Markets

Mapped: America’s $2 Trillion Economic Drop, by State and Sector

Mapped: America’s $2 Trillion Economic Drop

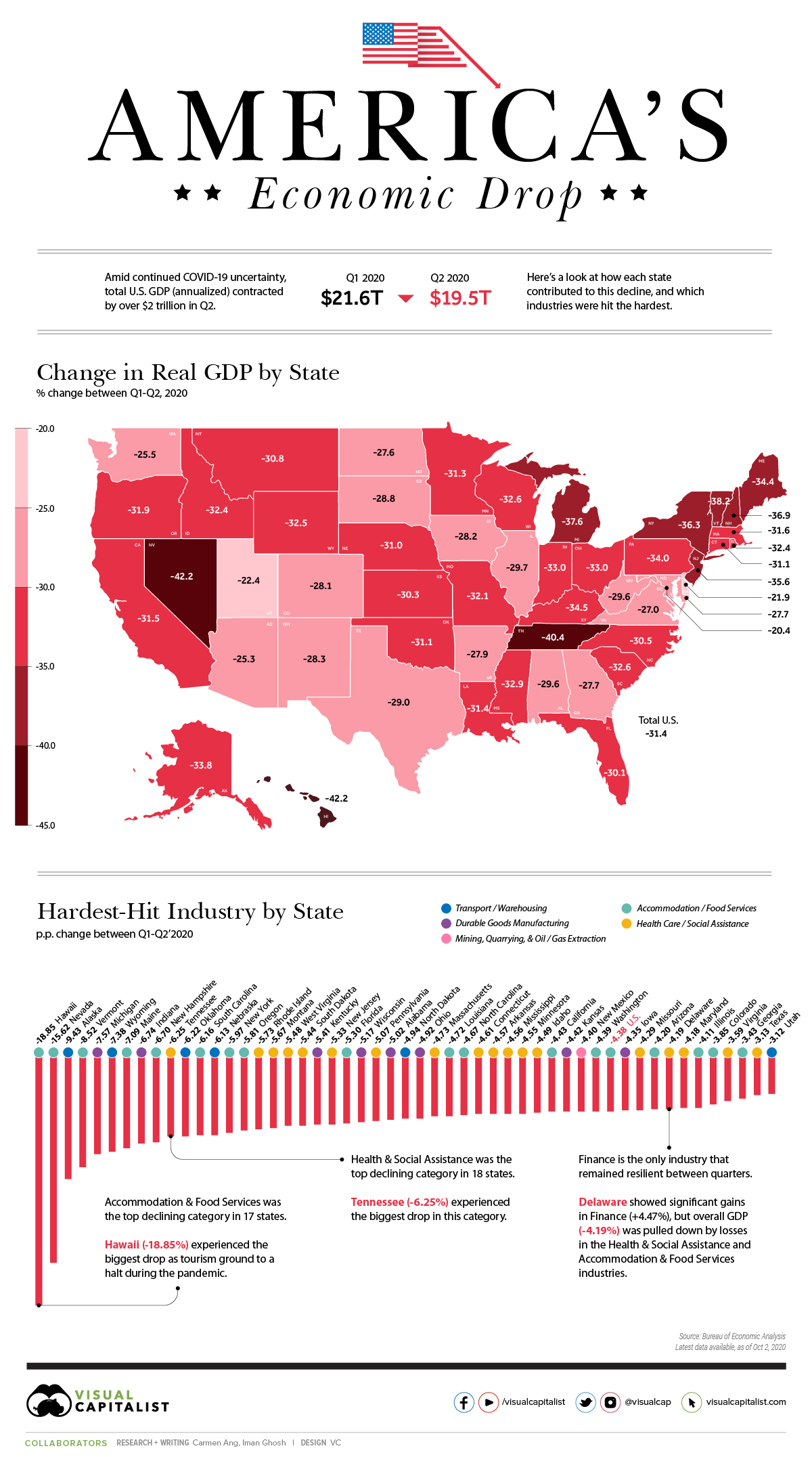

It only took a handful of months for the U.S. economy to reel from COVID-19’s effects.

As unemployment rates hit all-time highs and businesses scrambled to stay afloat, new data shows that current dollar GDP plummeted from nearly $21.6 trillion down to $19.5 trillion between Q1’2020 and Q2’2020 (seasonally adjusted at annual rates).

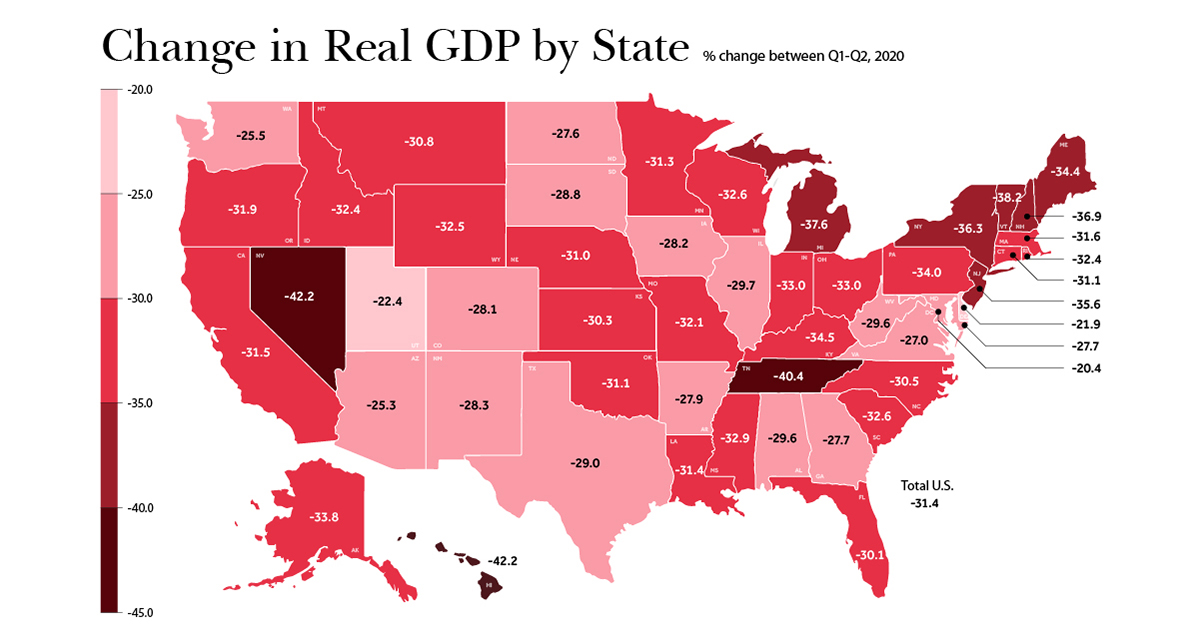

While all states experienced a decline, the effects were not distributed equally across the nation. This visualization takes a look at the latest data from the Bureau of Economic Analysis, uncovering the biggest declines across states, and which industries were most affected by COVID-19 related closures and uncertainty.

Change in GDP by State and Industry

Between March-June 2020, stay-at-home orders resulted in disruptions to consumer activity, health, and the broader economy, causing U.S. GDP to fall by 31.4% from numbers posted in Q1.

The U.S. economy is the sum of its parts, with each state contributing to the total output—making the COVID-19 decline even more evident when state-by-state change in GDP is taken into consideration.

| State | Real GDP Change | Biggest Industry Decline | Industry Change (p.p.) |

|---|---|---|---|

| Alabama | -29.6 | Durable Goods Manufacturing | -5.02 |

| Alaska | -33.8 | Transport and Warehousing | -9.43 |

| Arizona | -25.3 | Accommodation and Food Services | -4.2 |

| Arkansas | -27.9 | Health Care and Social Assistance | -4.57 |

| California | -31.5 | Accommodation and Food Services | -4.43 |

| Colorado | -28.1 | Accommodation and Food Services | -3.85 |

| Connecticut | -31.1 | Health Care and Social Assistance | -4.61 |

| Delaware | -21.9 | Health Care and Social Assistance | -4.19 |

| Florida | -30.1 | Accommodation and Food Services | -5.3 |

| Georgia | -27.7 | Accommodation and Food Services | -3.43 |

| Hawaii | -42.2 | Accommodation and Food Services | -18.85 |

| Idaho | -32.4 | Health Care and Social Assistance | -4.49 |

| Illinois | -29.7 | Accommodation and Food Services | -4.11 |

| Indiana | -33.0 | Durable Goods Manufacturing | -6.74 |

| Iowa | -28.2 | Durable Goods Manufacturing | -4.35 |

| Kansas | -30.3 | Durable Goods Manufacturing | -4.42 |

| Kentucky | -34.5 | Durable Goods Manufacturing | -5.41 |

| Louisiana | -31.4 | Accommodation and Food Services | -4.72 |

| Maine | -34.4 | Accommodation and Food Services | -7.09 |

| Maryland | -27.7 | Health Care and Social Assistance | -4.18 |

| Massachusetts | -31.6 | Health Care and Social Assistance | -4.73 |

| Michigan | -37.6 | Durable Goods Manufacturing | -7.57 |

| Minnesota | -31.3 | Health Care and Social Assistance | -4.55 |

| Mississippi | -32.9 | Health Care and Social Assistance | -4.56 |

| Missouri | -32.1 | Health Care and Social Assistance | -4.29 |

| Montana | -30.8 | Health Care and Social Assistance | -5.67 |

| Nebraska | -31.0 | Transport and Warehousing | -6.13 |

| Nevada | -42.2 | Accommodation and Food Services | -15.62 |

| New Hampshire | -36.9 | Accommodation and Food Services | -6.7 |

| New Jersey | -35.6 | Health Care and Social Assistance | -5.33 |

| New Mexico | -28.3 | Mining, Quarrying, and Oil and Gas Extraction | -4.4 |

| New York | -36.3 | Accommodation and Food Services | -5.97 |

| North Carolina | -30.5 | Accommodation and Food Services | -4.67 |

| North Dakota | -27.6 | Transport and Warehousing | -4.94 |

| Ohio | -33.0 | Durable Goods Manufacturing | -4.92 |

| Oklahoma | -31.1 | Transport and Warehousing | -6.22 |

| Oregon | -31.9 | Accommodation and Food Services | -5.81 |

| Pennsylvania | -34.0 | Health Care and Social Assistance | -5.07 |

| Rhode Island | -32.4 | Health Care and Social Assistance | -5.73 |

| South Carolina | -32.6 | Accommodation and Food Services | -6.16 |

| South Dakota | -28.8 | Health Care and Social Assistance | -5.44 |

| Tennessee | -40.4 | Health Care and Social Assistance | -6.25 |

| Texas | -29.0 | Health Care and Social Assistance | -3.13 |

| Utah | -22.4 | Transport and Warehousing | -3.12 |

| Vermont | -38.2 | Accommodation and Food Services | -8.52 |

| Virginia | -27.0 | Health Care and Social Assistance | -3.59 |

| Washington | -25.5 | Accommodation and Food Services | -4.39 |

| West Virginia | -29.6 | Health Care and Social Assistance | -5.48 |

| Wisconsin | -32.6 | Durable Goods Manufacturing | -5.17 |

| Wyoming | -32.5 | Transport and Warehousing | -7.38 |

| 🇺🇸 U.S. | -31.4 | Accommodation and Food Services | -4.38 |

Note: Industry changes are reported in percentage points (p.p.) of total current dollar GDP between Q1 and Q2.

A total of 18 states took the biggest hit within the Accommodation & Food Services sector, which was also the industry that suffered the most nationally, dropping by 4.38%.

Highly dependent on tourism, Hawaii bore the brunt of decline in this industry with a 18.85% drop. According to The Economic Research Organization at the University of Hawaii (UHERO), a second wave of infections and expired financial assistance were behind this contraction.

Next, the Health Care & Social Assistance sector was most impacted in 17 states between the two quarters, falling the most in Tennessee (-6.25%).

The most resilient industry amid the pandemic was Financial Services. In the state of Delaware, home to major banks such as JPMorgan Chase and Capital One, the sector actually grew by 4.47%. However, Delaware’s GDP ultimately still fell due to contractions in other sectors.

Each Industry’s Worst Performing State

Looking at it another way, the worst-performing state by industry also becomes clear when the change in percentage points (p.p.) Q1’–Q2’2020 GDP contributions are measured. Of the 21 industries profiled, Nevada shows up in the lower end of the spectrum four times.

| Industry | Worst-performing state | Change (p.p.) |

|---|---|---|

| Agriculture, forestry, fishing and hunting | Nebraska | -4.99% |

| Mining, quarrying, and oil and gas extraction | Wyoming | -5.76% |

| Utilities | Nebraska | -0.33% |

| Construction | New York | -2.02% |

| Durable goods manufacturing | Michigan | -7.57% |

| Nondurable goods manufacturing | Indiana | -2.65% |

| Wholesale trade | New Jersey | -3.35% |

| Retail trade | Nevada | -2.88% |

| Transportation and warehousing | Alaska | -9.43% |

| Information | California | -0.88% |

| Finance and insurance | South Dakota | -1.53% |

| Real estate and rental and leasing | Florida | -2.00% |

| Professional, scientific, and technical services | District of Columbia | -4.46% |

| Management of companies and enterprises | Nevada | -0.38% |

| Administrative/ support /waste management / remediation | Nevada | -2.48% |

| Educational services | Rhode Island | -1.47% |

| Health care and social assistance | Tennessee | -6.25% |

| Arts, entertainment, and recreation | Nevada | -4.44% |

| Accommodation and food services | Hawaii | -18.85% |

| Other services (ex. govt) | District of Columbia | -2.40% |

| Government and government enterprises | Alaska | -4.19% |

With many U.S. business leaders expecting a second contraction to occur in the economy, will future figures reflect further declines, or will states manage to bounce back?

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?