Misc

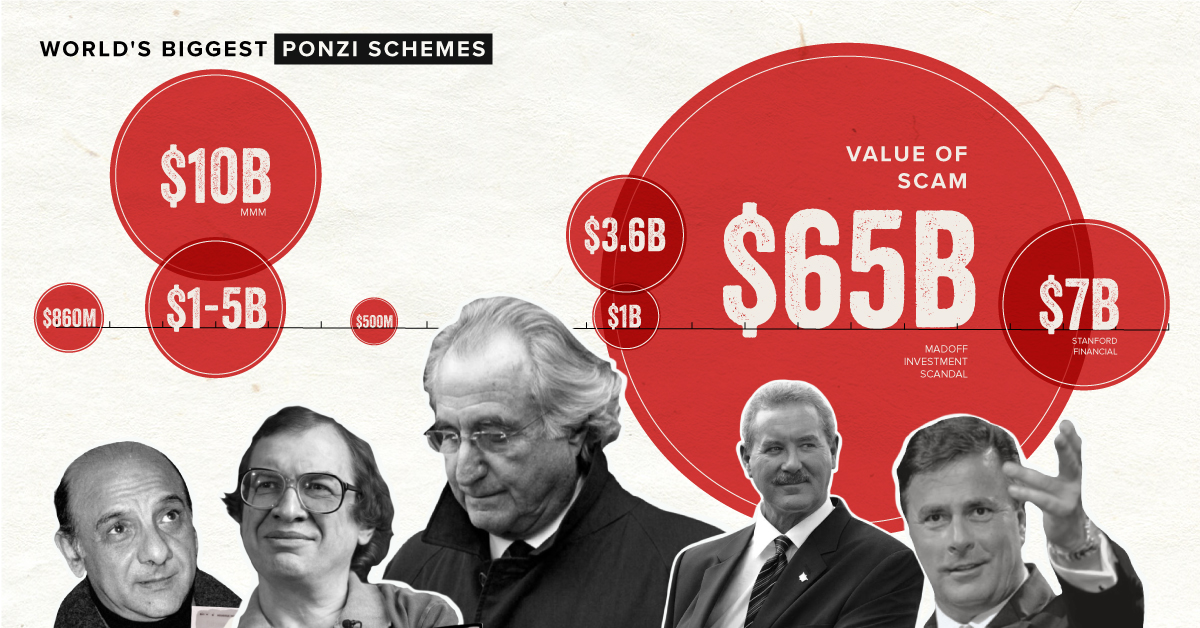

Visualized: The Biggest Ponzi Schemes in Modern History

The Biggest Ponzi Schemes in Modern History

Some things simply sound too good to be true, but when money is involved, our judgement can become clouded.

This is often the case with Ponzi schemes, a type of financial fraud that lures investors by promising abnormally high returns. Money brought in by new members is used to pay the scheme’s founders, as well as its earlier investors.

The scheme is named after Charles Ponzi, an Italian who became infamous in the 1920s for claiming he could double his clients’ money within 90 days. Since then, numerous Ponzi schemes have been orchestrated around the globe.

To help you learn more about these sophisticated crimes, this infographic examines some of the biggest Ponzi schemes in modern history.

Ponzi Schemes in the 20th Century

The 1990s saw a number of large Ponzi schemes worth upwards of $500 million.

| Country | Date Ended | Name of Scheme and Founder | Value (USD) |

|---|---|---|---|

| Belgium | 1991 | Moneytron, Jean-Pierre Van Rossem | $860M |

| Romania | 1994 | Caritas, Ioan Stoica | $1B - $5B |

| Russia | 1994 | MMM, Sergei Mavrodi | $10B |

| U.S. | 1997 | Great Ministries International, Geral Payne | $500M |

In many cases, these schemes thrived by taking advantage of the unsuspecting public who often lacked any knowledge of investing. Caritas, for example, was a Ponzi scheme based in Romania that marketed itself as a “self-help game” for the poor.

The scheme was initially very successful, tricking millions of people into making deposits by offering the chance to earn an 800% return after three months. This was not sustainable, and Caritas was eventually unable to distribute further winnings.

Caritas operated for only two years, but its “success” was undeniable. In 1993, it was estimated that a third of the country’s money was circulating through the scheme.

Ponzi Schemes in the 21st Century

The American public has fallen victim to numerous multi-billion dollar Ponzi schemes since the beginning of the 21st century.

| Country | Date Ended | Name of Scheme and Founder | Value (USD) |

|---|---|---|---|

| U.S. | 2003 | Mutual Benefits Company, Joel Steinger | $1B |

| U.S. | 2003 | Petters Group Worldwide, Tom Petters | $4B |

| U.S. | 2008 | Madoff Investment Scandal, Bernie Madoff | $65B |

| U.S. | 2012 | Stanford Financial Group, Allen Stanford | $7B |

Many of these schemes have made major headlines, but much less is said about the thousands of everyday Americans that were left in financial ruin.

For victims of the Madoff Investment Scandal, receiving any form of compensation has been a drawn-out process. In 2018, 10 years after the scheme was uncovered, a court-appointed trustee managed to recover $13 billion by liquidating Madoff’s firm and personal assets.

As NPR reported, investors may recover up to 60 to 70 percent of their initial investment only. For victims who had to delay retirement or drastically alter their lifestyles, this compensation likely provides little solace.

Do the Crime, Pay the Time

Running a Ponzi scheme is likely to land you in jail for a long time, at least in the U.S.

In 2009, for example, 71-year-old Bernie Madoff pled guilty to 11 federal felonies and was sentenced to 150 years in prison. That’s 135 years longer than the average U.S. murder conviction.

Outside of the U.S., it’s a much different story. Weaker regulation and enforcement, particularly in developing countries, means a number of schemes are ongoing today.

Sergei Mavrodi, known for running the Russian Ponzi scheme MMM, started a new organization named MMM Global after being released from prison in 2011. Although he died in March 2018, his self-described “social financial network” has established a base in several Southeast Asian and African countries.

If you or someone you know is worried about falling victim to a Ponzi scheme, this checklist from the U.S. Securities and Exchange Commission (SEC) may be a useful resource.

VC+

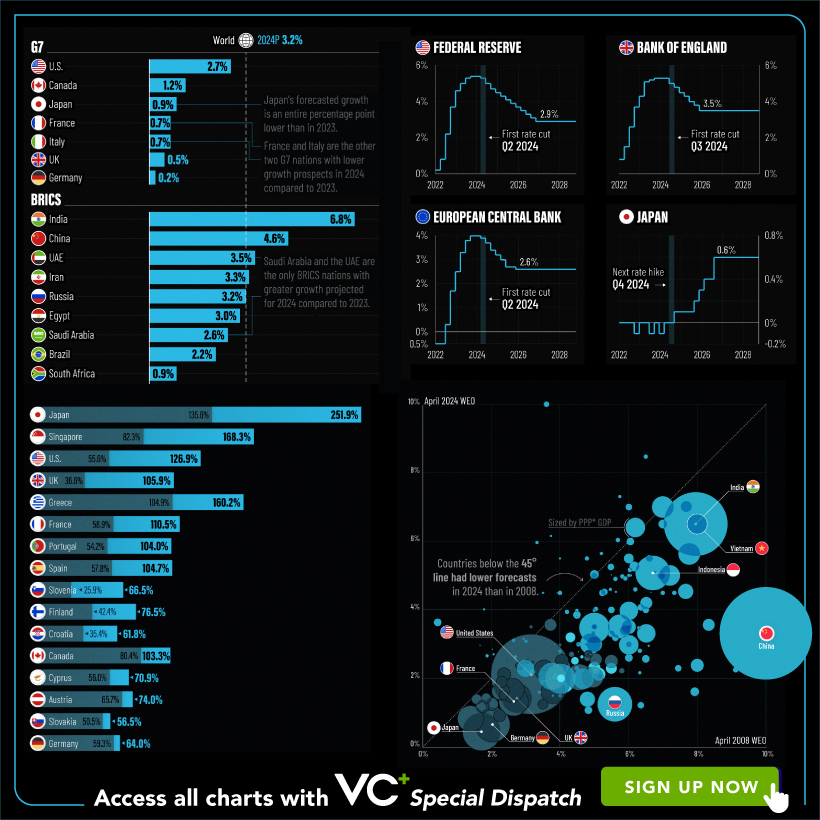

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees