Cannabis

Green Rush: How Cannabis Legalization Will Impact California

Across the United States, there’s a seemingly unstoppable movement gaining ground.

The legalization of cannabis for adult use – first passed in the states of Washington and Colorado in 2012 – is now approved in a total of nine states and the District of Columbia. By the end of the year, that total could be in the mid-teens as states vote on cannabis-related ballots in the upcoming mid-term elections.

California’s Green Rush

States are legalizing the adult use of cannabis for various reasons, but there’s no doubt that one of the primary ones is the potential impact on both the economy and government coffers.

Today’s infographic comes from cannabis royalty company FinCanna Capital, and it helps to contextualize the possible effects of cannabis legalization on the country’s largest state economy: California.

Experts say the current cannabis market (including unregulated sales) in California is already worth about $8.5 billion, making cannabis quite the cash crop to start with. In fact, it’s an amount that’s bigger than the current three largest agricultural markets in the state: milk and cream ($6.1B), grapes ($5.6B), and almonds ($5.2B).

With the passing of Proposition 64 in November 2016 and legalization officially taking effect January 1, 2018, the state of California is now the world’s largest regulated cannabis market.

To take advantage of this growing opportunity, entrepreneurs are rushing to the Golden State from far and wide.

Sizing Up the Green Rush

In 2016, the regulated market for cannabis, which only included medical marijuana at the time, was worth $2.81 billion in California.

However, Arcview Market Research predicts that California will see regulated sales grow at a 23.1% annual pace between 2016-2020 as adult use sales come into play. By 2020, the total regulated industry will be worth $6.5 billion.

Meanwhile, it’s expected that the state government will be pocketing from the rush as well, picking up $1 billion or more per year from taxes. That includes a 15% levy on all cannabis sales, as well as cultivation taxes applied to buds and trimmings.

The Medical Component

As the largest legal market on the planet, California could see less expected green shoots, as well.

Because of its federal classification as a Schedule I substance, cannabis is extremely under-researched globally. With wider state acceptance of cannabis in California, it may be possible to foster an environment where more could be learned about the vast medical potential of the plant through the state’s powerful universities and institutions. This could lead to increased innovation, investment, and medical discoveries that could have an additional economic impact.

Such a track would follow in the footsteps of Israel, which is the world’s leader in marijuana research. In the country, there are 120 ongoing studies, $100 million in foreign and U.S. funds invested into patents, startups, and delivery devices, and ten-fold growth in investment expected between 2017-2019.

Politics

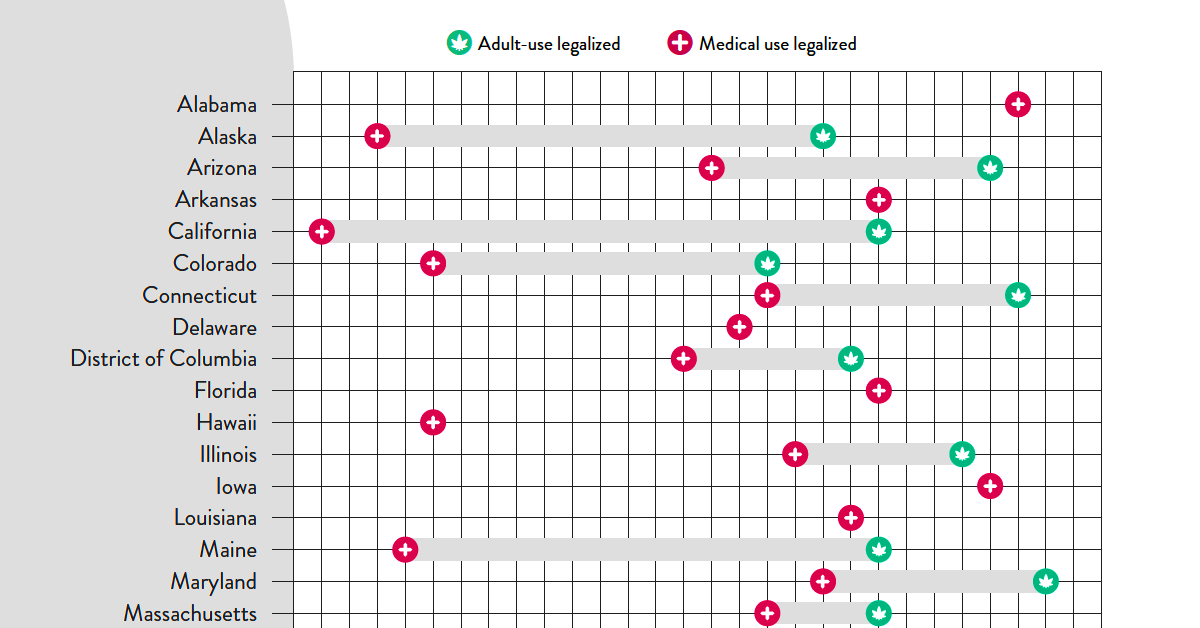

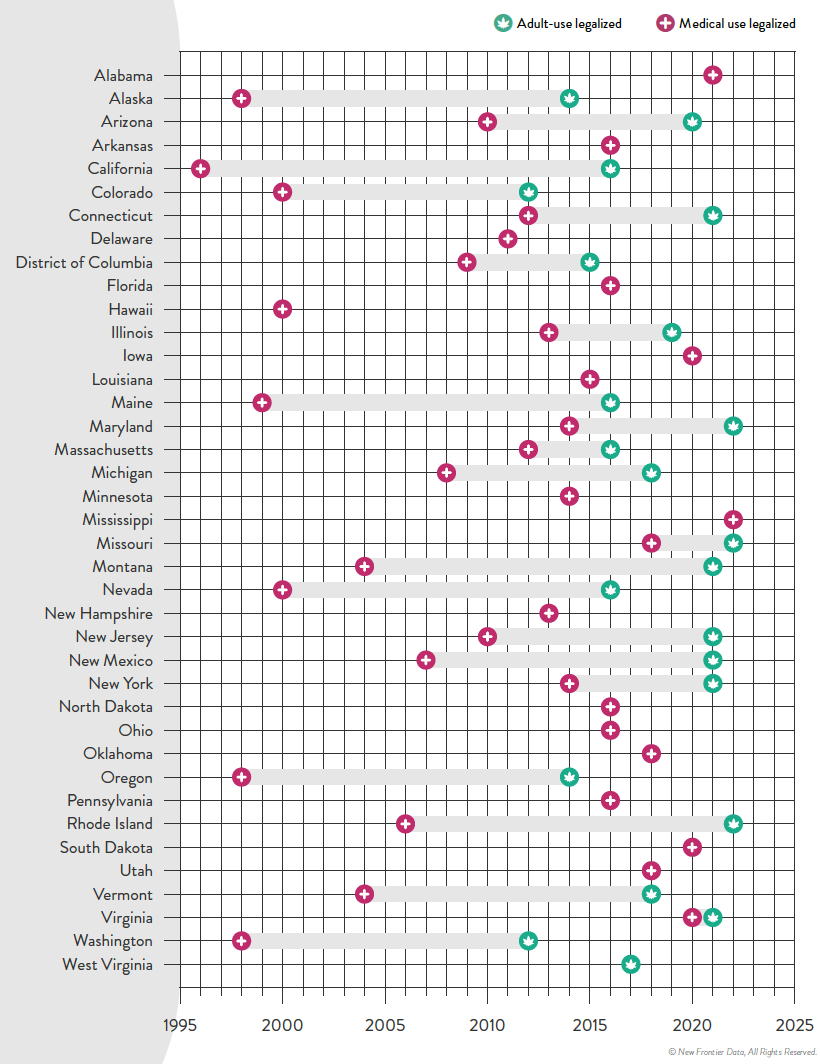

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue