Mining

Olympic Gold Medals Have Almost Zero Gold in Them

The 2016 Rio Summer Olympic Games are already 51% over budget, with the total cost expected to be in the $4.6 billion range. With that in mind, the organizers have tried their best to cut costs.

One area of compromise?

The Olympic gold medals, which weigh 500g (1.1 lbs) and are 85mm (3.3 in) in diameter, are gold in name only.

Olympic Gold Medals Have Almost Zero Gold in Them

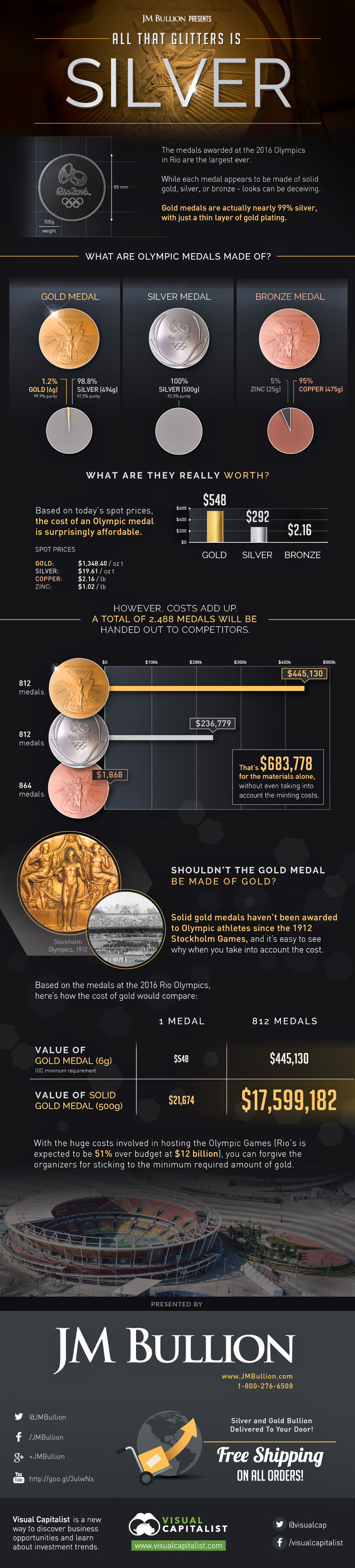

Today’s infographic comes from JM Bullion and it shows the real amount of metal in gold, silver, and bronze medals, along with the hypothetical cost of awarding solid gold to winning athletes.

All That Glitters is…Silver

That’s right, gold medals are actually 98.8% silver, with just a thin 1.2% coat of gold paint. The thin layer of gold meets the minimum requirement set by IOC says for the amount of gold actually in the gold medal – just six grams.

The material cost of a gold medal right now based on this composition is $548. Almost half of that comes from the six grams of gold, while the rest comes from the 494 grams of sterling silver.

The silver and bronze medals have material costs of $292 and $2.16 respectively.

Why Doesn’t the Olympics Use Solid Gold Medals?

Solid gold medals haven’t been awarded to Olympic athletes since the 1912 Stockholm Games. Back then, medals were a mere 33mm in diameter and made of silver gilded with gold. It’s easy to see why organizers have gone this route when you take into account the difference in material costs.

Each gold medal at the Rio Games currently costs $548 for materials – if they were solid gold that cost would balloon to $21,674 per medal. That means that if all 812 gold medals were solid gold, the tab would be a grand total of $17.6 million. That’s not including minting or additional security costs, either.

With the 2016 Rio Summer Olympic Games already 51% over budget, we can forgive the organizers for sticking to the minimum required amount of gold for each medal.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees