Green

The World’s 25 Largest Lakes, Side by Side

The World’s 25 Largest Lakes, Side by Side

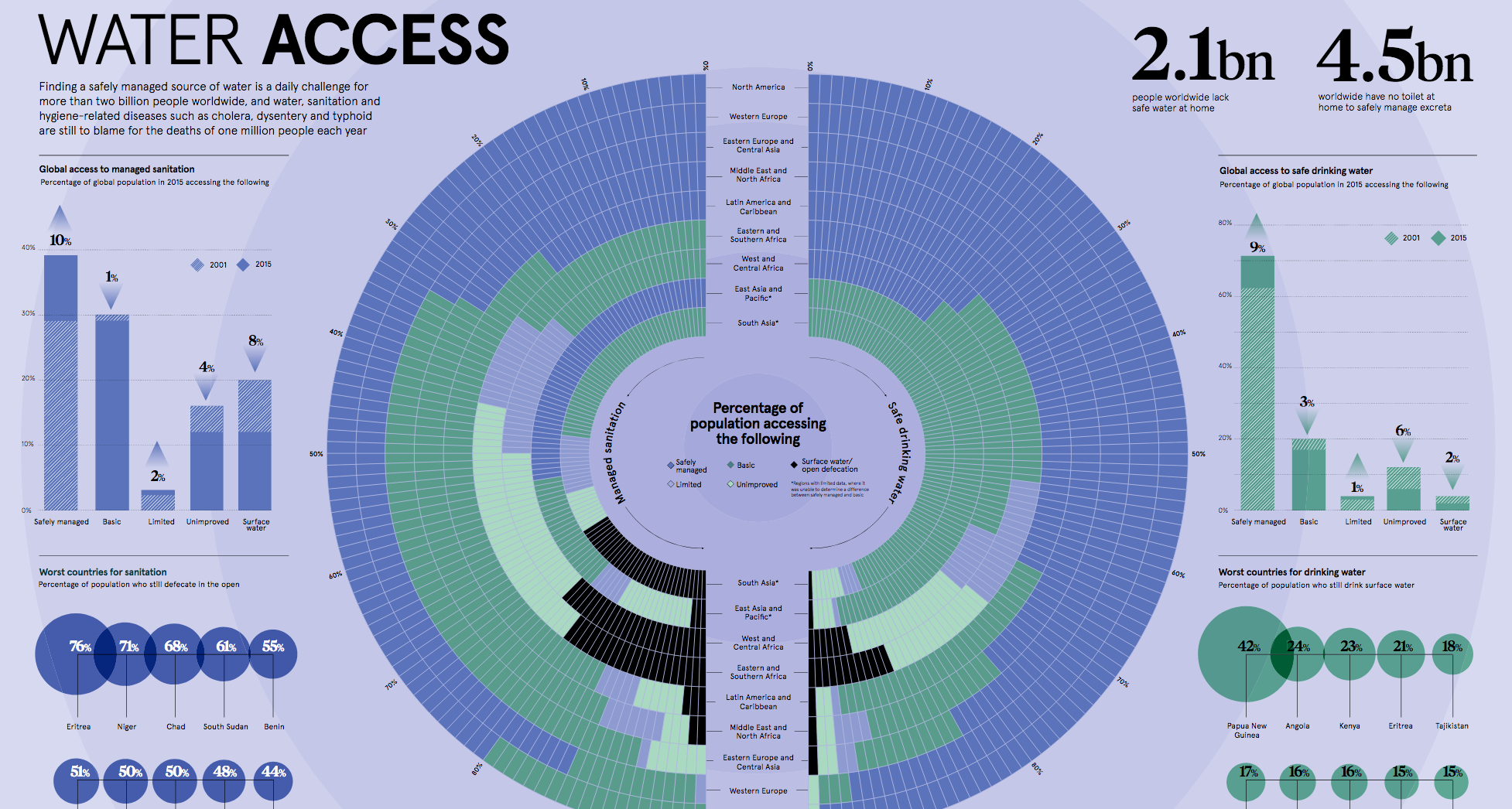

In many parts of the world, you don’t have to look very far to find a lake.

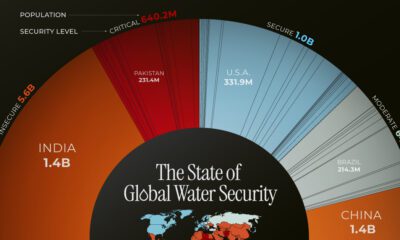

According to satellite data, there are roughly 100 million lakes larger than one hectare (2.47 acres) to be found globally. The largest lakes, which rival the size of entire nations, are more of a rarity.

One might expect the world’s largest lakes to be very alike, but from depth to saline content, their properties can be quite different. As well, the ranking of the world’s largest lakes is far from static, as human activity can turn a massive body of water into a desert within a single generation.

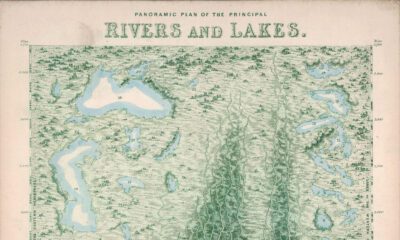

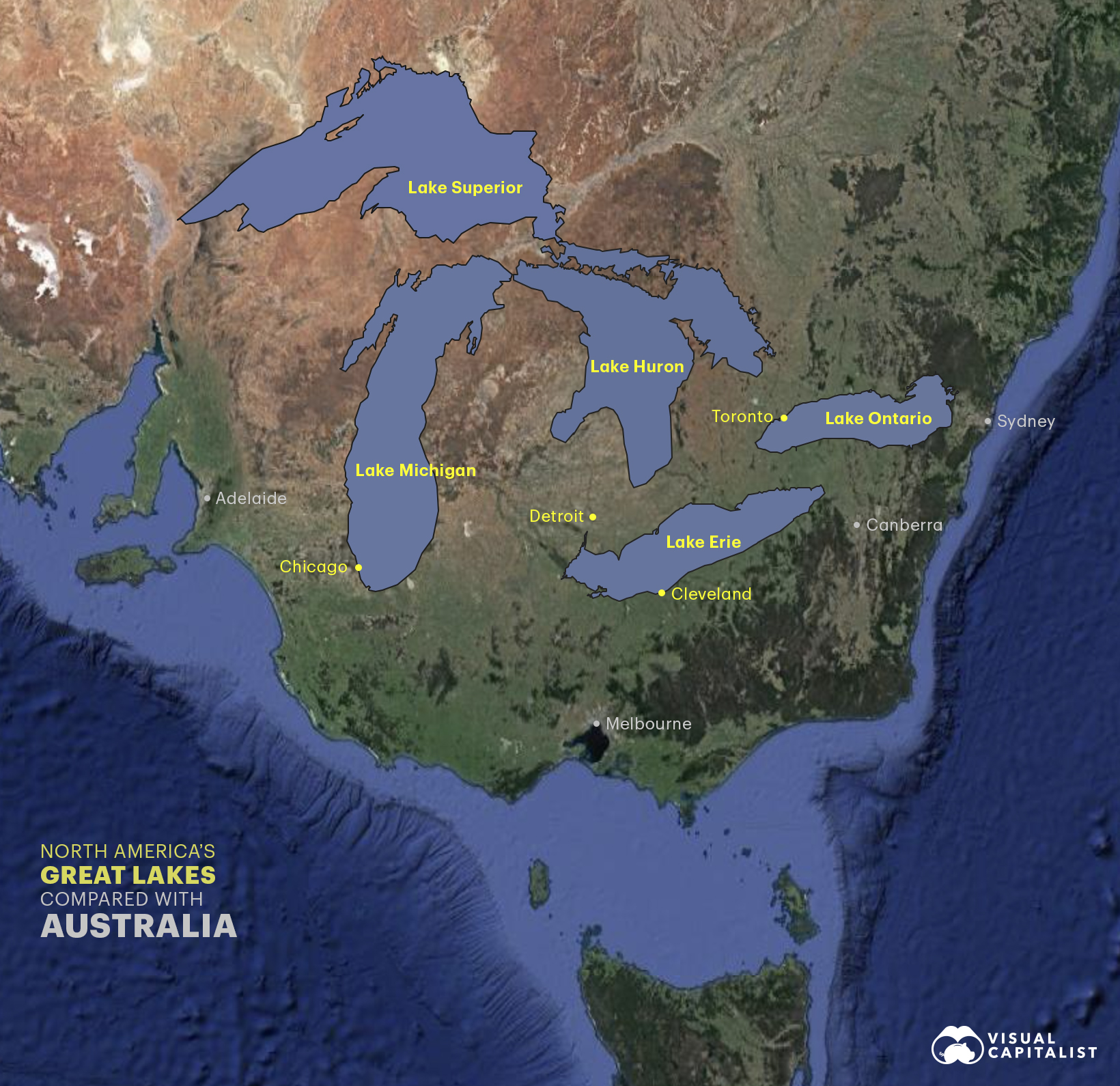

Today’s graphic – created using the fantastic online tool, Slap It On A Map! – uses the Great Lakes region as a point of comparison for the largest 25 lakes, by area. This is particularly useful in comparing the scale of lakes that are located in disparate parts of the globe.

The Greatest Lakes

The largest lake in the world by a long shot is the Caspian Sea – a name that hints at a past when it was contiguous with the ocean around 11 million years ago. This massive saline lake, which is nearly the same size as Japan, borders five countries: Kazakhstan, Russia, Turkmenistan, Azerbaijan, and Iran. An estimated 48 billion barrels of oil lay beneath the surface of the basin.

The five Great Lakes, which run along the Canada–U.S. border, form one of the largest collections of fresh water on Earth. This interconnected series of lakes represents around 20% of the world’s fresh water and the region supports over 100 million people, roughly equal to one-third of the Canada–U.S. population.

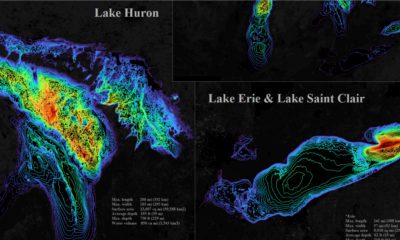

Amazingly, a single lake holds as much fresh water as all the Great Lakes combined – Lake Baikal. This rift lake in Siberia has a maximum depth of 5,371ft (1,637m). For comparison, the largest of the Great Lakes (Lake Superior) is only 25% as deep, with a maximum depth of 1,333ft (406m). Lake Baikal is unique in a number of other ways too. It is the world’s oldest, coldest lake, and around 80% of its animal species are endemic (not found anywhere else).

Here’s a full run-down of the top 25 lakes by area:

| Rank | Lake Name | Surface Area | Type | Countries on shoreline |

|---|---|---|---|---|

| 1 | Caspian Sea | 143,000 sq mi (371,000km²) | Saline | 🇰🇿 Kazakhstan 🇷🇺 Russia 🇹🇲 Turkmenistan 🇦🇿 Azerbaijan 🇮🇷 Iran |

| 2 | Superior | 31,700 sq mi (82,100km²) | Freshwater | 🇨🇦 Canada 🇺🇸 U.S. |

| 3 | Victoria | 26,590 sq mi (68,870km²) | Freshwater | 🇺🇬 Uganda 🇰🇪 Kenya 🇹🇿 Tanzania |

| 4 | Huron | 23,000 sq mi (59,600km²) | Freshwater | 🇨🇦 Canada 🇺🇸 U.S. |

| 5 | Michigan | 22,000 sq mi (58,000km²) | Freshwater | 🇺🇸 U.S. |

| 6 | Tanganyika | 12,600 sq mi (32,600km²) | Freshwater | 🇧🇮 Burundi 🇹🇿 Tanzania 🇿🇲 Zambia 🇨🇩 D.R.C. |

| 7 | Baikal | 12,200 sq mi (31,500km²) | Freshwater | 🇷🇺 Russia |

| 8 | Great Bear Lake | 12,000 sq mi (31,000km²) | Freshwater | 🇨🇦 Canada |

| 9 | Malawi | 11,400 sq mi (29,500km²) | Freshwater | 🇲🇼 Malawi 🇲🇿 Mozambique 🇹🇿 Tanzania |

| 10 | Great Slave Lake | 10,000 sq mi (27,000km²) | Freshwater | 🇨🇦 Canada |

| 11 | Erie | 9,900 sq mi (25,700km²) | Freshwater | 🇨🇦 Canada 🇺🇸 U.S. |

| 12 | Winnipeg | 9,465 sq mi (24,514km²) | Freshwater | 🇨🇦 Canada |

| 13 | Ontario | 7,320 sq mi (18,960km²) | Freshwater | 🇨🇦 Canada 🇺🇸 U.S. |

| 14 | Ladoga | 7,000 sq mi (18,130km²) | Freshwater | 🇷🇺 Russia |

| 15 | Balkhash | 6,300 sq mi (16,400km²) | Saline | 🇰🇿 Kazakhstan |

| 16 | Vostok | 4,800 sq mi (12,500km²) | Freshwater | 🇦🇶 Antarctica |

| 17 | Onega | 3,700 sq mi (9,700km²) | Freshwater | 🇷🇺 Russia |

| 18 | Titicaca | 3,232 sq mi (8,372km²) | Freshwater | 🇧🇴 Bolivia 🇵🇪 Peru |

| 19 | Nicaragua | 3,191 sq mi (8,264km²) | Freshwater | 🇳🇮 Nicaragua |

| 20 | Athabasca | 3,030 sq mi (7,850km²) | Freshwater | 🇨🇦 Canada |

| 21 | Taymyr | 2,700 sq mi (6,990km²) | Freshwater | 🇷🇺 Russia |

| 22 | Turkana | 2,473 sq mi (6,405km²) | Saline | 🇰🇪 Kenya 🇪🇹 Ethiopia |

| 23 | Reindeer Lake | 2,440 sq mi (6,330km²) | Freshwater | 🇨🇦 Canada |

| 24 | Issyk-Kul | 2,400 sq mi (6,200km²) | Saline | 🇰🇬 Kyrgyzstan |

| 25 | Urmia | 2,317 sq mi (6,001km²) | Saline | 🇮🇷 Iran |

The Great Lakes World Tour

For people living in Canada and the U.S., the shape and relative size of the Great Lakes system may be quite familiar. This makes the Great Lakes a fantastic point of comparison to help put the size of other world locations into perspective. To this end, we begin our Great Lakes World Tour.

First, the image below shows how the Great Lakes system would look if it was located in India.

Distortions on commonly used maps can downplay the size of India compared to more northern nations. This view of the Great Lakes can help put India’s true size into perspective.

Next, we look at the Great Lakes overlaid within Central Europe.

In the context of Europe, the lakes are so large that they extend from the Netherlands over to Slovakia. Lake Superior’s surface area of 31,700 mi2 (82,000 km2), is similar in size to Austria. Here’s are the five Great Lakes and European countries of equivalent size:

| Great Lakes | Surface Area | Equivalent Country | Area |

|---|---|---|---|

| Lake Superior | 82,000 km2 (31,700 sq mi) | 🇦🇹 Austria | 83,879 km2 (32,386 sq mi) |

| Lake Huron | 60,000 km2 (23,000 sq mi) | 🇱🇻 Latvia | 64,589 km2 (24,938 sq mi) |

| Lake Michigan | 58,000 km2 (22,300 sq mi) | 🇭🇷 Croatia | 56,594 km2 (21,851 sq mi) |

| Lake Erie | 25,700 km2 (9,910 sq mi) | 🇲🇰 North Macedonia | 25,713 km2 (9,928 sq mi) |

| Lake Ontario | 19,000 km2 (7,340 sq mi) | 🇸🇮 Slovenia | 20,271 km2 (7,827 sq mi) |

Lastly, here is a look at the Great Lakes in Southern Australia. Australia is the world’s 6th largest country, so the Great Lakes only occupy one corner of its land mass.

Australia’s lack of glacial history means that there are few permanent freshwater lakes in the country. Many of the country’s largest lakes only fill up during periods of excessive rainfall.

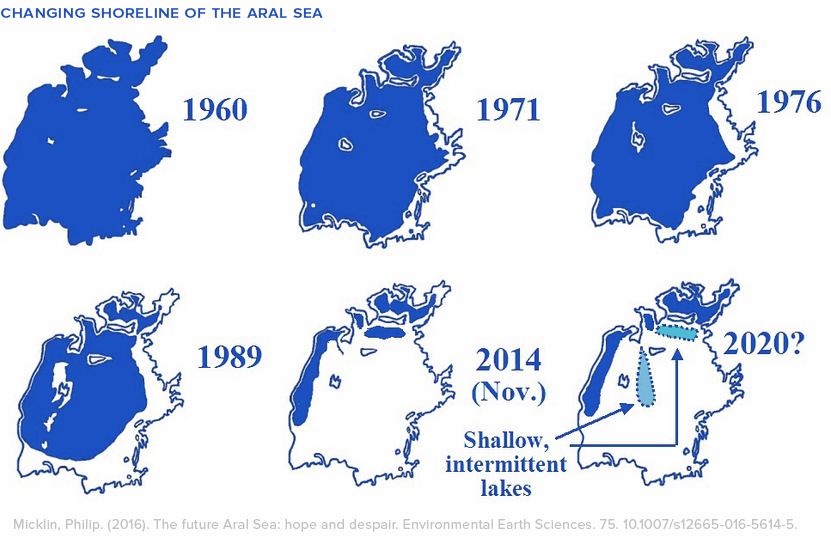

Shrinking out of the rankings

Not far from the world’s largest lake, straddling the border between Kazakhstan and Uzbekistan, lay the sand dunes of the Aralkum Desert. In the not so distant past, this harsh environment was actually the bed of one of the largest lakes in the world – the Aral Sea.

For reasons both climatic and anthropogenic, the Aral Sea began receding in the 1960s. This dramatic change in surface area took the Aral Sea from the fourth largest lake on Earth to not even ranking in the top 50. Researchers note that the size of the lake has fluctuated a lot over history, but through the lens of modern history these recent changes happened rapidly, leaving local economies devastated and former shoreside towns landlocked.

Lake Chad, in Saharan Africa, and Lake Urmia, in Iran, both face similar challenges, shrinking dramatically in recent decades.

How we work to reverse damage and avoid ecosystem collapse in vulnerable lakes will have a big influence on how the top 25 list may look in future years.

Green

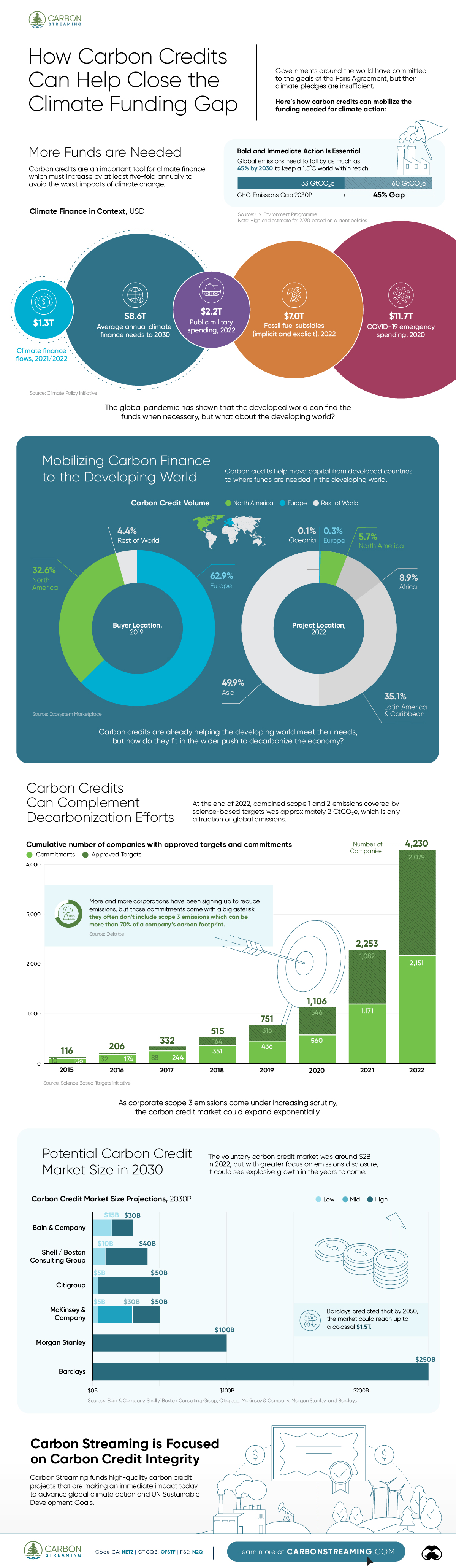

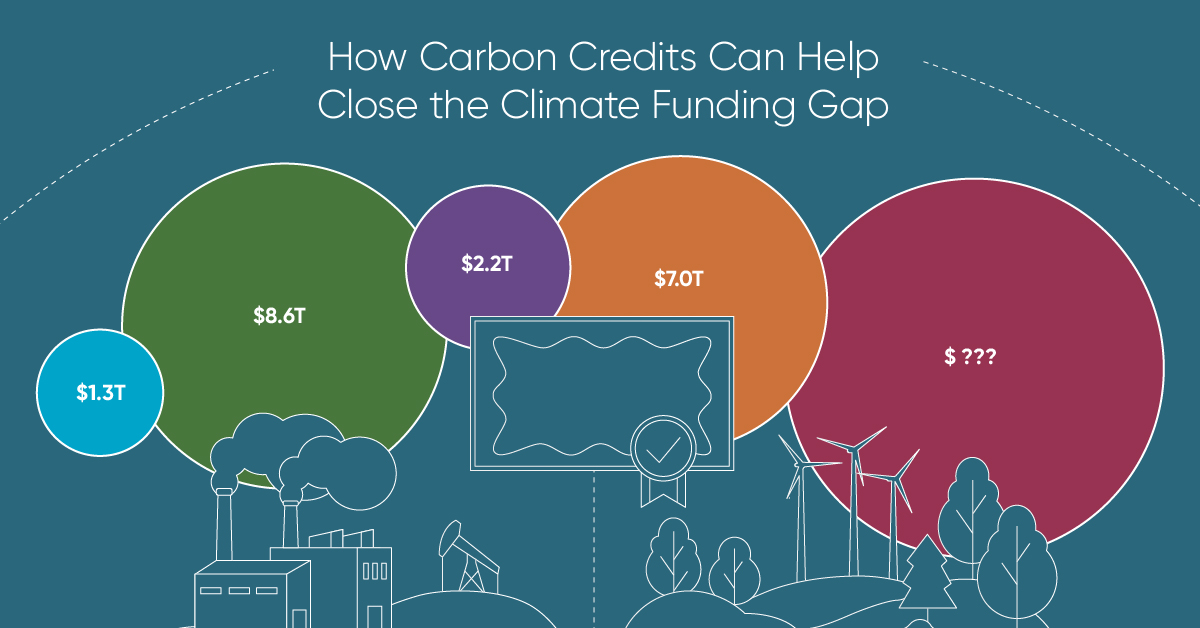

How Carbon Credits Can Help Close the Climate Funding Gap

To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030, and carbon credits could help close the gap.

How Carbon Credits Can Help Close the Climate Funding Gap

Governments around the world have committed to the goals of the Paris Agreement, but their climate pledges are insufficient. To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030.

Bold and immediate action is essential, but so are resources that will make it happen.

In this graphic, we have partnered with Carbon Streaming to look at the role that the voluntary carbon market and carbon credits can play in closing that gap.

More Funds are Needed for Climate Finance

According to data from the Climate Policy Initiative, climate finance, which includes funds for both adaptation and mitigation, needs to increase at least five-fold, from $1.3T in 2021/2022, to an average $8.6T annually until 2030, and then to just over $10T in the two decades leading up to 2050.

That adds up to a very large number, but consider that in 2022, $7.0T went to fossil fuel subsidies, which almost covers the annual estimated outlay. And the world has shown that when pressed, governments can come up with the money, if the global pandemic is any indication.

Mobilizing Carbon Finance to the Developing World

But the same cannot be said of the developing world, where debt, inequality, and poverty reduce the ability of governments to act. And this is where carbon credits can play an important role. According to analyses from Ecosystem Marketplace, carbon credits help move capital from developed countries, to where funds are needed in the developing world.

For example, in 2019, 69.2% of the carbon credits by volume in the voluntary carbon market were purchased by buyers in Europe, and nearly a third from North America. Compare that to over 90% of the volume of carbon credits sold in the voluntary carbon market in 2022 came from projects that were located outside of those two regions.

Carbon Credits Can Complement Decarbonization Efforts

Carbon credits can also complement decarbonization efforts in the corporate world, where more and more companies have been signing up to reduce emissions. According to the 2022 monitoring report from the Science Based Targets initiative, 4,230 companies around the world had approved targets and commitments, which represented an 88% increase from the prior year. However, as of year end 2022, combined scope 1 and 2 emissions covered by science-based targets totaled approximately 2 GtCO2e, which represents just a fraction of global emissions.

The fine print is that this is just scope 1 and 2 emissions, and doesn’t include scope 3 emissions, which can account for more than 70% of a company’s total emissions. And as these emissions come under greater and greater scrutiny the closer we get to 2030 and beyond, the voluntary carbon credit market could expand exponentially to help meet the need to compensate for these emissions.

Potential Carbon Credit Market Size in 2030

OK, but how big? In 2022, the voluntary carbon credit market was around $2B, but some analysts predict that it could grow to between $5–250 billion by 2030.

| Firm | Low Estimate | High Estimate |

|---|---|---|

| Bain & Company | $15B | $30B |

| Barclays | N/A | $250B |

| Citigroup | $5B | $50B |

| McKinsey & Company | $5B | $50B |

| Morgan Stanley | N/A | $100B |

| Shell / Boston Consulting Group | $10B | $40B |

Morgan Stanley and Barclays were the most bullish on the size of the voluntary carbon credit market in 2030, but the latter firm was even more optimistic about 2050, and predicted that the voluntary carbon credit market could grow to a colossal $1.5 trillion.

Carbon Streaming is Focused on Carbon Credit Integrity

Ultimately, carbon credits could have an important role to play in marshaling the resources needed to keep the world on track to net zero by 2050, and avoiding the worst consequences of a warming world.

Carbon Streaming uses streaming transactions, a proven and flexible funding model, to scale high-integrity carbon credit projects to advance global climate action and UN Sustainable Development Goals.

Learn more at www.carbonstreaming.com.

-

Green1 week ago

Green1 week agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

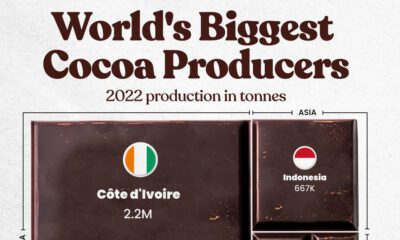

Markets2 months ago

Markets2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Environment2 months ago

Environment2 months agoCharted: Share of World Forests by Country

We visualize which countries have the biggest share of world forests by area—and while country size plays a factor, so too, does the environment.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001