Money

Black Friday: The Holiday Surge in U.S. Consumer Debt and Spending

Black Friday

Visualizing the surge in U.S. consumer debt and spending

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

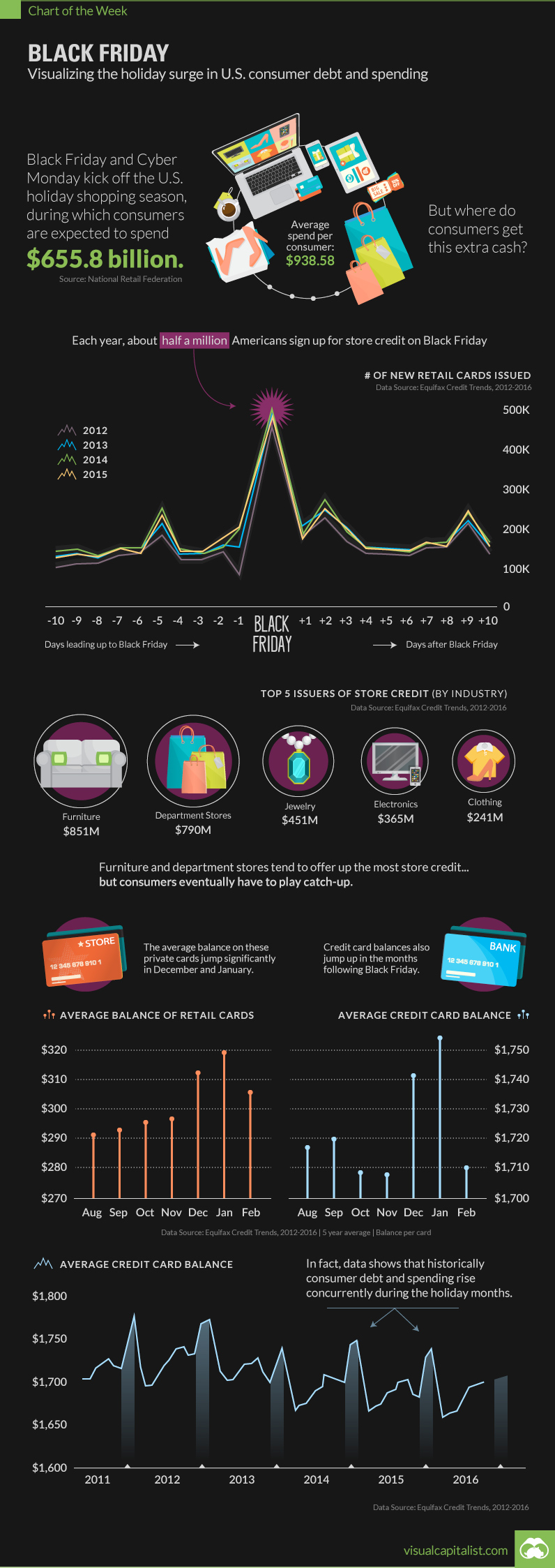

Next week, Black Friday and Cyber Monday will kick off the start to the U.S. holiday shopping season, during which consumers are expected to spend a total of $655.8 billion this year.

With the average bill coming in at $938.50 for holiday spending, where are people finding the extra cash?

We looked back at the last five years of Equifax data to see how consumer debt correlates to holiday purchases.

There’s Credit In Store

One way consumers take advantage of Black Friday deals is through the issuance of store credit. Specifically, Black Friday traditionally sees a noteworthy surge in signups to private label cards – the kind redeemed at stores like Macy’s.

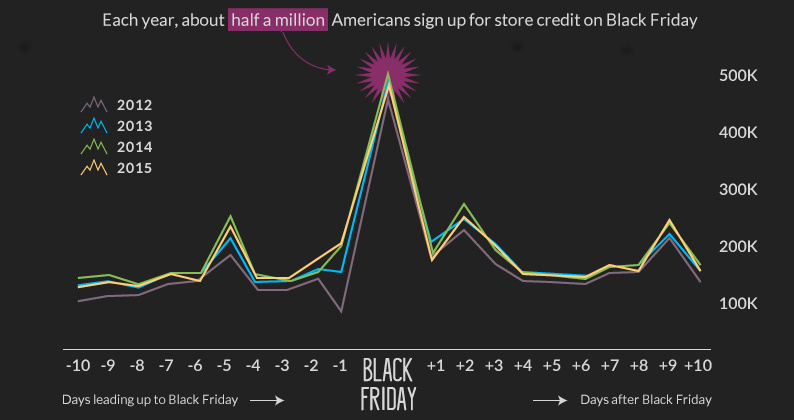

Each year, roughly half a million Americans are signing up for new accounts on Black Friday:

| Private label cards issued | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|

| Prior 10 days (Avg.) | 130,312 | 153,605 | 164,341 | 162,006 |

| Black Friday | 463,292 | 485,512 | 502,805 | 491,873 |

| Following 10 days (Avg.) | 167,144 | 181,454 | 182,320 | 181,903 |

Furniture and department stores are among the biggest providers of this type of credit to consumers. Here are the five-year averages by industry for the months of November and December:

| New store credit issued (Nov/Dec) | $ millions |

|---|---|

| Furniture | 851 |

| Department stores | 790 |

| Jewelry | 451 |

| Electronics | 365 |

| Clothing | 241 |

Charge it, please

This bump in activity doesn’t stop with new signups for store credit. The average balances on store cards and credit cards both jump noticeably in the months following the holiday season:

| Month | Store Card Balance (5-Year Average) | Credit Card Balance (5-year Average) |

|---|---|---|

| August | $291 | $1,717 |

| September | $293 | $1,720 |

| October | $296 | $1,709 |

| November | $298 | $1,707 |

| December | $313 | $1,742 |

| January | $320 | $1,756 |

| February | $308 | $1,710 |

Every year is different, but the data always follows the same trend.

Stocking up on Black Friday deals is not cheap, and extra dollars spent eventually make their way onto the credit card statement with the cost of interest added on.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries