Technology

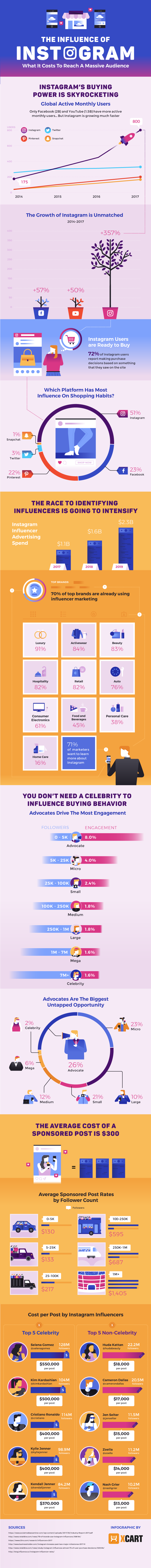

The Influence of Instagram

The digital advertising landscape has changed dramatically over the past decade.

Social media platforms are now some of the most heavily trafficked places on the internet, and sharing hubs such as Instagram are increasingly becoming a cultural touchpoint for millions of people around the world.

Tapping into Instagram Influence

Instagram is closing in on a billion monthly active users, and with such a massive audience, social influencers (i.e. people with large, engaged audiences) are raking in the dough from paid brand endorsements.

Today’s infographic, from XCart, walks us through the multi-billion dollar phenomenon known as influencer marketing.

Chasing Attention Spans

It’s estimated that 65% of adults in the U.S. use social networks – a figure that spikes to an astonishing 90% for young adults.

Social media has become a fixture in our everyday lives and where attention spans wander, advertising is sure to follow. And follow it has. Marketers dumped over $23.68 billion into ads on social platforms in 2016, and that momentum shows no sign of slowing down.

However, one growing and increasingly potent form of marketing that isn’t entirely tracked in that total stems from influencers.

The Kings and Queens of Instagram

Instagram (acquired by Facebook in 2012) has seen impressive growth in recent years coinciding with a shift towards more visual content sharing. A combination of good timing and plagiarism has helped the photo sharing network grow by over 350% since 2014.

Instagram has also become a major platform for influencers.

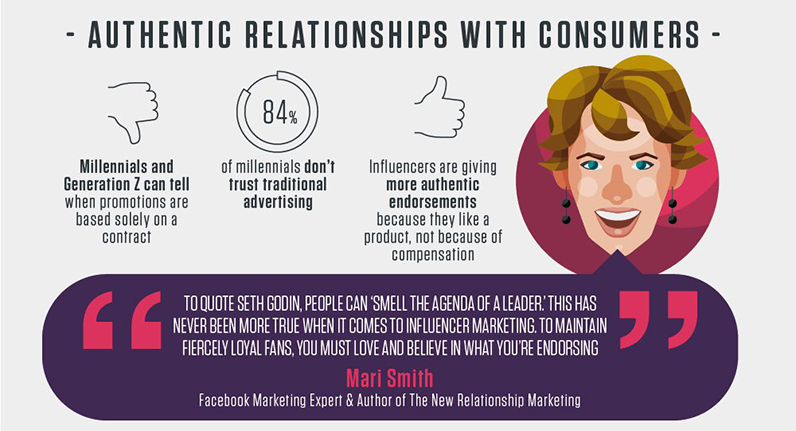

While endorsements have traditionally come from celebrities such as actors or athletes, today’s influencers have built their audiences though sharing compelling content via social media channels. This is a huge shift as influencers come with all kinds of quantifiable audience sizes and demographic make-ups. It makes for targeting and relatability rolled into one package – particularly in the case of microinfluencers.

The Value of Influence

Power users who create a lot of content and amass thousands – even millions – of fans on a platform find themselves in a unique position. Their influence is worth something more tangible than likes; it’s worth some serious coin.

On the flip side of the equation, fans generally understand that influencers use sponsored posts as their compensation for creating content. A contemporary analogy would be occasional commercial breaks in exchange for a “free” TV program. The audience knows there’s no free ride, but if the network goes overboard, or the advertisers don’t align with the show properly, the reciprocity breaks down.

Similarly, influencers know that endorsements use up “credit” they’ve built up with their audience, so the successful ones choose their brand relationships wisely and don’t go overboard on sponsored posts.

Brands are Betting on Microinfluence

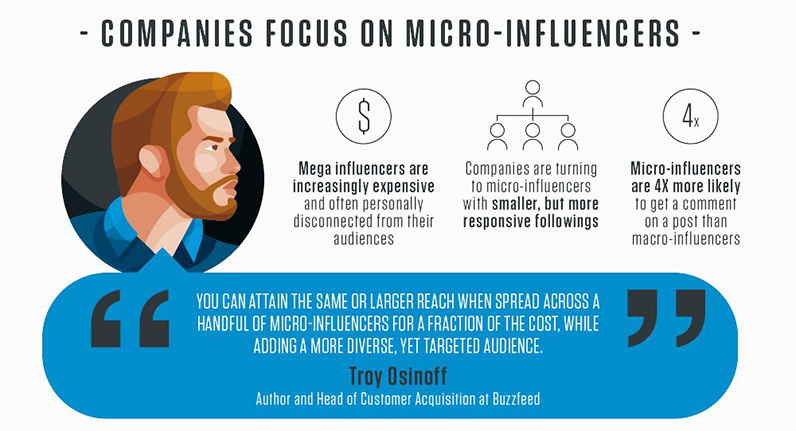

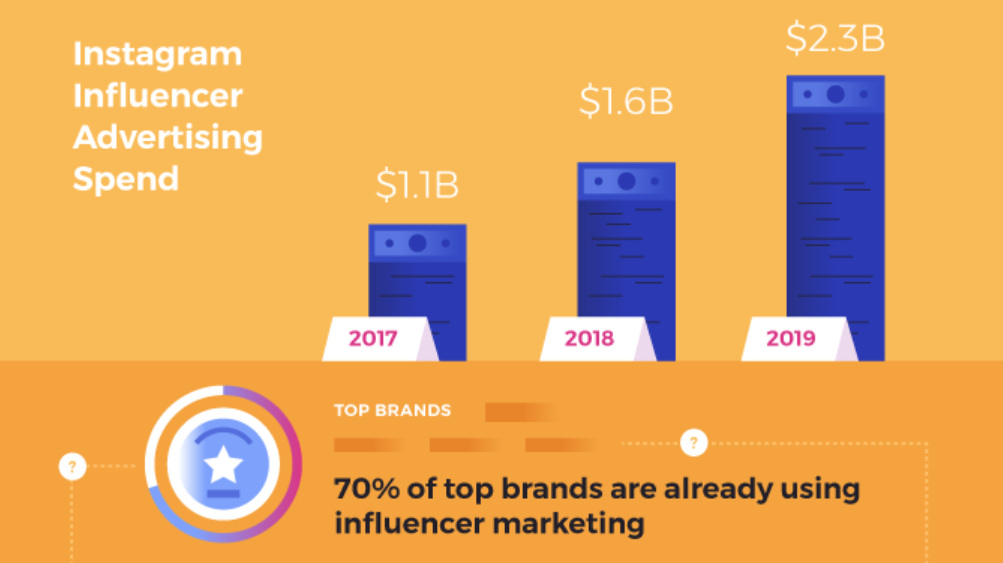

Over 70% of brands indicate they’re using influencer marketing, and brands will be spending an estimated $2.3 billion on it by 2019. While celebrities like Selena Gomez will earn a sizable chunk of that, people with much smaller audiences are each getting their slice of the pie too.

Not only is it easier to target local or niche audiences by working with microinfluencers, but these audiences also have much higher levels of engagement in the form of comments and likes on posts.

According to XCart, influencers with under 25,000 followers are a very affordable investment at ~$130 per post. This means that advertisers can collaborate with hundreds of influencers around the country for the same price as working with a celebrity.

Of course, there’s more vetting and logistics required in working with a larger group of influencers, but the payoff could be enormous for the right type of campaign.

—

Speaking of social media: Follow us on Facebook, Twitter, and LinkedIn to ensure you don’t miss your daily dose of data-driven visual content.

Technology

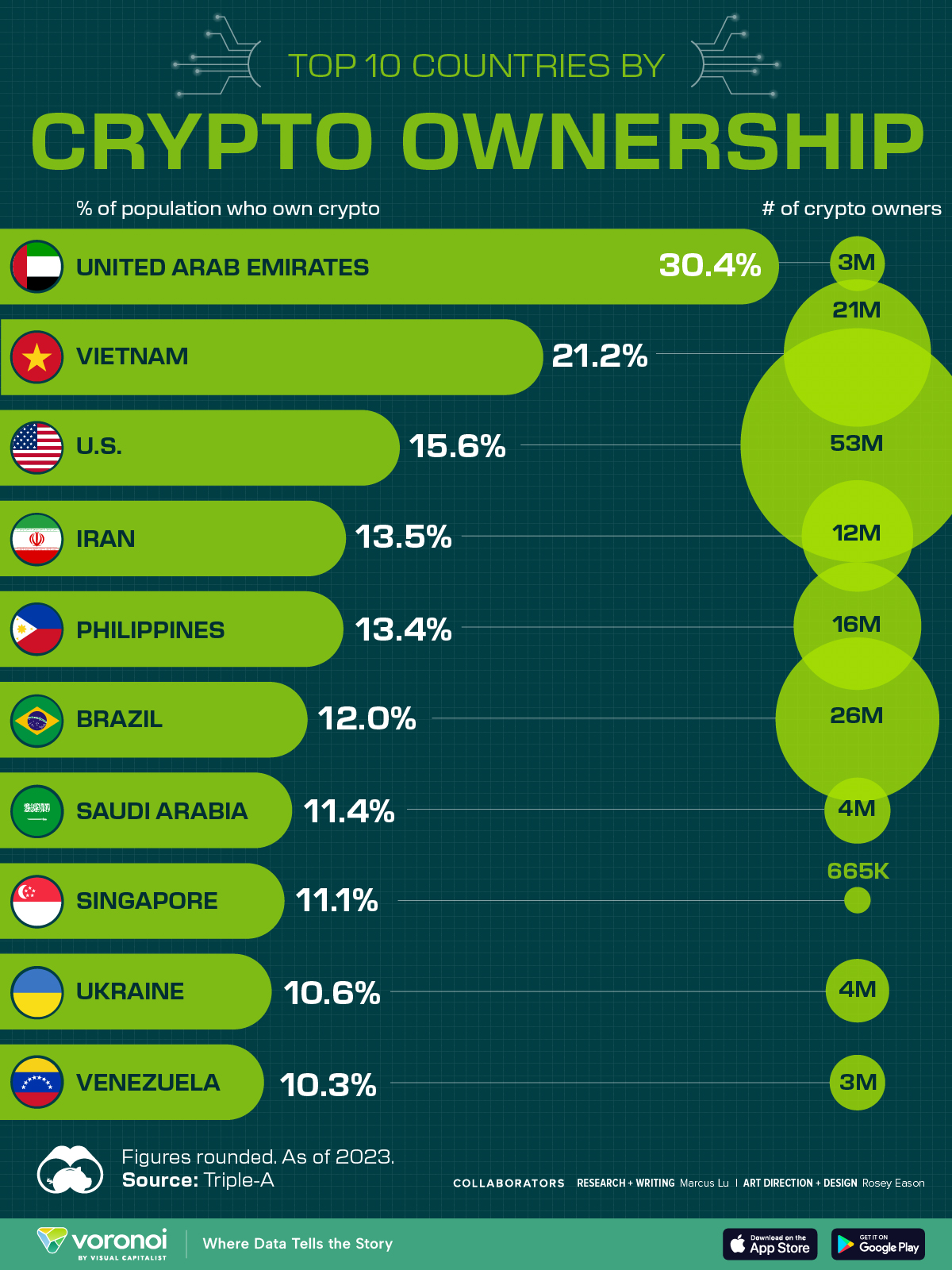

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Markets6 days ago

Markets6 days agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App