Misc

Influencer Marketing: The Latest Weapon in the Battle for Eyeballs

Influencer marketing is having its moment.

Whether it’s a tagged pair of shoes in an Instagram post, or an “unboxing” video on Snapchat, brands are fighting hard to get their products into the hands of social media celebs who can move the needle on their sales numbers.

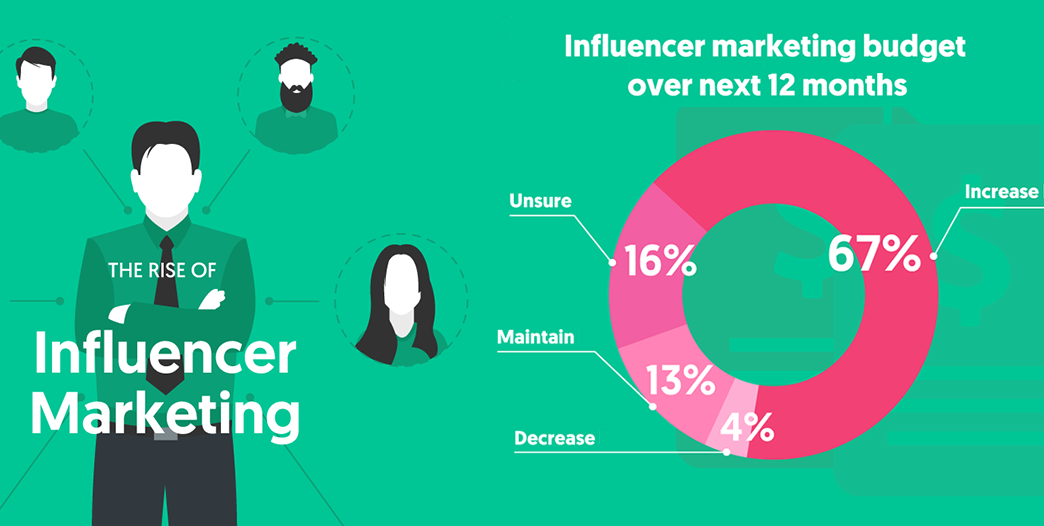

The Rise of Influencer Marketing

According to Influencer Marketing Hub, over one-third of marketers have a standalone budget for influencers in 2017.

It’s easy to see the appeal as influencer marketing can deliver 11 times higher ROI than traditional brand marketing. As influencer–brand partnerships begin to reach mass adoption, what metrics should markets be looking at? Today’s infographic is good primer on the state of influencer marketing.

At first glance, influencer marketing sounds like a strange concept, but it’s a natural evolution of content marketing over social media platforms. To understand influencer marketing, it helps if we step back and look at the big picture of how content marketing actually works.

Content Marketing: Fighting for Feed Space

Most social media platforms have the same format – content posted by people is arranged into a customized “feed” for you to consume. Content marketing is simply the process of getting users to follow your brand on platforms so your content appears in their feeds.

In the earlier days of social media marketing, people were more actively seeking out accounts to follow, including brand accounts. Today though, many platforms have hit a growth plateau, so unless your brand already has a large, engaged audience, it can tough to gain any traction. To add a layer of difficulty, many platforms (particularly in the Facebook ecosystem) now restrict the reach of brand accounts in an effort to get them to spend money on advertising.

In short, reaching people (including your opt-in audience) is much harder than it used to be.

The Human Connection

The algorithms that rank posts in your feed are looking for something specific: engagement. And let’s face it, a brand posting about their product is not going to be as exciting as a well-connected personality showcasing their life. It’s the latter example that shows up first in social feeds, and that’s one major benefit to working with an influencer.

As well, peer opinion is a powerful force in purchase decisions. If a content creator is truly influential, they can provide a massive boost to a brand’s profile that would be very difficult to manufacture through other marketing methods.

We see these creators as partners of the brand helping us to build deeper connections with the young millennials who look up to them.

– Obioma Enyia, Head of Brand Marketing at PepsiCo

Demographic Bundling

Smart marketers are always looking for ways to target the right demographics to maximize the efficiency of their spend. Because influencers already have a measurable and observable audience, you can hone in on a specific type of consumer. If you find similar influencers in other regions, you can scale out a campaign in a very effective way.

Bigger brand are often looking for macro impact, and shell out big bucks to work with top tier celebrity influencers, but brands can take a more grassroots approach and partner with content creators at the city or even neighborhood level (often for a fraction of the spend). This is referred to as “micro-influence”, and is a fast-growing segment of influencer marketing.

How Does Compensation Work?

Compensation can take a few forms, but many influencers work on a pay-per-post basis. Experienced influencers will often be happy to receive compensation through referrals, particularly on platforms that have e-commerce integration.

How Do You Measure This Stuff?

Measuring the effectiveness of a campaign always comes down to sales in the end, but an influencer’s contribution to that can take different forms. Some brands are simply looking to align their brand with a “cool personality” who fits with their target audience. Other times, it will make sense to work with people who can drive traffic – and ultimately conversions – to their shopping cart.

Industry Pushback

Many agencies are skeptical of the influencer marketing trend.

Since there is no industry standard for reporting results, and because certain platforms (e.g. Snapchat) offer scant analytics, it can be tough to calculate ROI or trust the numbers in post-campaign reports.

I have very strong opinions about micro-influencers. It’s basically the biggest scam…

– Anonymous marketing executive (The full interview)

Along with dubious analytics, marketers should watch for fake followers and engagement. Keeping track of average engagement rates and doing a proper qualitative analysis on an influencer’s account should be the first step before working together.

The Evolution of Sponsored Posts

There will be an estimated 14.5 million* sponsored posts in 2017, and by 2019 that number could mushroom to 35 million. This spike in popularity is prompting concerns that we’re reaching a saturation point for influencer marketing, and that consumers will begin to tune out sponsored posts.

One thing is for certain, social media personalities are amassing sizable audiences for their content and are commanding serious marketing dollars in the process. It remains to be seen whether sponsored posts become a ubiquitous part of the social media landscape, or whether it will become a hackneyed tactic.

–

*This estimate only accounts for tagged, public posts

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries