Mining

Visualizing U.S. Money Supply vs. Precious Metal Production in the COVID-19 Era

U.S. Precious Metal Coin Production in the COVID-19 Era

Gold and silver have played an important role in money throughout history. Unlike modern currencies, they can’t be created out of thin air and derive value from their scarcity.

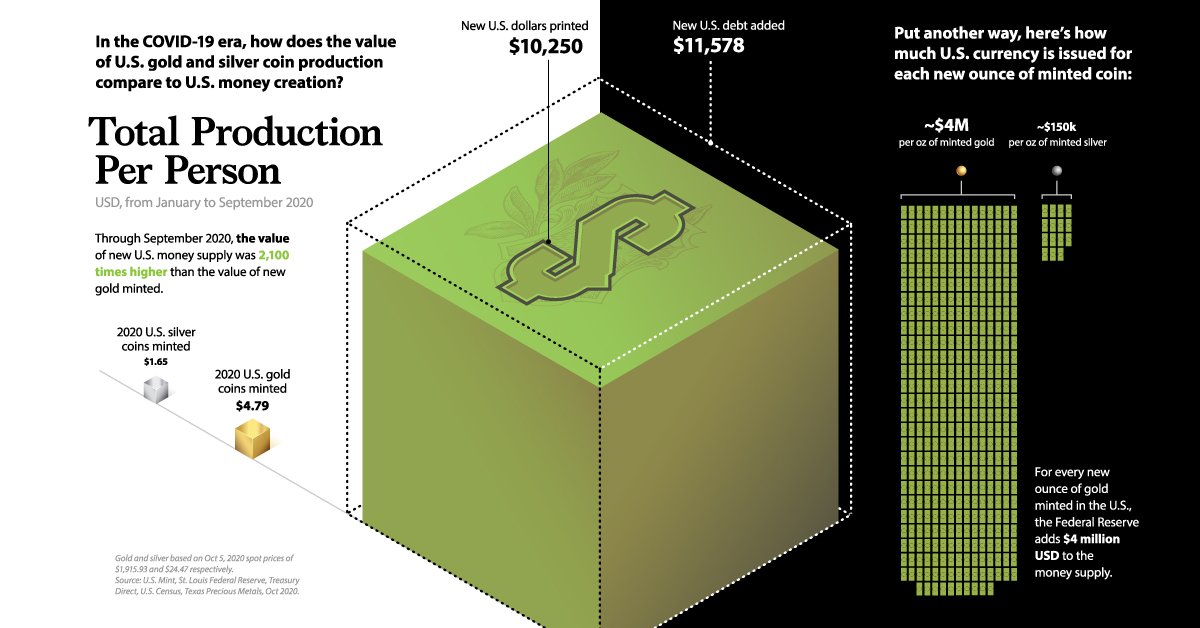

In the COVID-19 era, this difference has become more prominent as countries print vast amounts of currency to support their suffering economies. This graphic from Texas Precious Metals highlights how the value of U.S. precious metal coin production compares to U.S. money creation.

Year to Date Production

In this infographic, we have calculated the value of money supply added as well as bullion minted, and divided it by the U.S. population to get total production per person. Here’s how the January-September 2020 data breaks down:

| Total (Ounces) | Dollar Value | Dollar Value Per Person | |

|---|---|---|---|

| U.S. Gold Ounces | 826,000 | $1.6B | $4.79 |

| U.S. Silver Ounces | 22,261,500 | $544M | $1.65 |

| U.S. Money Supply | $3.4T | $10,250.16 | |

| U.S. Debt | $3.8T | $11,578.36 |

Gold and silver dollar values based on Oct 5, 2020 spot prices of $1,915.93 and $24.47 respectively.

The value of new U.S. money supply was more than 2,100 times higher than the value of new gold minted. Compared to minted silver, the value of new U.S. money supply was over 6,000 times higher.

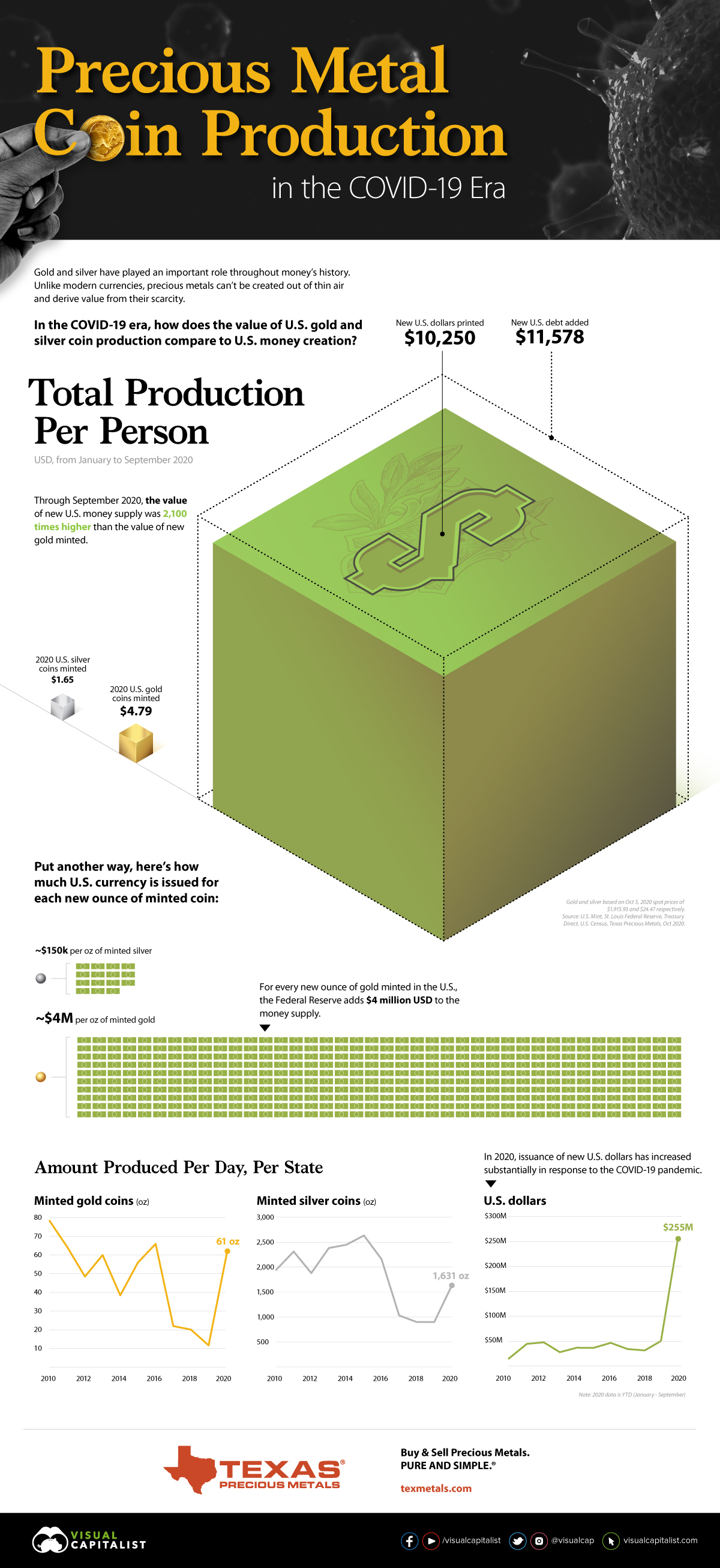

Production Per Day, Per State Over Time

Here’s how production has changed on a per day, per state basis since 2010:

| 2010 | 2020 YTD (Jan-Sep) | Min-Max Production, 2010-2019 | |

|---|---|---|---|

| Minted Gold Coins | 78oz | 61oz | 12oz-78oz |

| Minted Silver Coins | 1,945oz | 1,631oz | 899oz-2,633oz |

| U.S. Dollars | $19M | $255M | $19M-$50M |

Year to date, U.S. precious metal coin production is within a normal historical range. If production were to continue at the current rate through December, gold would be above historical norms at 81 ounces and silver would be within the normal range at 2,175 ounces.

The issuance of U.S. dollars tells a different story. Over the last nine months, the U.S. has already added 400% more dollars to its money supply than it did in the entirety of 2019—and there’s still three months left to go in the year.

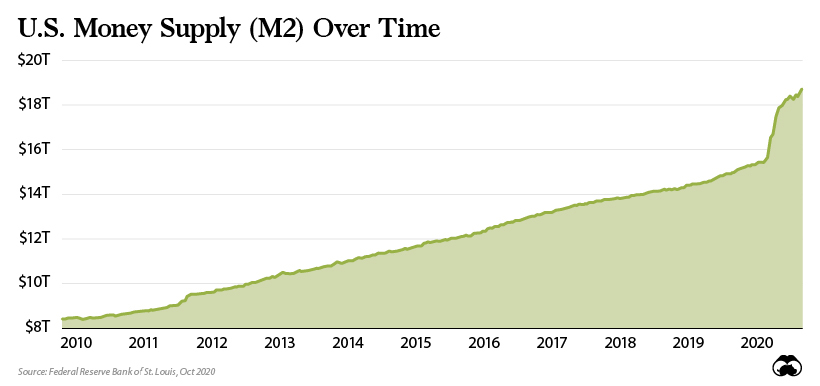

A Macroeconomic View

Of course, current economic conditions have been a catalyst for the ballooning money supply. In response to the COVID-19 pandemic, the U.S. government has issued over $3 trillion in fiscal stimulus. In turn, the U.S. Federal Reserve has increased the money supply by $3.4 trillion from January to September 2020.

Put another way, for every ounce of gold created in 2020 there has been $4 million U.S. dollars added to the money supply.

The question for those looking for safe haven investments is: which of these will ultimately hold their value better?

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees