Misc

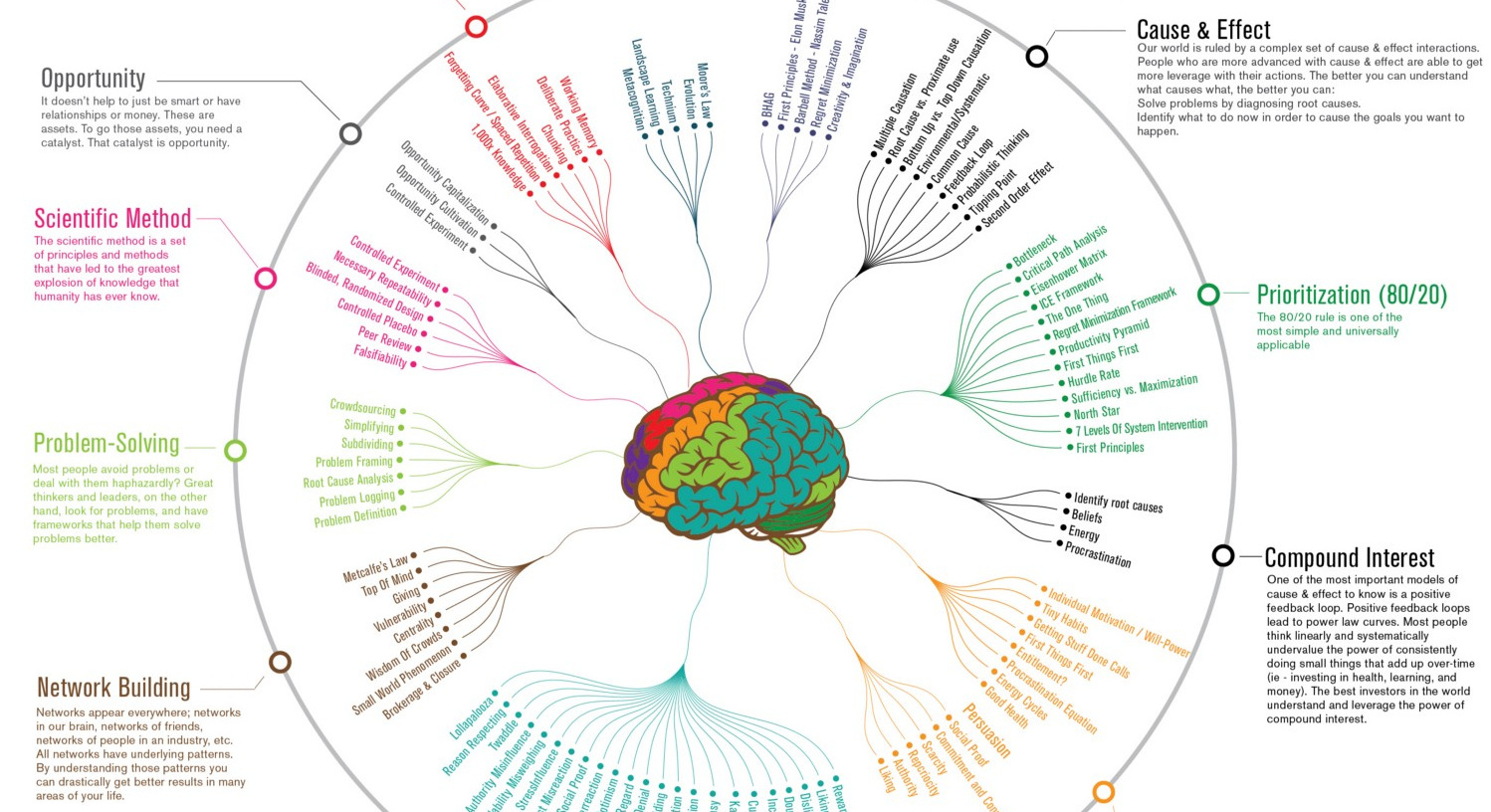

12 Ways to Get Smarter in One Infographic

View a high resolution version of this graphic

12 Ways to Get Smarter in One Infographic

View the high resolution version of today’s graphic by clicking here.

The level of a person’s raw intelligence, as measured by aptitude tests such as IQ scores, is generally stable for most people during the course of their adulthood.

While it’s true that there are things you can do to fine tune your natural capabilities, such as doing brain exercises, solving puzzles, and getting optimal sleep—the amount of raw brainpower you have is difficult to increase in any meaningful or permanent way.

For those of us who constantly strive to be high-performers in our fields, this seems like bad news. If we can’t increase our processing power, then how can we solve life’s bigger problems as we move up the ladder?

The Key: Mental Models

The good news is that while raw cognitive abilities matter, it’s how you use and harness those abilities that really makes the difference.

The world’s most successful people, from Ray Dalio to Warren Buffett, are not necessarily leagues above the rest of us in raw intelligence—instead, they simply develop and learn to apply better mental models of how the world works, and they use these principles to filter their thoughts, decisions, strategies, and execution.

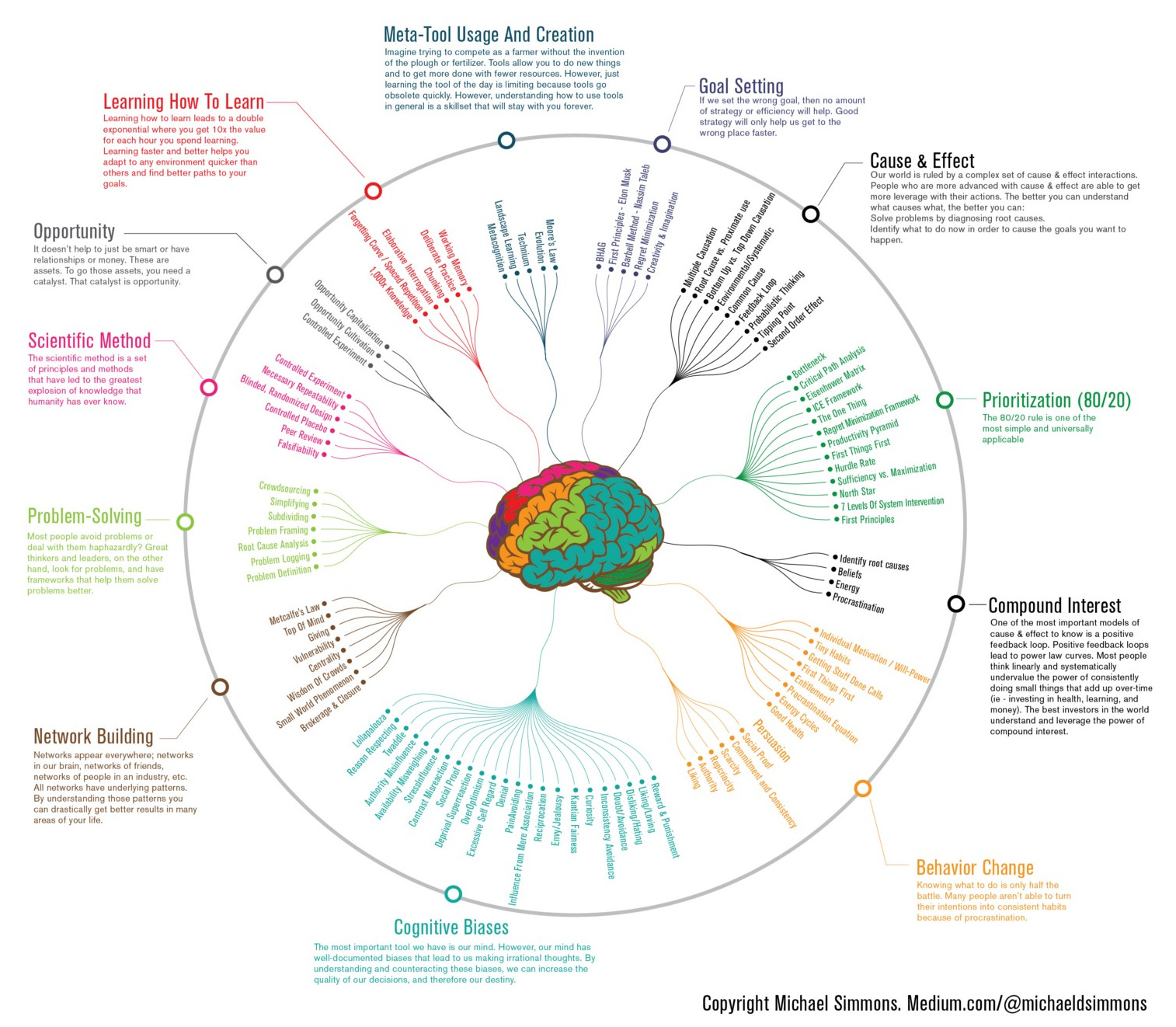

This infographic comes from best-selling author and entrepreneur Michael Simmons, who has collected over 650 mental models through his work. The infographic, in a similar style to one we previously published on cognitive biases, synthesizes these models down to the most useful and universal mental models that people should learn to master first.

Concepts such as the 80/20 rule (Pareto’s principle), compound interest, and network building are summarized in the visualization, and their major components are broken down further within the circle.

Mental Model Examples

Example #1: Pareto’s Principle (80/20 Rule for Prioritization)

In a recent Medium post by Simmons, he highlights a well-known mental model that is the perfect bread crumb to start with.

The 80/20 rule (Pareto’s principle) is named after Italian economist Vilfredo Pareto, who was likely the first person to note the 80/20 connection in an 1896 paper.

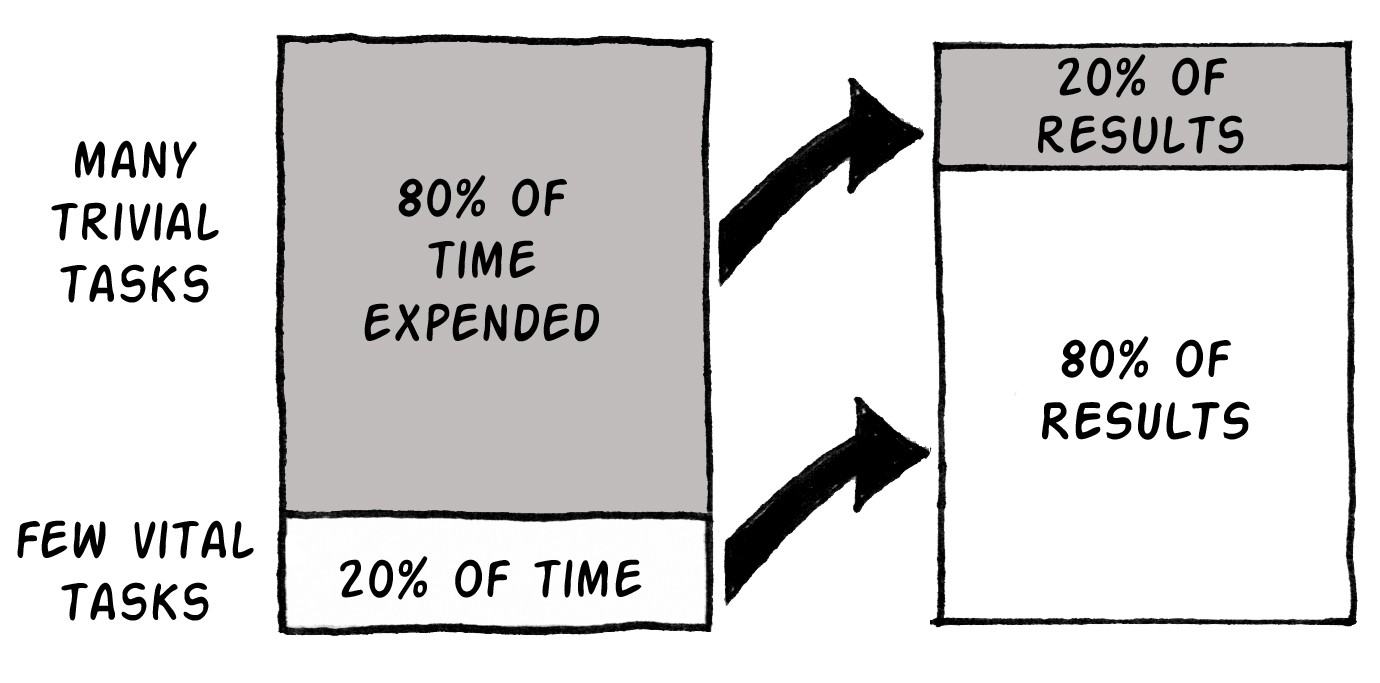

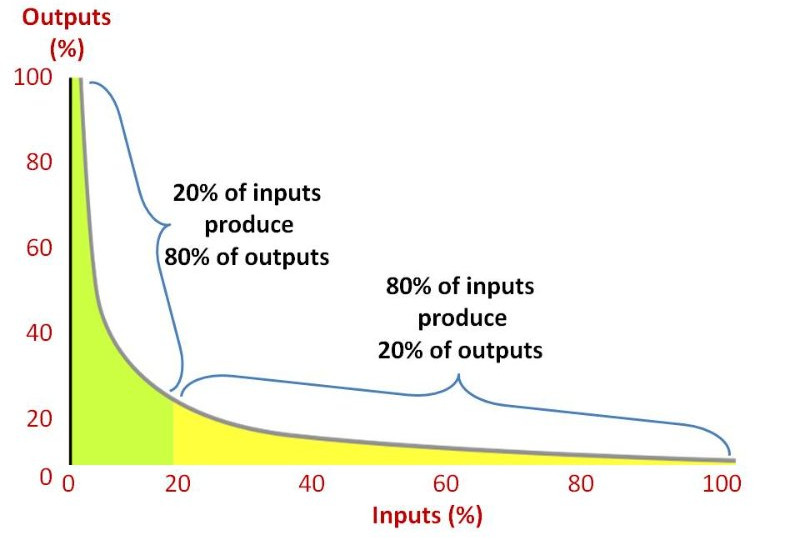

In short, it shows that 20% of inputs (work, time, effort) often leads to 80% of outputs (performance, sales, revenue, etc.), creating an extremely vivid mental framework for making prioritization decisions.

The 80/20 rule represents a power law distribution that has been empirically shown to exist throughout nature, and it also has huge implications on business.

If you focus your effort on these 20% of tasks first, and get the most out of them, you will be able to drive results much more efficiently than wasting time on the 80% “long-tail” shown below.

Example #2: Metcalfe’s Law (Network Building)

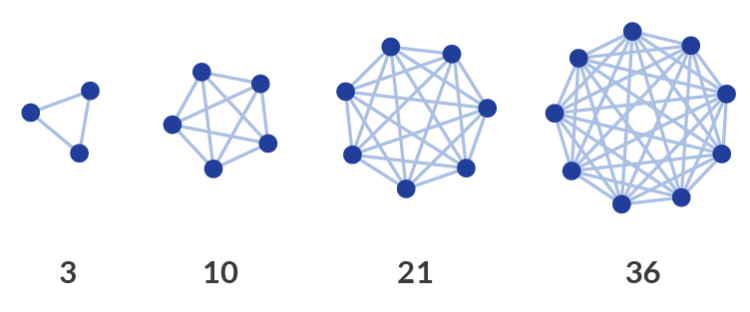

Metcalfe’s Law is one of network effects, stating that a network’s value is proportional to the square of the number of nodes in the network.

From a mental model perspective, this is a useful way to understand how certain types of technology-driven businesses derive value.

If you have a smart grid that is only connected to one power source, that’s alright—but one connected to many different energy sources and potential consumers is much more useful for everyone on the grid. Each additional node provides value for the rest of the connections.

This mental model can be applied outside of strict technology or business terms as well.

For example, if you build a personal network of connections, each additional relationship can provide more value to the other people in your network. It’s the same principle that Harvard or other prestigious universities operate on: the more value a student can get from the alumni network, the higher price they can charge for tuition.

It’s hard to compete with a fully formed network at scale, as they create massive economic moats for the owner. Modern social networks and messaging apps like Facebook, Instagram, LinkedIn, TikTok, WhatsApp, and Snapchat all operate with this in mind.

The Power of Mental Models

These are just two examples of how powerful mental models can be effective in making you think clearer and work smarter.

If you want to be a top performer, it’s worth looking into other mental models out there as well. They can help you better frame reality, so that you can harness your intelligence and effort in the most effective way possible—and it’ll allow you to deliver results along the way.

This post was first published in 2018. We have since updated it, adding in new content for 2021.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees