Cannabis

5 Key Innovations Driving the Future of Cannabis

5 Key Innovations Driving the Future of Cannabis

It’s said that necessity is the mother of invention.

As cannabis breaks into the mainstream, the complex web of regulations surrounding the plant may well be what compels the industry to think outside the box.

Today’s infographic from Valens GroWorks highlights some of the most anticipated areas of technology-based disruption in “cannabiz” – the business behind cannabis.

Potential Industry Game-changers

As the cannabis industry grows, the business behind it must grow as well – and to get an edge, industry players are investing in new technologies and innovative practices that could be industry game-changers.

Here are some of the most disruptive moves happening that could shape the future of cannabis:

Agricultural Technology

As consumers become more discerning, they’ve come to demand premium quality cannabis. That’s why many indoor growers are exploring various means to improve the productivity of cannabis plants.

- Cloud-controlled lights

Using cloud-based IoT technology, cultivators can remotely adjust the colors and cycles of growing lights that cannabis plants are exposed to in their operations. Such precise control ensures consistency in plant quality. - Tissue culture

Essentially, tissue culture is the multiplication of a single cannabis tissue into hundreds of identical ones. While this method is impressive, it’s incredibly tricky to get right at scale.

Biotech breeding is another upcoming trend to watch out for. Just like the ubiquitous GMO foods you can find in a grocery store, the genetic manipulation of cannabis plants to strengthen specific effects could take the industry by storm.

Novel Delivery

Millions of patients in North America rely on medical cannabis, which will only intensify as states continue to legalize its use. For the longest time, prescribed cannabis has relied on smoking – but extraction technology is introducing new delivery methods.

- Vaporizer Pens

These pocket-sized pens can deliver a controlled cannabis dose, with lower chances of including dangerous chemicals. The latest models include Bluetooth capabilities and smartphone apps to customize vape temperatures, among other features. - Oils and Tinctures

Cannabis concentrates, packaged into capsules or as liquid, can be used in vape pens or ingested directly. They also provide a small, controlled cannabis dose, and act fast in a patient’s system.

Consumer Products

Recreational consumers won’t be left behind. This growing segment is enjoying cannabis-based products in a myriad of ways, made possible by new extraction technologies.

- Nano-technology

Water soluble oils demonstrate their potent effects quickly through the bloodstream, instead of relying on the slow-acting respiratory or digestive systems. - Topicals

With a wide range of skincare products in the market, these cannabis-infused lotions can applied to the skin’s surface, where they are absorbed for a relaxing effect.

Cashless Payments

Despite the increasing legality of “cannabiz”, many businesses and their customers prefer to deal with cash. Financial institutions are also wary of investing in cannabis, as it’s still perceived as risky in certain circles.

To that end, fintech has stepped up to the plate. Secure and automated transactions can be made and processed via the blockchain, potentially creating an anonymous and convenient way for consumers and companies to transact.

Data and Analytics

Cannabis is finally coming out of hiding, but records around point-of-sale transactions are still lacking. Providing context for such data to give it meaning is difficult, but lucrative.

Leveraging big data to track the cannabis supply chain has secondary advantages of easing the regulatory process, and putting customer demand into perspective. What’s more, digital transaction data on these consumers also offers future opportunities for businesses to address their needs.

As the cannabis space steadily progresses, cannabis companies that respond and adapt to these broad trends of tech innovation will be poised for success.

Tech innovation and ongoing R&D are ingredients that the industry needs to continue to mature and grow.

– Michael Garbuz, CannRoyalty Corporate Strategist

Politics

Timeline: Cannabis Legislation in the U.S.

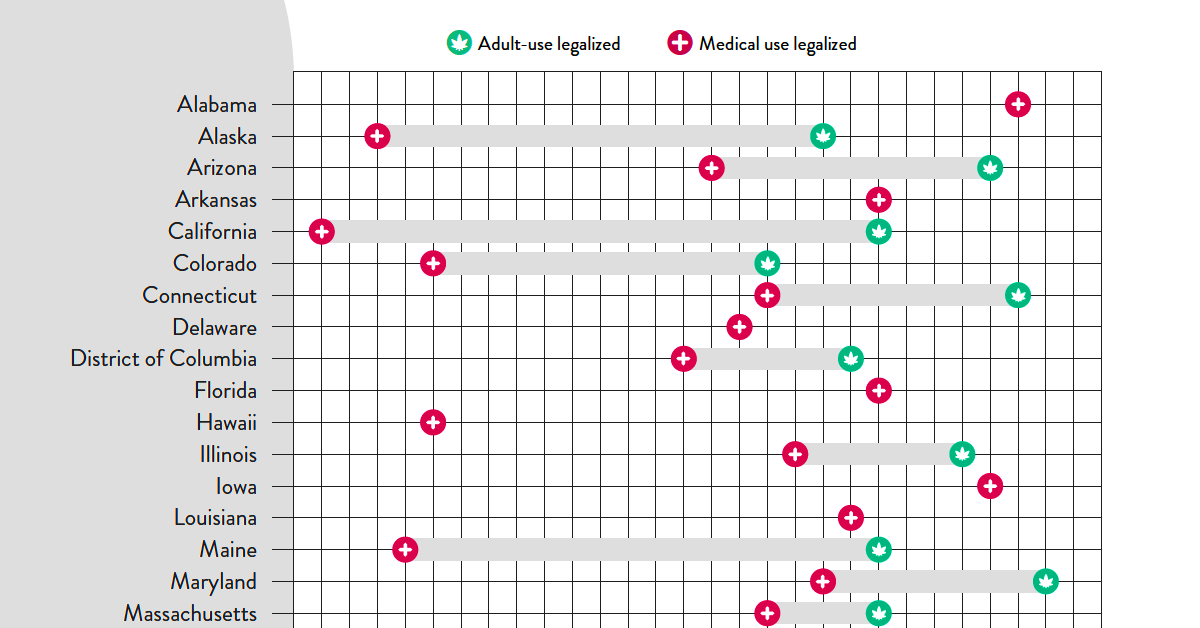

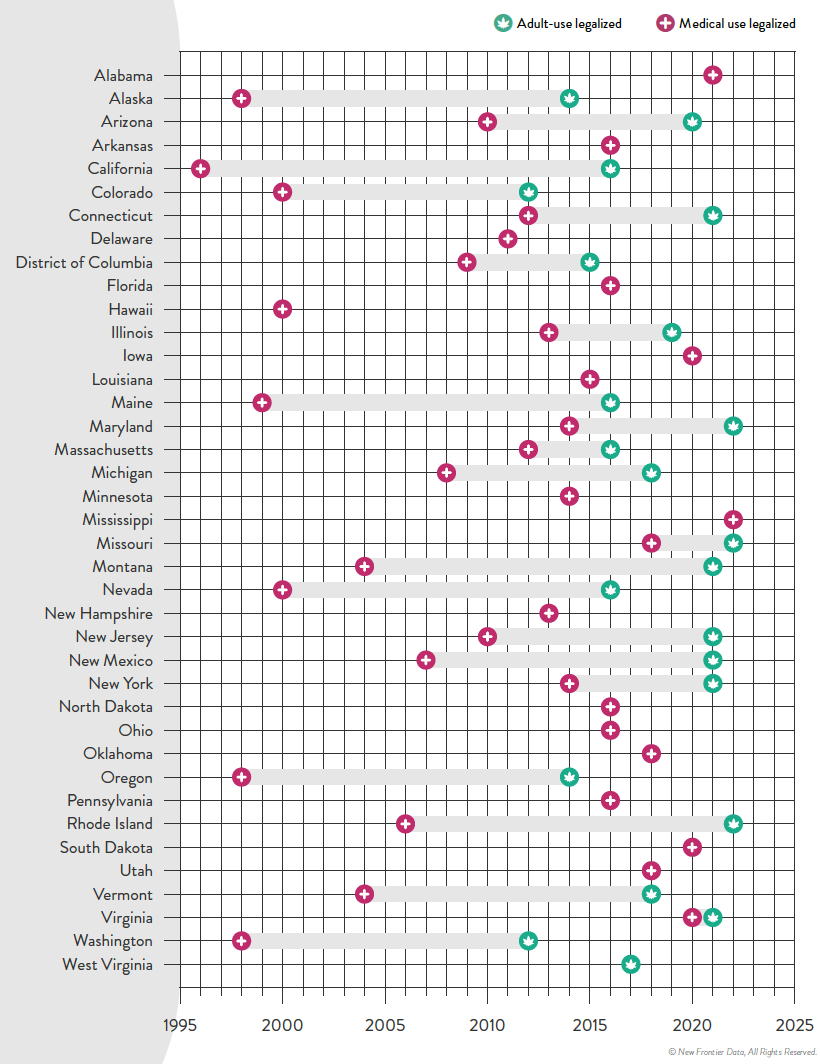

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

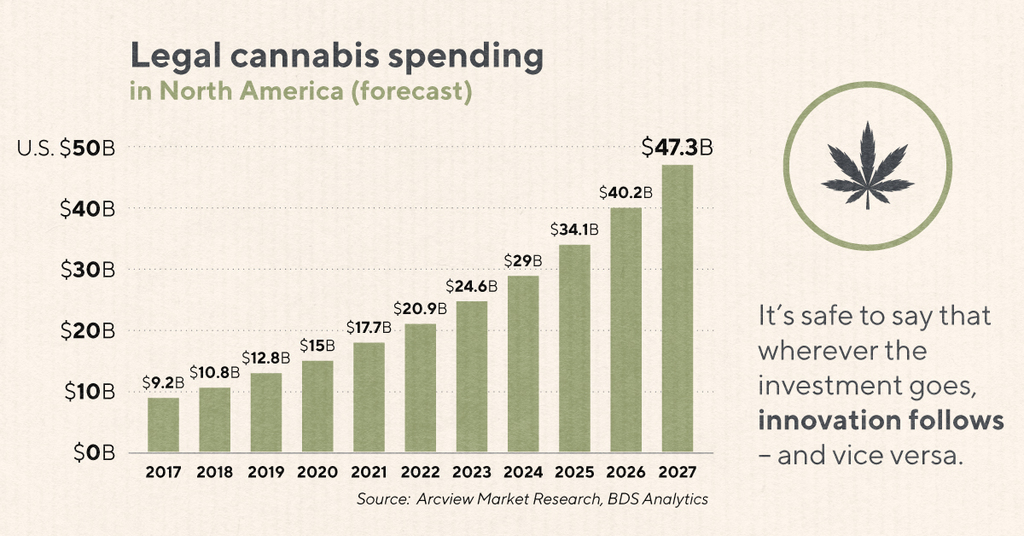

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue