Personal Finance

$1 Million Isn’t Worth What It Used To Be

Being a millionaire is overrated.

The term itself has quite a few connotations, including many that have been ingrained in us since we were children. Becoming a “millionaire” meant being set for life, and not having to worry about things like personal finances again. After all, millionaires are supposed to be destined for early retirement, right?

That was then, and this is now.

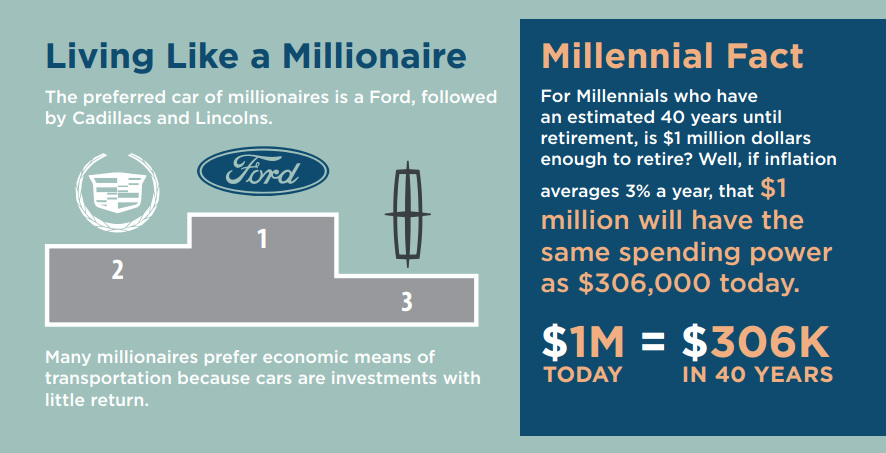

Time magazine recently estimated that for a millennial with 40 years until retirement, $1 million in savings is not likely sufficient. Taking into account 3% inflation over that time period, it would be worth just $306,000 in today’s dollars. That’s a pretty questionable nest egg for a “millionaire”.

How Much is a Million Dollars?

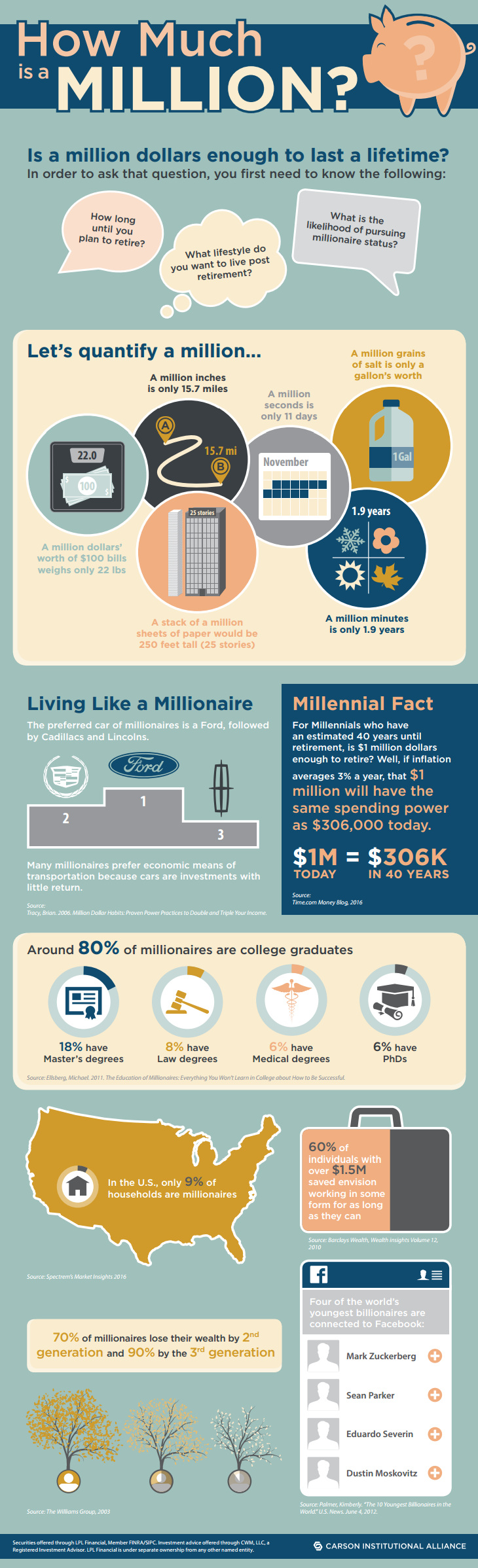

The infographic from Carson Wealth shows that things have changed over time, and that a million dollars of wealth ain’t what it used to be.

Fun facts: the preferred car for millionaires is actually a Ford, and the majority of millionaires envision working all the way until their retirement.

In today’s world, reaching the magical “millionaire” mark of a $1 million net worth is less meaningful than it used to be. In fact, roughly 9% of households in the United States have “millionaires” living in them – this is a record amount, caused partially through the devaluation of currency over time.

That said, there are many cities (San Francisco, Vancouver, New York, London, Melbourne, Tokyo, etc.) where even a million dollars isn’t even enough to purchase a home.

The “millionaire” case is a stark example of the erosion of a dollar’s purchasing power over time. To get a full sense, take a look at some historical numbers:

- To have the purchasing power of a millionaire from the 1900s, you would need at have nearly $30 million in today’s dollars.

- To have the same impact or influence on the economy as a millionaire from the 1900s, you’d need closer to $100 million in today’s dollars.

For more perspective on the topic, see how much money exists with this video from The Money Project:

Personal Finance

Chart: The Declining Value of the U.S. Federal Minimum Wage

This graphic compares the nominal vs. inflation-adjusted value of the U.S. minimum wage, from 1940 to 2023.

The Declining Value of the U.S. Federal Minimum Wage

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic illustrates the history of the U.S. federal minimum wage using data compiled by Statista, in both nominal and real (inflation-adjusted) terms. The federal minimum wage was raised to $7.25 per hour in July 2009, where it has remained ever since.

Nominal vs. Real Value

The data we used to create this graphic can be found in the table below.

| Year | Nominal value ($/hour) | Real value ($/hour) |

|---|---|---|

| 1940 | 0.3 | 6.5 |

| 1945 | 0.4 | 6.82 |

| 1950 | 0.75 | 9.64 |

| 1955 | 0.75 | 8.52 |

| 1960 | 1 | 10.28 |

| 1965 | 1.25 | 12.08 |

| 1970 | 1.6 | 12.61 |

| 1975 | 2.1 | 12.04 |

| 1980 | 3.1 | 11.61 |

| 1985 | 3.35 | 9.51 |

| 1990 | 3.8 | 8.94 |

| 1995 | 4.25 | 8.49 |

| 2000 | 5.15 | 9.12 |

| 2005 | 5.15 | 8.03 |

| 2010 | 7.25 | 10.09 |

| 2015 | 7.25 | 9.3 |

| 2018 | 7.25 | 8.78 |

| 2019 | 7.25 | 8.61 |

| 2020 | 7.25 | 8.58 |

| 2021 | 7.25 | 8.24 |

| 2022 | 7.25 | 7.61 |

| 2023 | 7.25 | 7.25 |

What our graphic shows is how inflation has eroded the real value of the U.S. minimum wage over time, despite nominal increases.

For instance, consider the year 1960, when the federal minimum wage was $1 per hour. After accounting for inflation, this would be worth around $10.28 today!

The two lines converge at 2023 because the nominal and real value are identical in present day terms.

Many States Have Their Own Minimum Wage

According to the National Conference of State Legislatures (NCSL), 30 states and Washington, D.C. have implemented a minimum wage that is higher than $7.25.

The following states have adopted the federal minimum: Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, New Hampshire, North Carolina, North Dakota, Oklahoma, Pennsylvania, Texas, Utah, Wisconsin, and Wyoming.

Meanwhile, the states of Alabama, Louisiana, Mississippi, South Carolina, and Tennessee have no wage minimums, but have to follow the federal minimum.

How Does the U.S. Minimum Wage Rank Globally?

If you found this topic interesting, check out Mapped: Minimum Wage Around the World to see which countries have the highest minimum wage in monthly terms, as of January 2023.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries