Money

Visualizing The World’s Top 50 Wealthiest Billionaires

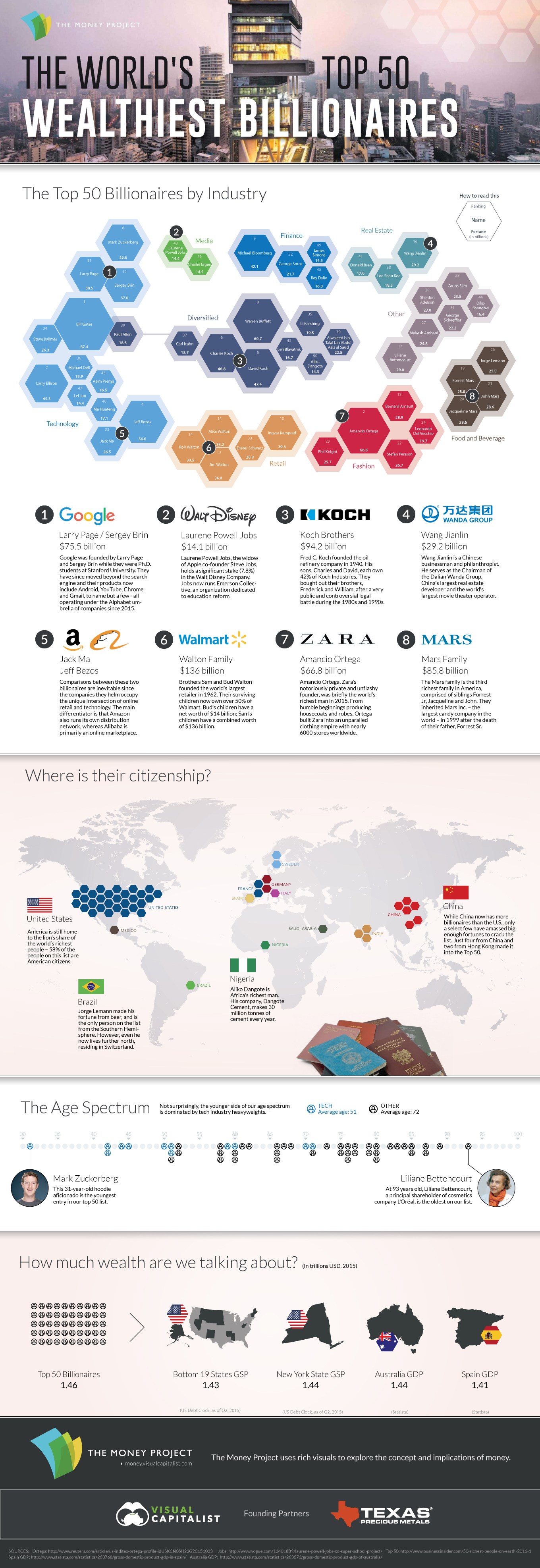

The World’s Top 50 Wealthiest Billionaires

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

Bill Gates. Warren Buffett. Mark Zuckerberg. George Soros. Charles and David Koch.

On an individual level, the people that make the definitive list of the Top 50 Wealthiest Billionaires are interesting, divisive, and envied around the globe. Together, they are a real force to be reckoned with: their combined fortunes tally to $1.46 trillion, which is more money than the GDP of entire countries such as Australia or Spain.

Today’s data visualization, using the latest information from Wealth-X, takes an in-depth look at the world’s wealthiest billionaires by breaking down important data on age, location, and the source of their fortunes.

Billionaires by Geography

The lion’s share of the wealthiest billionaires still come from the United States, where 58% of the list is located. The rest are mostly in Europe (16%) and China (12%), which includes those from Hong Kong.

The Southern Hemisphere only has one billionaire – Jorge Lemann from Brazil. However, even he now lives in Switzerland.

Surprisingly, the United Kingdom, Canada, Australia, Japan, and Russia combine to have a grand total of zero representation on the Top 50 Billionaires list.

Billionaires by Age

The youngest billionaire on the list is Mark Zuckerberg, at just 31 years of age. The oldest is Liliane Bettencourt, the principal shareholder of cosmetic giant L’Oréal. She is 93 years old.

The age of tech billionaires skewed the lowest, with an average age of 51. The age of all non-tech billionaires was far higher at 72.

Family Ties

The Walton siblings, which include Rob, Alice, and Jim Walton, are all descendants of Wal-Mart founder Sam Walton, and each have healthy fortunes of over $33 billion.

Meanwhile, the sons and daughters of Forrest Mars Sr., the creator of a candy empire, are not doing too bad for themselves, either. Forrest Jr., Jacqueline, and John Mars each have respective fortunes of $28.6 billion.

The divisive Koch Brothers also are high on the list, inheriting their initial wealth from father Fred C. Koch, the founder of Koch Industries. They succeeded in buying out their two other brothers, Frederick and William, after highly-publicized court battles in the 1980s and 1990s. Today the Koch Brothers have a combined fortune of $94.2 billion.

Other billionaires are connected by being from the same corporate family, sharing in the success of creating empires from the ground up. Bill Gates, Steve Ballmer, and Paul Allen all worked to create Microsoft, and Larry Page and Sergey Brin built Google (now Alphabet) into one of the biggest companies in the world.

Billionaires by Industry

Technology, which brings us names such as Mark Zuckerberg, Larry Page, Sergey Brin, Bill Gates, and Larry Ellison, has more billionaires than any other industry with 12.

The world’s largest fashion and retail brands, such as Wal-Mart, Zara, Nike, and H&M, also have helped to get many people on this list.

At the same time, other industries such as media are under-represented, with only two names with empires built in the sector making the top 50.

About the Money Project

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001