Markets

The 20 Best-Performing Stocks of the Decade

The 20 Best-Performing Stocks of the Last Decade

Hindsight is 20/20. It can be incredibly difficult to pick the “next big stock” in the moment, but looking back gives us clarity on where we could have reaped the highest rewards. While some of the decade’s chart-toppers—like Netflix and Amazon—are household names, other stocks may come as a surprise.

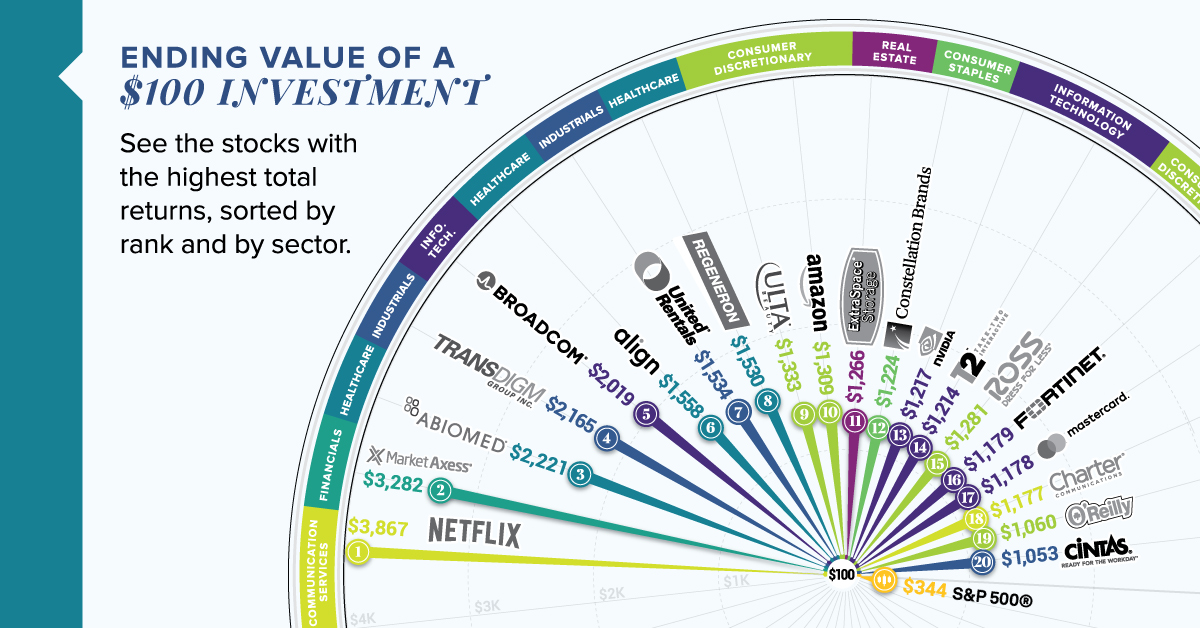

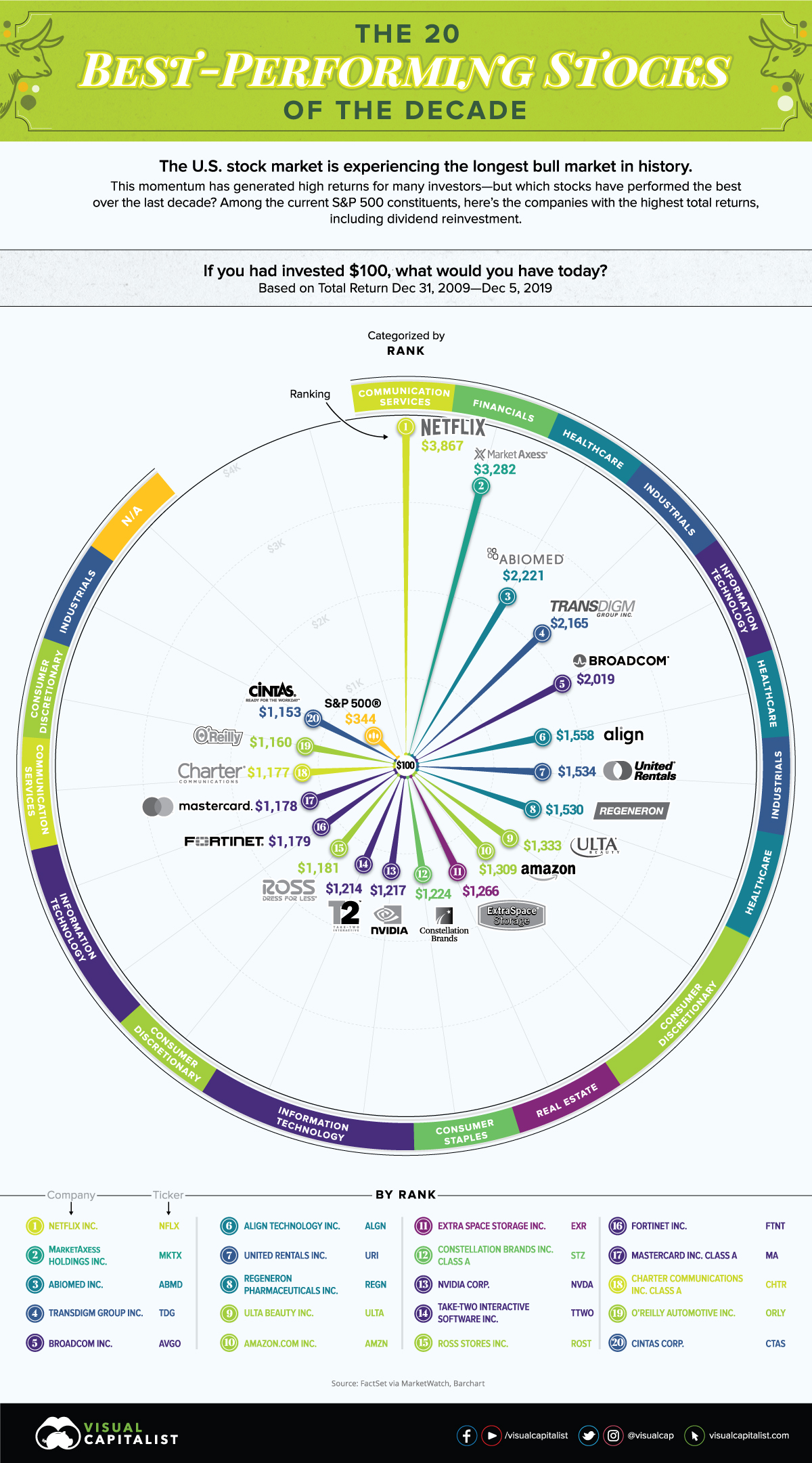

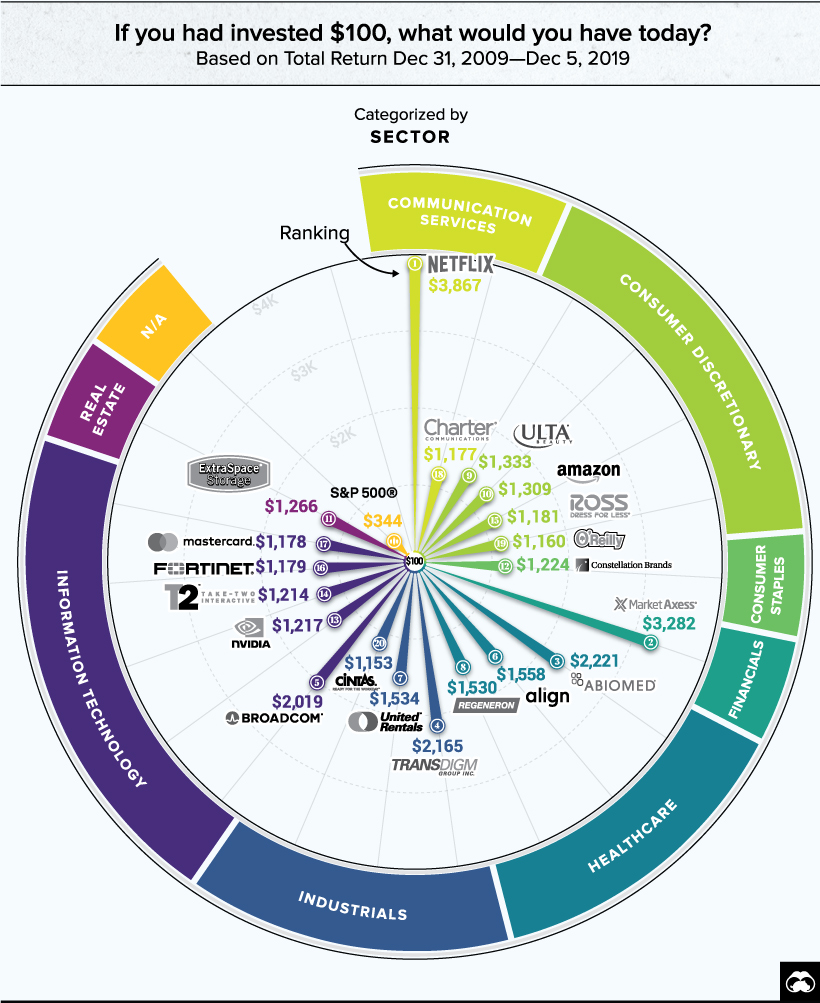

Today’s visualization reveals the best-performing stocks over the last 10 years, and shows how much an initial $100 investment would be worth today.

The Shortlist

To compile the list, MarketWatch reviewed the current S&P 500 constituents and excluded any stocks that have traded in their present form for less than 10 years. The remaining companies were sorted based on their total return, with reinvested dividends, from December 31, 2009 to December 5, 2019.

So, which stocks come out on top? Here’s a full list of the top 20, organized by ranking:

| Rank | Company | Ticker | Final Value of $100 Investment | S&P 500 Sector |

|---|---|---|---|---|

| 1 | Netflix Inc. | NASDAQ: NFLX | $3,867 | Communication Services |

| 2 | MarketAxess Holdings Inc. | NASDAQ: MKTX | $3,282 | Financials |

| 3 | Abiomed Inc. | NASDAQ: ABMD | $2,221 | Health Care |

| 4 | TransDigm Group Inc. | NYSE: TDG | $2,165 | Industrials |

| 5 | Broadcom Inc. | NASDAQ: AVGO | $2,019 | Information Technology |

| 6 | Align Technology Inc. | NASDAQ: ALGN | $1,558 | Health Care |

| 7 | United Rentals Inc. | NYSE: URI | $1,534 | Industrials |

| 8 | Regeneron Pharmaceuticals Inc. | NASDAQ: REGN | $1,530 | Health Care |

| 9 | Ulta Beauty Inc. | NASDAQ: ULTA | $1,333 | Consumer Discretionary |

| 10 | Amazon.com Inc. | NASDAQ: AMZN | $1,309 | Consumer Discretionary |

| 11 | Extra Space Storage Inc. | NYSE: EXR | $1,266 | Real Estate |

| 12 | Constellation Brands Inc. Class A | NYSE: STZ | $1,224 | Consumer Staples |

| 13 | Nvidia Corp. | NASDAQ: NVDA | $1,217 | Information Technology |

| 14 | Take-Two Interactive Software Inc. | NASDAQ: TTWO | $1,214 | Information Technology |

| 15 | Ross Stores Inc. | NASDAQ: ROST | $1,181 | Consumer Discretionary |

| 16 | Fortinet Inc. | NASDAQ: FTNT | $1,179 | Information Technology |

| 17 | Mastercard Inc. Class A | NYSE: MA | $1,178 | Information Technology |

| 18 | Charter Communications Inc. Class A | NASDAQ: CHTR | $1,177 | Communication Services |

| 19 | O'Reilly Automotive Inc. | NASDAQ: ORLY | $1,160 | Consumer Discretionary |

| 20 | Cintas Corp. | NASDAQ: CTAS | $1,153 | Industrials |

Note: The final value of a $100 investment is based on the total return, with reinvested dividends, from December 31, 2009 – December 5, 2019.

In comparison, $100 in the S&P 500 index overall would have amounted to $344 over the same time period. Let’s take a closer look at these strong performers.

Household Names

Streaming giant Netflix takes the #1 spot. The company earned a staggering 3,767% return over the last ten years, meaning an initial $100 investment would now be worth almost $4,000. However, it remains to be seen whether Netflix’s first mover advantage will remain strong with new competitors entering the space.

One such rival, Amazon, takes its spot at #10 in the best-performing stocks of the decade. From its humble roots as an online bookseller, the company has transformed into an ecommerce leader. CEO Jeff Bezos credits Amazon’s admirable success to three key customer-centric factors: listen, invent, and personalize.

At #12 on the list, Constellation Brands—owner of several alcohol brands such as Corona—is also no stranger to invention. The company is protecting itself against cannabidiol (CBD) disruption with a $5 billion dollar investment in Canopy Growth, and future plans to create its own CBD-infused beverages.

Other well-known names on the top 20 list include discount department store chain Ross Stores (#15) and the credit card company Mastercard (#17), with the latter benefiting from an oligopoly in the industry.

Flying Under the Radar

Apart from the names you’d expect to see, there are also some lesser-known companies that made the list.

Well established among institutional investors and broker-dealers, MarketAxess Holdings takes the #2 spot. The fintech company operates a global electronic bond trading platform, vastly improving the process for investors who traditionally traded bonds “over-the-counter”.

In third place, healthcare technology company Abiomed develops medical devices that provide circulatory support. The company’s Impella® device—the world’s smallest heart pump— has been used to treat over 50,000 U.S. patients.

Fourth place company Transdigm Group gains its stronghold by developing specialized products for the aerospace industry. It has a strong acquisition strategy as well, having acquired over 60 businesses since its formation in 1993.

A Sector View

If we organize the top 20 by sector, information technology stocks appear in the list most frequently with five companies, followed by consumer discretionary (4 companies), and industrials and healthcare (3 companies each).

Sectors with less representation in the top 20 are communication services (2 companies), as well as consumer staples, financials, and real estate (1 company each).

The Bottom Line

While these stocks have performed extremely well over the last decade, they are not necessarily the best portfolio additions today. Some companies may have become overvalued, or be facing new competition in their industry—as is the case with Netflix. It’s best to consider all current information when building a portfolio.

However, the top 20 stocks do demonstrate the power of a buy-and-hold strategy. If you’re lucky enough to identify a winner early on, it’s possible to simply sit back and let your dollars grow.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023