Technology

The Key Differences in Demographics for the Top 7 Social Networks

In today’s multi-platform world, the smart businesses are tailoring their messages to audiences based on a variety of factors.

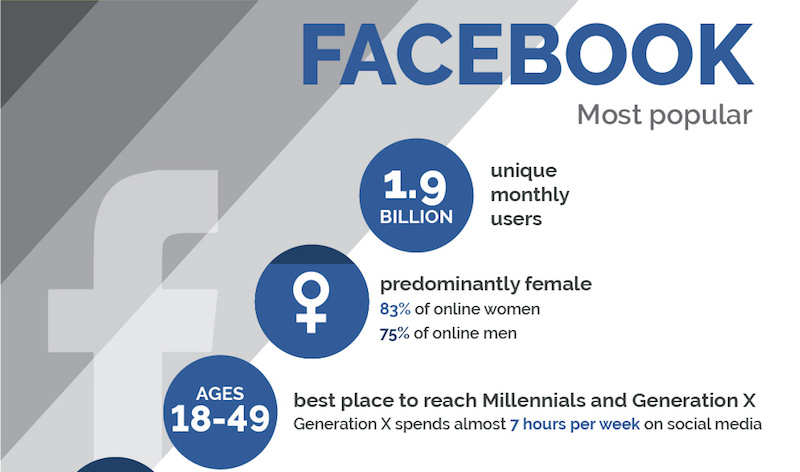

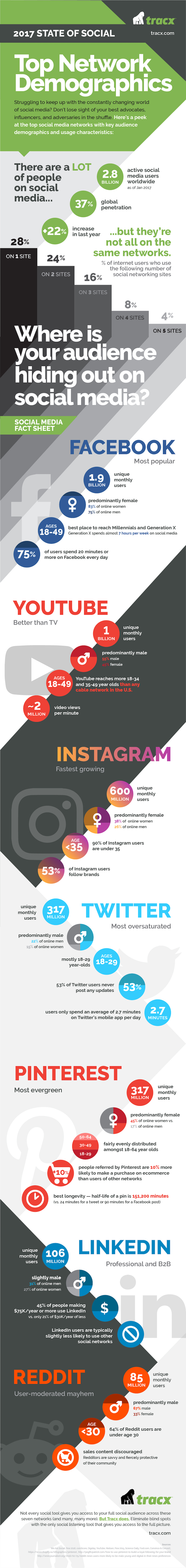

Of course, there are the benefits and limitations to each platform to be considered – but even more importantly, the audience and activity on each platform can differ considerably. The demographics of Pinterest vary from those of YouTube or Facebook, and content creators need to think about these fundamental differences in order to maximize user engagement.

Breaking Down the Top Social Networks

The following infographic comes to us from Tracx, and it dives deep into the demographic differences between the top seven social networks.

We noticed that Snapchat, owned by newly-IPO’d Snap Inc., is not included in the above infographic. While the growth of the $25 billion company has been extremely impressive, by some metrics it is still closing in on some of the smaller social networks (Twitter, Pinterest).

In any case, here’s what you need to know on the fast-growing, millennial-focused network.

The Missing Social Network

According to the most recent S-1 filing, Snapchat currently has 2.5 billion snaps created per day by an audience of 161 million Daily Active Users (DAUs) as of December 2016.

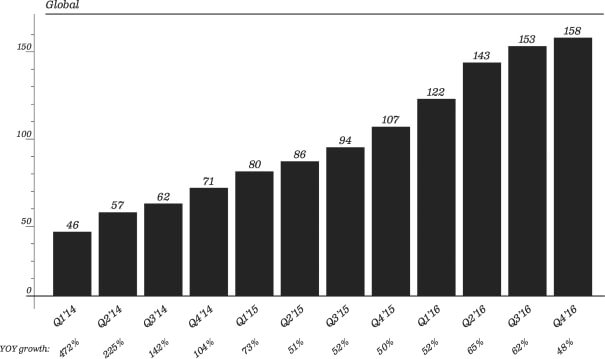

Here’s what growth looks like, on a quarterly level, for DAUs:

Some other interesting Snapchat stats?

- Users who were 25 years old or older opened Snapchat around 12 times a day and spent 20 minutes a day in the app on average.

- Users who were younger than 25 visited Snapchat more than 20 times a day and spent 30 minutes in it on average.

- Millennials account for 7 out of every 10 Snapchatters.

- Between 500,000 and 1 million Snapchat ads are seen per day.

- About 70% of Snapchatters are female.

- 30% of teens rank Snapchat as their most important social network.

Snapchat is already considered an important piece for companies looking to hit the North American millennial market. As a result, investors value the company over 2x more than Twitter, even despite Snapchat’s monetization problems.

The question is: how long can the growth continue – and when it stops, will it be a top three social network in North America overall?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees