Markets

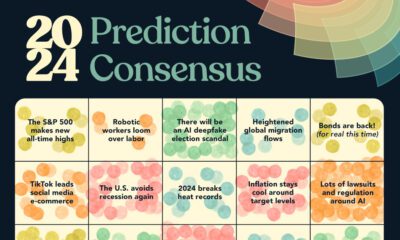

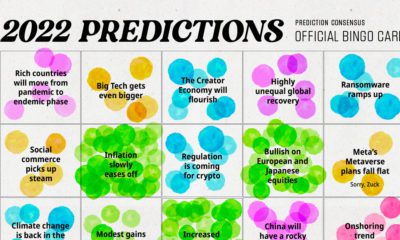

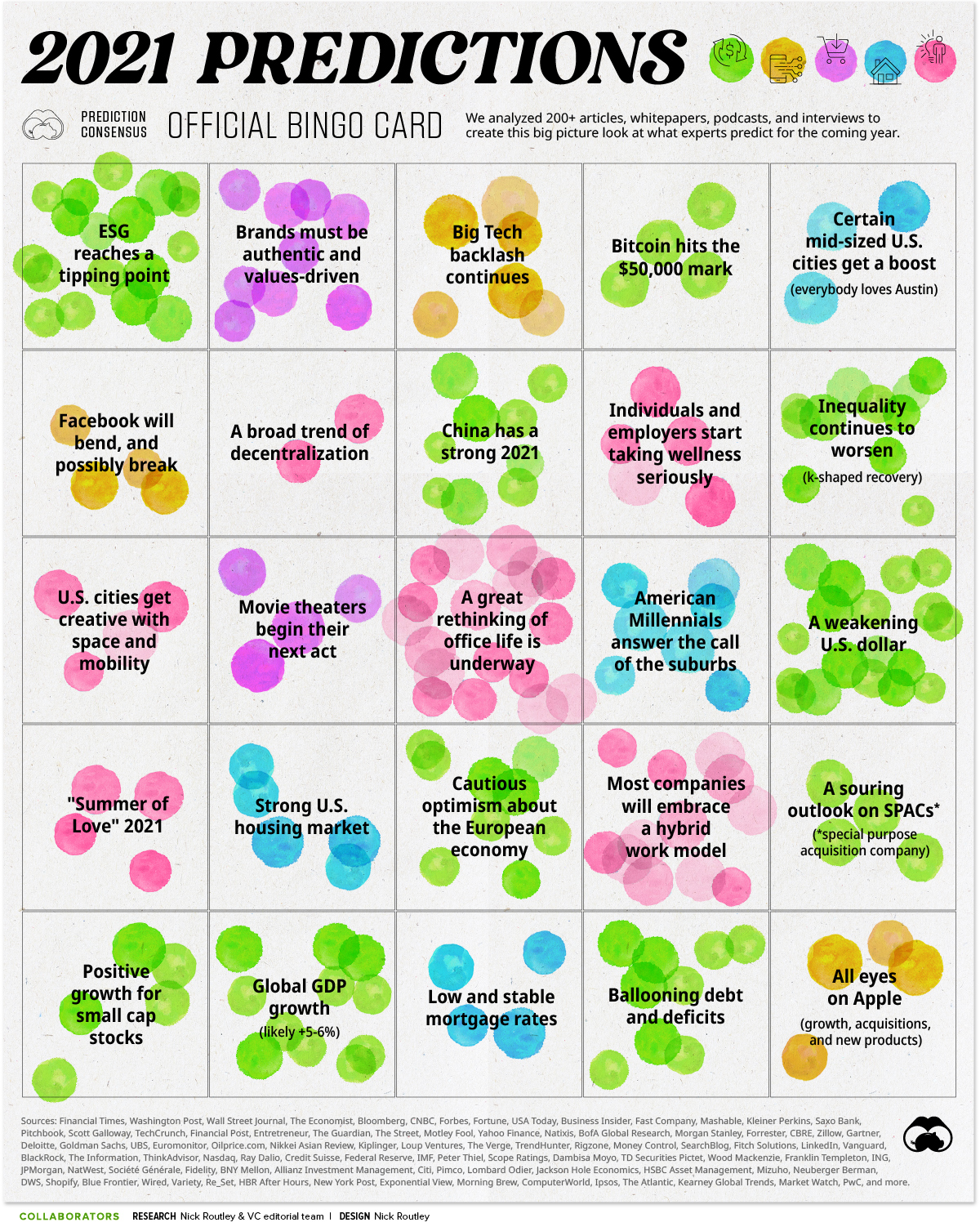

Prediction Consensus: What the Experts See Coming in 2021

2021 Predictions: What Experts See in the Year Ahead

Making predictions is a tricky business at the best of times, but especially so after a year of upheaval. Even so, that didn’t stop people from trying their hand at reading the crystal ball. If anything, the uncertainty creates a stronger temptation for us to try to forecast the year ahead.

Out of the thousands of public 2021 predictions and forecasts available, there are plenty of one-off guesses. However, things really get interesting when a desperate majority of experts begin to agree on what might happen. In some ways, these predictions from influential experts and firms have a way of becoming self-fulfilling prophesies, so it’s worth paying attention even if we’re skeptical about the assertions being made.

This year, we more than doubled the number of sources analyzed for our 2021 Predictions Consensus graphic, including outlooks from financial institutions, thought leaders, media outlets, consultancies, and more. Let’s take a closer look at seven of the most popular predictions:

ESG reaches a tipping point

It seems like only recently that the term ESG gained mainstream traction in the investment community, but in a short amount of time, the trend has blossomed into a full-blown societal shift. In 2020, investors piled a record $27.7 billion of inflows into ETFs traded in U.S. markets, and that momentum only appears to be growing.

Fidelity, among others, noted that climate funds are delivering superior returns, which makes ESG an even easier sell to investors. Nasdaq has tapped ESG to be “one of the hottest trends” over the coming year.

China has a strong 2021

Financial institutions that issue predictions generally hedge their language quite a bit, but on this topic they were direct. The world’s most populous country has already left the pandemic behind and is back to business as usual. Of the institutions that mentioned a specific number, the median estimate for GDP growth in China was 8.4%.

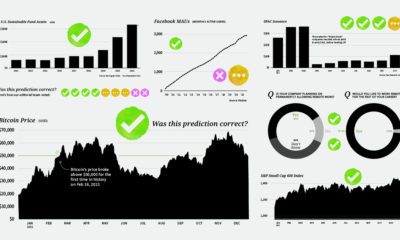

A souring outlook on SPACs

Much like any hot trend, once enough people get on the bandwagon the mood begins to sour. Many experts believe that special purpose acquisition companies (SPACs) are going to enter that phase in 2021.

SPACs had a monster year in 2020, raising $82 billion in capital. That’s more funds in one year than in the last 10 years combined. Of course, now that these 200+ companies are flush with capital, they’ll need to find a target. Scott Galloway argues that SPACs “are going to vastly underperform over the next two to three years” since there aren’t enough good opportunities to satisfy that level of demand.

Brands must be authentic and values-driven

Over the past few years, brands have become increasingly values-driven. In their 2021 predictions, experts see this trend being pushed even further.

Millennials, which are now the largest generation in the workforce, are shaping society in their own image, and the expectation is that companies have an authentic voice and that actions align with words. This trend is augmented by the transparency that the internet and social media have enabled.

Being a “values-driven” company can mean many things, and often involves focusing on a number of initiatives simultaneously. At the forefront is racial inequality and diversity initiatives, which were a key focus in 2020. According to McKinsey, nine out of ten employees globally believe companies should engage in diversity and inclusion initiatives. When the chorus of voices grows loud enough, eventually actions must follow.

A great rethinking of office life is underway

The great work-from-home experiment will soon be approaching the one-year mark and a lot has changed in a short amount of time.

Even firms that were incredibly resistant to remote work found themselves in a position of having to adapt to new circumstances thanks to COVID-19. Now that the feasibility of at-home work has been proven, it will be tough for companies to walk things back to pre-pandemic times. Over 2021, millions of companies will begin reengineering everything from physical offices to digital infrastructure, and this has broad implications on the economy and our culture.

Individuals and employers start taking wellness seriously

The past year was not good for our collective mental health. In response, many companies are looking at ways to support employees from a health and wellness standpoint. One example is the trend of giving teams access to meditation apps like Headspace and Calm.

This focus on wellness will persist, even as people begin to return to the office. As commercial leases expire in 2021, companies will be re-evaluating their office needs, and many experts believe that wellness will factor into those decisions.

Lastly, this trend ties into the broader theme of values-driven companies. If brands profess a desire to impact society in a positive way, employees expect actions to extend inward as well.

Big Tech backlash continues

Among experts, there’s little doubt that the Big Tech backlash will bleed over into 2021. There is a divergence of opinion on exactly what will happen as a result. There are three general themes:

- 1. Regulators will admonish and threaten Big Tech publicly, but nothing concrete will happen.

- 2. Facebook will be broken up into parts (Facebook, Instagram, and WhatsApp)

- 3. Companies will proactively change their business practices and look for ways to settle quickly

Aside from the thread of regulatory action, the tech sector is facing a bit of an identity crisis. Silicon Valley is grappling with the reality that the center of gravity is shifting. Pitchbook notes that Bay Area will fall below 20% of U.S. deal count for first time, and there have been very public departures from the valley in recent months.

Faced with pressure from a number of different angles, the technology sector may have a year of soul-searching ahead.

The Elephant in the Room

COVID-19 is the one factor that impacts nearly every one of these 2021 predictions, yet, there were few predictions–and certainly no consensus from experts–on vaccine rollouts and case counts. It’s possible that the complexity of the pandemic and the enormous task of dealing with this public health crisis makes it too much of a moving target to predict in specific terms.

In general though, expert opinions on when we’ll return to a more “normal” stage again range from the summer of 2021 to the start of 2022. With the exception of China, most major economies are still grappling with outbreaks and the resulting economic fallout.

It remains to be seen whether COVID-19 will dominate 2022’s predictions, or whether we’ll be able to look beyond the pandemic era.

The Good Stuff: Sources We Like

Of the hundreds of sources we looked at, here were a few that stood out as memorable and comprehensive:

Bloomberg’s Outlook 2021: This article compiled over 500 predictions from Wall Street banks and investment firms.

Kara Swisher and Scott Galloway’s Big 2021 Predictions: Swisher and Galloway combine their deep understanding of the technology ecosystem with frank (and hilarious) commentary to come up with some of the most plausible predictions of 2021. From Robinhood to Twitter, they cover a lot of ground in this interview.

Crystal Ball 2021: Fortune’s annual batch of predictions is always one to watch. It’s comprehensive, succinct, and hits upon a wide variety of topics.

John Battelle’s Predictions 2021: John Battelle has been publishing annual predictions for nearly two decades, and this year’s batch is perhaps the most eagerly anticipated. His predictions are thoughtful, credible, and specific. It’s also worth noting that Battelle circles back and grades his predictions – a level of accountability that is to be praised.

Like this feature? An expanded look at 2021’s predictions will be shared with our VC+ audience later this month.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees