Markets

Chart: The Aftermath of the Brexit Vote

The Aftermath of the Brexit Vote

It’s been 3 months, and no signs of doom or gloom.

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

For the first half of the year, we were warned early and often by authorities that the Brexit vote could be a calamity for the ages.

For example, the IMF claimed that a “Leave” result would threaten to “cause severe damage”, while Standard and Poor’s said that it would “paralyze” investment in the UK.

But, it turns out that the real Brexit casualty isn’t the UK economy – instead it is the reputation of the many professional economists who wrongly predicted doom and gloom as the likely aftermath.

The Story So Far

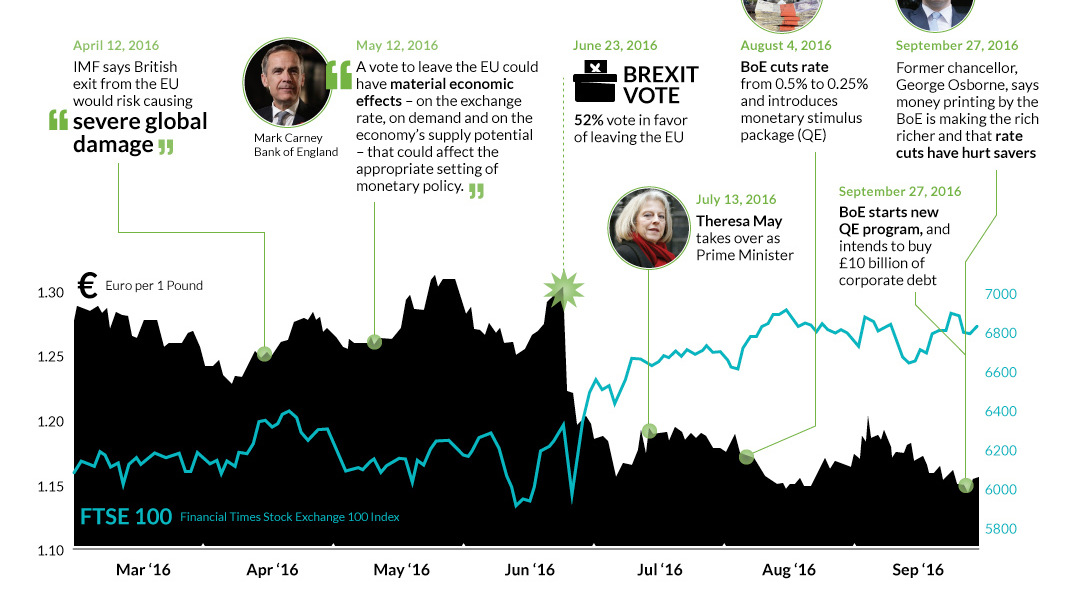

Today’s chart looks at the three months before and after the Brexit vote, which took place on June 23, 2016.

The two charts tracked are the GBP/EUR and the FTSE 100. The former is the price of the British pound in terms of euros, and the latter is a major stock index that includes the largest companies listed in London, such as Barclays, Glencore, HSBC, Royal Dutch Shell, or Sainsbury’s.

As expected, both markets have seen some action in the aftermath of the vote to leave. The pound has depreciated in terms of euros, but it is still higher now than it was from 2009-2011 in the post-crisis period. Against the ultra-strong USD, the pound is at decade-lows – but many other currencies are in similar territory as well.

The FTSE 100 is another story. It’s relatively close to all-time highs – and even despite the fears of a potential collapse of Deutsche Bank, it’s climbed over 12% since the initial Brexit slump.

In both cases, the action was partly underscored by the Bank of England, which announced a new stimulus program (QE) after its August meeting, while cutting rates from 0.5% to 0.25%.

Other Indicators

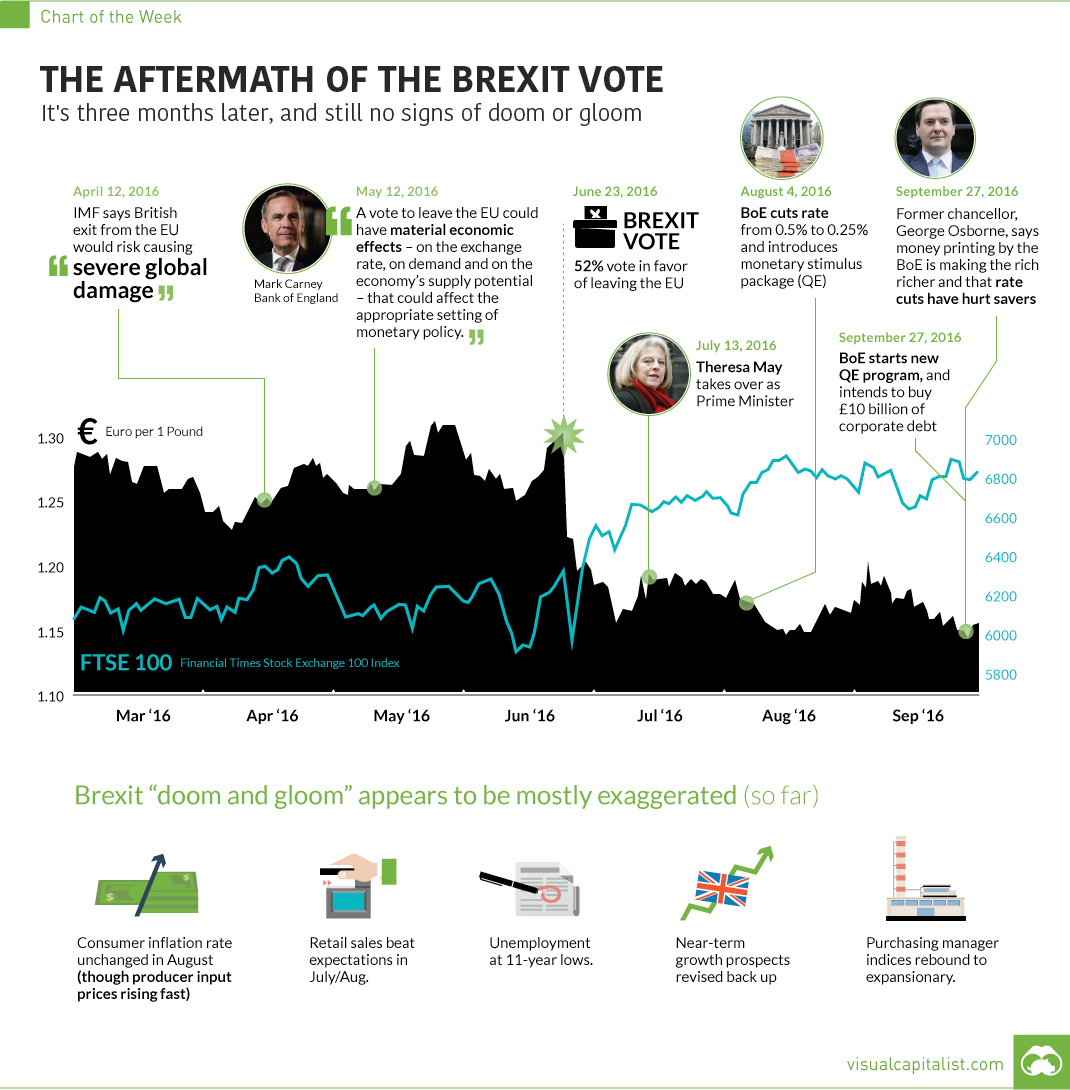

While there’s been movement in the currency and equity markets, other economic indicators have been status quo or better for the UK so far.

Retail sales beat in July and August, and unemployment remains at 11-year lows. Purchasing manager indices dropped temporarily, but jumped back up.

The economists that predicted that the sky was falling? They’ve been forced to revise growth expectations back up, at least on a short-term basis. It’s been dubbed the “Brexit Bounce” by The Spectator, a conservative magazine based in London.

While there is likely still going to be some long-term fallout from the Brexit decision, many “experts” blew it on this one.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Travel1 week ago

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America