Mining

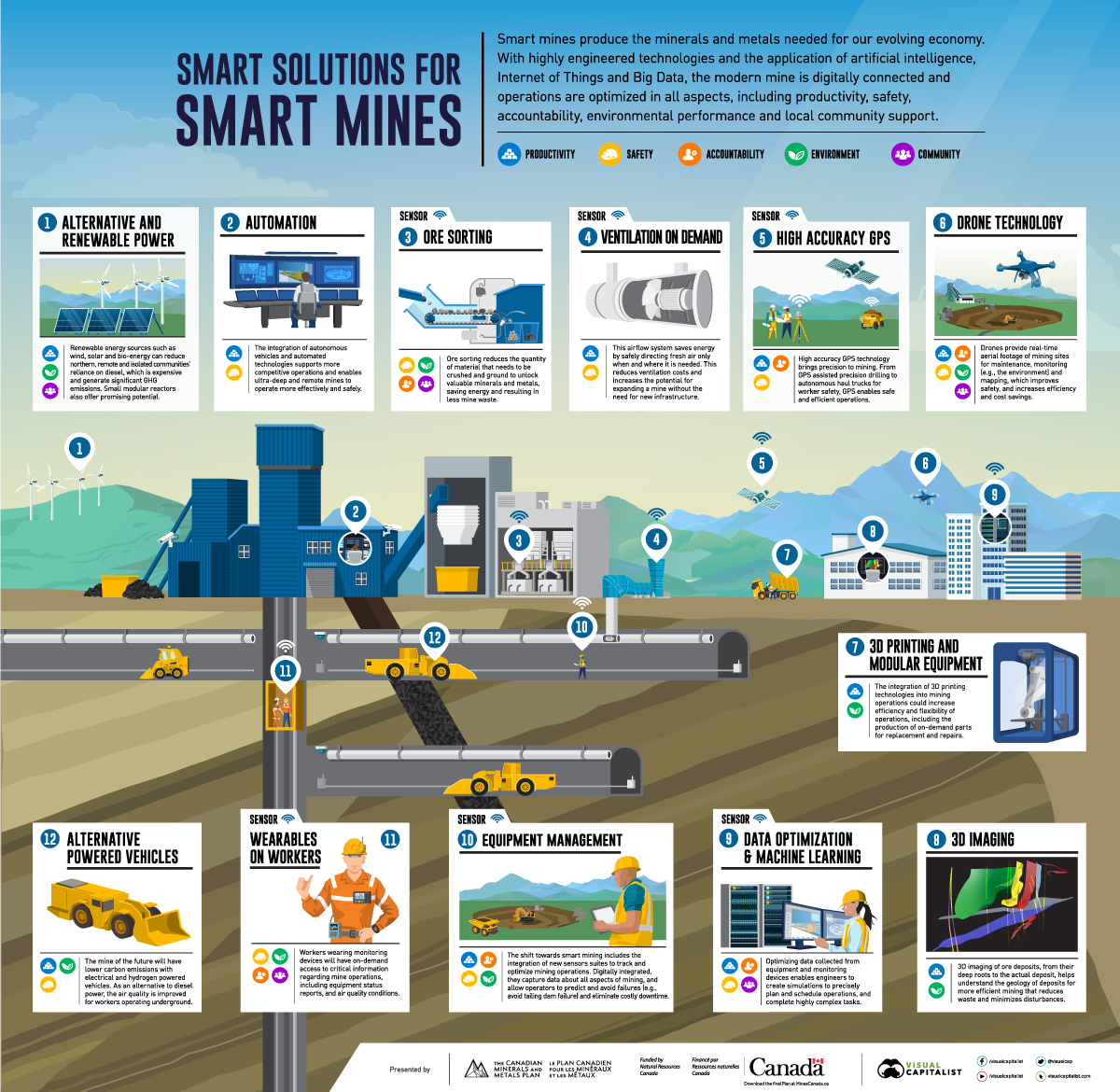

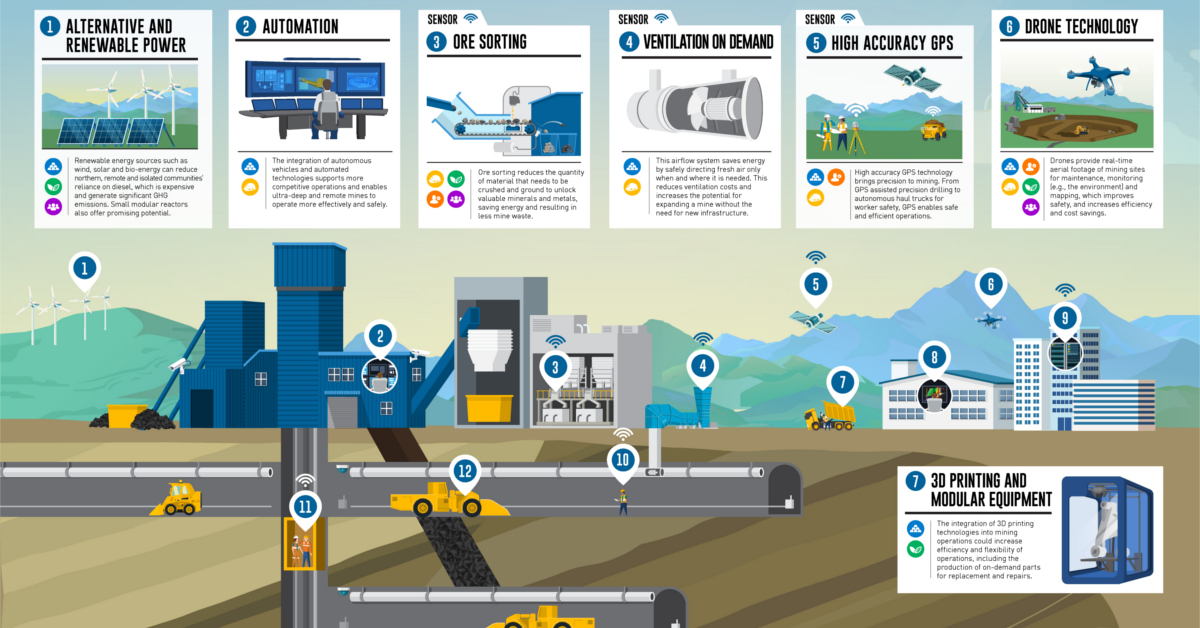

Visualizing the Potential of Smart Mining

View a high resolution version of this graphic

Visualizing the Potential of Smart Mining

View the full-size version of the infographic by clicking here

Mining has traditionally been depicted with pack mules, pickaxes, and rugged prospectors.

However, it may surprise you to learn that today’s mining industry is precisely the opposite in almost every respect. It’s high-tech, efficient, and safe.

This is partially because modern mining companies are deploying the latest in sensor and cloud technology. These connected mines are improving the extraction process and workers’ safety while also boosting productivity.

Today’s infographic comes to us from Natural Resources Canada and discusses how this sensor and cloud technology can be integrated into the extractive process.

What is Smart Mining?

A connected mine uses data from sensor technology to effectively manage underground and pit mining operations.

“Any mining operation today will have in the thousands or hundreds of thousands of sensors capturing in real time a vast swath of data.”

– Mukani Moyo, McKinsey Senior Expert (Source)

From a single application on a mobile device, supervisors at mine sites can now receive alerts via SMS, email or in-app notifications. This helps them react to critical problems in real-time and maximize productivity.

In addition, advanced data analytics can be applied to the raw data to create insights, visualizations, and recommendations. This information is delivered to mine managers and employees in real-time on their mobile devices.

Case Study: Smart Solutions in Practice

Dundee Precious Metals was one of the first companies to bring wireless networks into an underground mine. The company used RFID and Wi-Fi to monitor the location of equipment and people. The networks also allowed personnel to stay connected to the surface.

Once the networks were installed, communication was reliable and instantaneous – even almost 2,000 feet underground at the bottom of the mine. Workers could bring laptops and smartphones into the mine to stay connected to personnel and software on the surface.

With an RFID chip on every vehicle, machine, and person, managers can see the location of everyone and everything in the mine. This helps prevent accidents and breakdowns, and streamlines operations in real-time.

There are also environmental and cost-saving benefits. Using location data, an automated ventilation system can respond and minimize energy consumption.

Fans turn on and off as miners enter or leave an area. In addition, fan speeds adjust when machines or vehicles are running nearby to ensure that emissions are properly vented. This could drastically reduce a mine’s energy requirements.

Changing the Nature of Work: Remote Working

These smart mining solutions are reducing the risks miners face and creating new opportunities for a tech-savvy generation.

Remote mine locations that revolve around shift work can place stress on workers and their families. With a connected infrastructure, mine employees and managers can monitor operations at a distant office.

There will always be a need for workers on site, but connected technology can create some town-based career opportunities and help stabilize families.

A Sustainable Future for Mining

This is just the beginning.

Over time, data from sensor technology and cloud software, will reveal insights that could help develop sustainable mining operations.

By minimizing their negative impacts, mining companies will be able to responsibly deliver the materials the modern world needs.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue