Cannabis

Biosynthesis: The Science That May Unlock the Medical Potential of Cannabis

Attitudes are changing fast on cannabis, and investors are taking note.

With the birth of legal recreational markets in places like California and a growing appreciation for the medical applications of cannabinoids such as CBD, the floodgates are open for companies to pursue new and groundbreaking opportunities in the sector.

Unlike other fields where medical research has been mainstream for many decades, the work behind cannabis – an incredibly complex plant – is only getting started.

Untapped Potential

Today’s infographic comes from InMed Pharmaceuticals and it explains the medical potential behind the 90+ cannabinoids that we have yet to fully understand.

It also details a scientific process known as biosynthesis, which helped revolutionize the production of insulin for diabetics. A process such as this may be a key in unlocking the medical potential of understudied cannabinoids.

The medical benefits of cannabis are many, and scientific research is being conducted to explore the application of the plant in several disease categories, including multiple sclerosis, seizures, glaucoma, cancer, Alzheimer’s, and migraines.

However, this is just the tip of the iceberg. To understand the full potential of the cannabis plant, you need to know what cannabinoids are, and how they work.

The Human Endocannabinoid System

Like all mammals, the human body is loaded with natural cannabinoid receptors.

These receptors interact with cannabinoids, which occur naturally in the human body, but also in the cannabis plant.

| Type of Cannabinoid | Description |

|---|---|

| Endocannabinoids | Made in the human body |

| Plant cannabinoids | Found in the cannabis plant |

| Synthetic cannabinoids | Manufactured artificially to mimic natural cannabinoids |

| Biosynthesized cannabinoids | Biofermentation process using E. Coli-based system, which creates cannabinoids identical to those found in nature |

Some cannabinoids you may know include THC and CBD – and they have a wide variety of applications. They also make up the majority of cannabinoids (by volume) that can be easily extracted from the plant.

However, there are actually 90+ other cannabinoids that have potential medical benefits as well, and they make up less than 0.1% of total biomass. Because they are so difficult to isolate, they remain understudied in medicinal science.

A Problem of Volume

With only a tiny portion of the cannabis plant having medicinal value (the cannabinoids), a large degree of biomass must be harvested to extract even small amounts of medicine.

For example, 3 lbs (1.36 kg) of hig-CBD flowers may only yield 50 grams of pharmaceutical-grade compounds.

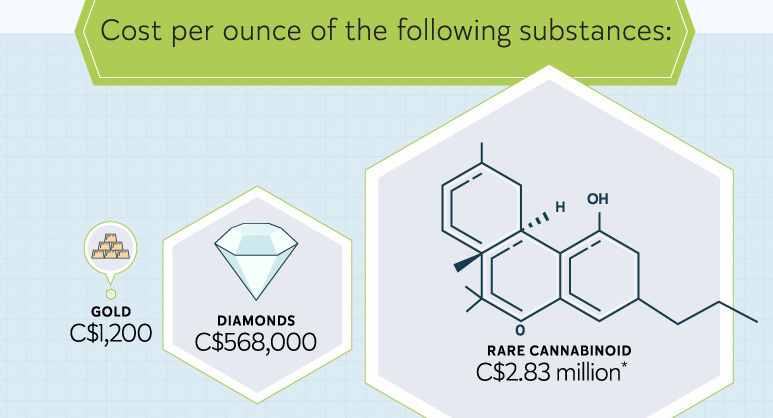

But this ratio is even more strenuous for the 90+ rare cannabinoids that make up less than 0.1% of the plant. With costs in the millions of dollars-per-gram range, it is extremely cost prohibitive to be researching these cannabinoids in any in-depth capacity.

Biosynthesis for Cannabinoids?

The process of biosynthesis could be a clue to maximizing the potential of these understudied cannabinoids.

In fact, this innovation has already helped democratize access to insulin, which originally was an extremely rare and expensive compound. To get just eight ounces of insulin, over 5,000 pig pancreases had to be harvested and processed. With biosynthesis, that is no longer the case.

Biosynthesis is a process that can occur by genetically modifying an organism to produce a pharmaceutically bioactive compounds that it normally would not make. Biosynthesis could thus be used to produce rare cannabinoids that are biologically identical to those produced by the cannabis plant itself.

Here’s how it works:

1) A biosynthetic cluster is inserted into a DNA vector.

2) DNA is inserted into E. Coli bacteria, where it provides instructions to produce cannabinoid compound(s)

3) The process is conducted at a large scale, resulting in materials that can be further processed into purified cannabinoids

The Potential of Biosynthesis

The world’s largest cannabis biotech company, GW Pharmaceuticals, has signed a contract with British Sugar to grow 18 hectares of cannabis for its CBD epilepsy drug, Epidiolex™.

Equivalent to approximately 23 football fields of greenhouse space, this represents a considerable amount of resources and investment needed to grow enough crops to treat 40,000 children with the disease.

If biosynthesis can produce similar quantities of cannabinoids from a much smaller space, it would be disruptive to the industry. Further, it may also make getting other understudied cannabinoids more economic – helping to possibly unleash the full medicinal potential of the cannabis plant.

Politics

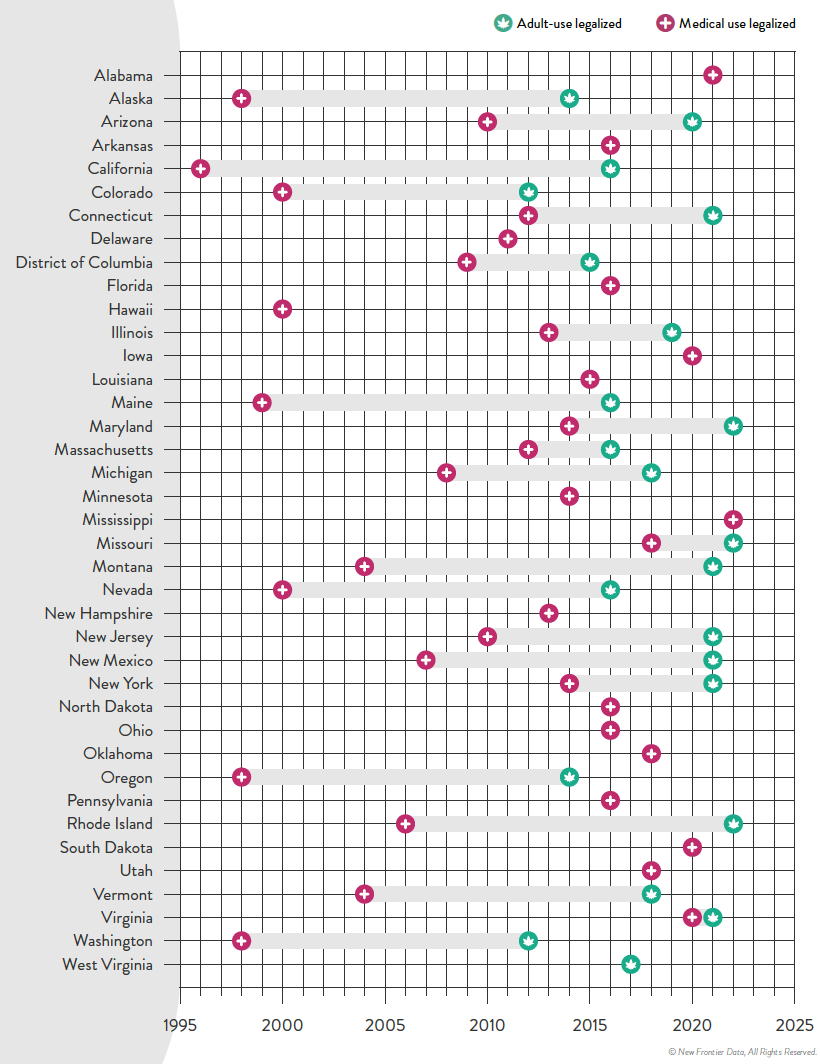

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

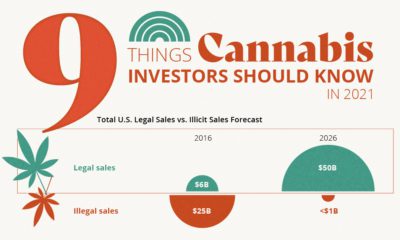

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners