Technology

The Snapchat Monetization Problem

There’s no doubt that messaging app Snapchat is on the brink of something huge.

The user metrics continue to impress, and the app just recently passed Twitter with 150 million daily active users. Snapchat has also vaulted past Instagram in time spent by users, making it the second-most used app by iPhone users, trailing only Facebook.

With a median user age of 18, Snapchat’s business premise is that it allows marketers to tap into the mysterious Millennial and Gen Z audiences that continue to perplex many brands. However, the jury is out on whether the app is delivering on this promise.

There’s now more than $2.65 billion of venture capital at stake that depends on solving the Snapchat monetization problem.

The Snapchat Monetization Problem

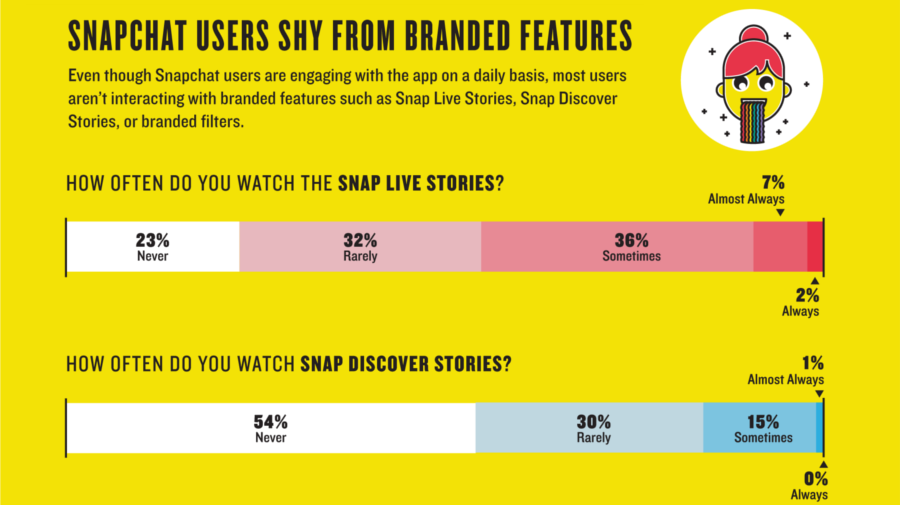

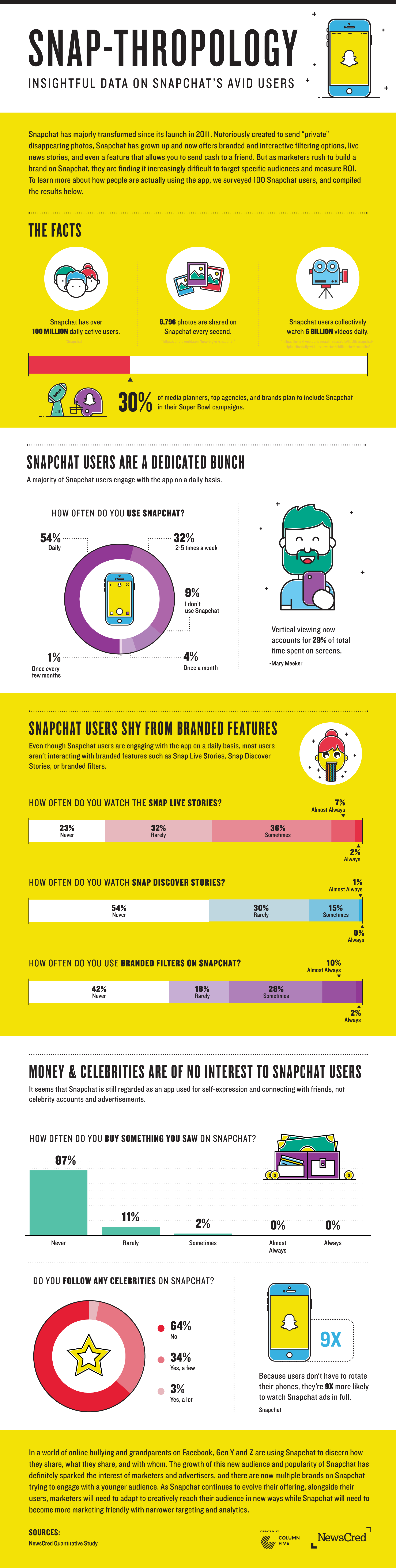

Today’s infographic shows the results from a survey of Snapchat users by NewsCred, a content marketing platform. The data paints a picture of Snapchat as an app that engages users, while whiffing on the branded content it needs to generate revenue.

Courtesy of: NewsCred

In other words, if Snapchat is counting on advertising as its main monetization driver, it is going to need to get more users engaging with branded content. Then, Snapchat must able to prove that to advertisers through targeting, analytics, and other useful metrics.

Snapchat is Getting Serious

In the first half of 2016, Snapchat raised $1.8 billion in its Series F round at a flat valuation of $16 billion.

This says two things.

First, with an estimated $59 million in revenue in 2015, investors are worried about the Snapchat monetization problem. Otherwise, the company’s valuation would have risen from the previous Series E which took place over a year prior.

Second, this war chest of new capital is going to be used to pounce on revenue opportunities, as well as providing better analytics to advertisers.

To the latter point, Snapchat is now making major moves to deliver on the revenue front. The company recently poached a key ad exec from Facebook. The app also launched a revamped Snapchat Discover portal that allows major publishers like Cosmopolitan or BuzzFeed to get in on the action to share ad revenue. Snapchat is also finally getting serious about metrics, and that’s why the company signed with Nielsen to start measuring the performance of ads like a television network would.

Will Snapchat’s revenues ever measure up to its user growth and marketing promise to advertisers? For now, the Snapchat monetization challenge remains, and investors are divided on the company’s future prospects.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024