Datastream

Return of the SPAC: They’re Back and Bigger than Ever

The Briefing

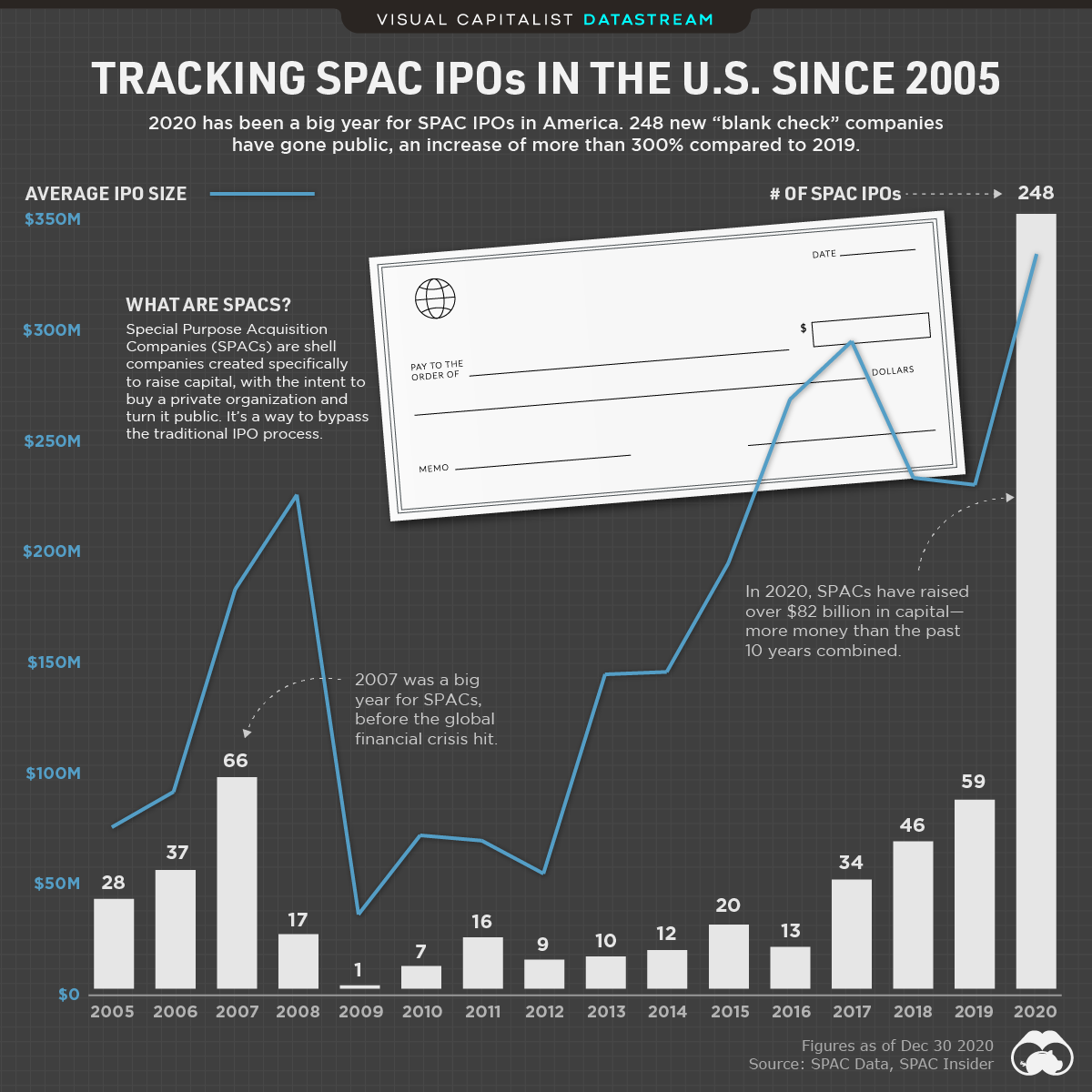

- Special Purpose Acquisition Companies (SPACs) are shell companies created with the sole intent to raise capital and buy a private organization, or a stake in a company

- In 2020, 248 new SPACs went public, an increase of more than 300% from 2019

- 2020 was a record-breaking year for SPACs on many fronts. For instance, Bill Ackman’s Pershing Square Tontine Holdings raised $4 billion—the largest raised in SPAC history

SPACs are Back and Bigger than Ever

In 2020, SPACs raised over $82 billion in capital. That’s more funds in one year than in the last 10 years combined.

But what exactly is a SPAC, and how have they changed over the years?

SPAC IPOs versus Traditional IPOs

SPAC IPOs are essentially the opposite of traditional IPOs.

In a traditional IPO, an established company goes public to raise funds. In contrast, SPAC IPOs involve a shell company that’s already raised capital and is looking to purchase an organization (or a stake in a company).

While traditional IPOs are seeking funds, SPAC IPOs already have the funds—what they’re seeking is an organization to attach themselves to.

SPACs, also known as “Blank Check” companies, provide a faster way to raise funds compared to traditional IPOs. That’s because the audit process for a SPAC is shorter, since they don’t have any financial statements to review.

A Brief History of SPACs

248 SPACs went public in 2020—189 more than in 2019.

2020 has by far been the biggest year for SPACs in the last few decades. Here’s a look at the number of SPAC IPOs over the last 15 years, along with their average size:

| Year | # of SPAC IPOs | Average IPO Size (M) |

|---|---|---|

| 2005 | 28 | $75.5 |

| 2006 | 37 | $91.5 |

| 2007 | 66 | $183.2 |

| 2008 | 17 | $226.0 |

| 2009 | 1 | $36.0 |

| 2010 | 7 | $71.8 |

| 2011 | 16 | $69.4 |

| 2012 | 9 | $54.5 |

| 2013 | 10 | $144.7 |

| 2014 | 12 | $145.8 |

| 2015 | 20 | $195.1 |

| 2016 | 13 | $269.2 |

| 2017 | 34 | $295.5 |

| 2018 | 46 | $233.7 |

| 2019 | 59 | $230.5 |

| 2020 | 248 | $334.4 |

SPACs had a brief moment in 2007 prior to the financial crisis, but by 2009 they had lost traction—that year, only one SPAC IPO went public. However, in the last few years, SPACs have picked up momentum again.

And in 2020, the use of this curious go-public vehicle has skyrocketed.

The New and Improved SPACs of 2020

Historically, SPACs haven’t had the highest returns for investors. In fact, they were once considered a last resort when it came to raising capital.

But in the last few years, SPACs have ramped up their game. According to a recent report by McKinsey & Company, there have been three significant changes:

- Improved track record

In 2020, more than 90% of SPAC deals closed. That’s a notable improvement compared to previous years—before 2015, at least 20% of SPACs liquidated. - Bigger in size

The average SPAC trust size is 5x larger than it was a decade ago. - Well-known participants

Some high-profile investors have jumped on the SPAC-train this year, which has helped generate hype.

While some experts are expecting the popularity of the SPAC to continue in 2021, it’s still early days. So it’s hard to know for certain if SPACs are back for the long-haul.

»If you found this article interesting, you might enjoy this full-length post on traditional IPOs: The World’s Largest IPOs Adjusted For Inflation

Where does this data come from?

Source: SPAC Data

Details: All US-listed SPACs are included in the data set. Figures as of Dec 30, 2020

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001