Global Web Index compares the popularity of streaming services, exploring how streaming behavior differs by age group and region.

While listeners can now gain access to an abundance of streaming options—is the success of the industry good news for everyone?

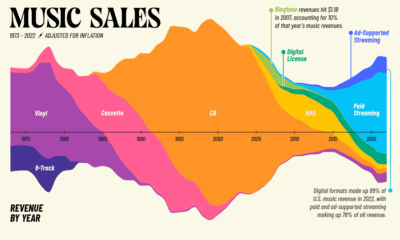

The Age of Streaming

Streaming platforms are web-based services that allow users to listen to high-definition music without having to download and store large files.

The foundations of music streaming were laid by peer-to-peer file sharing system Napster when it was created in 2001, followed by Apple’s iTunes a couple of years later. Spotify, in an attempt to combat music piracy, was founded in 2006 by Swedish duo Daniel Ek and Martin Lorentzon.

Today, 68% of adults use a music streaming service of some kind. According to Global Web Index, Gen Z leads the way with the highest average streaming times, accessing their favorite tracks across multiple platforms.

How Streaming Platforms Make Money

There are currently 33 active streaming platforms available, with a range of different features and characteristics available. Spotify and Apple Music, the largest of the streaming giants, rely on almost identical models to generate revenue:

- Paid Subscriptions: Advertising drives free users towards monthly subscription packages, which include a premium offering for $10 a month and a family offering for $15 a month.

- Advertising: Advertisers pay for exposure, with ads played every 15 minutes for 30 seconds, and can also include sponsored playlists, and homepage takeovers.

Spotify

With 217 million active users, and revenues of almost $6 billion in 2018, Spotify is the global leader in music streaming.

For Spotify, 91% of the company’s revenue comes from its 100 million paid subscriptions—double that of Apple Music—while the other 9% comes from advertising.

Apple Music

Apple’s streaming service commands a larger user-base than Spotify in the Asia Pacific and the Middle East and Africa regions.

While Apple Music has not been a profitable move for the company, the streaming platform bolsters Apple’s ecosystem of services—encouraging a more loyal consumer base.

How Artists Make Money

For both Spotify and Apple Music, 70% of the revenue generated from paid subscriptions and advertising goes towards paying music labels and artists.

Both platforms use the pro-rata model, which pays based on the total share of streams each artist has. For example, if $100 million is generated in revenue, and an artist accounts for 1% of all streams, then they would receive $1 million in royalties.

However, artists advocate for a fairer, more user-centric model that would pay artists based on who each user listens to the most, using their subscription fee. Smaller platforms like Deezer are moving towards a user-centric model and pressuring more established platforms to do the same.

The Future of Streaming

Over the next decade, the music streaming industry will continue to transform, with new innovations presenting significant opportunities and challenges for both streaming platforms and consumers alike.

- Personalization: Streaming platforms are using technology to fully understand a user’s listening habits and to tailor music recommendations directly to them.

- Original Content: Spurred on by the growth of streaming services like Netflix and YouTube, Spotify’s purchase of Gimlet Media for over $200 million signals the beginning of streaming platforms investing in original content.

- Premium Prices: Artists and music labels are demanding more for music, forcing streaming platforms to hike their subscription rates in an attempt to make up for lost revenue.

- Live Streaming: With live streaming rising in popularity, artists can offer audiences an intimate connection and more authentic version of their music.

Currently, artists can increase their chances of being featured on more playlists and ultimately earn more money by altering their music based on streaming platform algorithms. For example, artists only get paid if their song is listened to for 30 seconds, which results in much shorter songs that open with the chorus to keep the listener’s attention.

While streaming platforms continue to provide more avenues for artists to get in front of the right ears, many industry critics argue that music is no longer about creating something for pure enjoyment, but rather about using a formulaic approach to make more money.

Is the future of music safe in the hands of tech giants?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science7 days ago

Science7 days agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023